jiefeng jiang/iStock via Getty Images

Silicon Motion (NASDAQ:SIMO) develops integrated electronic circuits and microcontrollers, which are mainly used in the production of NAND flash memory for storage devices. Then, its potential acquisition by MaxLinear (NASDAQ:MXL) comes more as a surprise as the latter’s product line mostly covers radio frequency (“RF”) communications, 5G wireless infrastructures, opticals for high-speed connectivity, and connected-home applications.

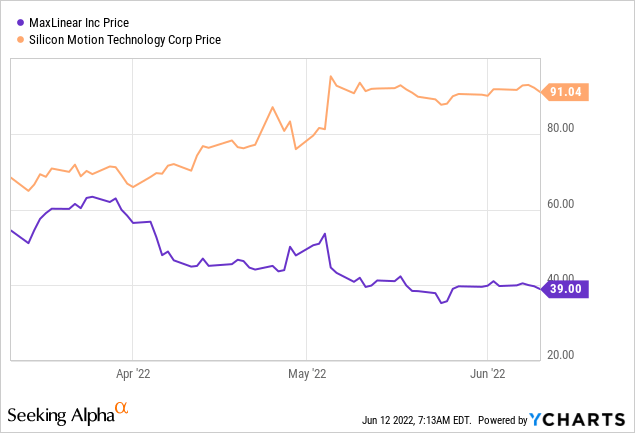

Thus, SIMO’s technology possibly falling outside MaxLinear’s key focus areas could be the reason why investors dumped shares of MaxLinear on May 5 as shown in the blue chart below with the company’s shares falling by about 30%.

Conversely, as the acquisition target, investors rewarded SIMO with an upside of about 20%.

The aim of this thesis is to make sense of the deal while bearing in mind that in the current economic context and supply chain challenges, it is important to focus on other factors than just technology. I start by providing insights as to why SIMO, which was already seeking potential takeover interest in April constitutes an attractive acquisition target.

SIMO’s attractiveness as an acquisition

SIMO is a fabless company that designs semiconductors. Founded in 1995 in California before being headquartered in Taiwan, it has design centers in the U.S., Taiwan, South Korea, China, and Japan. It grew at a phenomenal rate of 71% in 2021 when considered on a year-on-year basis, driven by increased demand for customized chips that need to be designed before being produced as opposed to commoditized ones that are readily available off-the-shelf.

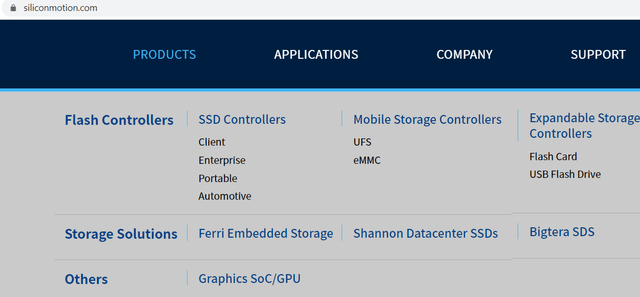

The company’s innovative approach lies in the way it develops NAND flash controllers, namely by using MMC (multimedia card controller) technology.

SIMO Products (www.siliconmotion.com/)

These are in turn used in order to manufacture the storage SSDs (solid-state devices) by hardware manufacturers like ScanDisk, Toshiba, Samsung Electronics (OTC:SSNLF), and others. These SSDs are capable of storing more data per disk than other NAND technologies. This ultimately means higher storage density and lower costs for data-hungry big tech. SIMO also supports the latest generation TLC (Triple-level Cell) flash and has acquired a leadership position in MMC controllers used in smartphones and tablet devices.

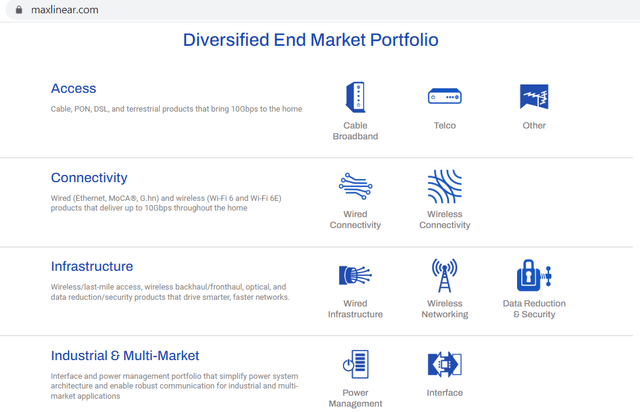

As for MaxLinear, its analog and mixed-signal integrated circuits are used in wired and 5G wireless infrastructures and data center optical interconnects that require high-speed connectivity. One of its key innovations is the low-powered tuner chip used in television and set-top boxes as part of IPTV offerings throughout the world.

MaxLinear’s products (www.maxlinear.com)

Its customers include Intel (NASDAQ:INTC), Teradyne (TER), Dell (DELL), Cisco (CSCO), etc. It is also a leading provider of analog and mixed-signal integrated circuits for connected home and industrial applications. The company is based in California.

Consequently, while there is some similarity, namely in terms of RF technology, these two companies predominantly offer different product types and their clients also differ.

Nonetheless, there are synergies.

Revenue and Cost Synergies

The main objective of the acquisition seems for the merged entity to become more of an end-to-end provider of chips, right from storage, and networking to data centers while not forgetting wireless mobile telephony. It will also advance MaxLinear’s strategy to increase scale and diversify sales to more end customers, especially those with tier-1 platforms.

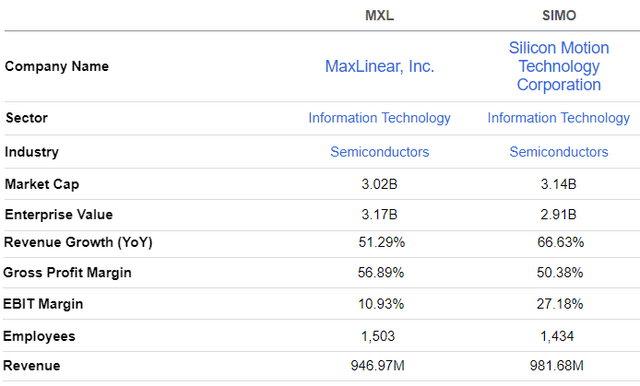

Tellingly, the combined entity will have access to a total addressable market of $15 billion, or roughly twice what MaxLinear can achieve on its own. At the same time, as I mentioned earlier, it will double in scale with a market capitalization of over $6 billion. Total revenues will also double to nearly $2 billion, obtained when adding the individual figures in the table below while gaining access to an additional talent pool of over 1,400 specialized employees is a positive in this tight labor market.

Comparison of key metrics (www.seekingalpha.com)

Furthermore, the acquisition has the potential to create a major fabless semiconductor supplier. Now, since both companies have to resort to contract manufacturers like Taiwan Semiconductor (TSM) for sourcing chips to use as components for their advanced electronic circuit boards, a combined entity could place high-volume orders meaning more economies of scale, in turn resulting in lower production costs. This can bring down the cost of revenues signifying better gross margins.

With different customer bases also comes the possibility to identify cross-selling opportunities without necessarily having to spend more on marketing, with one of the areas likely to be automotive. In this respect, SIMO has developed an array of storage solutions for EVs (electric vehicles) and autonomous driving applications. Now, with the densification of electronic content in cars whereby more chips are used in their control systems just like for servers in a data center, storage technologies using NAND flash can foster optimal performance and reliability. Furthermore, car manufacturers aim for sophisticated in-vehicle infotainment and navigation.

For investors, increased penetration of semis in the automobile industry represents a market on its own, one that should grow by 38.1% CAGR from 2022 to 2030.

Valuations and Key Takeaways

Therefore, there is the synergistic growth narrative, but, coming back to inflationary pressures and supply chain bottlenecks, I lay more emphasis on profitability.

First, more scale means that more revenues can be spread on the same fixed costs resulting in better gross margins. Continuing further, as the cost of doing business is rising, SIMO’s higher EBIT (or operating) margins with respect to MaxLinear, as shown in the above table deserve to be highlighted. These have been achieved despite the Taiwan-based company starting with lower gross margins of 51% compared to its U.S. peer. This in turn signifies that SIMO is incurring fewer operating expenses, probably as a result of keeping a large part of its staff in Taiwan, Japan, China, and South Korea where the impact of wage inflation is lower than in the U.S.

Second, with its successful M&A track record, MaxLinear should integrate SIMO in order to leverage technological expertise, thereby benefiting from cost synergies. For this purpose, the deal is expected to be immediately accretive to the bottomline including operating income and EPS. As for the cash flow, SIMO’s $174 million can potentially increase MaxLinear’s operating cash flow of $168 million by more than 100%, based on 2021 figures.

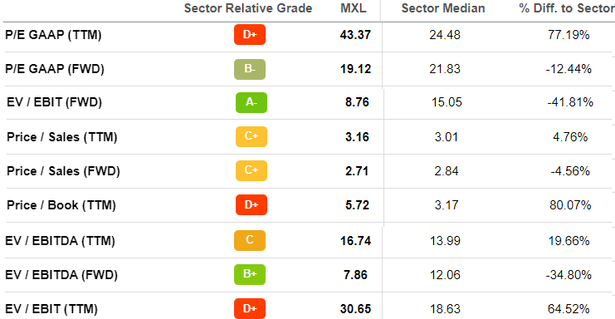

Digging deeper into the bottomline, in order to obtain the combined GAAP EPS for the year ending in December 2022, I added SIMO’s projected earnings of $7.46 to $9.34 to MaxLinear’s $3.84 to $4.18 using the midpoints. I obtain $12.41 (8.4+4.01) and when dividing MaxLinear’s share price of $39 by this figure, I obtain a P/E of 3.14x. This is much lower than the current forward P/E GAAP of 19.12x (table below).

This means that in the eventuality of the deal being closed in the current calendar year, MaxLinear could be undervalued by about 85% ((3.14-21.83)/21.83)) when considering the sector median’s P/E of 21.83x. Now, by incrementing MaxLinear’s current stock price of $39 by 85%, I obtain a target of $72, which is still lower than Wall Street’s forecast.

Valuation metrics (www.seekingalpha.com)

However, the deal could take some time to materialize given the number of jurisdictions it has to go through for regulatory approval, especially in China where SIMO is a leading supplier of SSD controllers for TLC flash. This is a technology that is seen as crucial in replacing mechanical hard disk drives in favor of TLC SSD which offers relatively higher performance and competitive advantage over traditional storage.

Therefore, there are some regulatory risks in case there is an aggravation of the geopolitical environment between the U.S and China over Taiwan. These risks may explain why, at $91, SIMO’s stock remains far from the $114.34 offered as part of the $93.54 in cash plus 0.388 shares of MaxLinear common stock. Now, the offer price represents a 48% premium to SIMO’s stock close on April 22, 2022, and despite its 20% upside, the company remains undervalued in terms of p/e multiples with respect to the sector median by at least 23%. Thus, based on valuations, SIMO is a buy and can still yield $10-11 in case there are positive developments on the regulatory front.

As for MaxLinear, it had only $170 million of cash and equivalents as per its last reported quarter and thus, it will have to fund the $3.1 billion cash part of the acquisition with debt financing. For this purpose, the company had $325 million of debt on its balance sheet at the end of March and a low long-term debt to total capital ratio of 37%. Going purely by the valuation metric, the company is a buy, but the adverse market reaction to the company’s stock on the announcement of the deal shows risk aversion, maybe due to the relatively large amount of money the company will have to borrow from banks, especially in a period of rising interest rates. Thus, in spite of its lower valuations, I consider the company to be a hold as it executes the deal.

Finally, this acquisition comes with both revenue and cost synergies, but there are risks of regulatory delays which may cause both stocks to be volatile. This said, SIMO is a buy, but, please wait for the market to stabilize before investing.

Be the first to comment