bymuratdeniz/iStock via Getty Images

Introduction

Bonterra Energy (OTCPK:BNEFF) is a micro-cap E&P company based in Alberta.

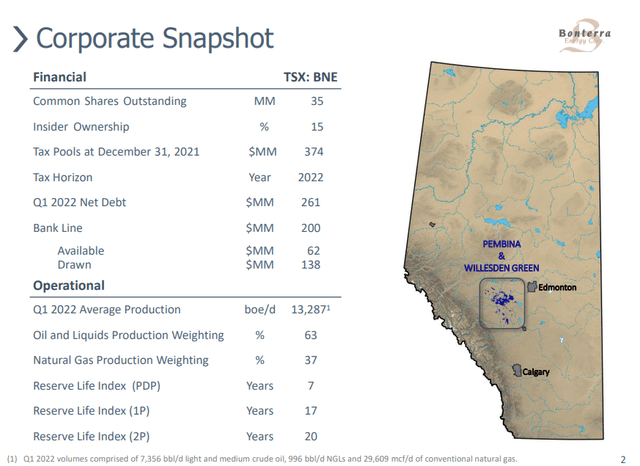

Below is a quick corporate summary:

Bonterra Energy Corporate Presentation

As can be seen, the two fields in Alberta are Pembina and Willesden Green. At the time of writing, the company has a market capitalization of $215mm USD and does around 13.5m BOE/D.

In this article, I will reference all figures in USD and use the OCTBB listing. This stock can be traded on the OTCBB in USD and TSX in CAD.

What Makes This Company So Attractive For Investors?

My avid readers already know that I follow a top-down approach to my investing where I start with a broader thematic or macro thesis and then find individual equities to play it.

I’ve already written about my macro views on oil a few months ago which I’ve linked.

In the article, I said that I’m very bullish on oil long-term due to my view that we have a shortage of oil, increasing demand, and secular inflation over the next decade.

But, over the next 6-18 months, I expect WTI oil to trade down to $70 per barrel due to significant slowdowns in the global economy along with significant monetary tightening.

With this view in mind, I would look to buy low-leverage oil stocks that are going at a cheap enough valuation, where even if oil prices were to go down during a recessionary period, the low leverage along with low valuation would support the price.

Why Micro-Caps?

More and more over the last year or so, I’ve looked at micro-cap E&P equities to find deep-value investments in this industry. This is because most sell-side analysts and large fund managers are only looking at large-cap companies which makes them go at a far higher multiple to free cash flow (“FCF”) (usually more than 10x) when compared to little-known and talked about E&P companies which will often trade at below 1.5x FCF.

Also, a company that’s going for only 2x FCF will compound at 50% per year, while one going at 10x FCF will compound at 10% per year, which means that deep-value micro-caps actually provide a better cushion against market downturns and better long-term compounding.

Growing Companies

Another factor I look for in E&P companies that Bonterra Energy has is high amounts of organic growth. An issue that I find with many larger E&P companies is that they pay out all their earnings in dividends or they do stock buybacks with their earnings, but they invest little to nothing into new high ROCE production projects. This is because many of these companies see the ESG pressures put on them by their shareholders and thus are looking to make fewer investments into new CAPEX and are instead giving capital back to shareholders or investing in green energy. Because Bonterra Energy is a smaller company with little shareholder ESG pressure, it can continue to invest in high ROCE CAPEX that its larger peers can’t.

Financials

The company does around 13,500 BOE/D currently.

Below I took the BOE/D to get the Revenue, then used the current Gross Margin to get the Gross Profit, and then used the current Operating Expenses to get the Operating Income for each price of oil including the breakeven price. To get info such as the gross margin and operating expenses, I used financials from Seeking Alpha. As for the production numbers, I used the corporate presentation.

| Price of Oil | $100 | $70 | $50 | $36 (Breakeven Price) |

|

Revenue (BOE/D*365.25*Price) |

$493,087,500 | $345,161,250 | $246,543,750 | $177,479,893 |

| Gross Profit (Revenue*0.746) | $367,843,275 | $257,490,292 | $183,921,638 | $132,400,000 |

| Operating Income (Gross Profit-Operating Expenses) | $235,443,275 | $125,090,292 | $51,521,638 | $0 |

Of course, there are a lot of caveats to doing this analysis. The first of which is that I’m using the oil price as a proxy for pricing revenue via the BOE/D; a possible risk in this kind of analysis that that gas prices go up with oil prices go down or vice versa, so the numbers are off since they are only based on an oil equivalent. If you want to know the production mix of the company I’ll link it here.

The second is that it doesn’t take into account the hedging that the company performs.

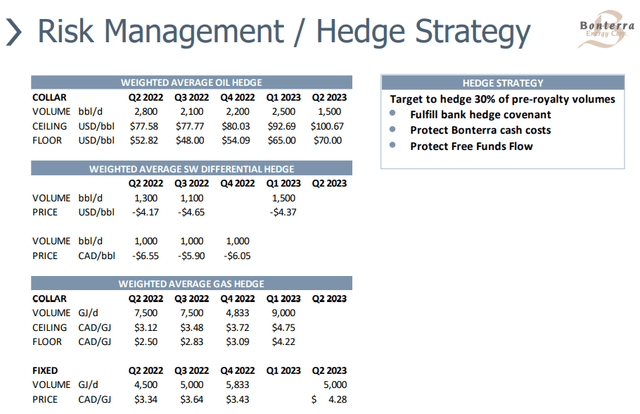

Bonterra Energy Corporate Presentation

As can be seen above, 30% of pre-royalty production is hedged. That means around 50% after royalties are taken into account. This hedging definitely makes it so that both profits and losses are capped. If you want to see a more in-depth view of the hedging losses I’ve linked the Bonterra Energy Q1 2022 Financial and Operating Results.

The third is that so much of this operating income goes into CAPEX. Just last quarter, $25.7 million was put into CAPEX. CAPEX is depreciated over time, and it counts as an operating expense, so this will negatively impact the EBIT/Operating Income over the coming years. This also leaves less cash for paying down debt, which I will talk about later in the article.

Production Levels

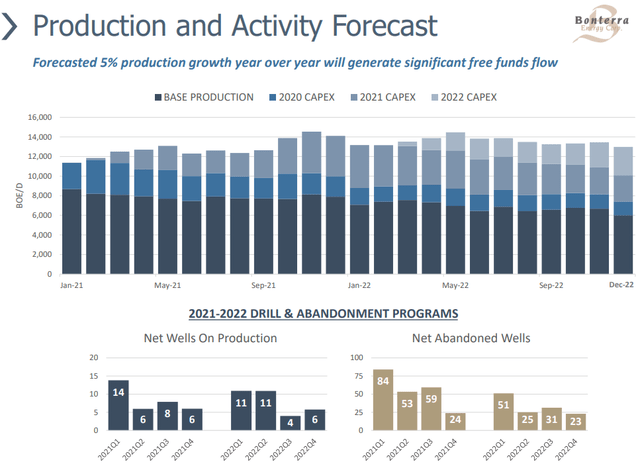

A positive thing I see with Bonterra Energy is that they are raising production.

Below is a chart of production in the past and expectations going forward:

Bonterra Energy Corporate Presentation

As can be seen above, all the CAPEX that the company does goes into increasing production. If they wouldn’t put this amount into increasing production then there would be declines in the current production, such as the chart below shows:

Bonterra Energy Corporate Presentation

Above are the decline rates for the Cardium Wells. If the company didn’t invest anything into CAPEX going forward, the decline rates would be similar to the chart shown above.

High ROA

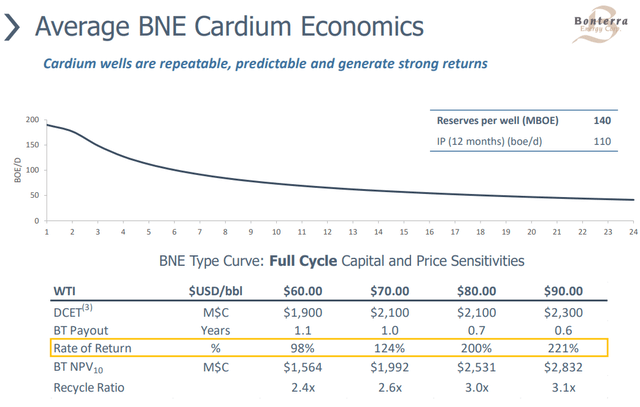

Another metric I like to look at is the return on assets of an E&P company. Many E&P companies today have a very low return on assets, and because of that they just pay out cashflows via dividends and stock buybacks rather than investing in new assets, since the returns aren’t high enough to justify the risk.

A benefit of Bonterra Energy is that they have a high ROA. As of March 2022, the total Net Property, Plant & Equipment is $729.2mm. The current operating income based on the strip prices over the next year is about $180mm. I generally calculate in the following manner: ROA = EBIT/NPPE; this makes for a ROA of 25%.

This will allow Bonterra Energy to consistently reinvest earnings into new assets and make a 25% CAGR on it.

Why I Still Wouldn’t Buy This Stock

You might be surprised to hear this, but I wouldn’t buy this stock. Yes, the operating income is $125mm at $70 oil, and higher currently; so a market cap of just $215mm seems like a very cheap multiple against it, and I like the growth, but there is too much leverage.

As of March 2022, the company has $448.6mm in total liabilities; of that amount, $166.7mm is current liabilities. That leaves $281.9mm in long-term liabilities. Most of this debt is due in 2024. While certainly the debt could be rolled over into another loan, I don’t like E&P companies to have a debt to equity of above 1, especially high-growth, micro-cap companies like this. As of March 2022, the book value of the company is $324.1mm. I would likely want to see the long-term liabilities go down below $200mm before buying. When a company has this much in liabilities, it becomes a call option on oil prices rather than a lower risk stream of cash flows that can be reinvested at a high ROIC. Since I’m slightly bearish on oil prices and not looking for a call option on oil, this company wouldn’t fit my criteria till it lowers leverage significantly. I’ve linked the annual report which provides more information on the two tranches of debt.

I also believe that the high leverage is the main reason that the market isn’t valuing this company at a higher multiple.

Conclusion

Overall, Bonterra Energy seems like it’s a good company. It has a low breakeven price on production and enough hedging to reduce downside risk along with a high return on assets and a cheap multiple on EBIT. The main issue I have with this company is the high leverage on debt that will be due in just two years, which could cause liquidity concerns if it can’t be paid down or rolled over.

Be the first to comment