tomch/iStock Unreleased via Getty Images

Thesis

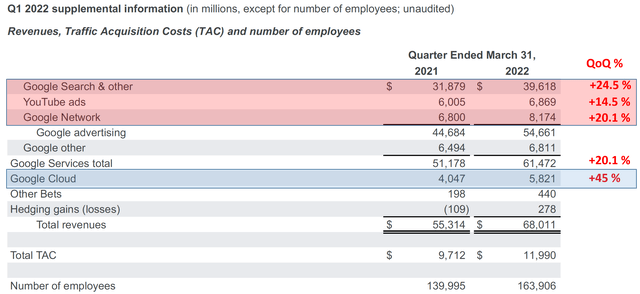

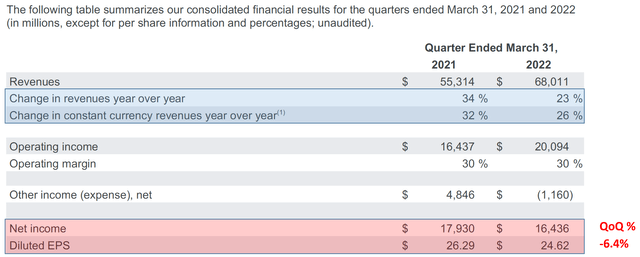

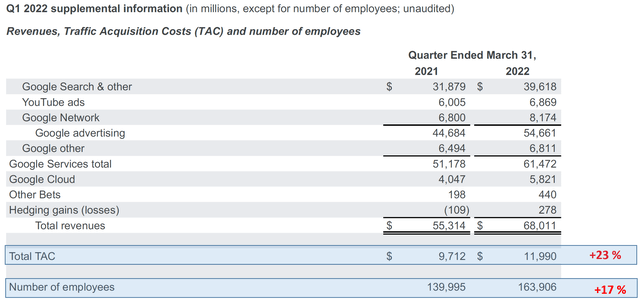

Google (NASDAQ:GOOG) (NASDAQ:GOOGL) reported mixed results for the March quarter, with 23% sales growth but profit is under pressure due to cost surges. These factors equated to about a 6.4% decline in its quarterly EPS, from $26.29 last year to $24.62 per share. The overall market suffered a substantial correction at the same time. All told, the stock price suffered more than a 25% correction YTD.

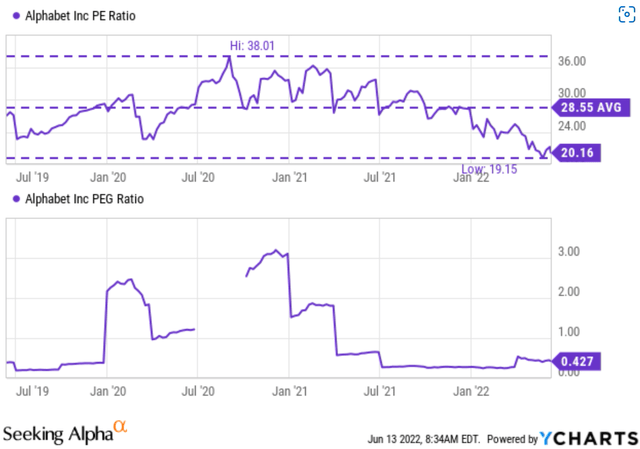

Looking past these short-term fluctuations, the thesis here is that GOOG is now priced like a value stock and the market has largely ignored its growth potential. All its main segments are posting terrific growth. Overall sales growth rate came in at 23% YoY. GOOG cloud grew 45% YoY. Its other “traditional” segments are also posting robust growth: search at 24.5%, YouTube at 14.5%, and Network at 20.1%. Yet, the stock is now priced at only 19.3x FW PE, about a 42% discount from the overall market’s 33+ PE. Its growth is even cheaper – its PEG ratio of 0.4x is less than 1/8 of the PEG assumed for the overall market. Such mispricing is too large to ignore. In a nutshell, it’s now a growth stock priced like a value stock.

Cloud outlook

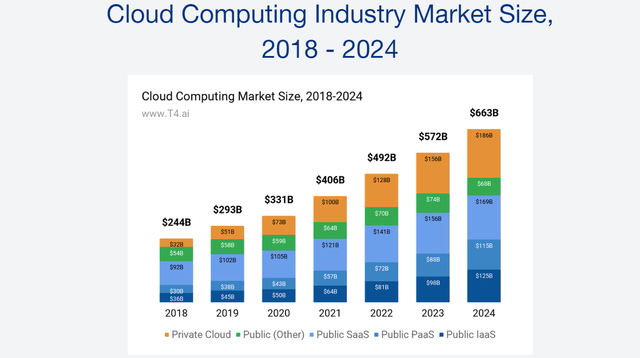

GOOG cloud is a high light in the earnings report. As you can see from the following chart, its growth rate of 45% YoY far exceeded the growth rates of its other “traditional” segments such as search (24.5% growth rate), YouTube (14.5%), and Network (20.1%). The growth is also supported by a robust secular shift toward the IaaS, PaaS, and SaaS models. According to a T4.ai report, the cloud computing industry market has increased from about $244 billion in 2018 to $492 billion in 2022, translating into a CAGR of 19.2% in the past four years. The total market size is projected to grow to $663 billion in 2024, at an annual rate of 16.1%. And as a leader in this space, GOOG is certainly growing faster than the overall market size.

I am also bullish on GOOG’s ongoing plan in this strategic future direction. It has identified 4 areas to focus on and differentiate itself, including cybersecurity, data cloud, secure infrastructure, and Google workspace. These areas address societal needs to transition into hybrid work securely and efficiently as CEO Sundar Pichai commented (abridged and emphases added by me):

Next, on to Cloud, where Q1 revenue grew 44% year-over-year with continued strong performance across Google Cloud Platform and Workspace. We continue to deliver differentiated products across 4 distinct areas. First, cybersecurity, where we introduced new offerings, including Assured Workloads to address digital sovereignty in the European Union… We also announced our intent to acquire Mandiant, a leader in dynamic cyber defense and response, to help protect customers from the most advanced threats.

Second, we continue to evolve a leading data cloud with serverless Spark to run batch Spark workloads… Third, our open secure infrastructure remains a differentiator as it enables customers to run their workloads and apps where they need them… Finally, we continue to advance Google Workspace. To support hybrid work, we recently introduced new collaboration features, including bringing Google Meet directly into Google Docs, Sheets and Slides.

GOOG earnings report Source: T4.ai

Valuation

Despite its strong fundamentals and robust growth prospects, its valuation is compressed both in absolute and relative terms thanks to the recent corrections. In absolute terms, its accounting FW PE is about 19.3x as of this writing. Its PE based on owners’ earnings (“OE”) is even lower, only about 18x, for the following reasons detailed in my earlier article:

- GOOG’s OE is higher than the accounting EPS, on average by about 30%.

- The reason is that almost ¼ of its CAPEX spendings are growth CAPEX, and the growth CAPEX should not be considered a cost because it is OPTIONAL.

In relative terms, the current valuation of the Nasdaq 100 index is about 33.8x. So GOOG is cheaper than the overall market by more than 43%. Its growth is even more cheaply valued as you can see from the bottom panel of the following chart. Its PEG ratio is currently at 0.43x. In contrast, the NASDAQ 100 index, assuming a generous growth rate of 10% for the overall economy, boasts a PEG ratio of 3.38, more than 8 times higher than Google.

Such large mispricing is too large to ignore considering that Google enjoys a much stronger financial position, wider moat, and better growth potential (because of segments like YouTube and Cloud as aforementioned) than most of the companies in the index.

Final thoughts and risks

GOOG is now a high-growth stock priced as a value stock. The market has disregarded its high growth (such as YouTube and Cloud), leading status, and financial strength. Also, the pending 20-for-1 stock split in mid-July serves as a near-term catalyst. A stock split makes no difference in terms of financials, and the catalyst impact will come in from other ways. The approval from the board of directors is a vote of confidence in the stock. The split will make GOOG stock more accessible to a broader investor base.

Finally, risks. It is very likely that there are some overcapacities to be digested in the near future after a long expansion cycle. Its headcount increased by 17% (or more than 23.9k) just over the past year alone. The rising TAC (Traffic Acquisition Costs) deserves more attention also. As detailed in my earlier article:

The TAC is one of the company’s most significant, yet difficult to model, costs (and hence the least discussed). TAC is the cost that Google has to spend to acquire traffic. It includes the costs that GOOG pays to its network members and also its distribution partners. Unfortunately, the TAC has been rising at a rapid pace too as competition in the digital ad world intensifies. As seen, TAC rose by 23% QoQ, slightly outpacing the revenue growth in its core segments (22%).

Be the first to comment