EvgeniyShkolenko

I recently came across a news article from CNN showing Russian ships allegedly stealing Ukrainian grain, and I was amazed by the detailed satellite images from the article. Apparently, the images were taken by Maxar Technologies Inc. (NYSE:MAXR)’s satellites, and my curiosity was piqued.

Maxar is reasonably valued for its existing operations, trading at 16.4x P/E on LTM earnings. Shares look attractive if we assume Maxar is successful in launching its fleet of new imaging satellites, with potentially 50% upside. I would recommend investors slowly accumulate shares ahead of the scheduled launch of the satellites in September. Bear in mind the stock has large 1-day moves, so risk-averse investors may want to consider a smaller position size.

Overview Of Maxar

Maxar has more than 60 years of experience in designing and manufacturing satellites and spacecraft components for communications, Earth observation, exploration and on-orbit servicing and assembly. It has two operating segments: Earth Intelligence and Space Infrastructure.

The Earth Intelligence business segment provides customers with high-resolution satellite images and analytics. Maxar currently operates 4 in-orbit satellites, which have combined collected over 137 petabytes of images over 20 years (Figure 1). Maxar is also designing and building a fleet of 6 new satellites called “Worldview Legion” that is expected to launch in The Fall. Customers for the Earth Intelligence segment include the U.S. government, other international government agencies, and enterprise customers.

Figure 1 – Maxar’s in-orbit satellites (Maxar 2021 annual report)

The Space Infrastructure segment provide solutions for communications, Earth observation, remote sensing, on-orbit servicing, robotic assembly and space exploration. Maxar primarily designs and manufactures satellites and space components for commercial satellite operators and government agencies worldwide. Over the years, more than 287 custom Maxar-built spacecraft, including 81 low Earth orbit (“LEO”) satellites, have launched with a combined 2,850 years of service.

Maxar Has Had Many Issues Recently

Investing in Maxar stock is definitely not for the faint of heart. In just the past 5 years, the company has experienced a short-seller attack in mid 2018, a satellite failure, a new CEO, a major write-down and dividend cut, a near escape from insolvency, a sale of an important business to pay off debt, and a bunch of delays to the launch of its next generation image satellites, just to name a few.

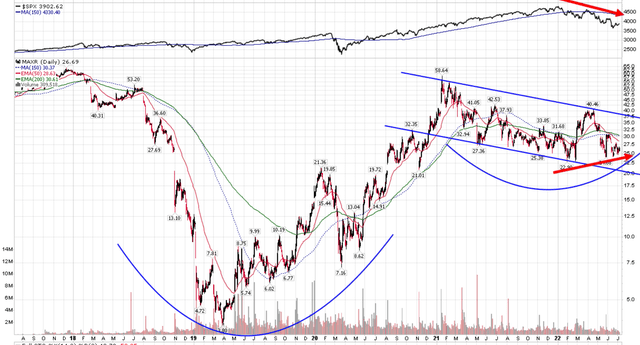

Figure 2 shows the stock price performance of Maxar. Notice the chart is full of large 1-day gaps, some as much as 35%. While the day-to-day price action in Maxar can be choppy, the long term chart does show a potential for a large cup+handle formation, with notable relative strength in recent weeks compared to the market.

Figure 2 – Maxar shares are volatile (Author created with price chart from stockcharts.com)

Financial Performance Has Been Volatile

One of the reasons why Maxar’s stock price has been so volatile is because its business model is dependent on contract wins and is very lumpy. It is very difficult for analysts to accurately predict Maxar’s earnings. Earnings per share surprise can range from -460% to +550% (Figure 3). Even when revenues surprised by +24% in Q4/2019, EPS ended up surprising by -300%!

Figure 3 – Maxar earnings are volatile. (Seeking Alpha)

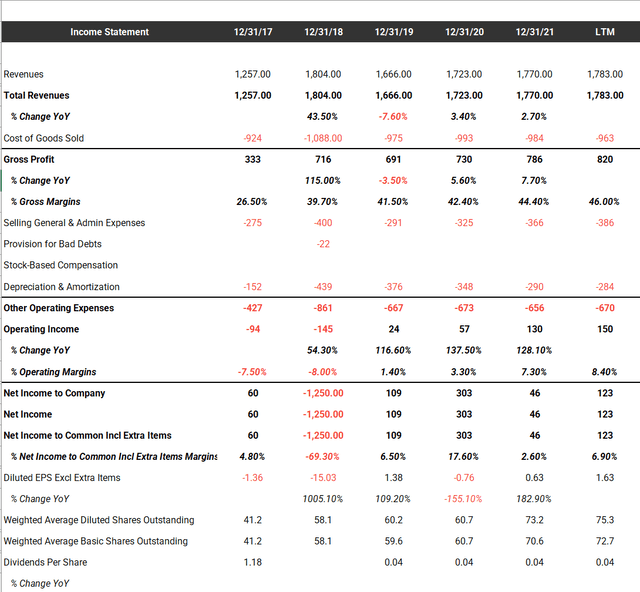

Lumpiness aside, the underlying business has been steadily improving since the near-death experience in 2019 (Figure 4). Even though revenues were still lower in 2021 than 2018, gross margin expanded by 470bps, which led to a dramatic turnaround in operating income from a loss of $145 million in fiscal 2018 to an operating profit of $130 million in 2021.

Figure 4 – Summary financials (Author created with data from tikr.com)

Worldview Legion A Key Upcoming Catalyst

A key upcoming catalyst for Maxar is the scheduled launch of its next generation satellites, “WorldView Legion.” Worldview Legion will be a fleet of six high performance satellites that will allow re-snapping of images of rapidly changing areas up to 15 times per day, an increase from four times per day currently, which will more than triple Maxar’s capacity to collect 30 cm resolution images and increase Maxar’s overall capacity in high demand areas.

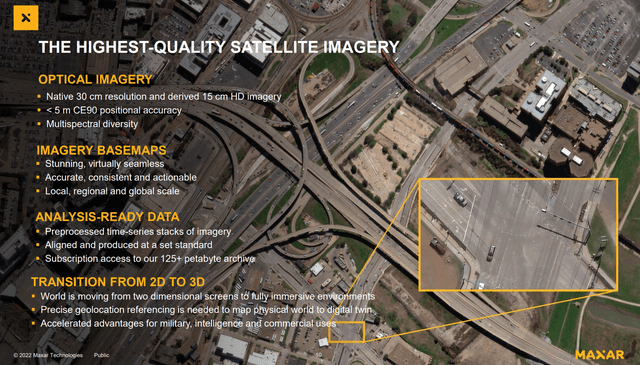

Figure 5 highlights Worldview Legion’s capabilities in more detail. Worldview Legion will have native 30 cm resolution and can derive 15cm HD images using data analytics. Worldview Legion will also be able to capture much larger single swath images, 672 sq km per swath at sub 50cm resolution compared to competitors that can only capture single image size of 26 sq km at 78 cm resolution.

Figure 5 – Worldview Legion capabilities (Maxar investor presentation )

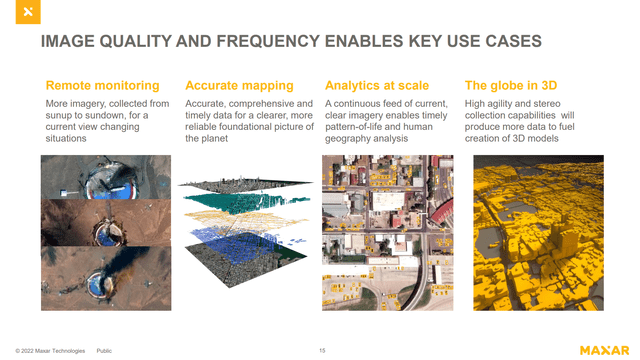

Worldview Legion’s enhanced capabilities will allow Maxar to offer novel use cases such as remote monitoring for high demand areas, accurate multilayer mapping, timely pattern-of-life and human geography analysis, and accurate 3D models of the world (Figure 6).

Figure 6 – Key use cases (Maxar investor presentation )

In fact, some analysts were so enamored with the new fleet of satellites that they estimated Worldview Legion can reignite topline growth for Maxar and drive the company to deliver $360 million of free cash flow by 2023. Obviously, the above analysis by Kerrisdale capital should be viewed with the 1-year delay in the satellites’ launch in mind.

Valuation Reasonable With Upside

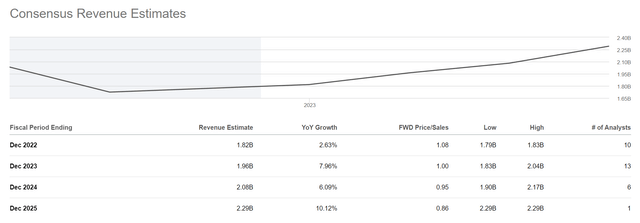

With LTM EPS of $1.63, shares are currently valued at 16.4x P/E, about inline with the market. Where it gets interesting is as Worldview Legion comes online in the next few quarters, Wall Street analysts estimate a significant ramp up in Maxar’s revenues from $1.8 billion in 2022 to $2.1 billion in 2024 (Figure 7).

Figure 7 – Consensus revenues (Seeking Alpha)

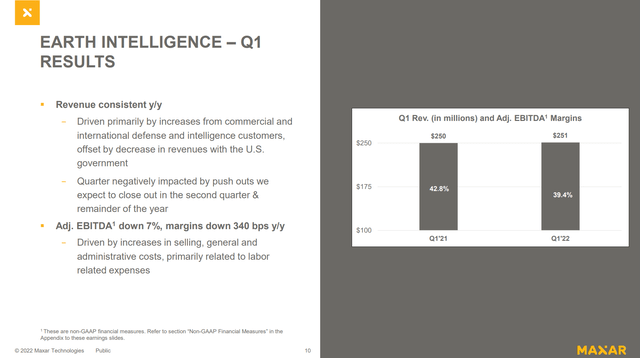

As we had mentioned above, Wall Street analysts are notoriously bad at estimating EPS for Maxar due to the lumpy nature of its business. Assuming the extra $300 million in additional revenue is from additional satellite images and that it comes at a 40% EBITDA margin (Figure 8), similar to the existing Earth Intelligence business, we could be looking at an additional $120 million in EBITDA.

Figure 8 – Satellite imagery EBITDA margins (Maxar Q1/2022 presentation )

If we value this $120 million in additional EBITDA at 8.5x (Maxar has traded between 7x to 13x EV/EBITDA, most recently at 8.4x), this could add $1 billion to Maxar’s market cap or almost 50% upside (Figure 9).

Figure 9 – Maxar EV / EBITDA valuation (Tikr.com)

Risks To Maxar Story

Worldview Legion Launch Date Biggest Near Term Risk

The biggest near-term risk is another delay in the launch of the Worldview Legion fleet of satellites. Initially, Legion was set to launch in mid-2021. Then it was delayed to the spring of 2022. In May, when Maxar released Q1 results, it delayed the launch again to September of this year. There is no guarantee that Legion will launch in the Fall.

Satellites Can Malfunction

Another key risk is that in-orbit satellites can malfunction. In face, in January 2019, the Worldview 4 satellite malfunctioned and Maxar lost 50% in value over two days even though Maxar had fully insured its fleet of satellites.

High Debt Load

Finally, the issue that almost pushed Maxar into insolvency in 2019 was its high debt load. Although more than $1 billion has been repaid, Maxar still carries around $2.1 billion of long-term debt. This equates to 4.8x Debt / EBITDA. High debt can limit Maxar’s operational flexibility or force the company to divest assets, like it did when it sold the MDA segment back in 2019.

Fortunately, Maxar’s period of high capital expenditures should be coming to an end once the Worldview Legion is in operation, and debt should be rapidly paid off from free cash flows that the satellites will generate.

Conclusion

In conclusion, I think investors should consider accumulating Maxar shares ahead of its launch of the Worldview Legion satellites, now penciled in for September. Its valuation is reasonable, and has considerable upside once the new satellites are in operation. However, Maxar is not a stock for the faint of heart, as its business is inherently lumpy and the stock price is prone to large 1-day moves. Investors should keep this in mind when sizing their position.

Be the first to comment