Investment thesis: The international environment is far too volatile right now. Although policymakers are engaging in the correct activities, we’re still too far away from a clear end game to make any moves into the international markets.

Markit released the first round of COVID-19 PMIs, with understandably brutal results:

- UK manufacturing: 52.2-44.3; Services: 53.2-35.7; composite: 53-37.1

- EU manufacturing: 49.2-44.8; Services: 52.6-28.4; composite: 51.6-31.4

- Japan manufacturing: 47.4-44.8; Services: 52.6-28.4; composite: 47-35.8

- Australia: manufacturing: 52.2-50.1; Services: 49-39.8; composite: 49-40.7

These numbers are actually somewhat interesting as manufacturing held-up well (all things considering); services took it on the chin. When Markit released the first China COVID numbers in the spring, someone commented that they expected a V-shaped recovery. Let’s hope that holds for all of the global economies.

The Bank of Japan released its latest meeting minutes. Here are a few salient points (emphasis added):

Due to the shock of COVID-19, firms’ mindset that it is desirable to accumulate cash and deposits could become more entrenched. Even when the economy recovers to a normal state, there is a possibility that income will not be used for spending but instead moved into deposits. Even though this may not be the case, if many firms try to accumulate once more the cash and deposits that were lost, due mainly to a decline in sales, the situation in which spending decreases and income is not easily generated may be prolonged

Remember that the BOJ is just as likely to use a national income macro analysis as a consumption analysis. This means the bank pays far more attention to the income-spending cycle than the Fed or ECB. It also means they’re far more attuned to economic velocity than other central banks while also explaining how Japan has actually done fairly well over the last four to five years.

The shock of COVID-19 is different in nature from that of the global financial crisis and that brought about by natural disasters at the time of the Great East Japan Earthquake. As there are high uncertainties, it is necessary to keep in mind that the impact of COVID-19 can be significant and not just temporary. Japan’s economy has shown some weakness since before COVID-19 exerted effects, and there is concern that it could remain weak even after overseas economies recover

The BOJ is not the first entity to use the natural disaster analogy to describe the actual impact of COVID-19. It’s an apt description since a natural disaster hits an area and essentially collapses that economy for a short period of time. However, unlike a tornado or hurricane, which lasts at most a few weeks, this will be at least several months in duration.

Like other central banks, the Bank of England is taking extraordinary measures. From their just-released meeting minutes:

-

On 17 March, HM Treasury announced the creation of the Covid Corporate Financing Facility (CCFF), for which the Bank would act as HM Treasury’s agent. This will provide funding to businesses by purchasing commercial paper of up to a one-year maturity. As an alternative source of finance for larger companies, the scheme will help preserve the capacity of the banking system to lend to other companies, including small and medium-sized enterprises.

-

Over recent weeks, the MPC has reduced Bank Rate by 65 basis points, from 0.75% to 0.1%, and introduced a Term Funding scheme with additional incentives for Small and Medium-sized Enterprises(TFSME). It has also announced an increase in the stock of asset purchases, financed by the issuance of central bank reserves, by £200 billion to a total of £645 billion.

-

At its meeting ending on 25 March 2020, the MPC voted unanimously to maintain Bank Rate at 0.1%. The Committee also voted unanimously for the Bank of England to continue with the programme of £200 billion of UK government bond and sterling non-financial investment-grade corporate bond purchases, financed by the issuance of central bank reserves, to take the total stock of these purchases to £645 billion

Expect more efforts to come in the near future.

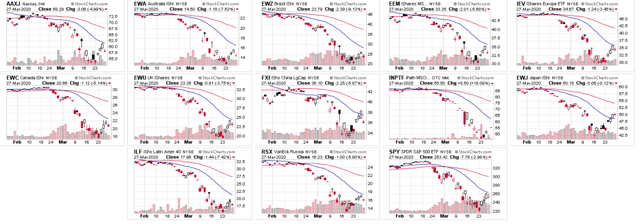

Let’s turn to this week’s performance table:This is what happens when fiscal and monetary policy markets act appropriately to a massive global contraction: the markets rally. The UK led the way higher, followed by Europe. Japan is as much a safe haven in difficult times as is the US.

However, the charts are less than impressive: All of the charts could be classified as a “dead-cat bounce” at this point. In other words, last week was a relief rally from an oversold condition. Next week, the markets are just as likely to move lower as the news drifts in a grim direction.

All of the charts could be classified as a “dead-cat bounce” at this point. In other words, last week was a relief rally from an oversold condition. Next week, the markets are just as likely to move lower as the news drifts in a grim direction.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment