piranka

Introduction

Even after a -20% decline in the S&P 500, it has been hard to find a good risk/reward in this market based on historical earnings trends. The task becomes even harder if an investor assumes the US could experience a recession within the next 18 months. I am well known for writing bearish articles when stocks are expensive and for aiming for very low prices before I buy quality stocks. But when the risk/reward looks attractive, I am more than willing to buy. Global Payments (NYSE:GPN) has risks, but I think the stock has fallen to the point that it now looks attractive even if we have a recession, so long as an investor is willing to hold the stock for the next few years.

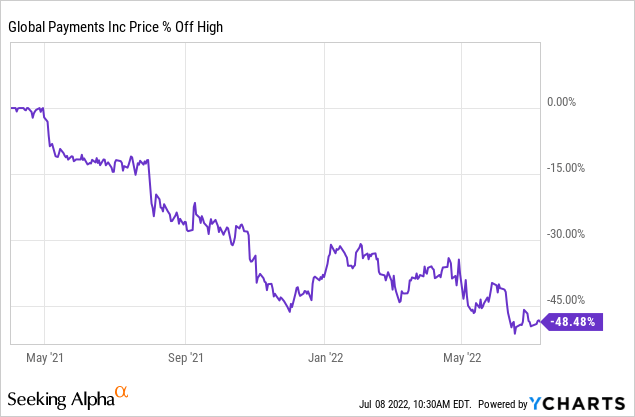

Currently, the stock is down nearly -50% off its highs from just over a year ago. This article will take investors through my standard valuation process for GPN, and then it will try to account for a potential recession as well.

How Cyclical Are Earnings?

Before I begin this analysis, I’ll check the business’s long-term earnings patterns in order to ensure that the business is a proper fit for this sort of analysis. If the historical earnings 1) don’t have a long enough history 2) are erratic in nature, or 3) are too cyclical, then I either avoid analyzing the stock altogether or I use a different type of analysis that is more appropriate.

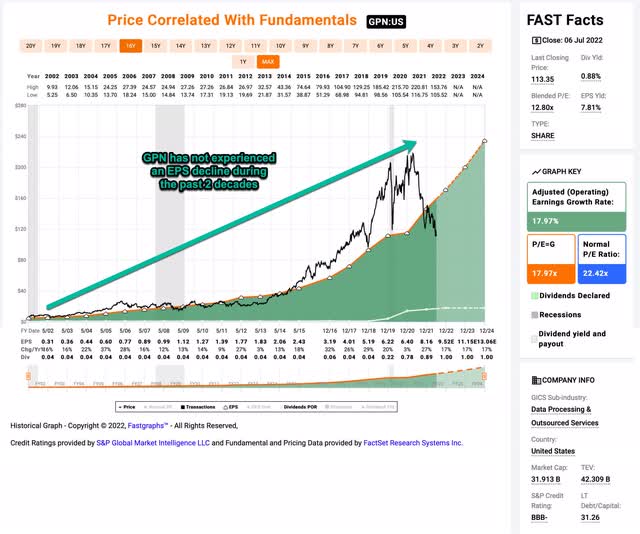

Over the past 20 years, Global Payments has grown earnings per share every single year. Not only does this make Global Payments a non-cyclical business, but it is what I categorize a “secular growth” business. It is very rare for a business not to have at least one or two years where EPS growth was negative, and there are only a couple of dozen stocks in the market that have managed to grow EPS every year for 20 years in a row. My experience has been that even if this trend changes at some point in the near future, that is even if things do go wrong, while a stock might underperform, investors often will have the opportunity to sell for a modest loss, or even a modest gain, so long as they buy the stock at a good price.

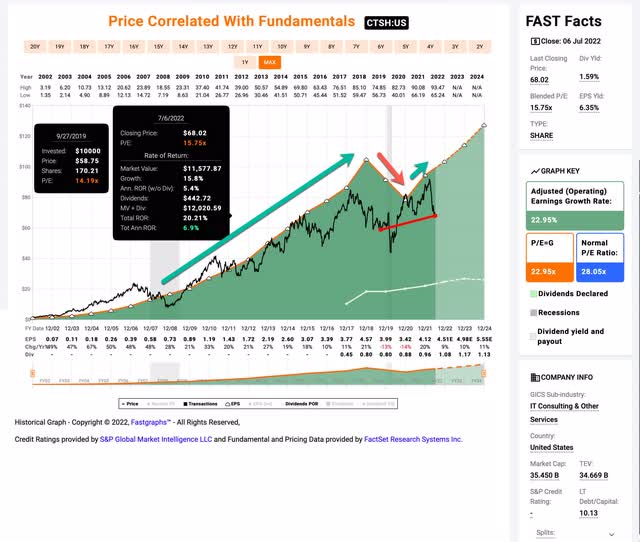

A good personal example of a former secular growth stock that I bought back on 9/24/19 that broke their historical growth trend and had earnings growth decline is Cognizant Technology Solutions (CTSH).

When I bought Cognizant in September of 2019, it looked like earnings would eventually decline that year, but analysts expected them to bounce back by 2020. Up until then, Cognizant’s earnings had risen every single year. What actually ended up happening was EPS declined both in 2019 and 2020. But because I paid a low enough price for the stock, I’ve actually been above water most of this time on my investment, and it has returned a modest 7% a year or so. Those aren’t the returns I was hoping for, but because it’s still a quality business with a very good historical record, I haven’t lost any money in it.

I have other similar data points like F5 (FFIV) as well, which has had a similar pattern. And though I don’t own it, IBM (IBM) had a similar pattern back when Warren Buffett held it, and it broke down, but after seven years, Buffett still managed to break roughly even on a total return basis. So, one of the benefits of buying a secular growth business, even if the immediate future of the trend might be threatened or uncertain, is often the actual downside risk isn’t very deep. So, as long as you buy at a good valuation, you can create a pretty good risk/reward situation for your investment where if it does work out, then you do great, and if it doesn’t, you have less of a chance to lose a lot. Generally speaking, it’s a good set for medium-term investors willing to hold 2-5 years.

As I noted, Global Payments does not have a record of EPS cyclicality, so the analysis I’m going to share is appropriate for this type of steady-earning stock.

Market Sentiment Return Expectations

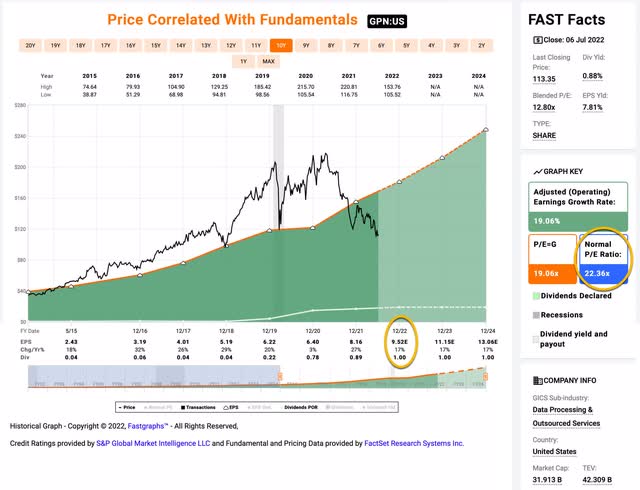

In order to estimate what sort of returns we might expect over the next 10 years, let’s begin by examining what return we could expect 10 years from now if the P/E multiple were to revert to its mean from the previous economic cycle. Since we have had a recent recession (albeit an unusual one), I’m starting this cycle in fiscal year 2015 and running it through 2022’s estimates.

GPN’s average P/E from 2015 to the present has been about 22.36 (the blue bar circled in gold on the FAST Graph). Using 2022’s forward earnings estimates of $9.52 (also circled in gold), GPN has a current P/E of 11.91. If that 11.91 P/E were to revert to the average P/E of 22.36 over the course of the next 10 years and everything else was held the same, GPN’s price would rise and it would produce a 10-Year CAGR of +6.05%. That’s the annual return we can expect from sentiment mean reversion if it takes ten years to revert. If it takes less time to revert, the return would be higher.

Business Earnings Expectations

We previously examined what would happen if market sentiment reverted to the mean. This is entirely determined by the mood of the market and is quite often disconnected, or only loosely connected, to the performance of the actual business. In this section, we will examine the actual earnings of the business. The goal here is simple: We want to know how much money we would earn (expressed in the form of a CAGR %) over the course of 10 years if we bought the business at today’s prices and kept all of the earnings for ourselves.

There are two main components of this: the first is the earnings yield and the second is the rate at which the earnings can be expected to grow. Let’s start with the earnings yield (which is an inverted P/E ratio, so, the Earnings/Price ratio). The current earnings yield is about +8.39%. The way I like to think about this is, if I bought the company’s whole business right now for $100, I would earn $8.39 per year on my investment if earnings remained the same for the next 10 years.

The next step is to estimate the company’s earnings growth during this time period. I do that by figuring out at what rate earnings grew during the last cycle and applying that rate to the next 10 years. This involves calculating the EPS growth rate since 2015, taking into account each year’s EPS growth or decline, and then backing out any share buybacks that occurred over that time period (because reducing shares will increase the EPS due to fewer shares).

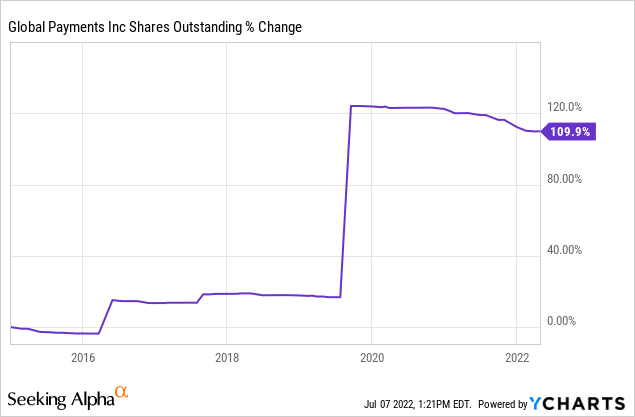

Since 2015, GPN has made a few acquisitions, and in order to fund those they have issued new shares, so over the time period since 2015 they have been a net issuer of shares. These are already accounted for in the earnings per share so I don’t need to make further adjustments for them. They have bought back about 6% of shares in the past couple of years since their last big M&A, so I did make adjustments for that. After making that adjustment, GPN has grown earnings at about +20.24% since 2015.

Now, at this point, I always like to ask myself if it’s reasonable to think they can keep growing earnings that fast for the next 5-10 years. And, in this case, I think that would be a pretty aggressive assumption. First, analysts are only expecting 17% earnings growth per year for the next three years. And second, a decent amount of their growth has come via acquisition this cycle. I am always cautious about businesses that have a history of a lot of M&A because usually it’s just a matter of time before one or more of the acquisitions don’t work out, and they overpay for it. It can also be a sign that they need to buy other companies to defend against disruption, and there is a long-term cost for that.

I don’t know enough about the specifics of this industry to declare what company policies are good or bad. So, the way I adjust for this risk is to lower my assumptions and make them less optimistic. This means if I buy the stock, it will be at a lower price. In GPN’s case, instead of a 20% earnings growth assumption, I am going to use a 15% earnings growth rate assumption, and that should bake in at least a little bit of an additional margin of safety.

Next, I’ll apply that growth rate to current earnings, looking forward 10 years in order to get a final 10-year CAGR estimate. The way I think about this is, if I bought GPN’s whole business for $100, it would pay me back $8.39 plus +15% growth the first year, and that amount would grow at +15% per year for 10 years after that. I want to know how much money I would have in total at the end of 10 years on my $100 investment, which I calculate to be about $295.81 (including the original $100). When I plug that growth into a CAGR calculator, that translates to a +11.46% 10-year CAGR estimate for the expected business earnings returns.

10-Year, Full-Cycle CAGR Estimate

Potential future returns can come from two main places: market sentiment returns or business earnings returns. If we assume that market sentiment reverts to the mean from the last cycle over the next 10 years for GPN, it will produce a +6.05% CAGR. If the earnings yield and growth are similar to the last cycle, the company should produce somewhere around a +11.46% 10-year CAGR. If we put the two together, we get an expected 10-year, full-cycle CAGR of +17.51% at today’s price.

My Buy/Sell/Hold range for this category of stocks is: above a 12% CAGR is a Buy, below a 4% expected CAGR is a Sell, and in between 4% and 12% is a Hold. That makes Global Payments a “Buy” at today’s price. In fact, even if I had used a 10% earnings growth assumption instead of 15%, it still would have been a buy. (I take small, 1% weighted positions when using this strategy.)

An Additional Consideration: Recession P/E

Since I have judged we are currently late in the economic cycle, I prefer to not hold stocks that are likely to fall dramatically during recessions, and I have sold most of the stocks in my portfolio that have a history of deep price or earnings declines during recessions (with a few exceptions), which is what I’ve spent most of my time writing about this year.

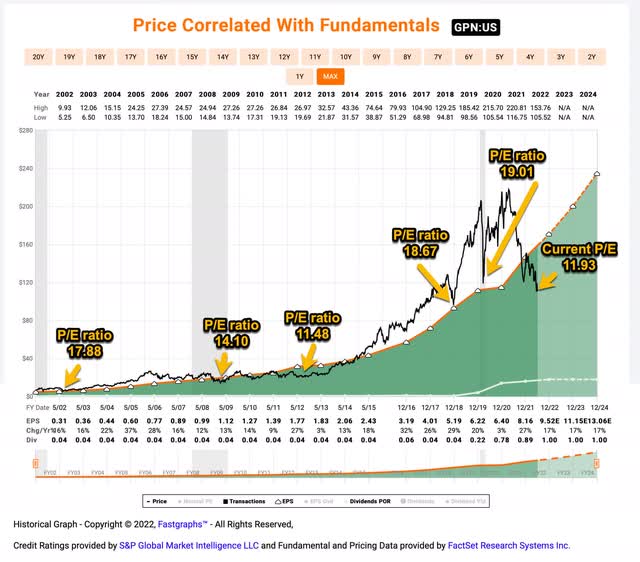

For the less-cyclical stocks that I’m currently buying, I require that their forward P/E ratios be lower than previous recession-low monthly average P/E ratios. Below I have illustrated the low points over the past two decades for Global Payments’ P/E ratio.

Global Payments’ lowest P/E over the past 20 years actually came in August of 2012, with a monthly average P/E 11.48. The current forward P/E is 11.93. Assuming earnings come in as expected, the price would need to drop only about -3.80% from here to hit that previous trough P/E, so basically Global Payments’ stock is trading right around its lowest P/E ratio in modern history. If investors wanted to wait for that -3.8% pullback before buying, chances are they will probably get it in the coming weeks, but I’m going to go ahead and give Global Payments a “buy” rating here.

Conclusion

Global Payments stock is not without risk. I am always very cautious about the stocks of businesses that are consistently acquisitive. It’s also possible that the market could be pricing in the danger of some disruption coming to their business in the future. I don’t claim to have the skill or time to sort all that out and produce an actionable probability. But right now, the analysts who cover the stock in close detail, are predicting 17% earnings growth and I am being much more cautious with my assumptions. Global Payments has a very good track record as a business and as a stock. My experience has been that 4 out of 5 times, as long as an investor buys at a good valuation, history carries the day and produces good, or great, future returns. But I don’t know ahead of time which ones are going to be the 1 in 5 that lose money. For that reason, I weight my stock purchases using this strategy with a 1% or 2% portfolio weighting, and no more. This way, I don’t lose a lot if a stock like GPN falters. If an investor wanted to take a bigger position in the stock, I would certainly do more detailed and deeper work on both the business and the industry.

Be the first to comment