Falcor/iStock via Getty Images

The Q1 Earnings Season was mixed for the gold producers (GDX), but most of the royalty names passed with flying colors, benefiting from similar metals sales at slightly higher metals prices. One example is Maverix Metals (NYSE:MMX), which reported a 6% increase in gold-equivalent ounces [GEOs] sold and a 12% increase in quarterly revenue. While partially overshadowed by some uncertainty for its Omolon Hub asset in Russia, its Nevada portfolio has never looked better. Given Maverix’s solid organic growth profile and attractive business model, sharp pullbacks should present buying opportunities.

Camino Rojo Operations – Maverix Metals 2% NSR (Company Presentation)

Maverix Metals has had a tricky couple of quarters from a development standpoint, but its luck may finally be changing as of last week. From a negative standpoint, Russia’s invasion of Ukraine and the risk of further sanctions have created some uncertainty for its Omolon Hub asset, and Agnico Eagle’s (AEM) decision to halt production at Hope Bay has sidelined this asset temporarily from a revenue contribution standpoint. Meanwhile, although the Moss Mine remains in production, marginal assets are at risk if inflationary pressures persist, potentially impacting the viability of Maverix’s 100% silver stream on the asset.

Fortunately, while these were all negative developments short-term, news out of Nevada remains quite positive, offsetting the negative developments elsewhere in the portfolio. The first piece of positive news was Centerra’s (CGAU) acquisition of the Goldfield District Development project in Nevada, where Maverix holds a massive 5% net smelter return [NSR] royalty on the permitted Gemfield project (main deposit at Goldfield). The second and most recent was Orla’s (ORLA) acquisition of Gold Standard (GSV), which has increased the likelihood of the South Railroad Project [SRP] heading into production and sped up the timeline. Before digging into these developments, let’s take a quick look at the Q1 results:

Q1 Results

As shown in the chart below, Maverix had another solid quarter from an attributable sales standpoint, with sales coming in at ~7,700 attributable GEOs, up 6% from the year-ago period, and growing at a ~21% CAGR since Q1 2019 (~4,360 GEOs). Meanwhile, cash costs remained at very attractive levels relative to its peer group, given its focus on royalty assets vs. streams, with a cash cost margin above $1,700/oz in the quarter. This was a meaningful improvement from the year-ago period (90% margin vs. 88% margin) and helped by lower cash costs.

Maverix – Quarterly GEO Sales & Cash Costs (Company Filings. Author’s Chart)

Looking at contributions across the portfolio, we can see that Beta Hunt, San Jose, and Karma had much softer quarters, weighing on contributions from these key assets in the period. However, this was more than offset by adding the Auramet stream that wasn’t present in Q1 2021, a new contribution from Elevation with a prepaid gold interest agreement, plus higher contributions from Omolon (expanded royalty interest) and the start of production at Camino Rojo. While Camino Rojo contributed 417 GEOs in Q1 2022, this is expected to increase to more than 500 GEOs per quarter once the Mexican asset reaches commercial production.

Maverix – Quarterly GEO Sales by Mine (Company Filings, Author’s Chart)

Finally, looking at revenue, Maverix reported a 12% increase in revenue, helped by increased gold sales and a higher average realized gold price ($1,894/oz). This translated to revenue of $14.7 million, with Maverix on track to report more than $60 million in revenue in FY2022, assuming it can meet its guidance of 32,000 to 35,000 GEOs for the year. While this is only a slight improvement from FY2021 levels, I expect a further increase in revenue in FY2023 and FY2024 as production increases at Beta Hunt and Camino Rojo delivers more ounces per annum with peak production averaging ~130,000 ounces in 2023/2024.

Maverix Metals – Quarterly Revenue (Company Filings, Author’s Chart)

Recent Developments

As noted previously, it wasn’t a great start to 2022 for Maverix when it comes to developments within its royalty portfolio. This was based on Americas Gold & Silver (USAS), excluding Relief Canyon from its multi-year outlook as it re-evaluates the project, Agnico halting production at Hope Bay to focus on exploration, and the Russian invasion of Ukraine resulting in significant sanctions on Russia. While this has yet to impact Maverix’s royalty on the Russian Omolon Hub operation and Polymetal (OTCPK:AUCOY) has shared that it hasn’t impacted operations, further sanctions and/or export/currency controls could impact operations and Polymetal’s ability to make payments to Maverix.

Obviously, this has created some uncertainty, especially given that Omolon Hub’s royalty interest was expanded late last year and now makes up nearly 7% of Maverix’s net asset value. Finally, while Elevation Gold continues to operate the Moss Mine in Arizona, the company’s all-in sustaining costs are among the highest industry-wide, and the company noted that it’s seeing impacts from energy, fuel, and consumables due to inflation. With all-in sustaining north of $2,200/oz, I don’t have a very optimistic long-term outlook for this asset, which could impact Maverix’s silver stream on the project.

Elevation Gold – Moss Unit Costs (Company Filings)

The one silver lining is that while Maverix can’t count on production from Agnico Eagle’s Hope Bay Mine over the short run, the commentary surrounding Hope Bay continues to improve. In fact, the company shared in its most recent Conference Call that this asset could have 300,000 to 400,000 ounce per annum potential, a significant upgrade from the 250,000 to 300,000-ounce potential discussed when it was initially acquired.

“We believe the project could ultimately produce 250,000 ounces, 300,000 ounces. But we still have to do the studies.”

– Sean Boyd, Agnico Eagle, Q4 2020 Conference Call

“The potential there, as we’ve always said, is to develop a project that’s 300,000 to 400,000 ounces a year, and we’re working on it. And again, we’ll leave that for a question period maybe with Guy.”

– Ammar Al-Joundi, Agnico Eagle, Q1 2022 Conference Call

The current focus is on exploration at Hope Bay, and there are no guarantees it heads back into production. Still, even at the low end of Agnico’s new upside potential outlook, we could see this asset contribute 3,000 GEOs per annum post-2026, which would be one of Maverix’s largest contributors, translating to nearly $5.8 million in annual revenue at a $1,900/oz gold price. Hence, while this was a downgrade to the short-term outlook with no likely contribution over the next 24 months, the long-term outlook remains solid at this asset. This is especially true given Agnico’s more aggressive exploration annual exploration budget after teaming up with free-cash-flow machine, Kirkland Lake Gold.

Railroad South Project (Orla Mining Presentation)

Now that the negative developments are out of the way, it’s worth spending some time on the positive developments. As discussed in my previous update, Centerra’s acquisition of the Goldfield District Project was great news, especially given that Centerra is likely hungry to diversify after arguably being robbed in the Kyrgyz Republic. However, Maverix’s future in Nevada looks even better following Orla’s recently announced acquisition of Gold Standard (GSV). Not only is Orla capable of developing the SRP Project, which is expected to produce ~150,000 ounces per annum, but Orla is a very solid operator among the junior producers, evidenced by its operational excellence to date at Camino Rojo.

Based on the recent Feasibility Study, the SRP in Nevada has the potential to produce ~150,000 ounces per annum over its first four years, translating to ~3,000 GEOs per annum attributable to Maverix. While this isn’t much different from the previous outlook for the project, the issue was that there wasn’t a clear start date for construction under Gold Standard, and any major cost overruns could have been crippling for a junior not benefiting from free cash flow generation. Hence, this project moving into the hands of an experienced operator with a strong management team is a major upgrade, with the potential for the first production from the SRP in 2025.

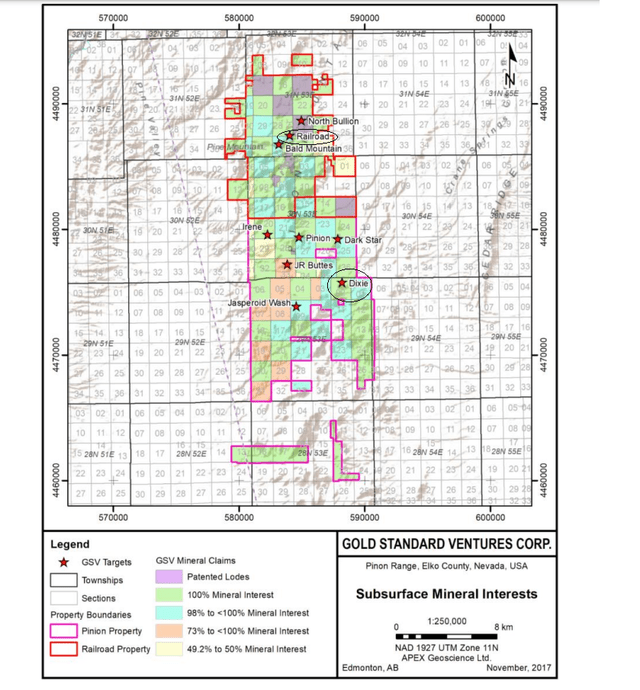

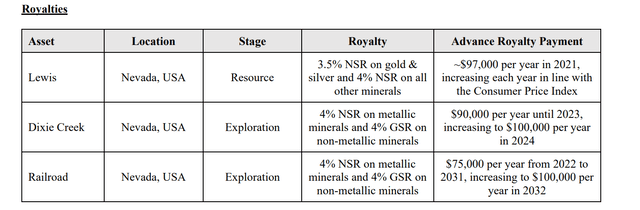

Railroad/Dixie Creek Claims – Railroad Project (Gold Standard Technical Report)

Finally, this has also significantly improved the regional potential at the SRP, which benefits Maverix since the company acquired Nevada royalty claims in Q1, including 4% NSR royalties on metallic minerals at the Dixie Creek and Railroad claims. Dixie Creek lies 3 kilometers south of the high-grade Dark Star deposit, while the Railroad claims lie north of the main and lower-grade Pinion deposit and just south of North Bullion towards the north end of the property. Under Gold Standard, which was tight for cash, the chance of developing these assets was low, so the value of the acquisitions was mainly for the advance royalty payments. However, with Orla taking over the reins, I imagine regional exploration could become a priority, to potentially explore the possibility of a larger mining hub in Nevada.

Recent Nevada Royalties Acquired by Maverix (Company Filings, Author’s Chart)

To summarize, while Gold Royalty Corporation (GROY) was previously the junior royalty company of choice (sub 50,000 attributable GEOs) regarding Nevada royalty exposure, Maverix looks to have the brightest future in Nevada. This is because while Gold Royalty Corp. has a royalty on REN at the Carlin Complex, Marigold, Isabella Pearl, Gold Rock, Rodeo Creek, and Jerritt Canyon, Maverix has a massive royalty on Gemfield, royalties covering a significant portion of land near the SRP, a royalty on SSR Mining’s (SSRM) Trenton Canyon, a royalty on Mother Lode, and a royalty on Waterton’s oxide heap leach project: Spring Valley.

One could argue that GRC has just as attractive a Nevada portfolio, and it certainly does have a lot of promise in the state from a future revenue standpoint. However, with AngloGold (AU) now controlling Mother Lode, Orla set to control the SRP, SSR Mining looking for growth opportunities at Marigold (Trenton Canyon), and Centerra set to publish a Feasibility Study on the already permitted Gemfield, I would argue that Maverix’s near-term outlook is much better. This is because if everything goes right, Gemfield, South Railroad, and Mother Lode could all be in production by H2-2026.

Valuation

Based on ~158 million fully diluted shares and a share price of US$4.60, Maverix trades at a market cap of ~US$727 million. Based on my estimated net asset value of ~$665 million for Maverix, this leaves the stock trading at ~1.1x P/NAV, which is a premium to its peers, but a discount to mid-cap/large-cap precious metals royalty/streaming stocks. Given Maverix’s attractive jurisdictional and impressive organic growth profile, it can easily command a premium multiple relative to its junior royalty peers. So, based on what I believe to be a fair multiple of 1.40x P/NAV, I see a fair value for the stock closer to US$6.00.

While this translates to more than 28% upside to current levels, I prefer to buy at a minimum 35% discount to fair value when buying small-cap royalty names. After applying a 35% discount to fair value, the low-risk buy zone for Maverix comes in closer to US$4.00. Obviously, there’s no guarantee that the stock will pull back this sharply following the recent upgrade to the investment thesis (ORLA buying GSV). Still, during a cyclical bear market for the S&P 500 (SPY) that often puts pressure on equities in all sectors, I am only interested in paying the right price for stocks, and no higher, and that price is closer to US$4.00 for MMX.

Summary

Maverix Metals is one of the better royalty bets out there in the precious metals space, and while the company has seen some negative developments in its portfolio over the past year, the recent acquisition of Gold Standard by Orla is a large win. This increases the probability of this asset heading into production in a timely manner and the value of Maverix’s other royalties on SRP claims, with a new operator capable of more aggressive regional exploration. Given this recent upgrade combined with an already solid organic growth profile, any pullbacks towards Maverix’s lows in May should present buying opportunities.

Be the first to comment