imaginima/E+ via Getty Images

Kilroy Realty Corporation (NYSE:KRC) is a REIT with interests in premier Class A office, life science, and mixed-use submarkets in strong barriers to entry regions of the West Coast and Austin, Texas. Their top fifteen tenants as a percentage of annualized base rent (ABR) include some of the most well-known companies, such as Amazon, Inc (AMZN), Microsoft Corporation (MSFT), and Adobe, Inc (ADBE).

Providing downside protection to KRC is their strong balance sheet that includes liquidity of nearly +$1.5B and no near-term debt maturities. Additionally, their increasing footprint in life science, which currently stands at about 12% of NOI but is expected to reach 30% in later periods, provides the company with an attractive growth opportunity comprised of an in-person, mission critical focused industry. This should lead to growth in NOI and multiple expansion in future periods.

Over the past one month, KRC is down over 15%, bringing their YTD losses to nearly 25%. This has brought the share price to levels last seen in early 2020, a period marked with significant disruption to offices across the country. Since then, occupancy has steadily improved and KRC’s earnings, along with their annual dividend, have continued to grow. The mispricing of the company’s performance, along with their overlooked expansion into Austin and the Life Science industry, has presented an attractive entry point for long-term focused investors drawn to continued dividend growth.

Earnings Review And Other Reportable Events

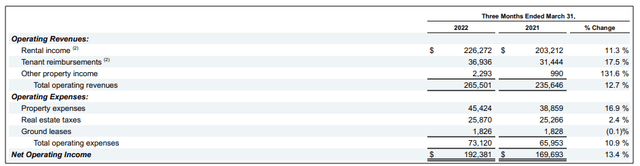

In the most recent quarterly filing period ended March 31, 2022, KRC reported total operating revenues of +$265.5M. This was up 12.7% from the same period last year and about +$8.5M better than expected. NOI was also higher by 13.4% on a total portfolio basis.

Q1FY22 Earnings Release – Total NOI Summary

On a same-store basis, GAAP same-store NOI was up 9.1%, while cash NOI was up 10.1%. When excluding onetime items and adjusting for nonpaying tenants, cash NOI was up 12.8%. This builds on a 10.5% GAAP increase reported at the end of Q4.

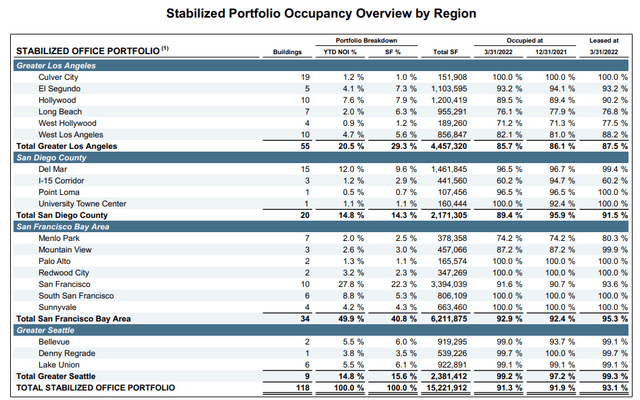

While there was a decrease in occupancy in the current quarter due to move outs in the San Diego region that were previously disclosed by management, the stabilized portfolio held strong at 91.3% occupied and 93.1% leased. Contributing to occupancy growth during the quarter were gains in San Francisco and Seattle, with occupancy increasing 50 and 200 basis points, respectively.

Q1FY22 Earnings Supplement – Total Occupancy Figures

Positive leasing trends continued in the quarter, with approximately 183K of new and renewal activity at cash rents that were up 6.7% from prior levels. Lease rollover also remains low at a peer low of 7% expiring each year through 2025. This minimizes near-term lease-up risks and costs associated with re-leasing.

The overall pipeline appears healthy, with the company in late-stage negotiations on more than 350K square feet of office space in their core portfolio across multiple markets. Additionally, KRC continues to see strong residential demand in their markets, which is good for their office portfolio in the longer-term.

KRC also continues to be active in development. In March, they began construction on the last two San Diego life science redevelopments discussed in the prior quarter. In total, the three life science redevelopments are expected to ultimately generate +$10M in excess NOI over pre-development levels. In addition to activity within life sciences, KRC is also further expanding into the Austin submarket, with the acquisition of a 2.9 acre development site at a purchase price of +$40M.

Looking ahead, KRC increased their expectations for development spending to a range of +$500M-+$575M. They also revised guidance upwards, with same-store NOI growth now expected to be 50 basis points higher at the midpoint and full-year FFO/share projected to be $0.06 higher at the midpoint.

The Fundamentals

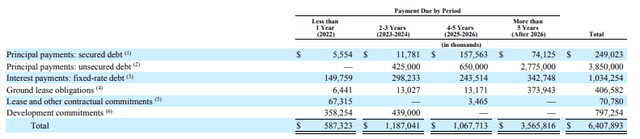

As of March 31, 2022, KRC had total assets of +$10.6B, comprised of +$9.3B of net real estate, and +$4.9B in total liabilities, composed principally of net unsecured debt of +$3.8B. Total liquidity at period end stood at +$1.4B, with +$331.7M in cash and equivalents and +$1.1B available on their revolving credit facility.

As a multiple of annualized EBITDA, net debt was 5.9x. In a timely move in 2021, the company issued +$450M in bonds at a rate of 2.65%, the proceeds of which were used to redeem debt due in 2023. As a result, KRC has no debt maturities until December of 2024 and faces no near-term repayment risks. Another appeal to KRC’s debt structure is their 100% fixed-rate weighting, which serves as protection against a rising rate environment.

2021 Form 10-K – Summary of Total Contractual Obligations

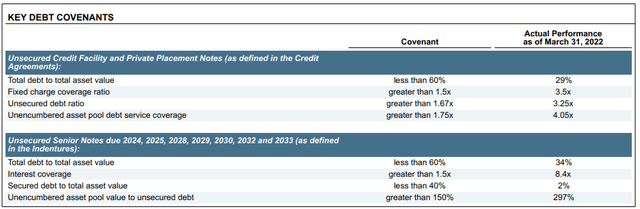

KRC is also at little risk of a covenant violation. One standout metric is their interest coverage ratio of 8.4x. This far exceeds the requirement of >1.5x and provides further confidence of the company’s ability to meet their reoccurring interest obligations prior to debt maturity.

Q1FY22 Earnings Supplement – Debt Covenant Compliance Summary

Through 2022, the company’s development pipeline is fully funded via existing liquidity sources and/or dispositions. In the years following, the company has numerous funding options, including ATM equity, debt capacity, and joint ventures, among others. As such, there is little risk of a liquidity event in future periods that would materially affect operations.

While headlines often point to the demise of the office, demand for office space is still up 76% YOY and according to JLL, leasing nationwide has increased for five straight quarters through Q1FY22. Additionally, hiring continues to be healthy in KRC’s markets, with job postings at large technology companies up 75% YOY. Back-to-office initiatives in places such as San Francisco are also contributing to increased office demand.

The increased demand in addition to portfolio quality are all factors that support continued earnings growth for KRC. In fact, leasing spreads have stayed positive every quarter throughout the pandemic, which is a testament to the quality of their portfolio.

A strong balance sheet and positive rental growth enables KRC to provide a steady stream of dividends to their shareholders. In 2021, for example, they increased their dividend for the 6th year in a row. Moreover, the 4% increase represents a cumulative increase of nearly 50% since the first quarter of 2016.

In the current period, KRC paid out +$61.2M in dividends and generated +$178.7M in operating cash flows and +$59.4M in net income. While the payout is over 100% of net income, it is covered by cash flows by nearly 3x. Additionally, the payout represents just 64% of AFFO, which is significantly better than the sector median of 73%. Strong coverage affirms the sustainability of the current payout and lends credence to a future period hike, which will likely occur later this year.

Primary Risks

KRC’s operations are concentrated in four markets: California; greater Seattle; Washington; and Austin, Texas. In California, operations are further concentrated into just three primary areas, Greater Los Angeles, San Diego County, and the San Francisco Bay Area. While these markets provide numerous benefits, they come with unique risks, such as an unfavorable tax and regulatory environment. In addition, these areas are also more susceptible to adverse weather-related events and natural disasters that could cause significant property damage and/or result in higher insurance premiums and redevelopment costs.

KRC is also significantly dependent on their top 15 tenants, who collectively accounted for nearly 50% of ABR as of December 31, 2021. Over 50% of their tenants are also concentrated in the technology industry. An economic downturn in the industry to the extent that it would affect any of these tenant’s ability to meet their obligations to KRC would have a material impact on the company’s results of operations.

The COVID-19 pandemic has structurally impacted certain aspects of the economy and has resulted in a few fundamental changes that could impact KRC’s future operations. At the onset of the pandemic, many companies initially required their employees to work from home for an extended period. This resulted in increased vacancies at offices across the country. While many office-related REITs benefit from longer-term lease expirations, there is a chance that existing tenants will choose not to renew their leases in future periods due to the increased adoption of more hybrid or remote working arrangements. Or, companies could negotiate lower rates, which would negatively impact KRC’s future leasing spreads. While the company has been immune from these challenges currently, there is no guarantee that they will continue to avoid losses in later periods associated with the uncertainties of the future of work.

Conclusion

KRC is an owner and operator of some of the highest quality Class A properties along the West Coast. In recent periods, they have also expanded their footprint in Austin, Texas, which is seen as a key growth market. As an owner of premier office space, KRC is benefitting from steadily improving occupancy as workers are increasingly being called back to more hybrid working arrangements, at a minimum, with Austin leading the nation at a 60% occupancy rate.

While there are concerns regarding the future role of offices, KRC has yet to be impacted. Occupancy has remained above 90%, and their leasing spreads have stayed positive every quarter through the pandemic. Additionally, the company is benefitting from increased nationwide leasing, with figures up for five straight quarters and volumes at approximately 75% of pre-pandemic levels. KRC’s high quality buildings are a further draw to companies who have become more selective on their spacing needs.

At present, KRC is trading at 11.4x forward FFO and near their 52-week lows. Their dividend, which has been growing for the past six years at a five-year CAGR of 6.5%, is currently yielding 4%, which is on the high end of their historical range. At a 3.25% yield, shares would have upside of over 20%. The application of a standard dividend discount model using a 4.5% dividend growth rate also yields an implied share price in the mid-sixties, which would indicate a forward multiple of just 14.4x. For long-term investors seeking a high-quality office REIT with a solid track record of dividend growth, KRC is one that can exceed expectations.

Be the first to comment