Thomas Northcut/DigitalVision via Getty Images

A Quick Take On Sacks Parente Golf

Sacks Parente Golf, Inc. (SPGC) has filed to raise $20 million in an IPO of its common stock, according to an amended S-1 registration statement.

The firm designs and sells a range of golf products for consumer use.

Given the firm’s lack of revenue and ultra-high pricing expectations, my outlook on the SPGC IPO is on Hold.

Sacks Parente Overview

Camarillo, California-based Sacks Parente was founded to develop ‘technology-forward’ premium quality golf equipment for sporting enthusiasts.

Management is headed by Co-founder, President and Chief Executive Officer, Timothy L. Triplett, who has been with the firm since inception in March 2018 and was previously CEO of Nippon Xport Ventures (NXV), the company’s largest shareholder and was Co-founder, President and CEO of Brass Ring Spirit Brands.

The company’s primary offerings include:

-

Putting instruments

-

Golf shafts

-

Golf grips

-

Other golf-related products

The company designs its products to fit all skill levels within golf, from amateur to professional.

Sacks Parente has booked a fair market value investment of $3.6 million as of September 30, 2022 from investors including Nippon Xport Ventures and Parcks Designs, LLC.

Sacks Parente – Customer Acquisition

The firm sells its products worldwide via its direct ecommerce website, through distributors, subsidiaries, and via online and offline retailers.

Management intends to expand its production in the United States and to grow its marketing in Japan, South Korea, and Mexico in the coming years.

Selling, G&A expenses as a percentage of total revenue have risen sharply recently as revenues have increased slightly, as the figures below indicate:

|

Selling, G&A |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Nine Mos. Ended September 30, 2022 |

1547.1% |

|

2021 |

179.5% |

|

2020 |

330.2% |

(Source – SEC)

The selling, G&A efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of selling, G&A spend, fell to 0.0x in the most recent reporting period, as shown in the table below:

|

Selling, G&A |

Efficiency Rate |

|

Period |

Multiple |

|

Three Mos. Ended March 31, 2022 |

0.0 |

|

2021 |

0.1 |

(Source – SEC)

Sacks Parente’s Market & Competition

According to a 2019 market research report by Grand View Research, the global golf equipment market size was an estimated $6.5 billion in 2018 and is forecast to reach $7.6 billion by 2025.

This represents a forecast CAGR of 2.2% from 2019 to 2025.

The main drivers for this expected growth are growing disposable income from consumers, increasing golf tourism, and a rising desire for consumers to play outside sports for health reasons.

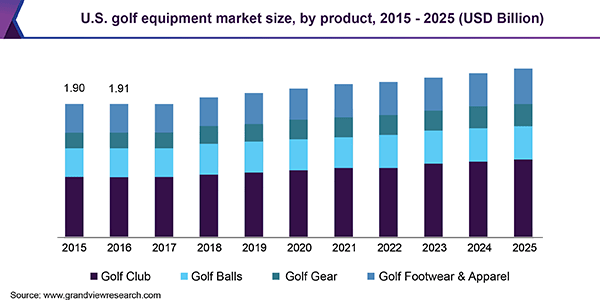

Also, below is a chart showing the historical and projected future growth trajectory for the U.S. golf equipment market:

U.S. Golf Equipment Market (Grand View Research)

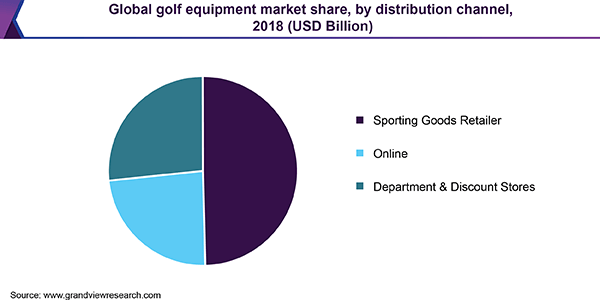

The chart below shows that, in 2018, approximately 55% of golf equipment was sold through sporting goods retailers:

Global Golf Equipment Market (Grand View Research)

Major competitive or other industry participants include:

-

Callaway

-

SRI Sports

-

Acushnet Holding

-

TaylorMade

-

Mizuno

-

Wilson

-

Ping

-

Fujikura Composites

-

Mitsubishi Chemical

-

Graphite Design

-

Paderson Kinetixx

-

Others

Sacks Parente Golf, Inc.’s Financial Performance

The company’s recent financial results can be summarized as follows:

-

Slightly growing topline revenue from a tiny base

-

Increasing gross profit but variable gross margin

-

Sharply growing operating loss

-

Higher cash used in operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Nine Mos. Ended September 30, 2022 |

$157,000 |

3.3% |

|

2021 |

$200,000 |

9.9% |

|

2020 |

$182,000 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Nine Mos. Ended September 30, 2022 |

$87,000 |

163.6% |

|

2021 |

$84,000 |

-40.4% |

|

2020 |

$141,000 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

Nine Mos. Ended September 30, 2022 |

55.41% |

|

|

2021 |

42.00% |

|

|

2020 |

77.47% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Nine Mos. Ended September 30, 2022 |

$(2,385,000) |

-1519.1% |

|

2021 |

$(294,000) |

-147.0% |

|

2020 |

$(473,000) |

-259.9% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

Nine Mos. Ended September 30, 2022 |

$(2,982,000) |

-1899.4% |

|

2021 |

$(302,000) |

-192.4% |

|

2020 |

$(479,000) |

-305.1% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Nine Mos. Ended September 30, 2022 |

$(575,000) |

|

|

2021 |

$(171,000) |

|

|

2020 |

$(228,000) |

|

(Source – SEC)

As of September 30, 2022, Sacks Parente had $145,000 in cash and $1.6 million in total liabilities.

Free cash flow during the twelve months ended September 30, 2022 was negative ($713,000).

Sacks Parente’s IPO Details

SPGC intends to sell 4.44 million shares of common stock at a proposed midpoint price of $4.50 per share for gross proceeds of approximately $20.0 million, not including the sale of customary underwriter options.

No existing or potentially new shareholders have indicated an interest in purchasing shares at the IPO price.

A separate Resale Prospectus was filed for the potential sale of 748,481 shares by a certain selling shareholder.

Assuming a successful IPO at the midpoint of the proposed price range, the company’s enterprise value at IPO (excluding underwriter options) would approximate $72.3 million.

The float to outstanding shares ratio (excluding underwriter options) will be approximately 22.71%. A figure under 10% is generally considered a ‘low float’ stock, which can be subject to significant price volatility.

Per the firm’s most recent regulatory filing, it plans to use the net proceeds as follows:

approximately $6.5 million for new opportunities and expansion into Asia;

approximately $3.8 million to fund marketing and professional tour-related expenses;

approximately $2.28 million for working capital to be used to add staff members including but not limited to sales/technical, engineering, factory, quality control, and administrative staff.

approximately $1.25 million for increased inventory;

approximately $1.0 million for manufacturing facilities and related capital equipment;

approximately $890,000 for accrued compensation owed to executives;

approximately $530,000 for loans to related parties;

approximately $350,000 for notes payable;

approximately $300,000 for legal, accounting, general and administrative expenses; and

approximately $250,000 for new product development.

This expected use of the net proceeds from this offering represents our intentions based upon our current plans and business conditions for approximately the next 12 to 24 months, which could change in the future as our plans and business conditions evolve.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Management says the firm is not currently involved in any legal proceedings or disputes.

The sole listed underwriter of the IPO is The Benchmark Company.

Valuation Metrics For Sacks Parente Golf

Below is a table of the firm’s relevant capitalization and valuation metrics at IPO, excluding the effects of underwriter options:

|

Measure (TTM) |

Amount |

|

Market Capitalization at IPO |

$88,073,519 |

|

Enterprise Value |

$72,295,519 |

|

Price/Sales |

429.63 |

|

EV/Revenue |

352.66 |

|

EV/EBITDA |

-29.21 |

|

Earnings Per Share |

-$0.15 |

|

Operating Margin |

-1207.32% |

|

Net Margin |

-1499.51% |

|

Float To Outstanding Shares Ratio |

22.71% |

|

Proposed IPO Midpoint Price per Share |

$4.50 |

|

Net Free Cash Flow |

-$713,000 |

|

Free Cash Flow Yield Per Share |

-0.81% |

|

CapEx Ratio |

-8.51 |

|

Revenue Growth Rate |

3.29% |

(Source – SEC)

Commentary About Sacks Parente Golf

SPGC is seeking U.S. public capital market investment to fund its marketing and production expansion plans.

The firm’s financials have produced increasing topline revenue from a tiny base, growing gross profit but variable gross margin, higher operating loss, and increased cash used in operations.

Free cash flow for the twelve months ended September 30, 2022 was negative ($713,000).

Selling, G&A expenses as a percentage of total revenue have fluctuated as revenue has increased; its selling, G&A efficiency multiple dropped to 0.0x in the most recent reporting period.

The firm currently plans to pay no dividends and expects to retain any future earnings for reinvestment back into the firm’s growth initiatives.

The global market opportunity for golf products is expected to grow at a relatively low rate of growth over the coming years.

The Benchmark Company is the lead underwriter, and IPOs led by the firm over the last 12-month period have generated an average return of 83.6% since their IPO. This is a top-tier performance for all significant underwriters during the period.

The primary risks to the company’s outlook include lower golf popularity in certain regions as well as high inflation on product costs.

Management is asking IPO investors to pay an Enterprise Value/Revenue multiple of over 352x.

The firm is still at a very early stage of development, and management hasn’t shown its ability to grow revenue in any appreciable sense.

Given the firm’s lack of revenue and ultra-high pricing expectations, so I’m on Hold for the SPGC IPO.

Expected IPO Pricing Date: To be announced

Be the first to comment