gguy44/iStock via Getty Images

(This article was co-produced with Hoya Capital Real Estate)

Introduction

Even though the FED Board lifted their key interest rate 25bps in March, it will be a long time before safer assets like CDs offer investors a real rate of return on their funds. Fed watchers are predicting at least five more 25bps hikes in 2022 and several more in 2023. Even so, that will barely reach or breach their 2% target for inflation. This has forced investors into funds of various types and investment strategies for the assets those investors do not want to have in equities. Investors can manage the risks to some degree by looking at a fixed income funds choice of assets, the fund’s duration and/or credit rating allocation, whether and how much leverage they employ. The article examines the Invesco Preferred ETF (NYSEARCA:PGX). Within the Portfolio strategy section of this article, I then compare it to other fixed income strategies. Depending on an investor’s goals, there are other options.

Examining the Invesco Preferred ETF

Seeking Alpha describes this ETF as:

Invesco Preferred ETF is an exchange traded fund launched and managed by Invesco Capital Management LLC. The fund invests in fixed income markets of the United States. It primarily invests in fixed rate U.S. dollar-denominated preferred securities including senior and subordinate debt securities that are rated at least B3 by Moody’s, S&P and Fitch. The fund seeks to invest in fixed income securities with at least one year remaining to final maturity. It seeks to track the performance of the ICE BofA Core Plus Fixed Rate Preferred Securities Index. PGX started in 2008.

Source: seekingalpha.com PGX

PGX has $6.6b in assets and provides investors with a current 5.3% yield. The managers charge 51bps in fees. The ICE BofAML Core Plus Fixed Rate Preferred Securities Index, which PGX benchmarks against, tracks the performance of fixed-rate US dollar denominated preferred securities issued in the US domestic market. This index is comprised of 100% retail securities and does not require securities to be investment-grade rated. Unfortunately, I could locate any more details on the Index, other than that the Index, thus PGX, are rebalanced and reconstituted on a monthly basis and the Index currently has 288 issues.

PGX Holdings review

PGX provided some basic portfolio information:

- Effective Duration 6.70 yrs.

- Modified Duration 10.58 yrs.

- Weighted Average Coupon5.48%

- Weighted Premium/Discount-3.84%

- Strip Yield 5.76%

|

S&P |

MOODY’S |

|---|---|

| A : 1% | A : 4% |

| BBB : 53% | Baa : 58% |

| BB : 39% | Ba : 20% |

| B : 2% | B : 1% |

| Not Rated : 6% | Not Rated : 17% |

The top two ratings listed are considered Investment-grade, making over 54%/62% fall into that category. Not Rated means the issuer did not ask to be rated, which they pay to happen. Sometimes this is done because the market knows where they would be rated, both good and bad.

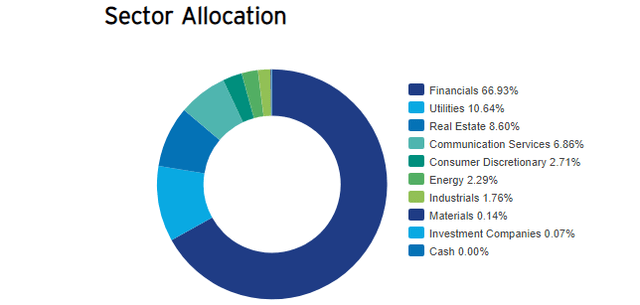

Investors should expect Financials to always be the dominate sector in Preferred Stock funds, with the exception of the ones that exclude that sector. Banks and Insurance companies are big Preferred stock issuers as they can count these assets as part of their required capital. I believe that rule requires said issues to be non-cumulative, a feature investors do not like as missed payments do not need to be made up before common shareholders can receive any dividends.

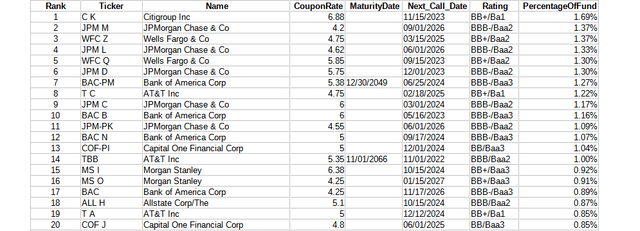

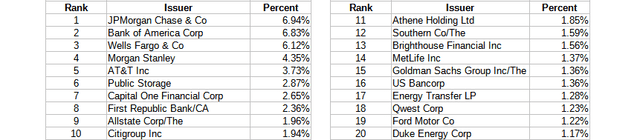

Top 20 assets

The list contains many of the largest banks in the country, as expected. The Top 10 account for 13% of the assets, with the Top 20 accounting for about 27% of the assets. PGX currently holds 293 assets. Of these, ones with a maturity date represent 13% of the portfolio and only one assets matures before 2030. All of the issues held are callable: 13% over the next 12 months and 60% over the next three years. Considering where rates are and possibly heading, I would expect most callable issues will be in 2022-23 if they can be retired or replaced with a lower coupon issue, neither of which would help PGX maintain its current payout level. A recent example was, JPM issued a Preferred with a 4.625% coupon about a year ago before rates were climbing. It now yields 5.4%; both below the weighted-average-coupon of PGX’s callable issues over the next year (5.7%).

What this list doesn’t tell investors is who are the largest Issuers, which I used the full holdings report to calculate.

There are 146 different issuers, where the Top 10 issued 39.8% of the portfolio and the second 10 another 13% of the portfolio. AT&T is the largest issuer outside the financial industry and only one in the Top 10. I do not see any of the Top 10, few in the next 10, likely to default on payments or principle.

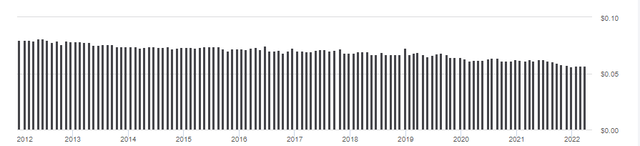

PGX Distribution review

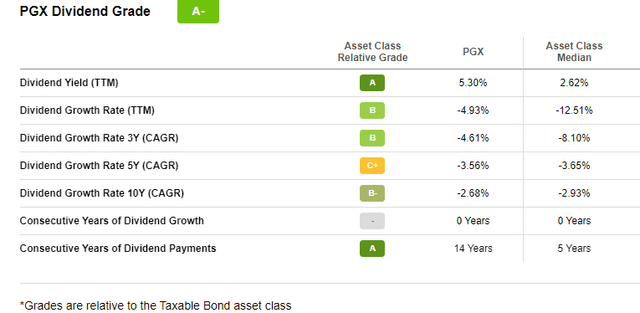

After years of steady decline, PGX’s three announced 2022 distributions are all slightly larger than the previous one. There is a history where that was followed by declining payouts, so something to watch for as rates climb and Call-dates are passed. This is how Seeking Alpha currently rates PGX on their dividend scales.

seekingalpha.com DVD scorecard

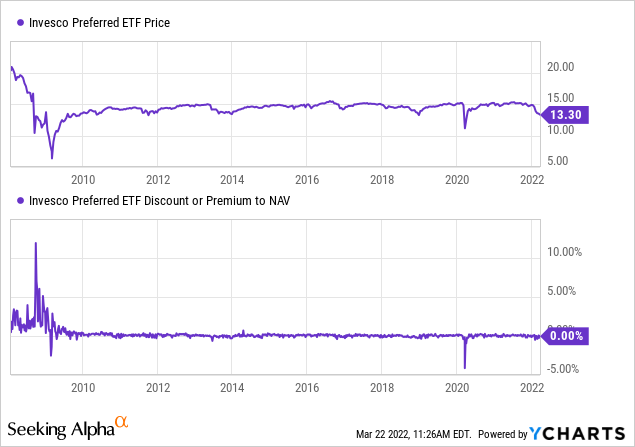

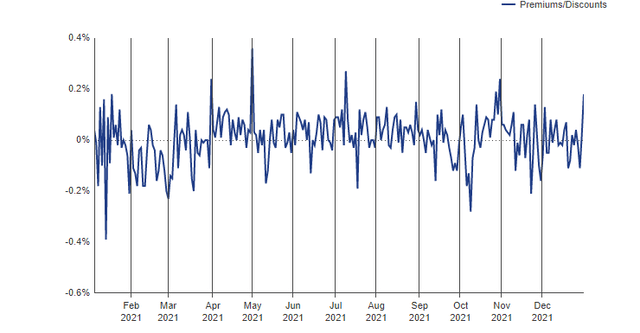

Pricing review

During the 2008-09 tumultuous times, PGX spiked to a large premium and during the COVID crash, a large discount for an ETF. Recent variations have been small, as shown in the next chart.

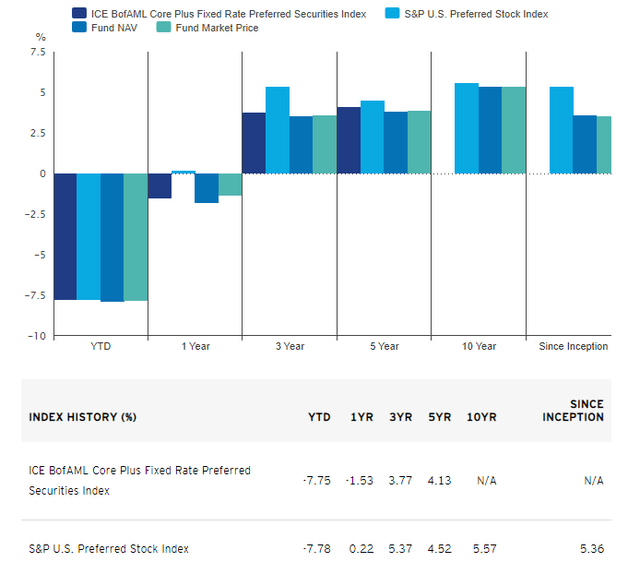

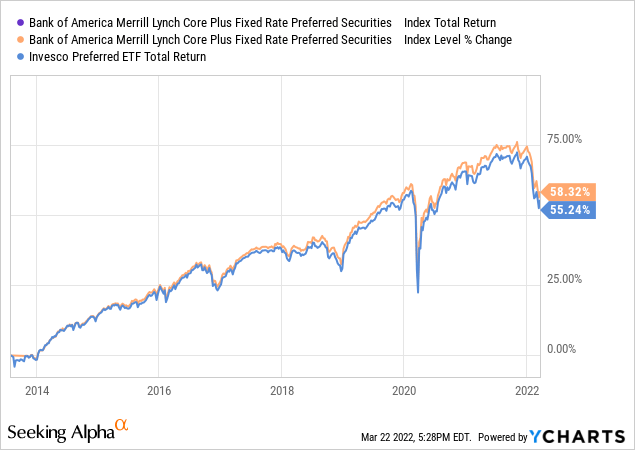

PGX has performed close to its target Index over the past ten years.

invesco.com PGX

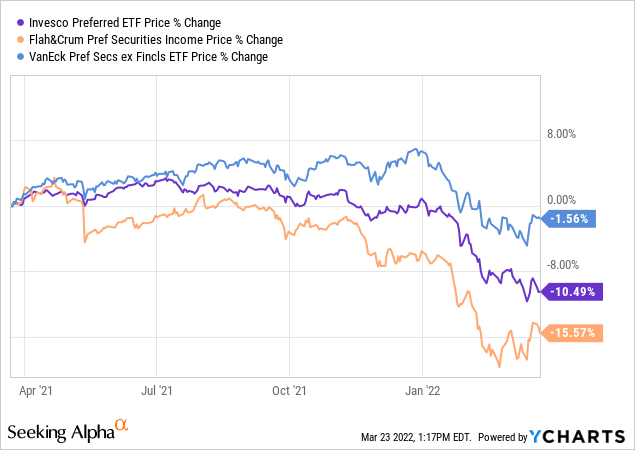

Like most fixed income funds, performance has been very poor since last fall. PGX hasn’t fared as well as the VanEck Vectors Preferred Securities ex Financials ETF (PFXF), which avoids issues offered by financial companies, the largest sector of the market, but much better than the Flaherty & Crumrine Preferred Securities Income Fund (FFC), a favorite of the CEFs.

Portfolio strategy

I will discuss two ideas. First is what about PGX? I’ll start by comparing how well it does versus its benchmark.

The underperformance can mostly be credited to the 51bps annual fees. When I ran the correlation, it came in at over 99% since the Index started in 2013, which shows it achieves it CAGR goals versus the Index.

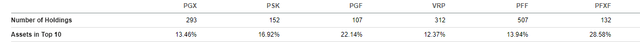

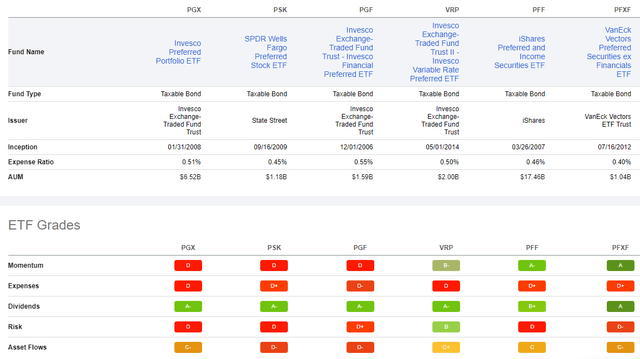

Using the Seeking Alpha Peers function, next I compared PGX against five ETF competitors.

seekingingalpha.com Peers seekingalpha.com Peers

Yields are all between 4.5% and 5.6%, with all cutting their payouts over the last 3- and 5-year periods. Except for the Invesco Variable Rate Preferred ETF (VRP), which I reviewed last fall, all score poorly on the risk scale. Even though VRP doesn’t, its recent performance is also very negative.

To the above ETFs, I added three popular CEFs; three “pure” Preferreds and one that blends REITs and Preferreds.

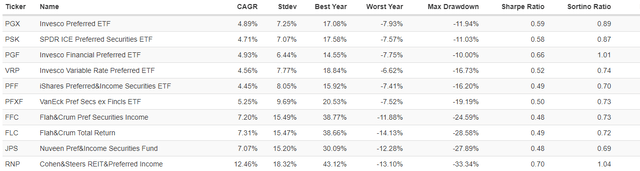

So while PGX, since 2014, has performed well against other ETFs measured by CAGR, its CAGR lags behind those of the CEFs used in this comparison. When looking at the Sharpe ratio, which measures return versus risk taken, only the Cohen & Steers REIT and Preferred Income Fund (RNP) had a better value, which the name implies, holds REITs too.

This seems to leave investors with several choices dependent on their own preferences:

- Invest outside just Preferred stocks and buy the RNP CEF, which has provided the best return and risk statistics.

- Accept the extra risk each of the other three CEFs have experienced for the potential higher returns they also generated.

- Stick with the ETF set but remove the largest sector, and own the PFXF ETF.

- Own the VRP ETF as the only fund listed that focuses on variable-rate Preferreds.

- Keep all sector exposure and pick the Invesco ETF you like best after taking a deeper look at FFC and Invesco Financial Preferred ETF (PGF).

Final Thought

With all but one of the ETFs having returns below 5% since 2014, one has to ask if Preferred stocks are a good place to invest with the Fed now pushing rates up. While VRP has done the best of all the funds listed above since 2021, it is still down 4%. Another strategy is building a baby bond ladder, as explained in my Building A ‘CD’ Ladder Using Baby Bonds article.

Be the first to comment