Aranga87/iStock via Getty Images

Thesis: Short-Term Pain, Long-Term Opportunity

Matthews International (NASDAQ:MATW) is an interesting small cap (~$800 million) conglomerate with a very diverse set of products, from caskets to warehouse robots to lithium battery manufacturing machinery.

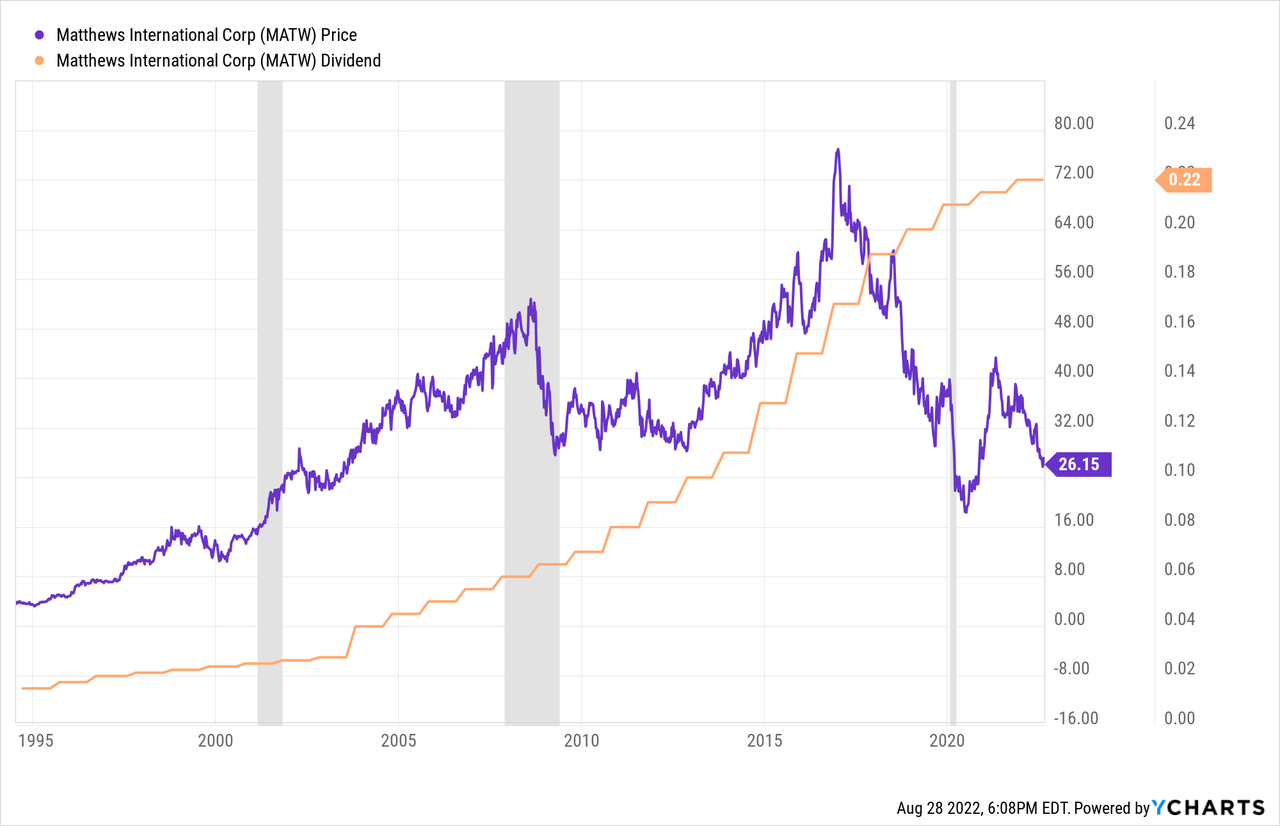

After a strong run of growth from the early 2000s through 2018, MATW’s stock price has hurtled downward – first because of COVID-19, and more recently because of a perfect storm of headwinds.

And yet, despite a slowing growth rate, these headwinds have not been enough to stop MATW from continuing its now-28-consecutive-year dividend growth streak.

This dividend appears to be safe and likely to keep growing for many years to come. Adjusted EPS for the first three quarters of fiscal 2022 (October 2021 through June 2022) were $2.06, down 17% from $2.48 in the prior fiscal year period. Even so, earnings still amply covered the dividend of $0.65 during those three quarters at a payout ratio of ~32%.

As we’ll see below, MATW has positioned itself well to capitalize on a few major growth trends, especially electric vehicles and warehouse automation and robotization.

At an enterprise value to EBITDA of 7.5x based on estimated EBITDA of $200 million to $210 million for fiscal 2022, MATW looks cheap, especially compared to its historical average EV to EBITDA multiple of around 14x. Plus, the company’s ~3.4% dividend yield is attractive for dividend growth investors.

Globe Newswire

Overview of Matthews International – Three Business Segments

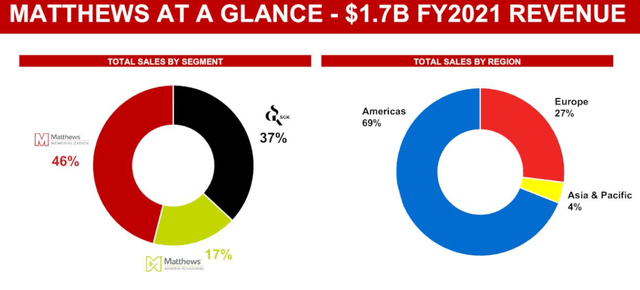

MATW is a conglomerate with three disparate and non-overlapping business segments:

- Memorialization (funeral and death care products)

- Industrial Technologies (battery storage and warehouse automation)

- SGK Branding Solutions (branding/packaging for retail and pharmaceutical products)

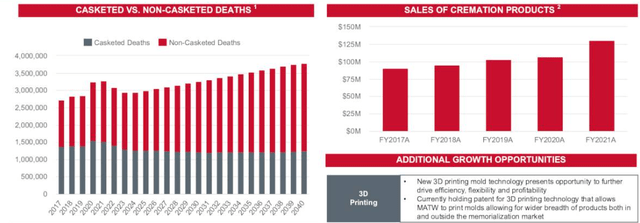

As you can see above, the largest segment is the memorialization business, which sells caskets, headstones, cremation machines, and other funeral home products. The company holds a commanding market position in this arena, which makes it strongly leveraged to the total number of deaths.

Given aging demographics across the developed world, this market should enjoy steady growth for decades to come. An increasing number of these deaths are projected to be non-casketed, but fortunately for MATW, the company’s globally leading market position in cremation equipment assures that it will benefit regardless.

Traditionally, this segment has been MATW’s bread and butter, generating lots of cash for the company, and it will probably remain that way for a long time to come.

Next up is the SGK Brand Solutions business, which generates the second most revenue for MATW. Here are some companies that make up some of SGK’s biggest customers:

Still, this segment has struggled recently, as the volume of products using SGK’s branding services has stagnated in the face of high inflation, especially in Europe.

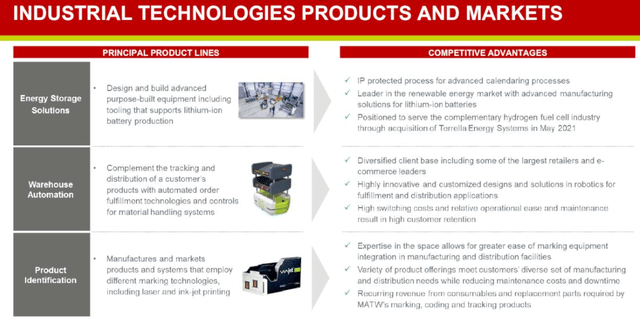

But the crown jewel and key driver of growth for MATW is its Industrial Technologies segment, which positions it to benefit from multiple megatrends including EVs, battery storage, e-commerce adoption, and warehouse automation.

MATW is the only producer of manufacturing machinery used for the production of lithium-ion batteries specifically using the dry electrode process. Admittedly, I am far outside my circle of competence here, but I have read that the dry electrode process of manufacturing lithium-ion batteries is significantly more efficient than the wet process as it saves a substantial sum in electricity costs.

Lowering the cost of producing lithium batteries in this way is a step toward accelerating wider adoption of the technology, both for EVs and in the utility space (large-scale battery storage).

In August 2022, MATW closed on the acquisition of two German engineering firms (Olbrich and R+S Automotive) that both specialize in lithium-ion battery production equipment. These acquisitions are a significant step forward for MATW’s burgeoning energy solutions division.

As CEO Joseph Bartolacci said of the acquisitions:

Our combined capabilities offer innovative solutions to accelerate development of an end-to-end solution for dry-electrode battery production and other energy solutions. Together, our offering will have significant impact on the mass market adoption of electric vehicles and benefit the entire energy solutions industry. This strategic acquisition continues our investment in technologies and accelerates commercializing new innovations across multiple industrial automation applications.

These acquisitions come in the wake of MATW’s opening of its own state-of-the-art production facility for calender rolls (a kind of equipment used for battery production) this year in San Antonio, TX, just a few hours from Tesla’s (TSLA) new gigafactory in Austin, TX. This facility also features expansion plans that would enable it to produce hydrogen fuel cell components in the future.

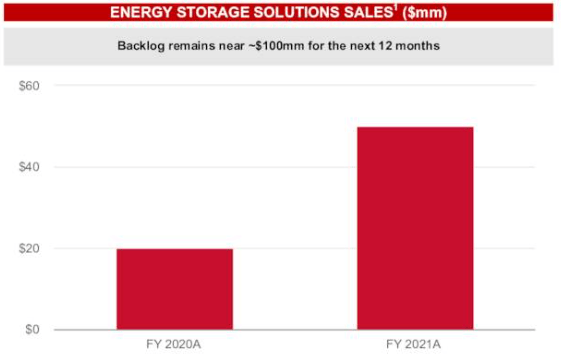

It’s hard to overstate how quickly MATW’s energy solutions business is growing. It went from $20 million in fiscal 2020 to $50 million in fiscal 2021 to probably around $100 million in fiscal 2022.

MATW Q2 Presentation

The industrial segment has a 6-8 months’ worth backlog of orders, while demand for lithium battery production machinery continues to grow rapidly.

While memorialization and branding solutions should deliver steady, low- to mid-single-digit growth going forward, the industrial segment should be the primary growth driver.

Long-Term Tailwinds Vs. Short-Term Headwinds

Here are the primary tailwinds in MATW’s favor:

- Growing EV battery production equipment business

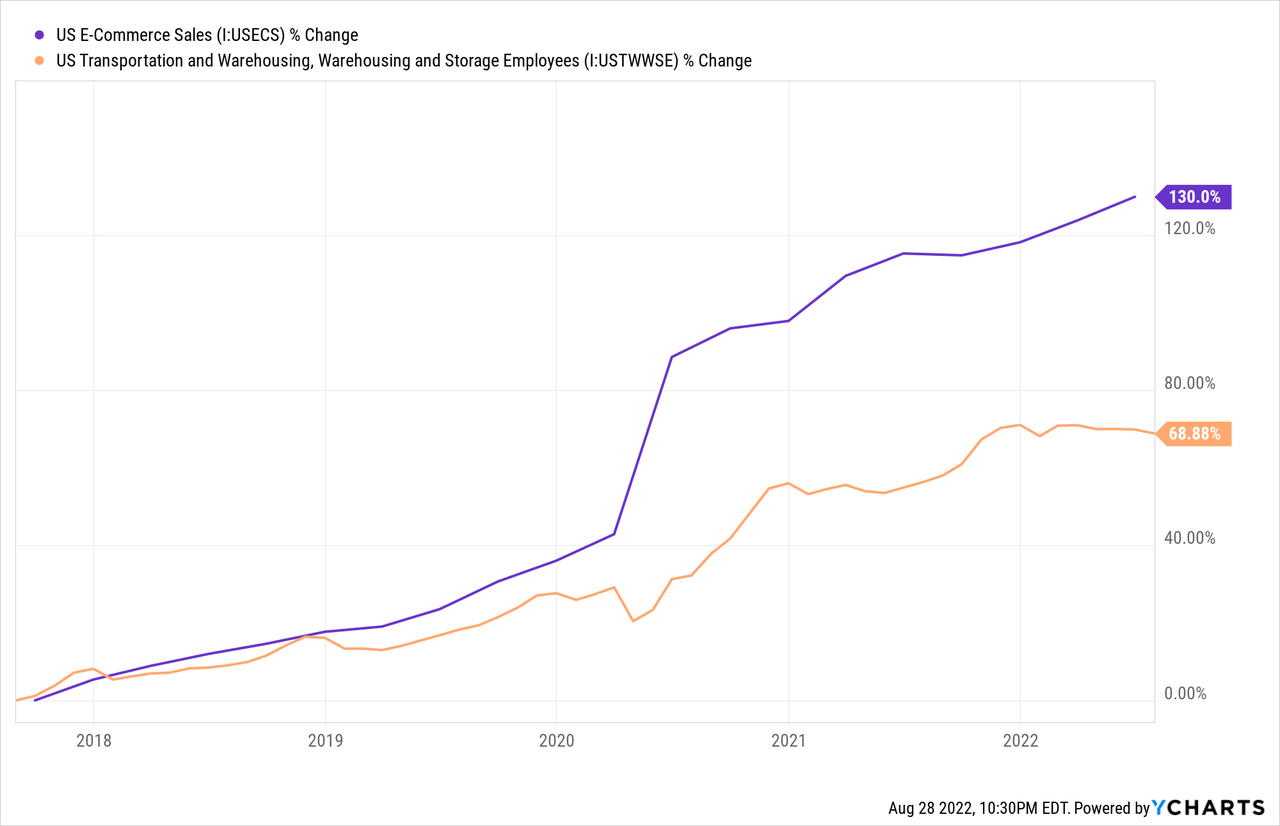

- E-commerce demand growth for warehouse automation products

- Aging demographics, which translates into steady demand for death care products

- Share buybacks (2% YoY reduction in shares outstanding in FQ3 2022)

The points about the growing EV market and aging demographics have been made above, but I’d like to mention a few points about warehouse automation.

Obviously, just the words “warehouse” and “automation” used together sound like high growth. That is likely true for multiple reasons, including both the rise in e-commerce adoption as well as persistent shortages of warehouse workers.

What’s more, on a constant currency basis, MATW’s industrial segment is enjoying strong growth this year, even though it saw a decline in sales in fiscal Q3, as we’ll see below.

Share buybacks, while they obviously haven’t done much to lift the share price or change MATW stock’s trajectory, have at least come at a good time. During FQ3 (April-June), MATW repurchased 705,000 shares at an average of $30.92 apiece. And MATW still has authorization to repurchase another 1.6 million shares (5.2% of shares outstanding), so hopefully they are continuing to buy more back as the price drops.

Here are the main headwinds affecting MATW right now:

- Currency headwinds (strong dollar vs. weak euro)

- Commodity inflation (rising prices for lumber and steel)

- Higher labor and transportation costs

- Europe economic weakness (primarily affecting the branding & packaging segment)

- Rising interest rates

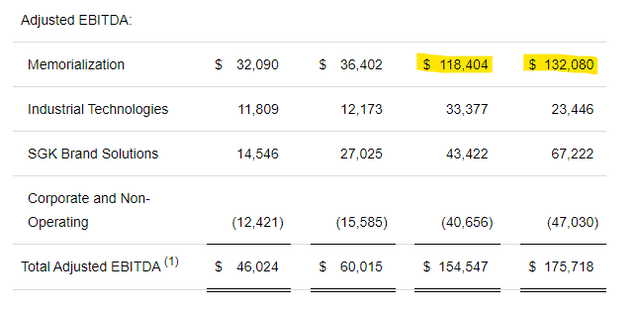

Together, these headwinds (especially inflation) are the reason why MATW’s adjusted EBITDA margin dropped over three points from 14% in FQ3 2021 to 10.9% in FQ3 2022.

If currency headwinds weren’t present, MATW’s YTD USD revenue would have been ~$33 million higher (8.6% YoY growth vs. 5.9%) and EBITDA $6.2 million higher (down 8.5% instead of down 12.1%).

What’s more, transportation costs and supply chain snarls caused some deliveries to be pushed back from the previous quarter to the current quarter.

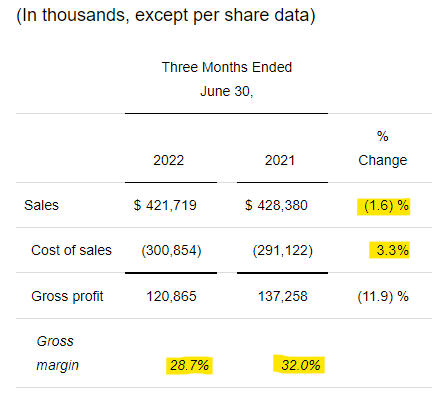

So, when we look at gross profit, we find that it fell 3.3 percentage points YoY because of a drop in USD sales combined with a rise in USD cost of sales.

MATW Q2 Earnings

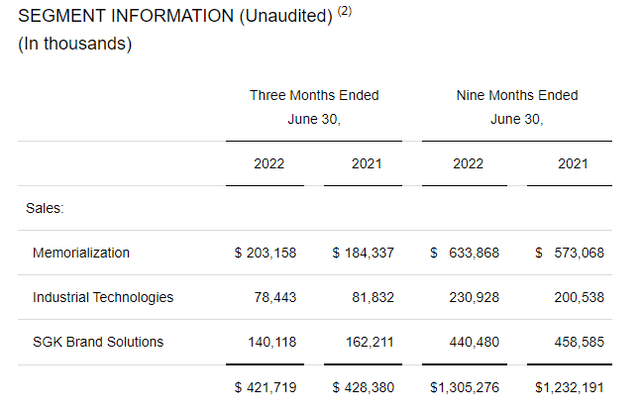

Breaking it down by segment, we find that MATW’s bread and butter memorialization segment enjoyed robust, 10.2% revenue growth in FQ3 and similarly robust 10.6% growth in the last nine months. But due to currency headwinds (largely due to the imbalance between the strong dollar and weak euro), USD sales in the industrial and brand solutions segments were down YoY during the quarter.

For the trailing three quarters, the industrial segment was still up on a non-adjusted USD basis, but the brand solutions segment was down.

When it comes to adjusted EBITDA, however, all three segments are down not only in FQ3 but also in the trailing three quarters.

Offsetting this somewhat are declines in corporate and non-operating expenses. But obviously, the headwinds are significant at a time when most companies are at least able to grow their USD revenues, even if earnings are stagnating due to soaring costs.

Finally, let’s address interest rates. To be fair, rising interest rates have not been a headwind to MATW yet, as the company’s interest expenses have actually dropped YoY in both the second quarter and the nine months ending June 30th 2022. But MATW has a fairly substantial debt load, which means that rising interest rates should begin to eat into profits eventually.

Free Cash Flow

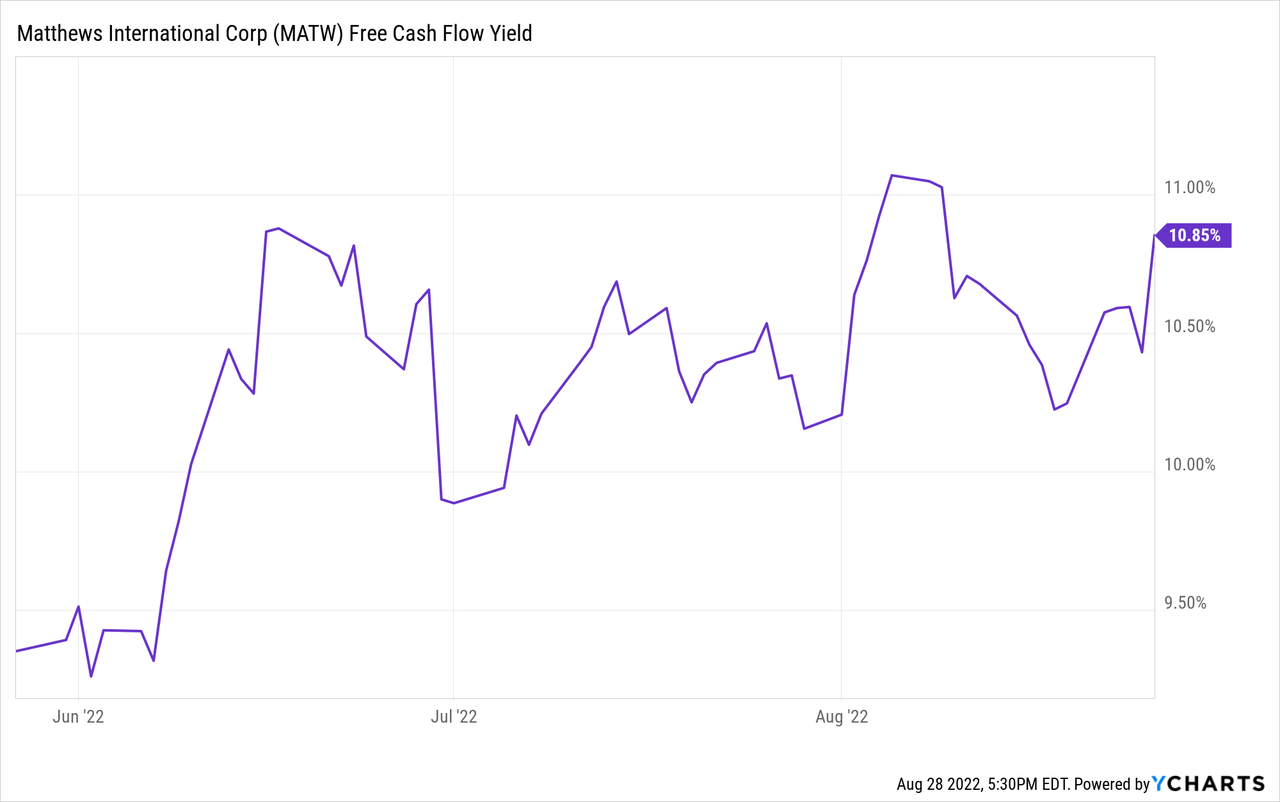

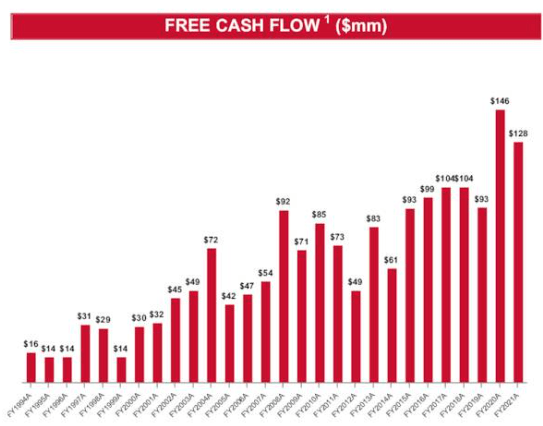

MATW has historically generated a lot of free cash flow, and even in the midst of the current headwinds, it still does. In fact, based on TTM data, MATW’s FCF yield is nearly 11% right now.

But this is based on YCharts’ estimate of trailing four quarter FCF using its data-scraping algorithm. Using MATW’s actual FCF from fiscal 2021 of $128 million, we come up with a FCF yield of 16%.

MATW Q2 Presentation

Although the increase in deaths during COVID-19 may make fiscal 2020 and fiscal 2021 unusual years to look at for MATW. Even taking the company’s pre-COVID average annual FCF of $100 million, we still come up with a 12.5% FCF yield.

To be fair, though, in the last three quarters, MATW has generated annualized FCF of only $58.4 million, significantly below its long-term average.

If MATW’s fiscal 2022 FCF does end up being around this number, it would amount to FCF per share of $1.91 (assuming no further buybacks after the end of June). That would still cover the $0.87 TTM dividend by more than 2x, giving a cash payout ratio of 45.5%.

Balance Sheet

When it rains, it pours. And for MATW, headwinds to EBITDA growth have also resulted in weakening debt metrics.

With $772.7 million in long-term debt and expected EBITDA for fiscal 2022 of $205 million, MATW’s debt to EBITDA is currently around 3.8x.

Net debt to EBITDA (including cash), meanwhile, rose from 3.1x in September 2021 to 3.5x at the end of June 2022. This is both because debt rose slightly and because EBITDA shrank. It’s worth noting that MATW’s net leverage ratio of 3.5x is still below the 3.9x where it sat at the end of fiscal 2020 (September 30th 2020) or the 4.1x where it was at the end of fiscal 2019.

Since management’s stated policy is to reduce net debt to EBITDA to below 3.0x, the company’s current leverage level would imply that deleveraging will likely be prioritized in the coming quarters, perhaps above buybacks.

Bottom Line

MATW is a small, easily overlooked company with some measure of complexity stemming from its three disparate business segments. Despite some temporary headwinds from inflation and European economic and currency weakness, the company’s long-tenured management team (the current CEO has been in that role for 16 years) has proven itself farsighted and skilled.

I like the way MATW is steadily positioning itself as a market leader in a few other long-term growth trends, namely EV batteries and warehouse automation. I believe that, perhaps not this year, but eventually this positioning will pay off for shareholders.

I’m buying MATW for its ~3.4% dividend yield along with the strong prospect for many more years of dividend growth to come.

Be the first to comment