Aranga87

Published on the Value Lab 11/21/22

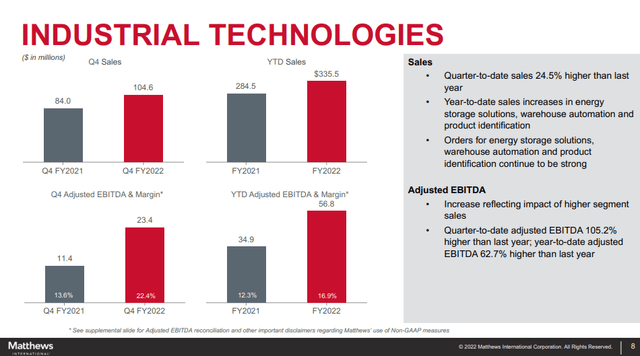

Matthews International (NASDAQ:MATW) is a recent example of the stock picking we do at the Value Lab. Selected as a Top Idea as well, the merits of the idea have already delivered these past couple of months with more than 30% capital appreciation. The key of the thesis was the memorialization would be resilient while the energy storage industrial technology solutions, in other words the equipment for battery production, would be a key tailwind to the business and quickly dwarf other segments that are much more levered to macroeconomic headwinds. Not only have these tailwinds been demonstrably materialized, our macro outlook has improved which could see restoration in more troubled businesses. The energy solutions business is what blasted off the stock after earnings and continues to guide the upside picture.

Q4 Breakdown

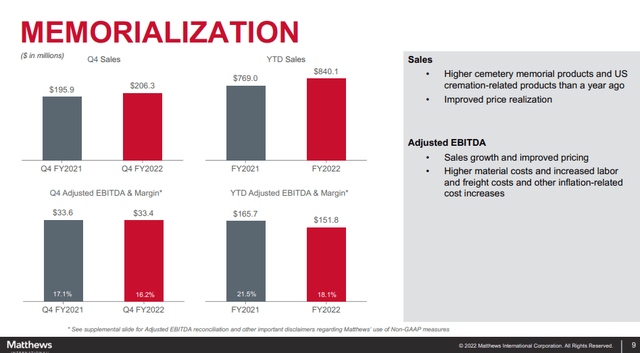

The MATW fiscal year comes to a close in a rather promising fashion as far as the key levers of our thesis go. Beginning with memorialization, revenues were decent thanks in particular to pricing measures. These measures did not get fully ahead of inflation however, and margins did compress slightly. Nonetheless, figures annualized more or less as one would expect, and the resilience of the segment was very clear, not really being discretionary and already exposed positively to higher cremation rates, which is a secular change that is driving down typical dollar values of funerals compared to casketed deaths.

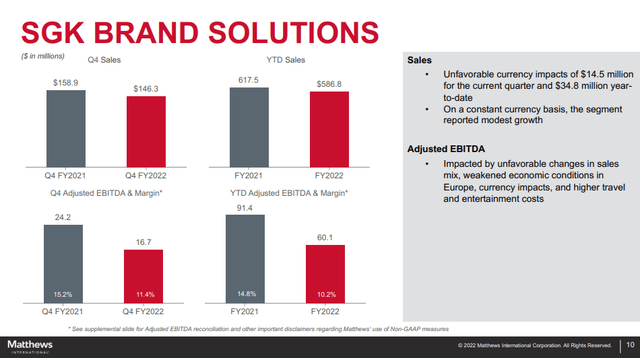

SGK Brand Solutions is a bit of a weird segment that does essentially copy and marketing advice around packaging, and also organizes the industrial packaging solutions for clients. They also do other types of in-store marketing and prints, and are pretty dependent on retail. Overall, macro pressures have been pretty brutal on the business’ topline, but only really through FX effects due to exposure to the Euro. The bottom line is where the poor positioning relative to the macro becomes evident, with labor costs, general inflation, and lacking pricing power limiting success in EBITDA for the segment. This was a segment from which we expected trouble, and are surprised that it was even growing in the topline on a constant currency basis.

Finally, there’s the industrial tech segment, which does warehouse automation, printing for boxes and calendering equipment for making battery plates. This segment is substantially exposed to Germany, so the growth that was achieved was in spite of FX headwinds on the top line due to an appreciating dollar. The growth was massive, and while some of it was from the Olbricht and R+S acquisitions, quite a lot was organic and we are seeing growing orders for the calendering equipment in particular for battery production. The EU has 60 billion EUR earmarked for battery production financing, so this segment has the force of the green agenda already in action behind it. This growth which has now been demonstrated will continue for a while longer.

Bottom Line

The EBITDA that we are seeing across segments averages out to be in line with the simple annualization that we did in our model for the Top Idea. SGK is actually a bit better than we expected pointing to a better end to the year than the previous quarters, illustrated by at least some constant currency growth. Memorialization performed a little worse in the end due to continued pressures from inflation, which we are seeing easing in the latest CPI figures. Finally, industrial technology is better than expected, lying ahead of annualization we did excluding the R+S and Olbricht consolidations. We have faith in a normalization of the memorialization segment over time, as it is the most reliable of the MATW markets. That it was the one to fall a bit behind is not concerning. Moreover, while we expected SGK to see declines, we think that the economic outlook for the US is less dire, and that while European exposure is still a problem for SGK, improvements in US markets over the next year or two as rates plateau and hopefully shrink will support that business. What really matters though is that the growth proposition is supported in the performance of the industrial tech business. With organic growth being delivered in part with inorganic growth from the consolidations, we still have the Olbricht integration to improve cost synergies and the offering for manufacturers of batteries on top of the strong tailwind already being felt. Markets will respond to continued developments on this front, and with the force behind the EV push being an easy one to be on, this continues to be a high conviction buy.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment