AlexSecret/iStock via Getty Images

As my readers know, I’ve covered ARK Invest extensively in recent years. My main focus has been on the flagship ARK Innovation ETF (ARKK), which has more than half of the firm’s assets. Last week, Cathie Wood’s team completed its exit of a longstanding holding, and the firm didn’t take long before adding a new name to the ARKK portfolio.

For a few months now, the flagship fund has been selling shares of Compugen (CGEN), and that holding was completely exited last week. This put the ARKK ETF at just 33 holdings, which is the lowest number in quite some time. At the same time, there have been large sales of Signify Health (SGFY), ever since buyout rumors started. Signify is in the process of being sold to CVS Health (CVS), but ARK Invest isn’t waiting around to tender its shares. That gets us to Monday’s trades, which can be seen below.

The name at the top of the list is a new one for followers of ARKK. Verve Therapeutics (NASDAQ:VERV) now becomes holding number 34, although it appears Signify may be gone rather soon. The past couple of names added to ARKK during 2022 have seen their shares drop quite a bit. First, there was Sea Limited (SE), which the fund reversed course on and sold for a loss. ARKK also started a position in chip giant NVIDIA (NVDA), which has lost a chunk of its value since the initial late May purchase.

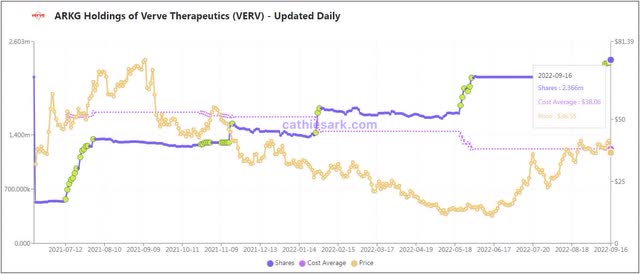

Now for those that follow the entire ARK Invest complex, Monday’s addition to ARKK is not a totally new name. Verve has been a holding in the ARK Genomic Revolution ETF (ARKG) for over a year. In fact, the ARKG ETF bought almost 13,000 additional shares on Monday, increasing its holding towards 2.4 million shares. As the chart below shows, this position just 15 months ago was less than 530,000 shares, so it has increased quite significantly over time.

VERV Holding In ARKG (cathiesark.com)

As of August 4th, Verve Therapeutics had a little less than 60 million shares outstanding. This means that ARK Invest with its purchases on Monday now owns more than 4% of the entire company. While that may seem rather high to some, my followers know that I’ve covered a few names where Ark through its ETFs owns over 10%. At the moment, there are about three dozen names where Ark’s total ownership is more than Verve, but that number could come down quickly if we continue to see shares added moving forward.

For those not familiar with Verve, it is a rather new company, only having been formed a few years ago. It describes itself as a “a genetic medicines company pioneering a new approach to the care of cardiovascular disease, transforming treatment from chronic management to single-course gene editing medicines”. Up until now, the company has mainly been involved in capital raising and R&D, and it didn’t record any revenue in the first half of this year.

A couple of months ago, the company reached a collaboration agreement with Vertex Pharmaceutics (VRTX), which can be read about starting on page 5 of the most recent 10-Q filing. Shortly thereafter, the company sold over 9.5 million shares of stock, bringing its total cash pile to a little over half a billion dollars. Management expects to need further capital down the line to fund its growth strategies and continue operations.

Those that follow Cathie Wood and her team probably view Verve like many of the ETF firm’s holdings. This is an early stage company that is losing a lot of money currently with significant cash burn, hoping that there will be a big payoff down the line. Analysts seem very positive on the name, with the average price target of $53.86 implying significant upside from Monday’s close of $35.63. Last month, Verve received an upgrade and major price target boost from Stifel on the prospects of the firm’s heart disease therapy candidate.

Like many small, highly speculative biotechs, Verve shares have been very volatile. Since going public in June 2021, the stock has traded has high as $78, but as the chart below shows, it was under $11 at its low just about three months ago. It is nice to see a rising 50-day moving average (purple line), but if this key technical trend line rolls over in the coming weeks, it could provide some resistance for the stock moving forward. A name like this could easily be hit hard if the market drops after this week’s Fed decision, given investors’ limited appetite for significant loss and cash burn names right now.

VERV Last 12 Months (Yahoo! Finance)

In the end, Cathie Wood’s flagship ARKK fund has added a new component, speculative biotech Verve Therapeutics. The genetics company was already held by the Ark Genomics ETF, and Monday’s multiple fund purchases bring ARK Invest’s total stake to over 4% of Verve’s outstanding shares. It will be interesting to see how large this holding in ARKK becomes over time, and Verve investors certainly hope that this new position in the top ETF does better than the others that ARKK has started so far this year.

Be the first to comment