Hispanolistic/E+ via Getty Images

The construction industry is truly large and diverse. There are so many different goods and services required in order to produce the infrastructure that makes up our homes, offices, and other related structures. Some investors may be drawn to the larger players that have their hands in a number of different things. But there is a certain level of attractiveness to buying up shares in niche operators with a very narrow focus. One such prospect that is definitely worth consideration is Masonite International Corporation (NYSE:DOOR). Although the market is worried about a probable recession, this operator has done well to grow its business in recent years. Profitability has been rather volatile, but cash flow metrics have been generally positive. Add on top of this how cheap shares are today, and it’s not difficult for me to rate the business a solid ‘buy’ at this time.

Open The Door On Masonite International

As its ticker symbol suggests, Masonite International focuses on producing and distributing doors that are used in new construction projects, as well as repair, renovation, and remodeling activities. These include both interior and exterior doors geared toward the residential and non-residential building construction markets. The company currently has a sizable portfolio of brands, including Masonite, Premdor, USA Wood Door, Nicedor, National Hickman, and others. In addition to selling its products to a variety of customers through the firm’s direct distribution channels, it also sells its products through well-established wholesale and retail partners.

To illustrate just how large a player this business is, management said that in the company’s 2021 fiscal year, it sold approximately 32 million doors to more than 7,000 customers worldwide. 75% of the company’s sales came from the North American residential market. A further 13% of sales were attributable to European customers, while 11% fell under the architectural category. The latter of these centers on highly specified products that are designed, constructed, and tested by the company to ensure regulatory compliance and environmental certifications where necessary. Examples include fire-rated doors, lead-lined doors, attack-resistant doors, bullet-resistant doors, and others. The remaining 1% of sales fell under miscellaneous corporate activities. Digging down a bit further, the company said that 89% of all sales fell under the residential category, with 54% dedicated to residential repair, renovation, and remodeling end-users, while 35% of sales went to residential new construction customers. The other 11% of sales fell under the non-residential construction market.

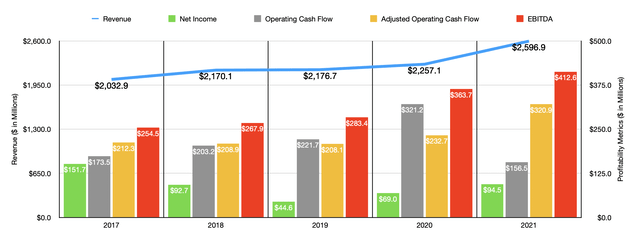

Over the past few years, the management team at Masonite International has done a good job growing the company’s top line. Revenue increased from $2.03 billion in 2017 to $2.26 billion in 2020. On May 21, revenue jumped to nearly $2.60 billion. Interestingly, most of this growth was not driven by an increase in the number of doors sold. Yes, the company did see the number of units shipped rise from 31 million in 2020 to 32 million in 2021. However, sales are still down from the 35 million doors sold in 2017. From 2020 to 2021, a significant contributor to the company’s rising revenue in the North American residential market was a 12.2% increase in average unit price. By comparison, higher base volume increased net revenue by just 4.8%. In Europe, the company experienced a 12.1% increase in average unit price and benefited from an 11.6% rise in higher base volume. Unfortunately, the company saw the architectural category report a 15.1% decrease in revenue, driven in large part by a 17.5% drop in base volume.

From a profitability perspective, the picture for the company has been rather mixed. Net income decreased in the three years ending in 2019, falling from $151.7 million to $44.6 million. Profits then ticked up to $69 million in 2020 before rising further to $94.5 million in 2021. Operating cash flow has been a bit more consistent. From 2017 through 2020, this metric rose from $173.5 million to $321.2 million. It then dropped to $156.5 million last year. If, however, we were to adjust for changes in working capital, it would have risen from $232.7 million in 2020 to $320.9 million in 2021. Meanwhile, EBITDA for the company also improved, climbing from $254.5 million in 2017 to $412.6 million last year.

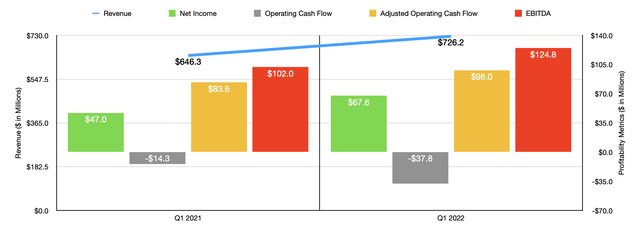

Although investors are rightfully concerned about the construction market as we appear to be heading into a recession, Masonite International has started the year off right. For the first quarter of its 2022 fiscal year, the company generated sales of $726.2 million. This represents an increase of 12.4% compared to the $646.3 million reported one year earlier. Net income for the company also rose, climbing from $47 million to $67.6 million. Unfortunately, operating cash flow did worsen, dropping from negative $14.3 million to negative $37.8 million. But if we adjust for changes in working capital, it would have risen from $83.6 million to $98 million. Meanwhile, EBITDA for the company also improved, rising from $102 million to $124.8 million.

Despite the broader economic concerns, the management team at Masonite International is rather bullish about the current fiscal year. At present, they expect sales to come in higher than in 2021 to the tune of between 6% and 10%. At the midpoint, that would translate to revenue of $2.80 billion. The company also anticipates earnings per share of between $9.10 and $10.05. At the midpoint, this would translate to net profits of $216.1 million. In addition, the company also thinks that EBITDA will be between $445 million and $475 million. No guidance was given when it came to operating cash flow. But if we assume that the first quarter of this year was indicative of what the rest of the year will look like, we can anticipate an adjusted reading for the business of $376.2 million.

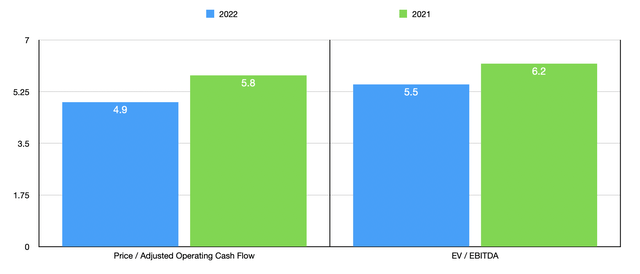

Using data from 2021, shares of Masonite International look incredibly cheap. The price to operating cash flow multiple comes in at 5.8. This drops to 4.9 if we rely on 2022 estimates. Meanwhile, the EV to EBITDA multiple, using 2021 results, should be 6.2. This should drop to just 5.5 if we use management’s guidance for 2022. To put the pricing of the company into perspective, I decided to compare it to five similar firms. On a price to operating cash flow basis, these companies ranged from a low of 16.5 to a high of 75.3. Using the EV to EBITDA approach, the range was from 7.2 to 15.3. In both cases, Masonite International was the cheapest of the group.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Masonite International | 5.8 | 6.2 |

| Griffon Corporation (GFF) | 75.3 | 12.1 |

| CSW Industrials (CSWI) | 22.2 | 13.3 |

| Janus International Group (JBI) | 16.5 | 15.3 |

| Gibraltar Industries (ROCK) | 72.5 | 9.3 |

| JELD-WEN Holding (JELD) | 23.4 | 7.2 |

Takeaway

Based on the data provided, Masonite International strikes me as a fascinating company with great upside potential. Shares look very cheap on both an absolute basis and relative to similar firms. Cash flows are particularly robust, even though net profits have been all over the map. Yes, the company may be hurt in the near term by economic issues. But for those focused on the long haul, now might be a great time to consider buying in. Because of this, I’ve decided to rate the business a ‘buy’. But if it weren’t for the broader economic concerns, I would certainly rate it a ‘strong buy’.

Be the first to comment