Author’s Note: This is a free version of the article posted on iREIT on Alpha on May 30th.

Thierry Hebbelinck/iStock Editorial via Getty Images

Dear subscribers,

In this article, we’ll take a deeper look at Colruyt (OTCPK:CUYTY), a grocer in the mixed Dutch/French Belgian market. It’s family-owned, has a great upside, and a great valuation. I’ll show you why I have a watchlist position in the business, and why I might going forward, expand this position to a full investment position in my core portfolio.

What is Colruyt?

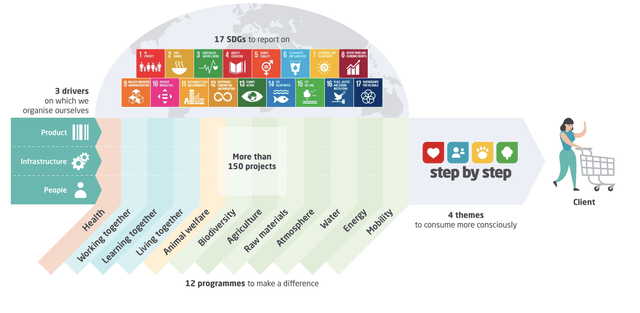

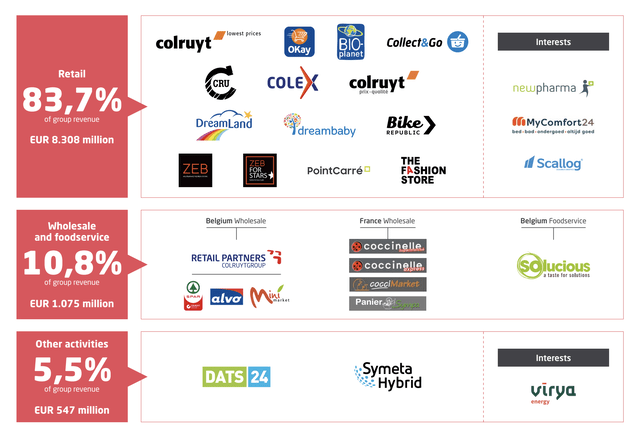

Colruyt, previously known as Établissements Franz Colruyt S.A., a Belgian, family-owned retail corporation. Its main interest is the management of the Colruyt supermarket retail chains, and the corresponding subsidiaries, including stores like OKay, Bio-Planet, DATS 24, Dreamland, Dreambaby, and others.

Colruyt Presentation (Colruyt IR)

The company is approaching its 100-year birthday. It’s most well-known for its namesake supermarket chain, which is one of the absolute major chains in all of Belgium. It has a market capitalization of €4.2B, and owns an impressive 32% of the market in Belgium. I’m well-versed in the grocer oligopoly market, because the structure in Sweden is not dissimilar from Belgium, and Colruyt has a similar market position to the recently taken private grocer, ICA AB.

Colruyt Presentation (Colruyt IR)

Like in Sweden, 3 retailers control over 70% of the Belgian home market. Colruyt has achieved the remarkable feat of growing from a 7% market share to a 32%+ market share today, despite investments and competition from grocer-favorite Ahold Delhaize (OTCQX:ADRNY).

Colruyt’s selling point is guaranteeing cheaper prices on a regional basis. Obviously, recent historicals have seen competition and margin pressure growing fiercer and tougher, not in the least because of impacts concerning the overall economy. Discounters like Colruyt stalled growth during the past few years, being presented with an almost-impossible choice of sacrificing margins or raising prices, with either choice bringing issues.

Colruyt expanded to a broader geographic segment and has tried store remodeling to retain its customer base, as well as optimizing its lineup of stores and subsidiaries. What’s left, and where Colruyt is somewhat behind, is optimizing its sales space in terms of sales on a square meter basis – because the trends in groceries is a “Space-race” sort of problem, with numerous peers trying to outspend and out-optimizing one another.

Colruyt Presentation (Colruyt IR)

On the positive side, the economy is recovering – and the company’s cost-cutting has given rise to the lowest price policy, which it still runs. Colruyt is ahead of the competition, even Swedish ones, by already running its entire distribution network out of two huge distribution centers. This is a model Swedish peers are still in the midst of adopting.

The company has an active online presence, but it’s small at around 5% of total sales, and this includes Collect & Go services. Still, Colruyt is the leader in Belgium when it comes to online here, and years, including the pandemic, have obviously seen online sales increase.

The main argument for investing in a grocer like Colruyt is the near-impossibility of duplicating the company’s model in its markets. This is a near-unassailable moat, where only established players can try to slowly chip away at the company’s customer base and margins.

Colruyt Presentation (Colruyt Dividends)

The company has a superb geographic reach and excellent price awareness and image. Its policy of having the lowest price is paying off, even if it has resulted in lower sales growth and more pressured margins. Duplicating Colruyt’s model at this stage is close to impossible for a new entrant.

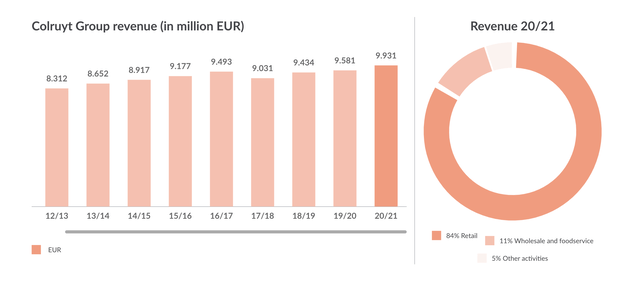

Operationally, Colruyt reports Retail (over 83% of sales), Wholesale (about 10-11%), and Oil Filling Stations/Gas distribution, at around 5% of overall sales. The company has a near-100% Euro exposure for revenues, and a 92.4% Belgian market exposure (Rest France).

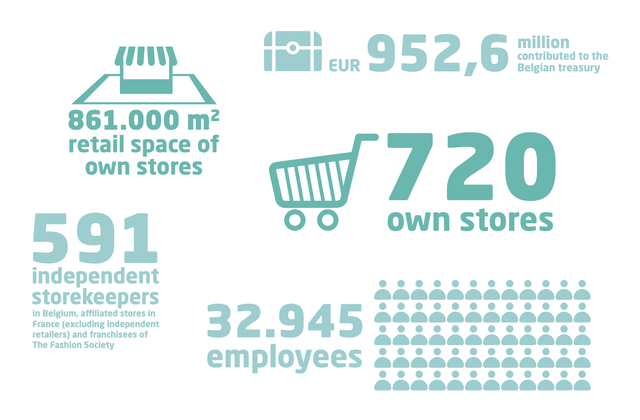

The company operates a network of 720 owned stores, 591 affiliated stores, and 212 Collect & Go points. Colruyt has chosen not to pursue a S&P Global or Fitch Credit rating. We can instead say that Colruyt has almost no debt, at an adjusted Net debt/EBITDA of 0.3-0.5X, with a positive net cash position for the past few years, and expected to continue for the coming years. This company is in no way a credit risk or an indebted company.

Colruyt has posted impressive revenues even throughout the pandemic, and it has a profile of a very mature grocer.

Colruyt Presentation (Colruyt IR)

The main argument for seeing Colruyt as positive is its Swedish-level grocer margins. The underlying operating profit margins for the company are over 5%. When comparing this to typically margin-starved grocers that are happy to get 1.5%-3%, this is a massive boon. It’s the highest margin in the entire, Scandinavian-excluded retail universe of Europe.

This margin is supported by a well-balanced retail business where the company has been able to maintain, and even grow the profit margin from sub-5% through rigorous cost control in its operations. In the past few years, the company’s EBIT has been at a level of around 22%-27% of capital employed. The company is also significantly outpacing peers in ROCE, with a 19% ROCE versus a WACC of less than 8%. Peer averages here range from a difference between ROCE and WACC of less than 9%. The low debt and solid financial structure mean that Colruyt is, from a high level, one of the most convincing plays in this entire space.

From an operational and financial level, this company is very well-capitalized. The net cash position allows for growth through M&As, as well as distributing impressive dividends which due to the share price declines are higher than ever. The company’s operational efficiencies make it one of the best players in the space, managing a 2X multiple for profit margins versus ROCE. Its history shows us that the company isn’t going anywhere.

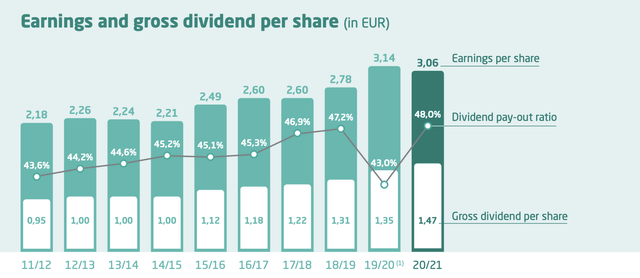

The fact that it’s a family business, where the Colruyt family still owns close to 60% of the voting rights, with the Sovereign wealth fund of Norway as one of the other main investors gives further security. Acting with mutual funds, the Colruyt family is the major shareholder of the Belgian retailer. Anima, Herbeco, and Farik are 100% subsidiaries of the family’s holding company which has been permanently represented by a Colruyt family member as a board member. It is worth noting that management ensures a decent dividend payout ratio (higher than 40%, in line with its benchmark). As such, shareholder interests have been well-covered.

Still, there are some risks to Colruyt.

Colruyt Risks

The elephant in the room, or one of them, is the company’s massive 90%+ exposure to the Belgian market overall. This is a mature, rapidly-saturating market with intense competitive pressure that requires Colruyt to operate with the skill of a brain surgeon in order to not either lose customers or lose margins. The fact that management has been neglecting to expand beyond this geography either means strength and belief in the company’s models or just plain neglect and blindness to the true impacts of this risk.

The way the market has been punishing Colruyt as an investment would suggest the view is the latter.

Beyond this, the company’s corporate governance, in no small parts due to its familial roots, must be considered “poor”. The chairman has the position of CEO, and the number of independent directors, given again the familial ties, is less than 50%. This gives management zero independence, and while the Colruyt family might and indeed seems to be willing to compete for smaller and smaller pieces of the pie with more and more effort, shareholders should question whether they are inclined to do the same. The Colruyt family are billionaires, and a few years of bad results might not bother them – it should bother us. This also goes into a lack of full disclosures when it comes to management pay, incentives, and overall comp questions. This might not bother every investor, but a lack of oversight, control, and insight certainly bothers me.

Beyond these, the other risks aren’t Colruyt-specific. They exist, and they are entrant risks such as Amazon (AMZN), which is focusing more and more on its cashier-less stores. Amazon has opened its first such store in the UK, and is likely to move to other portions of the European continent as well – and it has also started licensing its technology to third parties (though the response so far has been a little laughable). The Amazon risk exists and is worth mentioning because Colruyt isn’t just in the grocery, but general retail space as well as one of the leading retailers online in Europe and Belgium – which makes Amazon a direct competitor.

Beyond this, it’s all input cost risk, supply chain, and inflation risks – none of which are specific to Colruyt, and none of which change the fact that Colruyt sells food, and people will continue to need food. Colruyt provides 30%+ in Belgium with this, and this makes them a convincing play in the sector here.

Colruyt Valuation

Colruyt’s valuation is the main thesis for investing in the business. I often write about European grocers and their safety – but Colruyt has seen a massive share price decline, losing almost 40% in a single year despite being, as it’s said, a grocer.

The reason for this poor performance has been missing street expectations. A year ago, the company dropped 10% in a single day due to missing these expectations, and management guided for a weaker overall market. This is compounded by the fact that Colruyt has started losing, and is losing market share slowly in its home market. While Colruyt is almost guaranteed to stay financially healthy in the next few years, this has put the valuation of the business in question, and what premiums we should assign to a slowly-declining (for now) retailer.

Until management gives better guidance and a turnaround on the results back to growth, it’s unlikely that the company’s valuation will bounce back quickly. Still, this gives us an opportunity given that we’re value investors. The jewel in the company’s crown is the food service business which is growing massively during the pandemic.

The company is at a discount in every single valuation perspective.

When it comes to Colruyt, I forecast a very modest DCF sales growth of only 1.5-2% – almost GDP-like, in a way that corresponds to most companies such as this. Company EBITDA is forecasted at a similar growth rate – we basically use 1.5%-2% across the board, and a WACC of between 6-7%, with the company ROCE of 18-19%. The implied EV given these high-quality earnings based on cash flow growth is no less than €48-€50/share. Given that the company currently trades at €30.4/share, you can see what this would mean in terms of the upside. I view DCF, in this case, as very usable because of the relative predictability of company cash flows, even if they don’t always meet expectations in full.

There are plenty of peers. Ahold Delhaize, Tesco (OTCQX:TSCDY), Carrefour (OTCPK:CRRFY), Axfood (OTCPK:AXFOF), Jeronimo Martins (OTCPK:JRONY), and J Sainsbury (OTCQX:JSAIY). All of these trade at multiples of between 9-21X, which is a massive spread for a very similar sector. However, the sector has several retailers under massive pressure, including Sainsbury and Carrefour, which trade at discount multiples.

And Colryut is similar. The business trades at a P/E of 10X, to an average peer multiple of 15X, and a high premia of 22X for a working company. The company also trades at significant P/B and EV/EBITDA discounts to its peers, and the current yield, no less than 5%, makes it one of the better-yielding grocers/retailers in the entire world. Based on peer discounts, this company calls for a valuation of between €43-€50 per share even without assigning the company a slightly-deserved premium given its upside.

In NAV, we use EBITDA multiples as a proxy for cash available for shareholders. Retail is the strongest and deserves an 8-9X multiple, with Gas/Filling stations the weakest deserving no more than a 3-4X multiple. The company has no moat there, beyond the proximity to its stores, and it’s unclear if they’re able to push similar gas/diesel discounts as they are in terms of food. This brings us to a NAV/share of no less than €54/share.

Analysts also consider Colruyt undervalued, but they take a far more conservative stance. 11 S&P Global analysts following this Belgian giant call for a €29-€48.5 valuation range, coming to an average of no more than €39/share. I believe that these analysts are assigning unfair discounts to the company’s fundamentals, perhaps impairing due to Amazon. The fact is, you can feel free to impair them in this manner – the company is undervalued even to almost the lowest sort of PT here.

For my own calculations, I don’t see a justification to go any less than €49 on a per-share basis. The company’s fundamentals and its market simply don’t support a higher impairment or discount – quite the contrary. I want to assign a premium for the strong moats the company has.

It reminds me a lot of a Belgian Axfood, and Axfood is my #2 position in my entire portfolio, giving me a 100%+ 3-year return.

I rate Colruyt a “BUY” with a PT of €49/share.

Thesis

The company does come with an ADR, but I don’t view the ADR as all that great. It isn’t liquid, it’s a 0.25X ADR, and I would say that in every way of, the native ticker is far more appealing.

So, for interested investors, I would recommend that you go for the native ticker in Belgium, COLR. The main issues to the company are competition and resulting market share erosion – but in my view, the company can handle these challenges with relative ease.

What you’re investing in is one of the most profitable retailers on the entire European continent, with a good yield, and at a superb valuation with what I view as a massive upside.

I view the company as a “BUY”.

Be the first to comment