Hispanolistic

Investing can be scary. This is especially true when the company you own shares in happens to reduce guidance for the current fiscal year and warns about weakening demand when it comes to its offerings. One fantastic example of this can be seen by looking at Masco Corporation (NYSE:MAS). This firm, which operates as a provider of home improvement and building products like paint, bath and shower fixtures, faucets, and more, recently announced that it was lowering expectations for the 2022 fiscal year. This is most certainly painful and I understand why shares of the company have now fallen more than with the broader market has. Having said that, for those who can weather the storm, now might be a good time to consider buying in. This is not to say that the ride moving forward would be fantastic. Surely, it will be bumpy. But for those focused on the long haul, the enterprise could very well be a solid prospect at this time.

A revision in expectations

The last article I wrote about Masco was published in early August of this year. In that article, I talked about how the company had been experiencing a bit of share price weakness even though the general financial performance of the firm was looking up. At the time, shares were not exactly cheap. But I also said that they weren’t expensive either. Add on top of this the fact that the firm was going through an accelerated share buyback, and I was generally pleased with each trajectory of the enterprise. But given the state of the economy, and where shares were priced, I ended up rating at a ‘hold’, reflective of my belief at that time that shares should generate performance that more or less matched the broader market moving forward. So far, this call has not gone exactly as planned. While the S&P 500 is down by 7.3%, shares of Masco have generated downside of 11.8%.

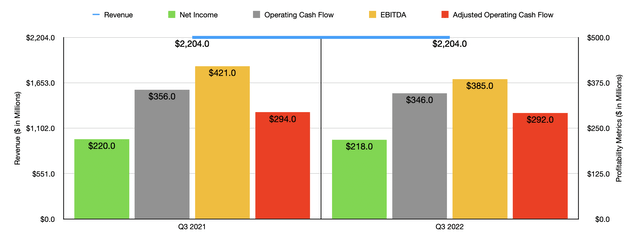

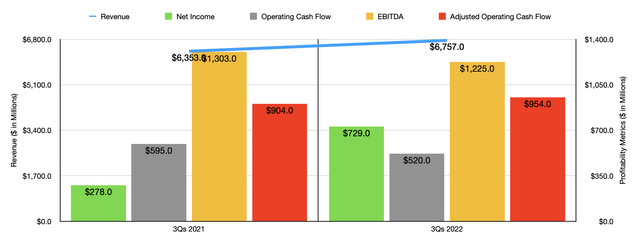

It would be wrong of me to say that this downside disparity was unjustified. Truthfully, it probably was. To see what I mean, we need only look at financial performance covering the third quarter of the company’s 2022 fiscal year. This is the only quarter for which new data is available that was not available when I last wrote about the firm. During that quarter, revenue came in at $2.20 billion. This exactly matches what the company generated in the third quarter of 2021. While this may seem neutral, consider that financial performance covering the first three quarters of the year as a whole were better year over year than what the third quarter alone had demonstrated. Strong demand for some of the company’s products (particularly its plumbing products and paints), and higher pricing for its products, was instrumental in pushing sales higher year over year. Now, for the first three quarters of 2022 as a whole, revenue came in at $6.76 billion. That’s 6.4% above the $6.35 billion generated one year ago.

The company’s struggles were even more evident when you look at bottom line results. During the third quarter, net income came in at $218 million. That’s down from the $220 million reported one year ago. Operating cash flow dropped from $356 million to $346 million. Meanwhile, if we adjust for changes in working capital, the decline would have been from $294 million to $292 million. And finally, EBITDA for the company also worsened, falling from $421 million to $385 million. Unlike in the case of revenue, this bottom line performance was helpful in pushing overall financial performance on the bottom line down for the company for the first three quarters of this year. Although net income of $729 million is still significantly higher than the $278 million generated in the first nine months of last year, other profitability metrics don’t look so great.

Operating cash flow dropped from $595 million to $520 million. Admittedly, using the adjusted figure, it would have actually risen from $904 million to $954 million. At the same time, however, EBITDA for the company fell from $1.30 billion to $1.23 billion. Once again, none of this should be much of a surprise for investors. In the firm’s most recent quarterly report, for instance, they even said that current and changing market conditions may not only push demand for its offerings down, but may also lead to elevated commodity and other input costs, higher transportation costs, and supply chain disruptions. It’s also unclear whether the company can more than offset these cost increases by increasing the pricing of its offerings. Recently, the answer has appeared to be no.

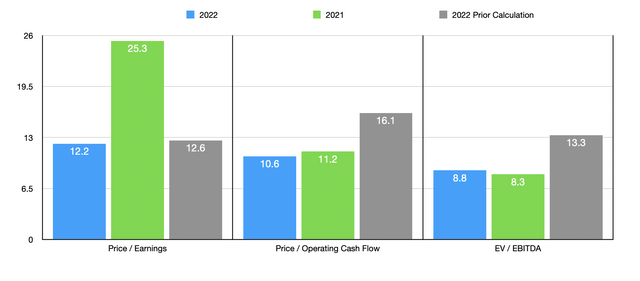

Given these concerns, management did recently decrease guidance for the current fiscal year. They now anticipate earnings per share of between $3.70 and $3.80 on an adjusted basis. This compares to the prior expectation of between $4.15 and $4.25. At the midpoint, earnings should translate to net income of $851.3 million. And if we annualize results experienced for the rest of the year, we should anticipate adjusted operating cash flow of $981.4 million and EBITDA $51 billion. These numbers would imply a price-to-earnings multiple in the company of 12.2, a price to adjusted operating cash flow multiple of 10.6, and an EV to EBITDA multiple of 8.8. In two of these three cases, as the table above illustrates, shares do still look cheaper than if we used data from 2021. Interestingly, as the table also illustrates, our 2022 guidance now calls for the stock to be quite a bit cheaper, particularly from a cash flow perspective, than when I last wrote about the firm. To put this all in perspective, I also compared the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 4.2 to a high of 26.4. And using the EV to EBITDA approach, the range was between 2.7 and 15.4. In both cases, four of the five companies were cheaper than Masco. Meanwhile, using the price to operating cash flow approach, the range was between 3.8 and 94, with two of the five being cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Masco Corporation | 12.2 | 10.6 | 8.8 |

| Advanced Drainage Systems (WMS) | 26.4 | 21.4 | 15.4 |

| Builders FirstSource (BLDR) | 4.2 | 3.8 | 3.1 |

| Simpson Manufacturing (SSD) | 10.7 | 16.4 | 8.0 |

| Owens Corning (OC) | 6.2 | 5.9 | 4.2 |

| Insteel Industries (IIIN) | 4.3 | 94.0 | 2.7 |

Takeaway

Given what we are looking at today, I understand why some investors would be cautious when it comes to Masco. In truth, we could see additional pain moving forward based on what data is available now. At the same time, for those who believe in the long-term outlook, I could understand the decision to buy stock in the company. This is especially true when you consider how much cheaper shares have gotten in just a couple of months. But even with that being the case, shares are not cheap enough for me to pull the trigger given the uncertainty that the future holds. So although the company is starting to look more appetizing, I have decided to keep the ‘hold’ rating that I have on it for now.

Be the first to comment