Brandon Williams

Technology stocks have had a challenging year in 2022, falling around 29% compared to the S&P 500 at 19%. While many investors have been surprised by the sector’s weak performance, technology was the leading segment in the years before 2022. Further, technology stocks have had a great decade, rising 380% since October 2012. With the sector at depressed levels (from a short-term standpoint), many investors are looking for dip-buying opportunities in technology-centric ETFs such as Vanguard’s popular (NYSEARCA:VGT).

VGT allocates toward the most prominent technology stocks on the market, with Apple (AAPL) and Microsoft (MSFT) alone making up an aggregate of roughly 40% of the fund’s total value. These two companies are the primary drivers of VGT’s performance and, due to their immense economic influence, either directly or indirectly impact the earnings of most other technology companies. Apple recently posted surprisingly strong earnings causing the stock to rise; however, Microsoft has slipped despite showing signs of apparent sales growth. Most technology firms are facing strong sales and earnings growth declines over the past year. Many technology firms are pursuing significant layoffs to offset reductions and maintain profit margins, but economic difficulties continue to grow.

Technology stocks generally carry greater negative exposure to inflation. For one, equities with significant expected earnings growth decline with higher interest rates as discounted future cash-flows are devalued. Secondly, most prominent technology companies, such as Apple and Microsoft, are net importers with significant overseas manufacturing. As such, higher inflation in the US tends to depress technology firms’ profit margins more than other sectors. That said, the ongoing strength of the US dollar against foreign currencies, particularly the Chinese Yuan, largely offset this factor by lowering the relative cost of imports.

A mix of factors may cause VGT and its constituents to rise or decline in value. In general, it appears that “the bottom” may not yet have occurred as interest rate factors, valuations, and other trends may continue to weigh on technology stocks. Of course, many investors in VGT are likely less concerned about a short-term decline and are more focused on the fund’s potential for a long-term sustained recovery. In my view, it is seemingly unlikely that VGT will see the same exuberance over the coming years as it saw over the past decade, making it a weak long-term investment compared to stocks with lower valuations.

Short-Term Outlook for VGT

Is the bottom in? Maybe, depending partly on actions from the Federal Reserve and trends within mega-cap technology firms’ earnings. Many analysts and investors expect the Federal Reserve to slow or end interest rate hikes due to declining economic data. While this is taken as good news for stocks, technology companies appear to have elevated exposure to the ongoing earnings recession. Further, interest rate cuts do not necessarily benefit VGT since its valuation is primarily tied to long-term interest rates, which are relatively low given the high inverted state of the yield curve.

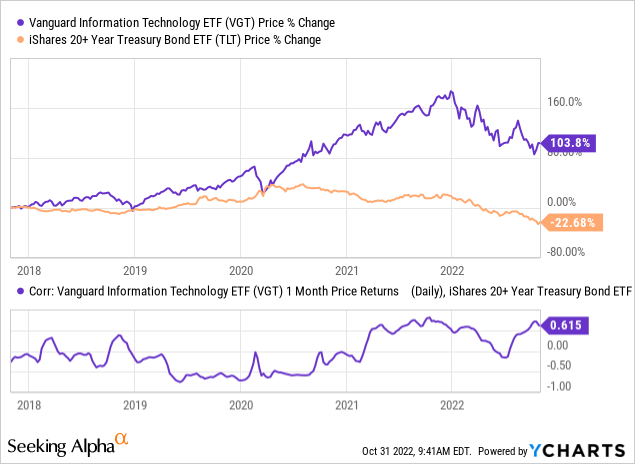

Since last year, the correlation between VGT and long-term Treasury bonds (TLT) has become quite substantial. See below:

Long-term Treasury bonds have declined dramatically due to their negative exposure to inflation. Growth-centric stocks like those in VGT usually fall as long-term interest rates rise since the present value of future cash flows is highly rate-sensitive. In my view, short-term bonds may have reached their bottom as the Federal Reserve will likely slow or end interest rate hikes over the coming months as economic data trends lower. That said, the yield curve remains highly inverted with short-term rates ~50 bps above long-term rates, meaning long-term bonds may still have moderate downside ahead of them. In general, the trend in long-term bonds is particularly bearish for technology stocks.

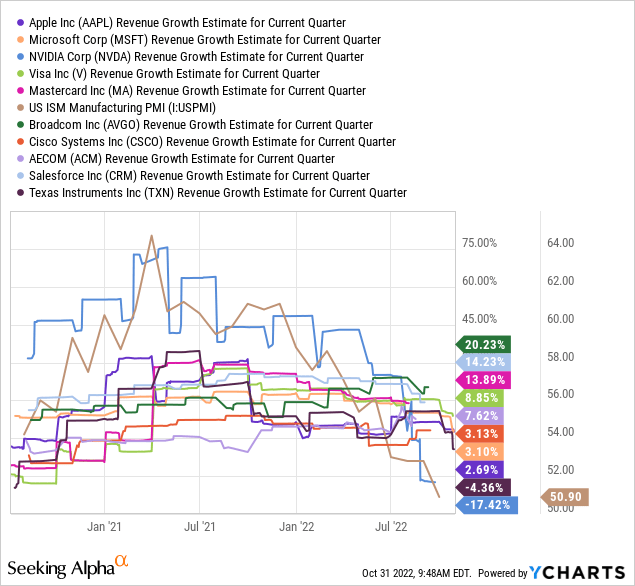

Since 2020, the revenue growth estimates for the top holdings in VGT have generally tracked the ISM Manufacturing PMI. The PMI is a general measure of US business confidence based on surveyed data regarding changes in business activity. The PMI recently slipped to the 50 level and has trended sharply lower, indicating a general contraction in business activity. While the sales growth estimates of technology firms differ for each, on aggregate, they mirror the trend in the PMI. See below:

I believe the PMI will follow its traditionally cyclical pattern and shift into contractionary territory over the coming months. Accordingly, the sales growth estimates of many of these firms may likely become negative if they have not already. Most technology companies operate in the realm of discretionary household and business spending. As rising cost pressures lower discretionary spending capacity, people and businesses can generally choose to reduce spending on phones, computers, and other technological gadgets to save money. This economic trend has forced large companies like Apple to avoid price increases despite rising input costs, creating some profit margin strain.

As inflation remains persistent and real wages trend lower, many discretionary-spending-oriented firms may see asymmetric profit margin declines. The higher prices for non-discretionary goods (gasoline, rent, etc.), the more people and businesses will be forced to reduce spending on discretionary goods. As such, I believe earnings declines in technology companies could accelerate substantially over the coming year as more customers delay more significant technology purchases and upgrades. This trend may continue until supply-side inflationary pressures end; given my bullish outlook on the oil market, it seems this strain may accelerate over the coming quarters.

Asia Labor Strain Threatens Profit Margins

On a related note, inflationary and other pressures may also directly negatively impact the input costs of many large technology companies. Recently, a major Apple iPhone factory saw workers race to flee in fear of renewed lockdowns. It is, at this point, an undeniable and well-documented fact that most large US technology companies depend on Chinese factories with extremely abusive labor conditions. While US technology firms may not own these factories, their profitability directly depends on abusive labor practices that allow companies such as Foxconn to keep input costs low. In China and India, Foxconn workers have increasingly protested or fled amid human rights abuses.

Many companies in VGT are highly dependent on manufacturing from China and India. As these countries see more significant labor unrest in light of awful working conditions, Apple, and most other technology firms, will likely see input costs rise or production decline. It is not guaranteed that labor abuse in Asia will end soon, but there seems to be a rapidly growing effort both in Asia and in importing countries to end labor abuse. The US (and other developed countries) cannot see widespread manufacturing job growth as long as China and India benefit from more competitive underpaid, and overworked workers.

I believe an end to these practices is inevitable and may occur over the coming two years. Of course, this is a significant adverse risk factor for most firms in VGT, Apple in particular, due to its immense dependence on Foxconn. In my view, the most recent event of people fleeing iPhone production factories is a sign this trend may proliferate if China pursues more “zero-COVID” lockdowns this winter. The impact this shift could have on Apple’s (and other technology firms’) earnings is difficult to calculate. Still, I believe it may substantially disrupt profit margins and production volume over the coming two years. Further, as the era of cheap labor in Asia ends, most prominent technology firms may see depressed earnings for years as production costs rise.

VGT’s Long-Term Outlook

I believe VGT will likely decline in value over the coming year for three reasons. First, I expect even higher long-term interest rates will likely negatively impact the valuations of technology firms. VGT currently trades at a weighted-average “P/E” of ~22X, which is well below its level last year but not necessarily high, given the rising potential for earnings declines. Secondly, as US and worldwide business activity slows on rising non-discretionary prices, I believe most technology firms will see sales decline at an accelerating pace as people and businesses delay or avoid large purchases. At this point, few analysts expect most technology firms to see earnings declines over the next year despite the adverse economic signals. Lastly, I believe most technology firms will see input costs grow rapidly over the next two years as labor strains continue to rise across Asia and awareness of apparent human rights abuses rise. Input prices may also increase due to a decline in the US dollar from its current all-time high.

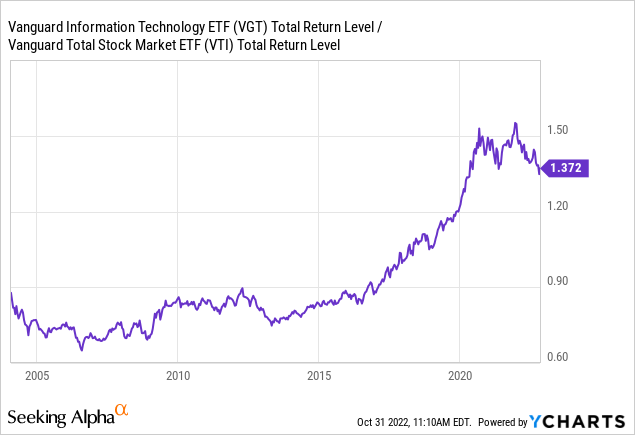

Overall, I expect VGT to decline an additional 20-40% in value as earnings, earnings growth outlooks, and valuations fall simultaneously. While this may seem large, such a decline would put the ETF back in its 2018-2020 price range as it rose dramatically in 2021 as irrational exuberance created an apparent technology stock bubble. If negative economic trends, particularly inflation, continue to grow, I would not be surprised to see VGT fall even further as more investors lose confidence in the sector. VGT has outperformed the general stock market by a great deal over the past decade. This trend is illustrated well in the total return ratio chart of VGT to the broad stock market ETF VTI. See below:

In much of the 2000s, technology stocks underperformed chronically as the market recovered from the downfall of the “dot-com” bubble. Of course, most of the sales and earnings growth in the sector since 2010 was due to immense innovations made during the 2000s. In my opinion, technology innovation has slowed over the past decade as these firms have shifted focus away from R&D investments toward profitability investments. The pace of technological innovation may slow even further as many of these firms pursue layoffs to offset profit margin strains.

Overall, I believe today’s situation sets the scene for a repeat of the technology sector’s experience in the 2000s, marked by falling valuations and little earnings growth. The technology sector has grown tremendously since 2010 and may need years of declines that force firms to reduce unnecessary spending and re-focus on long-term innovation over immediate profitability. With that in mind, I believe VGT is a generally poor investment, even with a 3-7 year investment horizon, as the sector may take years to shed itself of the excesses it has created over the past decade.

The Bottom Line

I have a bearish outlook on VGT and believe the fund will decline further in value over the coming months. Contrary to its performance in 2020, I think it will not recover quickly after its bearish trend ends and may stagnate for years as the technology sector metaphorically “cuts the fat.” Potential labor strains in Asia and commodity shortages may add further pressure by increasing input costs while demand for discretionary products declines.

Today, I am generally bearish on most of the stock market, but it seems the technology sector is due for sustained underperformance. Comparatively, I expect dividend growth stocks, such as those in the Vanguard Dividend Appreciation ETF (VIG), or other “quality-centric” stocks, to outperform over the coming months due to their stronger earnings moats. Further, commodity producers, particularly the energy sector, may be an unlikely “haven” as weak supply factors may cause their profits to rise despite negative economic trends. Still, I believe today’s stock market is not as discounted as it may seem, given high systemic corporate leverage and chronic inflation. With that in mind, most investors may be best off in short-term bonds or cash to save money for better buying opportunities in the future.

Be the first to comment