imaginima/iStock via Getty Images

Of the companies that recently entered the public markets, we believe that Planet Labs PBC (NYSE:PL) is one of the most interesting. It has a constellation of satellites to monitor the earth and has developed a lot of advanced machine learning software to be able to easily extract insights from satellite data. The way the company explains it is that they want to be ‘the Bloomberg Terminal’ for earth data. Some of the main applications currently include agriculture insights, military intelligence, and ESG tracking of industries like forestry.

Planet Labs Investor Presentation

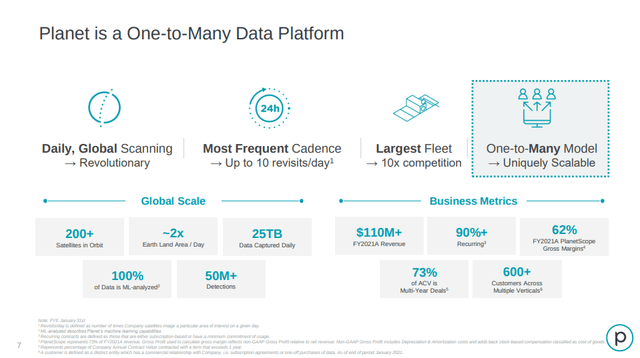

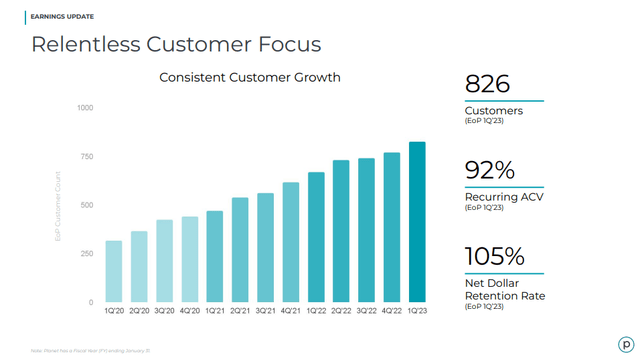

This makes them into a one-to-many type of data platform, which still has some benefits from network effects. The technology developed to serve one type of customer can make it easier to serve another, or to serve them better. Therefore, the more customers the company has, the better the service should get. The company also benefits from scale advantages, as the number of customers the company has grown, it can afford to increase the cadence of the monitoring. Already the company has the largest satellite fleet in its industry, 10x more than its competition.

Planet Labs Investor Presentation

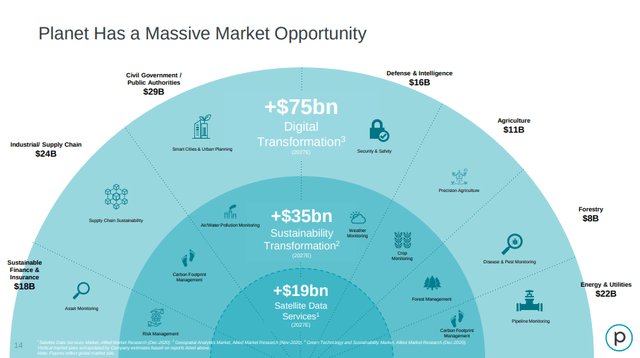

Market

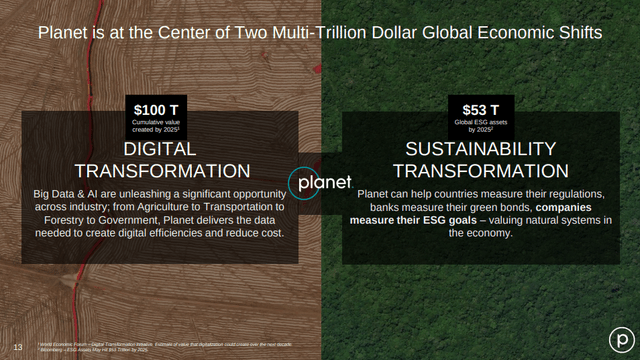

One of the main things which has attracted a lot of investors to Planet Labs is the size of the opportunity, with a potential market size that is massive. Their most immediate addressable market is satellite data services, which is a ~$19 billion market, but the size of the potential market grows considerably if ‘sustainability transformation’ and ‘digital transformation’ applications are added into consideration.

Planet Labs Investor Presentation

The company has demonstrated the need for these types of services, having added more than 600 customers across a wide range of verticals, which go from agriculture, mapping, energy and forestry, to finance and insurance.

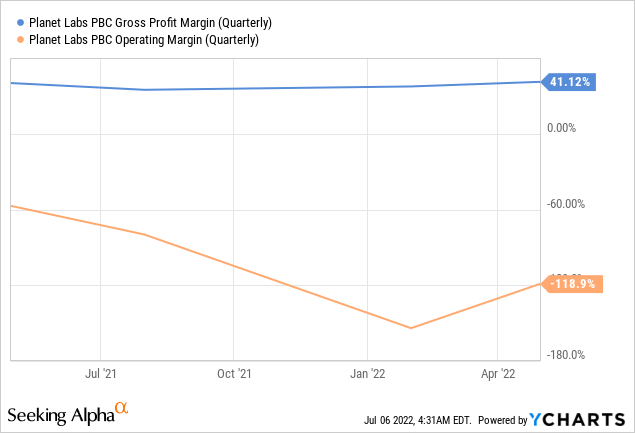

Financials

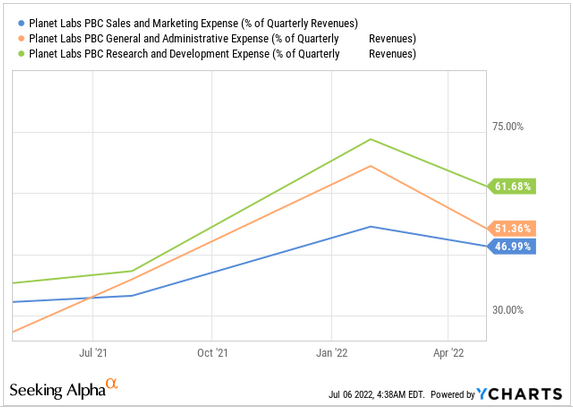

While Planet Labs has an acceptable gross profit margin, we are disappointed with the operating margin, which is significantly negative and is showing no signs of operating leverage as revenues increase.

In fact, taking a more detailed view of the different expense categories, we can see that all three of the main expense segments have increased as a percentage of revenue. We can understand the need to ramp up R&D to increase the competitive moat against the competition, but we are disappointed to see that general and administrative has grown to more than 50% of revenues, and sales & marketing is quite high as well. With expenses growing faster than revenue, we do not currently see a path to profitability.

YCharts

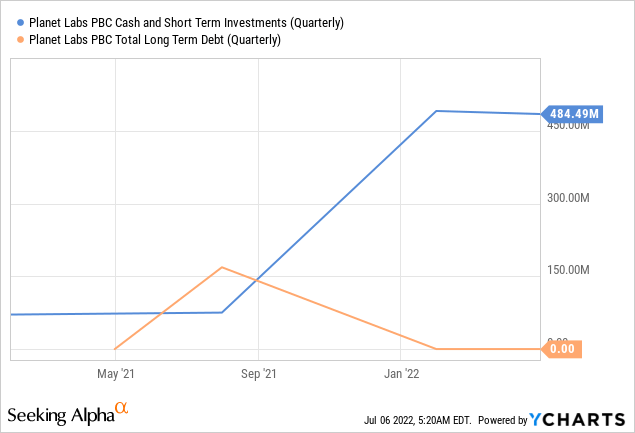

Balance Sheet

Fortunately for the company, it has basically no long-term debt, and it has a significant amount of cash & short-term investments, which amount to ~$484 million. At least this cash buffer should give the company some runway to try to achieve profitability.

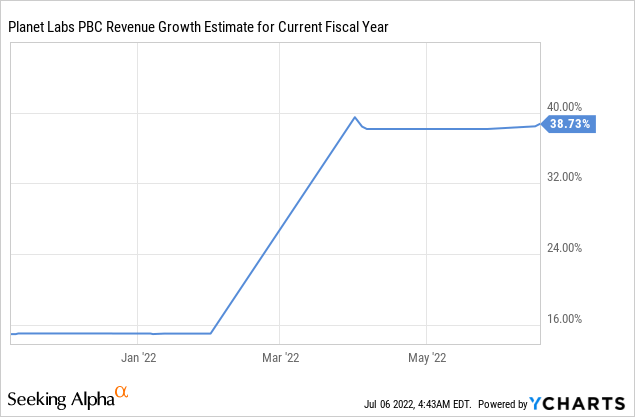

Growth

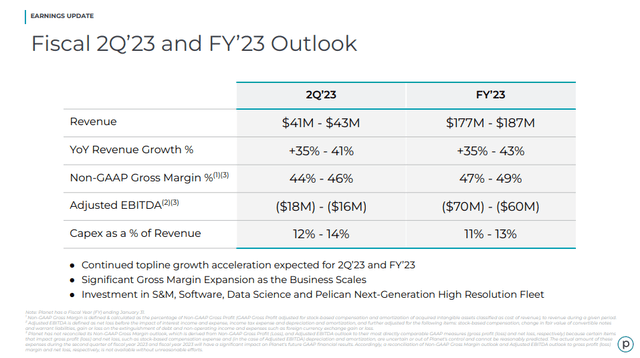

Analysts appear quite optimistic about the company’s revenue growth potential, with estimates raised to ~38% growth for the current fiscal year. This is faster than what the company has been delivering so far, but given the level of expenses in sales & marketing, an important increase in revenue should be expected.

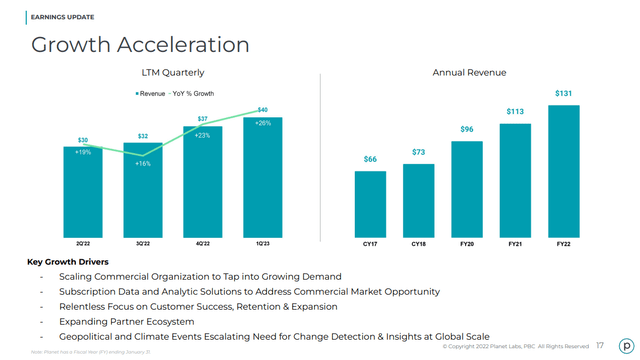

The company has been delivering some revenue growth acceleration, with the most recent quarter delivering +26% revenue growth, which is higher than the growth experienced in the previous three quarters. Annual revenue for FY22 reached $131 million, which at least proves that there really is a need for the type of data the company sells.

Planet Labs Investor Presentation

A good amount of revenue is recurring, and the company has a net dollar retention rate a little above 100%, at 105%. So its customers on average seem happy to renew and even expand the services they get from the company.

Planet Labs Investor Presentation

ESG

One thing that makes Planet special is that it is one of only a few public companies that is a Public Benefit Corporation (PBC). This means that it has to take into account the benefit of not only its shareholders, but its other stakeholders as well, such as employees, communities, and society at large.

Planet Labs Investor Presentation

In particular, it has strong ESG credentials as its technology is helping measure and follow ESG progress, or as the company calls it, the ‘sustainability transformation’.

Planet Labs Investor Presentation

FY2023 Guidance

The most important takeaways from the company’s guidance for FY2023 we believe are that the company expects revenue growth acceleration to between 35% and 43%, and that it still expects to be losing money, with a significantly negative adjusted EBITDA.

Planet Labs Investor Presentation

Valuation

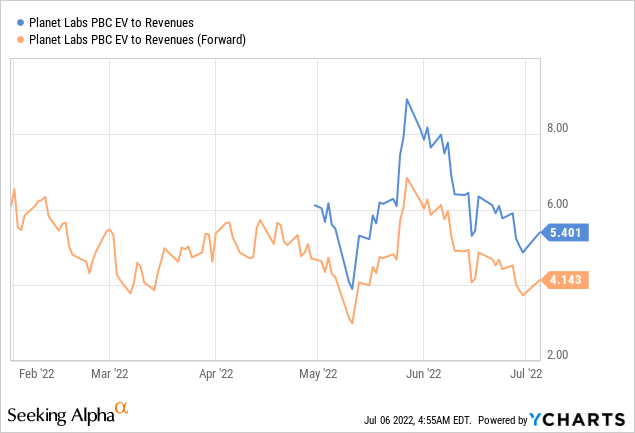

With no earnings in sight for the company, it is really difficult to value it. It is currently trading at ~2x its book value, most of which is made up of cash and short-term investments. Measuring it against revenues, it is trading at ~5.4x trailing twelve months revenues, and 4.1x forward estimated revenues. Until we get a clearer picture as to whether the company can become profitable, and how profitable, it is difficult to tell if these multiples are cheap or not.

We believe at this time the best thing to do with this company is to keep it on the watch list and make a decision as to whether to invest or not when it becomes clearer if it can control costs, deliver operational leverage, and once there is a clear path to profitability.

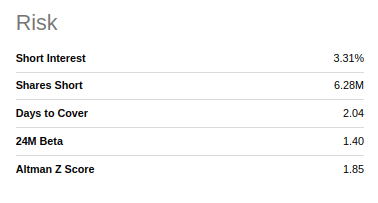

Risks

In the short to medium term, we do not see any particular risks for the company, since it has enough cash and short-term investments to finance losses for some time. Longer term, the company could be at severe risk if it does not manage to contain its costs, and if it fails to reach profitability before it runs out of cash.

Seeking Alpha

Conclusion

Planet Labs PBC is a promising company that certainly deserves a place on the watch list, as it is a very unique company. We do not currently see a clear path to profitability, and as such, it is difficult to value the company and to determine whether it is expensive or not. At this point, we believe it is more of a speculation than an investment. If the company can continue growing at a good pace, and if it starts controlling costs better, maybe then the company can deliver the necessary operating leverage to achieve profitability. Until then, we’ll remain on the sidelines, and we’ll continue to monitor the story to see how it progresses.

Be the first to comment