Wirestock/iStock via Getty Images

With crack spreads “to the stars” in the June quarter, investors should expect to-the-stars results from the largest refiner in the United States, Marathon Petroleum Corporation (NYSE:MPC). The company reported stellar results, then started to answer investor questions about the future, including a large amount of surplus cash. For a marvelous experience, let’s head inside and chat with management.

The Quarterly Conference Call

Management opened with this:

“Good morning, everyone. In the second quarter, our operational activity was driven by strong market demand for transportation fuels we manufacture. Demand remains resilient, largely driven by the removal of globally imposed mobility restrictions and the pent-up desire to travel.”

The report continued:

- EBITDA of $9.1 billion driven from crack spreads at extraordinarily high values “excluding favorable working capital changes was almost $7 billion.” (1st quarter of $2.6 billion)

- Earnings per share of $10.61. (1st quarter of $1.50)

- Management noted that several factors, low inventory, and strong global demand, drove a strong business environment.

- Refining operated at 100%.

- Management noted a repurchase of 24% of its shares since beginning in May 2021.

- Minimal effect from product backwardation.

- Guidance at 94% utilization, driven by fall outages.

The Company & Business Background

Marathon is the largest refiner in the United States with locations reaching across the Continental U. S. and Alaska, with “capacity of approximately 2.9 million barrels per day in our 13-refinery system.” The company added many refining locations, with a while-back purchase of Tesoro. The variety of locations spread across the whole United States offers a competitive advantage. The company also owns two renewable diesel refineries, one operational, the former Calumet Specialty Products (CLMT)/MDU at Dickinson, North Dakota, and the Martinez, California, facility now under conversion.

The following slide from the last presentation summarizes the company’s strategy.

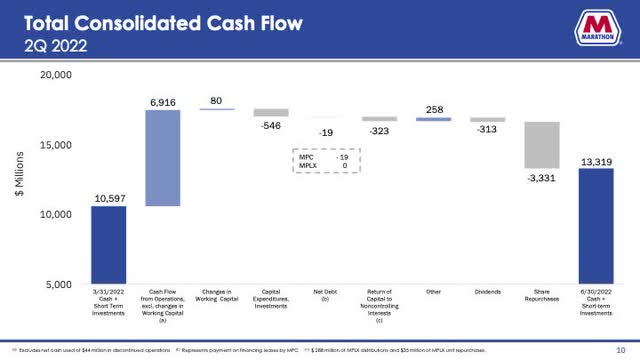

This next slide shows the cash flow for the quarter.

The company purchased $3.3 billion worth of stock. The total cash on hand now rings in at $13.3 billion, paying out only $300 million in distributions. The cash jumped from $10.5 billion in the 1st quarter.

Management confirmed what other refiners reported with respect to business conditions. With respect to volatility, management discussed the significant volatility in WTI and WTL crude pricing, adding:

“So if you look at where MPC is positioned and with our pipeline commitments with Galveston Bay really sitting in the backyard of the Permian. There’s really nobody better positioned than us to take advantage of [W]TI and [W]TL.”

Discussing WCS and WCS/WTI spread increases, management responded that excess SPR oil release, which is medium sour, pressured the medium sour market, thus pressing lower the WCS pricing in Canada with much its final destination at the Gulf Coast. That is a long distance with significant transportation cost.

Management also discussed recent rumors of demand destruction induced from prices. Like Valero (VLO), Marathon experienced a speed bump around the 4th of July, but since, demand has picked up for gasoline and diesel. Jet fuel is 20% higher year over year. Management finished, “And the consumer is showing us very positive demand signals today, and we view that going forward as well.” Remember, Marathon held the conference during the first week of August. It is also important to note that the price of gas is significantly lower than in May and June when it reached near $5.00 per gallon.

With respect to renewables, high soy oil prices negatively affected performance, but a RINs tailwind positively offset part of the negative pricing. Adding together the pluses and minuses, management noted that the performance is in line with its expectations. They expect the same from Martinez when it comes online.

Crack Spreads Drove Performance

The June quarter should have been a miracle. With crack spreads across the board reaching sky-high values, malfeasance by management would have been needed to achieve otherwise. For the June quarter, the Gulf Coast 2-1-1 averaged $50. (Thus far in the September quarter, that same spread fell some to $40.) Crack spreads in the 1st quarter averaged in the $20s. Third quarter financial results should be toward the upper range between first quarter and second quarter results. After September, results become more foggy, but with tight refinery capacity still in vogue, higher spreads than traditional will likely remain, barring major demand destruction from a deep recession.

Distribution

The company paid $313 million to shareholders, or $0.58 through dividend payments. Perhaps the most interesting discussion for investors on dividends included MPLX LP (MPLX), Marathon’s transportation system. Doug Leggate of Bank of America Merrill Lynch asked:

“But today, your dividend is, I guess, about 2/3 of the distribution you get from MPLX, which basically means MPC free cash flow isn’t paying the dividend at all. So I just wonder if you can give us a steer as to what you think about the right level of base dividend as a proportion?”

Mike Hennigan, CEO, answered:

“So we’re pretty close to talking about that in a more constructive way, we are committed, and we said this in our remarks, we’re committed to a competitive dividend. We want to show the market that we’ll grow that dividend. It’s probably taken a little longer than everybody’s patience has been as far as this return program, but it’s actually been executing well in our mind.”

Following the rest of the discussion defining shareholder return on investment, management explained that once the $15 billion authorized for stock buyback is completed this year, there is another $5 billion of authorized funds coming. The level of repurchases is about to drop. When this is finished, the issued shares of stock will be approximately two-thirds.

In round numbers, the number of units will be around 425 million. At $2.50 per year distribution, the company will spend approximately $1 billion. What will happen to the $2-$3 billion in cash now used to purchase stock? That amount is two to three times more than being spent. As management explores the future dividend, several questions arise. What is a competitive dividend? Will funds from MPLX continue to flow into Marathon for dividends? If not, what will MPLX do with that extra money? Between the two companies, a lot of cash is about to become available for distribution or for other uses. This is a story more than worth watching.

Risk & Investment

Risks are always in abundance. A deep recession begins our list. American refiners carry a natural competitive advantage, making the reach more global than local. The hostile climate in the existing government against fossil fuels remains a head-scratcher. But, the total debt of $7 billion (slide 14 in the last presentation) and cash flows quarterly in billions, the company has tremendous wiggle room in the case of rough economic circumstances.

For investors, some of the best experiences in life are free, like the miracles experienced at sunset and investing into strong companies such as Marathon, well, not quite free for Marathon. In the next year or two, Marathon and its associated transportation partner will be forced into a crossroad, one in which will likely involve more lucrative returns for investors. Watching for cheaper stock prices just might provide an unusual opportunity.

Be the first to comment