designer491

Introduction

I have to say that I’m extremely excited to write this article as I think I’ve only written one article covering more than one (dividend) stock since I started writing for Seeking Alpha. The reason is that I like to focus on a single company/investment per article, as it’s hard enough to cover all details for a single company without writing an article that’s too darn long. In other words, in this article, I’m trying something “new” as I’m going to give you two dividend stocks that not only make sense as stand-alone holdings but even more when combined. The first one is PepsiCo (PEP), which was one of the first five holdings of my dividend growth portfolio. It’s one of my favorite holdings because of its boring (that’s a good thing in investing) but consistent growth pattern and solid business model. The second stock is Archer-Daniels-Midland (ADM), which I have covered a number of times from an agriculture point of view.

The beauty isn’t that the two are phenomenal companies, in general, but that the two make a perfect couple. They are both components of the consumer staples sector, they are both (somewhat) anti-cyclical, both have credit ratings higher than some countries, and both are great dividend stocks. The most important thing, however, is that they reduce long-term volatility as one benefits from higher inflation while the other benefits when inflation is slowing.

So, let’s look into the details!

Playing Inflation From Two Sides

(Most) people know what PepsiCo is all about. Some are daily consumers of its products. Yet, for the sake of this article, it’s important to dive a bit deeper. This $233 billion market cap consumer staples giant headquartered in New York State has an incredibly well-diversified product portfolio.

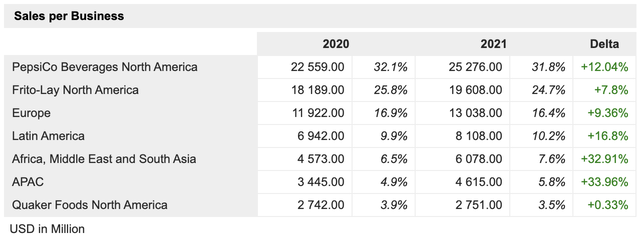

As its business segment breakdown shows, Frito-Lay North America alone did close to $20 billion in sales in 2021. Frito-Lay North America sells products that are also part of the company’s other segments, which include Cheetos, Doritos, Lay’s, Ruffles, and other brands that dominate the snack section in certain countries.

I’m bringing this up because the company’s products have one thing in common: they require an efficient agricultural supply chain. After all, and according to the company:

The principal ingredients we use in our beverage and convenient food products are apple, orange, and pineapple juice and other juice concentrates, aspartame, corn, corn sweeteners, flavorings, flour, grapefruit, oranges and other fruits, oats, potatoes, raw milk, rice, seasonings, sucralose, sugar, vegetable and essential oils, and wheat.

The company’s drinks rely on juice concentrates whereas its snacks are often based on vegetable oils and potatoes – to put it very bluntly. That’s one of the reasons why the company is currently suffering from high inflation.

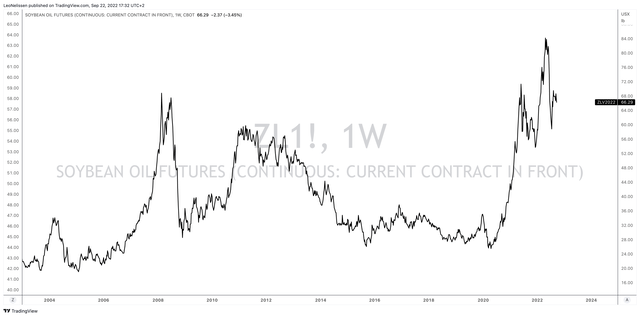

For example, the chart below shows soybean oil futures (vegetable oil), which I am using as a benchmark in this case. Just like the prices of corn, potatoes, fertilizers, and diesel fuel for farmers, it has witnessed a steep price increase since the end of the 2020 COVID lockdowns.

TradingView (COMEX Soybean Oil)

Inflation is a big risk to a company like PepsiCo as competition in supermarkets is vicious. People can easily replace a bottle of PepsiCo with a generic product. The same goes for its other products. Although I would make the case that PepsiCo has extremely competitive products (why I own it), I think you get the point I’m trying to make here.

Thanks to its products, the company has pricing power. In 2Q22, total organic revenues were up 13% (meaning excluding acquisitions/divestitures). That was based on 3% and 6% growth in convenient goods and beverages volumes.

That’s an impressive result. However, and according to PepsiCo:

We’re all concerned in a way about the high inflation and how that’s going to impact. Especially as we look at the full consumer universe, the lower part of the income pyramid, that’s where we’re all looking more carefully. And we’re making decisions on entry point in the categories and how do we continue to have that particular consumer engaged in our categories.

With this in mind, the best environment for PepsiCo is an inflation-slowing environment as it makes pricing products much easier. This in combination with its recession-proof business model means that the stock more often than not outperforms the market in times of economic weakness. Excluding dividends, the stock has outperformed the market in the Great Financial Crisis, the 2014/2015 manufacturing recession, the 2018 global growth slowing trend, the first lockdowns, and the past 8 months. That’s a pretty good track record.

Now, wouldn’t it be awesome if we had a second stock that is well-protected against recessions, operating in the same sector, but a beneficiary from high inflation?

That company is not as well-known as PepsiCo (not even close) but is still one of the most important players in the agriculture supply chain. Unlike PepsiCo, it operates further up the supply chain, which explains why most haven’t heard about Archer-Daniels-Midland.

To use the company’s own words:

The Company is a global leader in sustainable human and animal nutrition, one of the world’s premier agricultural origination and processing companies, and an innovator in creating sustainable solutions in agriculture, energy, and bio-based alternatives to materials and fuels currently produced from petroleum products.

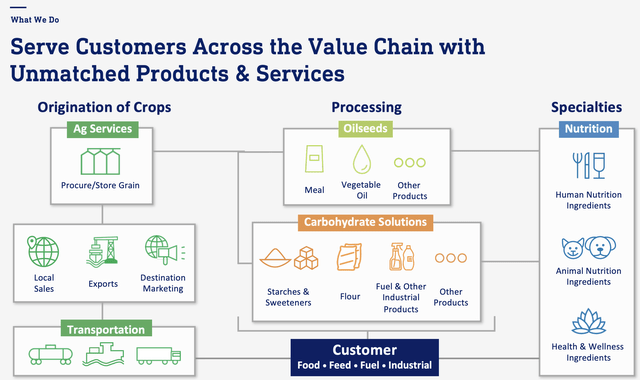

ADM is a rather complex company that engages in multiple stages of the agriculture supply chain. Founded in 1902, the company has become a giant with a $48.2 billion market cap engaged in:

- Ag Services & Oilseeds (79% of 2021 sales)

- Carbohydrate Solutions (13%)

- Nutrition (8%)

- Other (Negligible)

In other words, the company’s operations include merchandising, transportation, storage, and processing of agricultural commodities like oilseeds.

In 2021, ADM processed more than 35 thousand metric tons of oilseeds and close to 20 thousand MT worth of corn.

ADM is also supplying PepsiCo. In 2013, ADM Cocoa received a supplier of the year award from PepsiCo Mexico.

More recently, both companies announced a partnership on regenerative agriculture projects that could reach 2 million acres of farmland by 2030. According to Food Dive:

The broad reach of the two businesses across the food and agricultural supply chains should enable them to have influence across a wider swatch of the U.S.

“This partnership with ADM marks a sea change in how PepsiCo engages with strategic partners,” Jim Andrew, PepsiCo’s chief sustainability officer, said in a statement. It is expected to help PepsiCo reach almost one-third of its goal to reduce carbon emissions to 7 million acres by 2030. “By enabling greater collaboration through strategic partnerships like this one, we can strengthen the livelihoods and resilience of the farmers we work with.”

With that said, ADM is different from PEP as the ADM/S&P 500 ratio below shows. The company usually doesn’t do as well when inflation is falling as we saw in 2015. However, higher inflation is fantastic news for the company.

Year to date, ADM shares are up 27% excluding dividends. PepsiCo is down 3%. The S&P 500 is down roughly 21%.

This brings me to long-term low-volatility outperformance.

A Power (Dividend) Couple

The power of buying both PEP and ADM comes from the fact that both operate in the same sector (consumer staples), both have recession-proof business models, both are dividend growth stocks (more on that in this article), and both are able to deal with strong competition. Moreover, one of them “hates” inflation, and the other “loves” it.

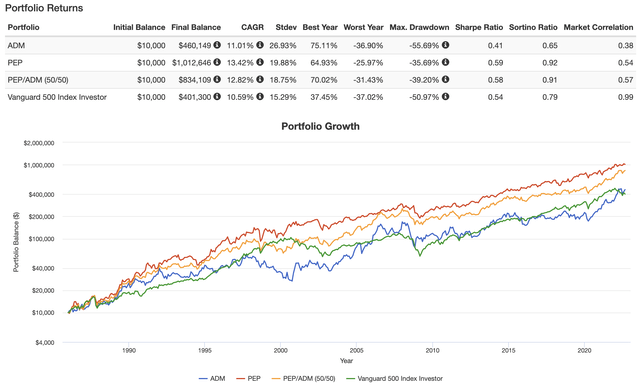

Going back to 1986, ADM and PEP have both outperformed the S&P 500, returning 11.0% and 13.4%, respectively. A portfolio consisting of 50% ADM and 50% PEP generated 12.8% per year, with a standard deviation of just 18.8%. This portfolio beat the S&P 500 by more than 200 basis points per year, which allows it to also beat the market on a volatility-adjusted basis (Sharpe/Sortino ratios).

Moreover, the max drawdown is just 39%, which beats the S&P 500 by more than 11 points.

Now, onto the dividends. Both companies are considered dividend growth stocks. PepsiCo yields 2.7%. ADM has a 1.9% yield.

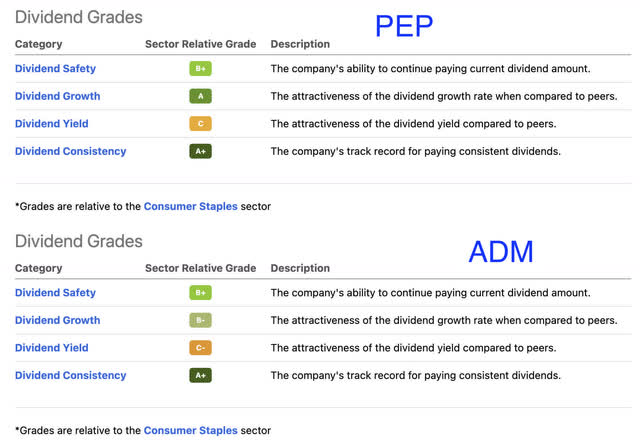

Using the Seeking Alpha dividend scorecards below, both companies score high on dividend consistency as both are dividend aristocrats. Both companies also score decently on dividend growth. The dividend yield doesn’t score as high as a lot of companies in the consumer staples sector have higher yields. Yet, most of them have very slow long-term growth, which does not apply to PEP and ADM.

So, how high is dividend growth, and how sustainable/safe are dividends?

Over the past 10 years, the annual average dividend growth rate of ADM was 8.4%. The most “recent” three hikes are:

- January 2022: 8.1%

- January 2021: 2.8%

- January 2020: 2.9%

In other words, dividend growth slowed when inflation was low. However, now the company is boosting its dividend again as its financials improve (as I discussed in this article).

PepsiCo’s average annual dividend growth over the past 10 years is 7.8%.

The last three hikes are:

- May 2022: 7.0%

- May 2021: 5.1%

- May 2020: 7.1%

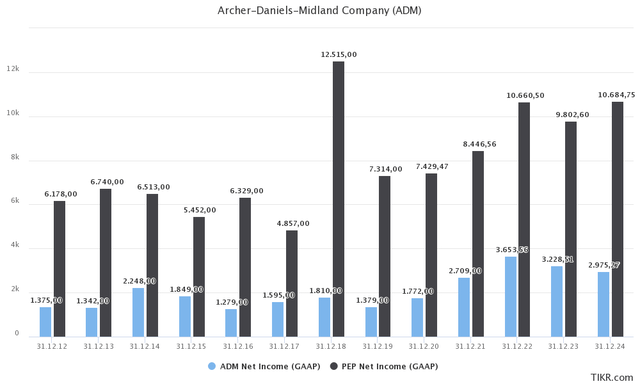

These are the payout ratios for ADM and PEP. The numbers are based on the last-twelve-months EPS result.

In this case, the payout ratio of ADM is much lower, yet its net income is much more volatile. PepsiCo has a much higher payout ratio, but consistent growth in net income.

So, what about the valuations?

Valuation

The other day, I wrote a market-focused article highlighting risks to the market and economy. A part of my conclusion was:

My strategy is unchanged. I have a list of existing holdings and stocks I want to buy. I have increased my savings rate to buy larger positions on weakness. While stocks have priced in a lot of weakness, I believe we could see more downside before the Fed is forced to change its course.

Both ADM and PEP offer attractive valuations for people who do decide to either initiate a position in one of the companies – or both – or for people looking to add to existing positions.

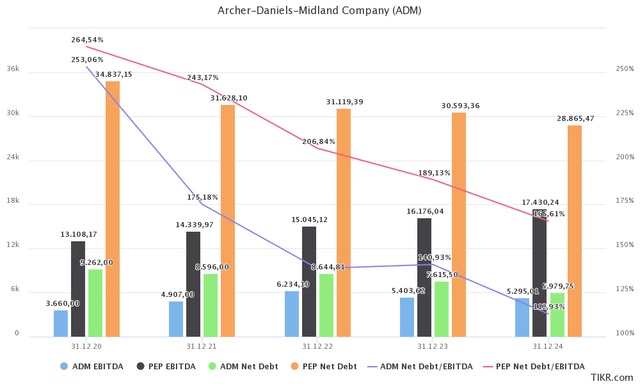

With that said, ADM has an implied enterprise value of $56.1 billion consisting of its $48.2 billion market cap, $7.6 billion in expected 2023 net debt, and $300 million in minority interest. PEP has a $251 billion enterprise value using its $233 billion market cap, $16.2 billion in expected net debt, $120 million in minority interest, and $1.7 billion in pension-related liabilities.

All numbers are visible in the chart below – excluding minority interest and pensions.

The numbers above also show that both companies have net leverage ratios of less than 2.0x.

As a result of their strong business models, both companies have an “A” credit rating, which is truly impressive – but no surprise.

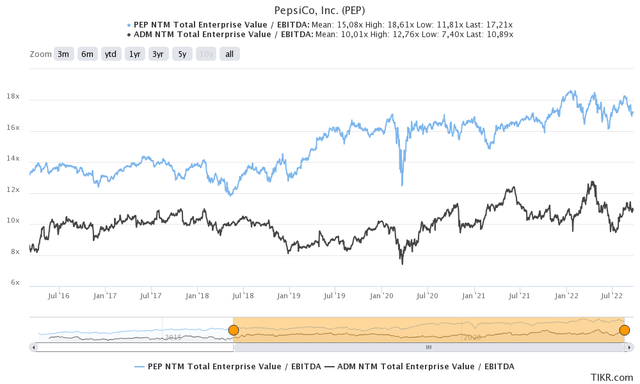

Using these enterprise values and 2023 EBITDA estimates, the companies are trading at the following multiples:

Both valuations are in what I like to call “fine” territory. Ignoring market risks, both stocks offer opportunities for buyers. If stocks continue to drop, the bull case grows as I do not believe that economic developments can do significant damage to either ADM or PEP.

Takeaway

Dividend investing is fun. While I have to say that the fun factor is much lower this year due to the ongoing market carnage, I am far from worried as I know that I own quality companies.

Two of the best conservative dividend growth stocks money can buy are PepsiCo and Archer-Daniels-Midland. In this article, I discussed why the two are great next to each other in a portfolio. They both cover different parts of the agricultural/consumer supply chain. PepsiCo offers strong anti-cyclical consumer exposure with strong brands that withstand high competition and that come with high pricing power. Archer-Daniels-Midland is a major supplier of companies like PepsiCo as it stores, trades, ships, and processes a wide range of agriculture commodities, which also helps it to do well when inflation is high. PepsiCo prefers low inflation.

This helps to lower overall long-term volatility as the two assets complement each other perfectly. Moreover, because both have a decent yield and sustainable dividend growth, investors own assets that allow them to beat the market on a long-term basis with low economic risks.

It also helps that the valuations are attractive for investors looking for places to put their money.

**On a side note, please let me know in the comment section if you like articles that cover more than 1 dividend stock. If there’s enough demand, we can build on this and add the top investments in each industry and work on different strategies.**

That said, I hope that this article offered some investment ideas with regard to low-volatility strategies and ways to offset both inflation and deflation risks in a long-term portfolio.

(Dis)agree? Let me know in the comments!

Be the first to comment