gorodenkoff/iStock via Getty Images

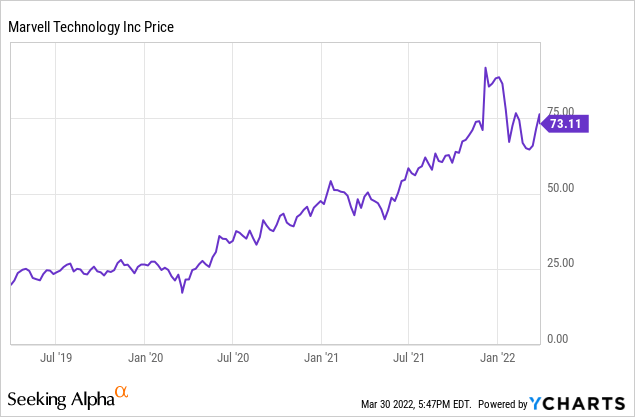

Marvell Technology (NASDAQ:MRVL) is a semiconductor device manufacturer with a broad portfolio. From about 2007 to early 2020 the stock price tended to be south of $20 per share, reflecting difficulties in competing with companies like Qualcomm (QCOM). In 2020, the stock price took off, peaking at $93.85 on December 8, 2021. Since then it has pulled back to near $73 per share. This article will examine whether $73 or so is a good entry point for long-term investors. The basis of that decision will be projections of Marvell’s future device sales given demand.

Fiscal 2021 v. 2022 Sales and Profits

Marvell works on a fiscal year that ends in January. Marvell fiscal Q4 2022 revenue was $1.34 billion, up 68% over fiscal Q4 2021 revenue of $798 million. As to profits, GAAP and non-GAAP numbers varied widely. On a GAAP basis, net income was just $6 million, which was down from $17 million a year earlier. For GAAP EPS that results in $0.01 versus $0.02 year-earlier. On a non-GAAP basis however, net income was $429 million, more than double the $201 million in net income in Q4 fiscal 2021. That resulted in non-GAAP EPS of $0.50 v. $0.29 year-earlier.

For the full fiscal year 2022 revenue was $4.46 billion, up 50% from $2.97 in fiscal year 2021. GAAP net income was a loss of $421 million or $0.53 per share, compared to a loss of $277 million or $0.41 per share a year earlier. Again, non-GAAP numbers flip the story, with FY 2022 net income of $1.28 billion or $1.57 per share, about doubling FY 2021 net income of $627 million or $0.92 per share.

While revenue growth is spectacular, it is a good idea to understand why there were GAAP losses and non-GAAP profits. In FY 2022 the main items eliminated from GAAP to reach non-GAAP numbers were share-based compensation and amortization of acquired intangible assets, which with lesser items added up to $449 million. Different investors have their opinions on share-based compensation, which is non-cash but dilutive, and acquisition costs, which really were in the past. Marvell made two significant acquisitions in fiscal 2022 which led to the high amortization numbers. My main point of comparison is cash flow from operations: is it close to the GAAP or non-GAAP figure? In this case cash provided by operating activities for FY 2022 was $819 million. So I consider, in this particular case, the non-GAAP numbers to be closer to reality, and what I think should be used by investors to judge profitability.

At the end of FY 2022 Marvell had a cash (and equivalents) balance of $613 million. Long term debt was near $5.5 billion. Nothing wrong with that, but it is several years of annual cash flow at today’s rates. While I would like a clean balance sheet better, debt is certainly acceptable given the cash flow. It also is worth it if the two acquisitions work out longer term.

Guidance

What about the future? The short-term future is easier to predict than the long term. At the March 3, 2022 analyst conference, where FY Q4 2022 results were reported, Marvell gave guidance for Q1 FY 2023, which ends May 1st. The center of the guidance range for revenue is $1.425 billion, which is up 6% sequentially from Q4 2022 and up 71% y/y from $832 million. So revenue growth is expected to remain rapid.

As to profit, the center of the GAAP EPS range is $0.01. The center of the non-GAAP EPS range is $0.51. The profit story remains the same: neglecting non-cash items, profits remain strong.

Marvell’s semiconductor portfolio

Longer term, how Marvell will do will depend on demand for semiconductor chips and how it competes in specific segments of the market. Management discussed those issues in the recent analyst conference (link in Guidance section, above). One of the recent acquisitions, Inphi, has given Marvell a competitive edge in chips that connect cloud data centers networks. The acquisition of Innovium added switches for cloud and edge data centers. Clearly, some of the y/y revenue and non-GAAP earnings growth came from these two acquisitions. They are also gaining design wins, which should propel revenue and profits in the future.

It is notable that exiting the fiscal year Marvell had record bookings. Demand was still growing faster than supply, and backlogs were growing. Marvell was working to secure more capacity to meet demand. In addition to strong demand growth for data center products, Marvell’s cell carrier infrastructure end market grew 45% y/y. That was driven by the rollout of 5G. The enterprise networking end market had even strong growth, up 64% y/y. This market has hit an upward inflection point largely due to the need to continuously connect employees with video.

The automotive and industrial end market is also seeing explosive growth, though at $79 million for Q4 it is less of a revenue driver. It was up 134% y/y. Brightlane Ethernet devices for vehicles led growth. These devices provide the high-speed capabilities needed to connect sensors, including video, to the software needed to run the newest, and coming, generations of cars and trucks.

That all sounds great, but it is good to keep in mind that rosy scenarios do not always work out. Auto sales should go up in 2022 and 2023, and semiconductor devices per automobile should go up too. But a severe recession could change that, and supply chain issues that reduce the total volume of vehicles produced would also reduce the number of semiconductor devices purchased from providers like Marvell. It is also hard to see the cloud computing environment decelerating any time soon, but macroeconomics can affect even that sector. Marvell seems to be outsmarting its competition lately, but that is not a guarantee of future success.

Conclusion

The future is notoriously more difficult to predict than the past. It looks to me like the additions of Inphi and Innovium have given a boost to Marvell’s technological leadership. I do not see how the percentage jump in revenue growth between FY 2021 and FY 2022 can be achieved again in FY 2023, but I still expect strong revenue growth. The stock price closed at $73.01 on March 30, 2022, well down from its 52-week high of $93.85. While forward PE (price to earnings ratio) is still a bit steep at 33, I think that is fair given the short and long-term growth outlooks. This is a buy-the-dip situation, though I would not argue with anyone that if the stock price does continue to drop short term, that would be an even greater opportunity.

Be the first to comment