Aliaksandr Litviniuk/iStock Editorial via Getty Images

Introduction

Carlsberg (OTCPK:CABGY) (OTCPK:CABJF) (OTCPK:CABHF) is one of the largest beer producers in the world and its namesake brand doesn’t need any further introduction. Inflation remains one of the big themes in the investment world these days and Carlsberg obviously also has to navigate through the choppy waters. The company’s first semester was good, better than expected even, and the full-year guidance was hiked. H2 will be a bit tougher but the Carlsberg management still sounded pretty upbeat. And looking further into the future, it helps that 60% of the natural gas needs for its West European production in 2023 are covered. The downside is of course that about 10% of its revenue in 2020 and 2021 was generated in Russia, and the Russian subsidiary has been put up for sale.

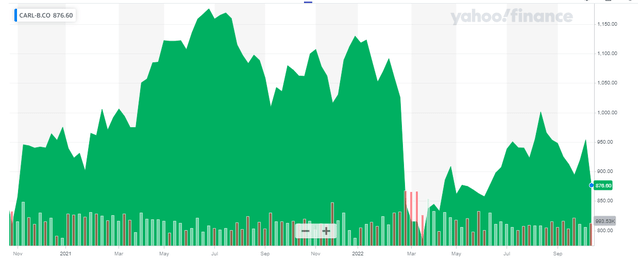

Carlsberg has its most liquid listing in Copenhagen where the stock is trading with CARL-B as its most liquid ticker symbol. The average daily volume is just under 200,000 shares and based on the current USD/DKK exchange rate of 7.54, has a monetary value of just over 20M USD per day. As Carlsberg reports its financial results in DKK as well, I will use the Danish Crown as base currency throughout this article.

The strong performance in H1 was overshadowed by the Ukraine-Russia issues

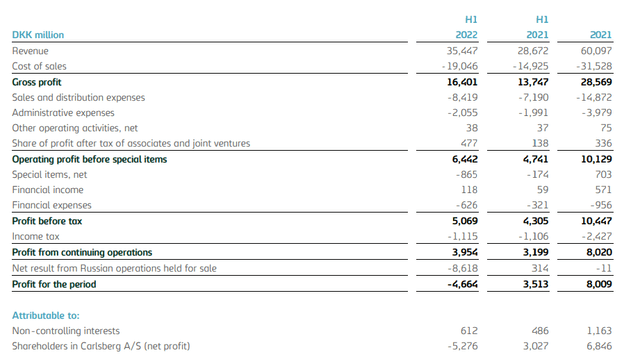

The first half of the year was excellent, both in absolute and relative terms. The relative strength is easy to explain as H1 2021 was still characterized by COVID-related lockdowns but it is impressive to see how Carlsberg was able to expand its margins: the organic volume growth was just 8.9% but the revenue increased by almost 21% while the operating profit increased by almost 32%.

The total revenue in the first half of the year came in at 35.45B DKK while the gross profit jumped from 13.7B DKK to 16.4B DKK. And as you can see below, the 30%+ increase in the operating profit was mainly caused by the company being able to keep its administrative expenses under control while there also was an important contribution from the share of after-tax income in associates and joint ventures. While that is great, keep in mind that does skew the results a little bit and the operating profit excluding the contribution from associates and JVs would have been approximately 5.97B DKK versus 4.6B DKK. That still is an increase of in excess of 30% so the underlying result is obviously still very strong.

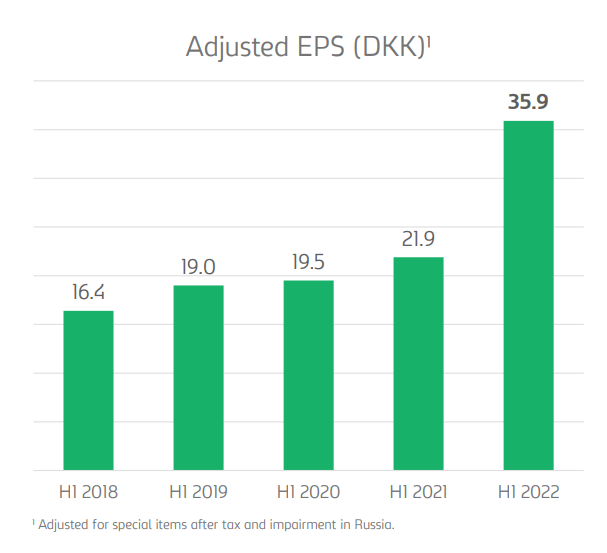

The pre-tax income increased by just over 17%, mainly due to higher financial expenses and a much higher impact from ‘special items’ with the latter having a negative impact of approximately 700M DKK. That being said, the reported net income was still more than 20% higher at 3.95B DKK and the only reason why Carlsberg posted a net loss in H1 (and will likely post a net loss in FY 2022) is the write-down on the assets of the Russian operations. This resulted in a recorded net loss of 4.66B DKK and a net loss attributable to the shareholders of Carlsberg of almost 5.3B DKK. That’s a pity as the reported attributable net income on an underlying basis (excluding these impairment charges) was a very solid 35.9 DKK per share.

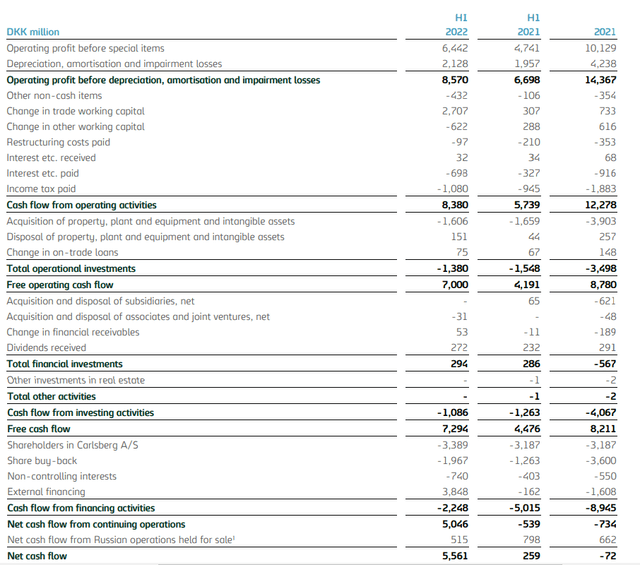

Carlsberg Investor Relations

That’s also being confirmed in the cash flow statement (as impairment charges are obviously non-cash expenses). The reported operating cash flow was 8.38B DKK although this includes a 2.1B DKK contribution from working capital changes. On an adjusted basis, the operating cash flow was 6.3B DKK, a very nice improvement compared to the 5.15B DKK in the first half of last year. If we add in the dividends received from the associates and joint ventures, the operating cash flow was 6.6B DKK compared to 5.4B DKK.

The total capex in the first half of the year was 1.6B resulting in an underlying free cash flow of 4.85B DKK (I included only half of the received dividends as the majority of the full-year dividends are collected in the first half of the year). I am also excluding the 515M DKK free cash flow from the Russian operations in this calculation and this offsets the net income attributable to non-controlling interests. With approximately 138.5M shares outstanding (A-shares and B-shares, and this amount is decreasing as Carlsberg continues to buy back stock), the free cash flow per share was approximately 35 DKK.

Will Carlsberg be able to maintain its full-year guidance?

I was surprised when Carlsberg actually upgraded its earnings outlook a week before it announced its H1 results. On August 8th, the Danish brewing company hiked its expectations based on the strong business performance on a YTD basis, which included the July performance.

That being said, the company did warn for a lower result in the second half of the year using a YoY comparable basis. While the H1 results were still relatively shielded from the high inflation rate, Carlsberg warned that higher commodity prices, higher energy prices and the existing hedges gradually rolling off will cause upward price pressure. The plan is to combat this with price hikes but there will be a lag. Additionally, Carlsberg specifically warns for the difficult comparison in Q3 as Q3 2021 was exceptionally strong. But judging from the tone used on the H1 conference call, the Carlsberg management doesn’t seem to be too alarmed about H2.

So with regard to that, so far, we have not seen any impact from higher prices and inflation in our regions and in countries. We expect, of course, some impact in the second half of the year, although for this year it will not impact us that much anymore because, as you know, the season is almost over.

That’s reassuring, but it could also mean that Carlsberg is expecting the majority of the impact to occur in 2023 so it will be interesting to see if Carlsberg is providing a [soft] guidance for 2023 when it announces its Q3 results. An important element will be the energy cost. For 2022, 85% of the natural gas needs were hedged, and Carlsberg already hedged 60% of its Western European gas needs and 25-30% of its Eastern European gas needs in 2023 so the company is definitely proactive and having hedges in place will improve the visibility.

It will also be interesting to see how the cost of debt will evolve from here on. Earlier this month, Carlsberg had to offer a 3.25% interest rate on three year Eurobonds.

Investment thesis

While 2022 will appear to be a bad year due to the anticipated net loss, the underlying performance of Carlsberg is actually better than expected. While I will be looking for confirmation on the Q3 call, Carlsberg’s 2022 is off to a very strong start. I already own AB InBev (BUD) and have always considered Carlsberg to be relatively expensive but I will have to revisit that opinion. It looks like the Danish brewer has a good grip on costs and with a debt ratio of just 1.1 times EBITDA, the balance sheet is very strong as well. Interest rate increases will increase the cost of debt, but Carlsberg should have enough pricing power to mitigate the impact of higher COGS and interest rates on the bottom line.

While (the much smaller) Danish competitor Royal Unibrew (OTCPK:ROYUF) rattled the market with a negative update earlier this month (citing customer destocking and a tougher pricing environment), Carlsberg’s pricing power should be superior. That being said, I will wait for the Q3 update before deciding on taking a position.

Be the first to comment