shaunl

The transport industry takes on the moving of people and things from one place to another in many shapes and forms. Due to the importance of the sector, it can provide investors with some outstanding returns. Marten Transport, Ltd. (NASDAQ:MRTN) is a small cap stock that has outperformed the sector year-to-date with returns of 14.43%.

Year to Date Stock Price Growth (SeekingAlpha.com)

Since my previous article, the stock price has fluctuated between $19 and $23. There are two sides to the transport industry. On the one hand, it is experiencing a surcharge in demand due to the changing buying behavior of customers who increasingly expect door-to-door deliveries. On the other hand, transport stocks are very cyclical as they are directly impacted by travel and shipment demands which can heavily fluctuate during economic uncertainty. On top of that, these companies are still dealing with ongoing supply chain disruptions, a shortage of workers and increased overall operational costs. MRTN is a market leader in its sector of trucking time and temperature-sensitive goods across the United States, Canada and Mexico. In its long history, it has shown resilience in previous economic downturns. Its business model allows it to quickly up and downscale operations according to demand. It has demonstrated a solid financial performance this year and has recently declared a quarterly dividend of $0.06 per share to be paid out this month. For sturdy performance and shareholder-orientated decisions, I recommend that investors take a bullish stance on this company while the price is well below the average analyst estimate of $24.

Business at a Glance

MRTN is a truckload carrier for time and temperature-sensitive goods and operates across four segments. If we look at the segments by total revenue performance in the last Q2 2022 financial report, we have the following split: “Truckload”, at 39%, followed by “Dedicated” with 33% revenue, next with “Brokerage” at 17% revenue and lastly with “Intermodal” at 11%. Across these sectors, MRTN has invested in technology that automates a significant number of activities allowing the company to scale up and down according to market conditions. Its in-house technology systems also allow for quick and real-time data-driven decision-making. However, the company has been in the news recently for a breach in its security, which is one of the threats that can negatively impact the company’s reputation and operational efficiency.

Currently, across the transport industry, there is a severe shortage of workers. MRTN has increased its workforce by 15% this year, according to the second quarter report. The company has incentivized drivers by increasing its driver compensation package. There is an ongoing trend in the competitive market in which demand is higher than the availability of drivers available and is set to be a trend to continue into 2030.

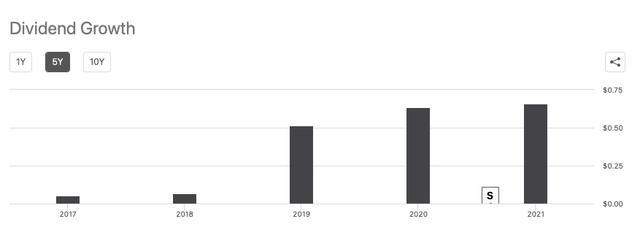

Investors in MRTN have benefited from consistent quarterly dividend payouts since 2011. On September 30th, stockholders will be issued a dividend of $0.06 per share. The dividend growth rate over the last three years has increased by 33.08%, compared to the sector average of 6.15%.

MRTN Dividend Growth over 5 years (SeekingAlpha.com)

The company will be releasing its following earnings report in mid-October. It has beat earning expectations for every quarter this year and looks set to bring forth strong results with its increased number of drivers to take on the demand. The expected EPS for the next quarter is $0.35, an increase of 34.62% from the prior year. Furthermore, the latest revenue prediction is also a high $329.05 million, a rise of 30.95% year on year. For the full year, analysts expect revenue of $1.28 billion, which would increase 31.38% year on year.

Valuation

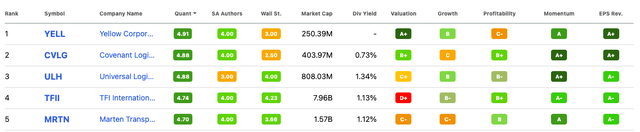

Analysts have recently reviewed their opinions of MRTN in a more positive light. If we compare MRTN to the transport industry, we see sturdy growth, and on top of that, the company looks to be undervalued as it stands now. On Seeking Alpha, it is classified as the top fifth trucking stock.

Top Trucking Stock Stocks (SeekingAlpha.com)

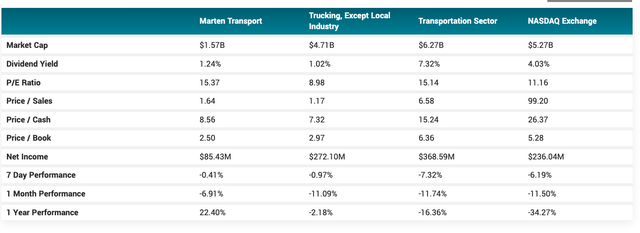

If we compare MRTN to the transport sector, especially the trucking industry, the ratios do not look extremely interesting in terms of putting MRTN in a good light. However, MRTN has had some momentum, sturdy financial results and rate in terms of analyst expectations. We can see that although it has a higher price-to-earnings ratio of 15.37 compared to 15.14 for the transport sector, the forward-looking price-to-earnings ratio is expected to be lower at 13.92. We can see that the price-to-sales ratio is significantly lower than the transport industry indicating that it may be undervalued if we compare it to what investors are willing to pay for the company’s revenues.

MRTN versus Competitors Valuation (MarketBeat.com)

MRTN is a Strong Buy on Zack’s Rank, as a rating of 1. It is currently also highly rated on Seeking Alpha’s Quant rating, and various Wall Street analysts have given positive feedback on the company.

Final thoughts

In a world of economic uncertainty, it seems wise to look into well-established companies with long histories of stable performances, irrespective of market trends. On top of that, MRTN is undervalued if we compare it to the transport sector. Although its price-to-equity ratio is higher than the average trucking industry ratio, it has an excellent price-to-book ratio and some serious positive momentum towards the soon-to-be-announced third-quarter earnings report in mid-October. As the price has currently taken a dip, I see this as an opportunity for investors to consider a stock with more upside potential backed up by consistently strong financial results and high demand that they are meeting with a growing number of truckers employed.

Be the first to comment