z1b

The TriplePoint Venture Growth (NYSE:TPVG) company is one of the beaten-down dividend stocks to buy in the current bear market. It is a quality venture debt company with strong portfolio growth trends, high returns on investments, and solid growth in net investment income. In addition, fundamentals for venture debt seem healthy, and it appears that TPVG’s aggressive growth strategy would help in accelerating earnings over time. In general, the firm has many characteristics that make it a good long-term dividend investment, including an attractive entry point and a dividend yield of more than 13%.

The Robust Venture Debt Demand

The venture capital market has been struggling in 2022, with VC funding plunged to $122 billion in the first half of 2022 from $150 billion in the same period last year. Several factors have contributed to the drop in venture capital funding, including low confidence in cash-burning technology stocks. The uncertainty has, however, raised the demand for venture debt companies. Startups are aggressively pursuing venture debt because it enables them to meet their cash needs without selling their stakes at a significant discount to venture capital firms. Consequently, venture debt firms are making record investments and debt commitments while their portfolio values are soaring and returns are climbing rapidly.

Apart from past performance, the fundamentals of venture debt look strong as looming recession, rate hikes policy, and lower earnings growth expectations may discourage venture capitalists from investing in early-stage companies and drive founders to seek cash assistance from venture debt.

TriplePoint’s Double-Digit Dividend Yield is Safe

TripplePoint’s dividend yield of over 13% isn’t a dividend yield trap. It not only has the potential to sustain its dividends, but it can also raise them by double-digit percentages. Currently, the company offers a quarterly dividend of $0.36 per share. In my view, several factors contribute to high prospects for TripplePoint’s dividend growth, including its aggressive investment strategy, which is helping it to post solid investment income growth. In the first half of 2022, the total investment income for the company reached $54.8 million, up from $40 million in the first half of 2021. Another notable factor is earnings are improving not only because of the increased investment but also because of higher yields. On total debt investments, its weighted average annualized portfolio yield increased to around 15.0% in the first half from 13.6% in the same period last year. Its net investment income came in at $0.84 per share in the first half compared to $0.59 per share in the same period last year. The net investment income also exceeded the dividend of $0.72 per share in the first half. There is room for significant dividend increases in the coming quarters given the gap between dividends per share and net investment income per share.

Besides solid first-half performance, the company’s net investment income is likely to increase in the following quarters due to a noteworthy increase in investment commitments and debt funding. In the second quarter alone, the company signed a record $803.6 million of term sheets and closed a record $259.9 million of new debt commitments. Over its previous guidance range of $50 million to $100 million, it funded $157.6 million in debt investments to 20 portfolio companies. This also represents an increase of $76 million in debt funding from the same period last year. The company expects quarterly funding between $100 million and $200 million on a gross basis for the third and fourth quarters.

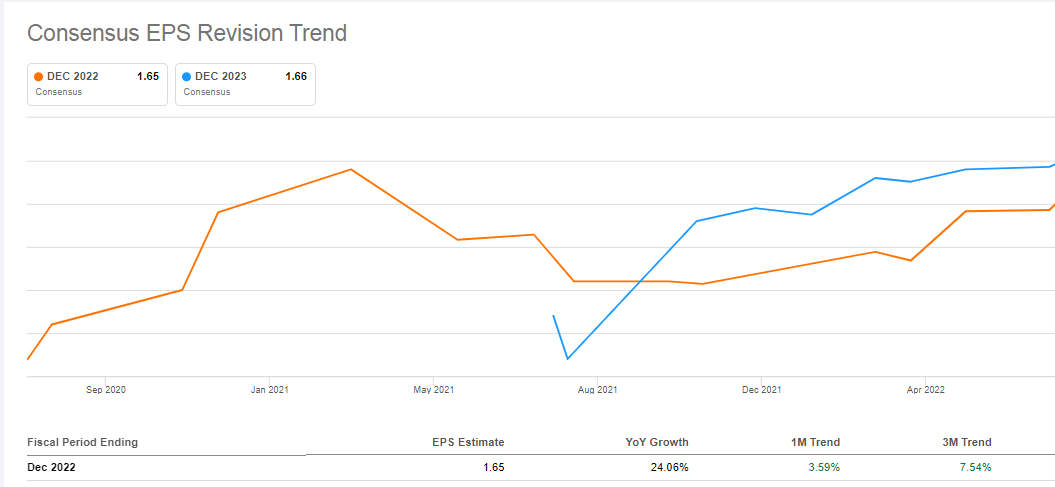

EPS Revision (Seeking Alpha)

In response to the company’s aggressive investment strategy, Wall Street analysts are increasing their earnings expectations. During the last three months, seven analysts raised their earnings expectations for the company to $1.66 per share, according to Seeking Alpha. TripplePoint would have significant space to increase dividends from its current level if it earns around $1.66 per share in 2022. As spillover income already exceeded $14 million at the end of last quarter, I also expect special supplemental distributions in the future.

A Perfect Entry Point for New Investors

Buying decisions cannot be made simply based on the prospect of dividend growth and high yield. Choosing the right entry point is crucial for maximizing returns. Fortunately, TripplePoint Venture Growth stands among the most beaten-down stocks in the venture debt space, making it an attractive investment for long-term investors. The company’s stock has plunged 41% so far in 2022 because of broader market volatility. At the time of this writing, its shares are trading around $10, down from a book value of $13.01 per share and a 52-week high of $18. As soon as the broader market stabilizes, I believe its shares are likely to bounce back strongly. This is because the selloff in shares was supported by broader market volatility rather than fundamentals or financial data. The stock is also undervalued based on its forward price-to-earnings ratio of just 6.34, well below the sector median of around 9. Seeking Alpha quant grading system also gave it an A grade on valuation.

The Risk Factor is Low

Real dangers for a company arise when fundamentals deteriorate and earnings begin to decline. At present, TripplePoint Venture Growth does not face any real risks. In addition to the strong credit quality of its portfolio holdings, diversification contributes to stability in investment income. For instance, the company ended the second quarter with 56 funded obligors, up from 34 the previous quarter. Additionally, it invested 35% of its debt in its top 10 obligors, compared to 51% in the same period last year.

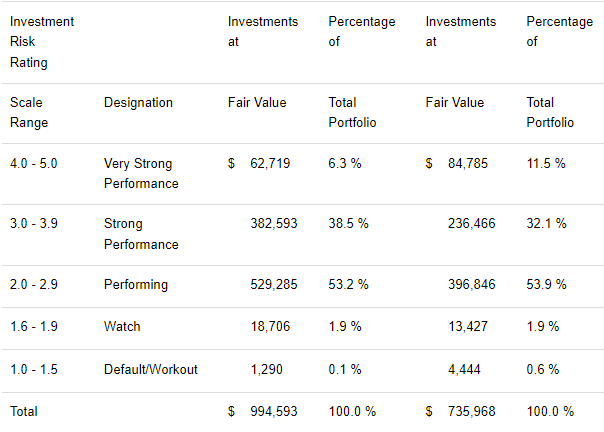

Investment Risk Rating (Earnings Release)

Moreover, 90% of its portfolio is ranked among its three best credit scores, indicating that investments are performing excellently or exceeding expectations. A small percentage of loans fall into categories 4 and 5, indicating a low risk of credit loss. When it comes to credit losses, the company has a stellar record. Since IPO, its cumulative net credit loss rate stands at 0.9% based on commitments and 1.4% based on funding.

In Conclusion

While the broader market selloff has wiped out trillions of dollars of stock market value, it has also created attractive opportunities to buy quality companies like TripplePoint Venture Growth. Since the selloff was not supported by softening fundamentals, TPVG shares are likely to rebound strongly when the market stabilizes. The data suggest that venture debt is flourishing over the past few quarters, and TripplePoint is poised to capitalize on this trend. A healthy increase in net investment income also points out that dividends can be increased in the near future.

Be the first to comment