baranozdemir

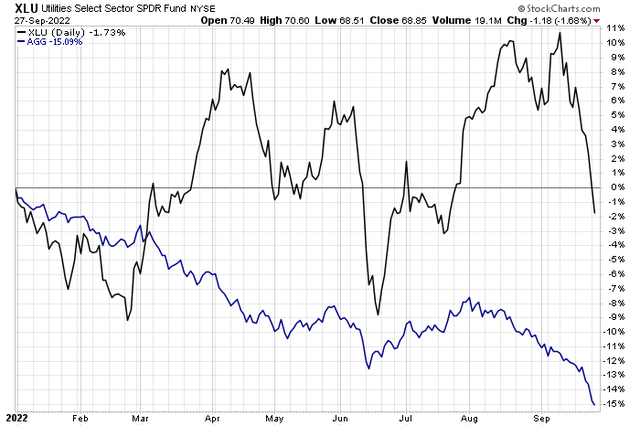

Utilities keep performing well versus the S&P 500 in 2022. So far this year, the Utilities Select Sector SPDR ETF (XLU) has a whopping 27% of alpha versus the S&P 500 ETF (SPY) on a total return basis.

Interestingly, the utilities group used to be seen as a bond proxy given its steady operations and high dividend yield, but this year it has traded like a flight-to-quality asset.

While the bond market suffers, the “utes” are doing just fine. One Utilities sector company has a decent yield with some earnings growth potential.

Utilities: Not A Bond Proxy In 2022

According to Bank of America Global Research, The AES Corporation (NYSE:AES) is a global power company with 38+ GW of generation capacity, operations in 24 countries, and goals to expand generation and utility segments in mature and emerging markets. AES operates four main business segments: contracted generation, competitive supply, large utilities, and growth distribution. A domestic and global player, 28% of the company’s capacity is derived from South America generation, 26% from North America generation, and 19% from North America utilities.

The Virginia-based $15.3 billion market cap Independent Power and Renewable Electricity Producers industry company within the Utilities sector has negative trailing 12-month GAAP earnings and sports a 2.8% dividend yield, according to The Wall Street Journal.

The company has solid upside potential via its broad renewable energy development business and exposure to the LNG markets overseas. The independent power producer should trade at a premium EV/EBITDA multiple given its unique growth prospects. Downside risks are there, though. Regulatory actions, unfavorable currency moves, and more costly financing could hamper the stock price.

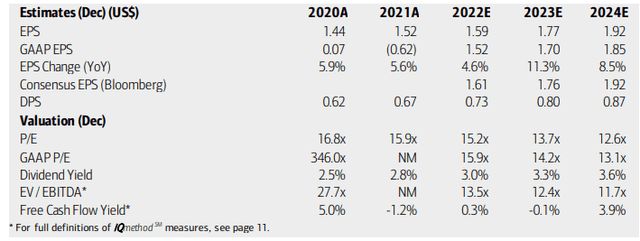

Analysts at BofA see operating earnings growing at a solid clip through 2024. While its inflation-adjusted EPS growth rate will likely be negative in 2022, that looks to reverse next year. Moreover, the stock’s non-GAAP P/E ratio is actually attractive to the broad sector while the yield may be on the rise. Its EV/EBTIDA multiple is elevated, however, and free cash flow is weak. Still, I like the valuation on this utility.

AES Earnings, Valuation, And Dividend Forecasts

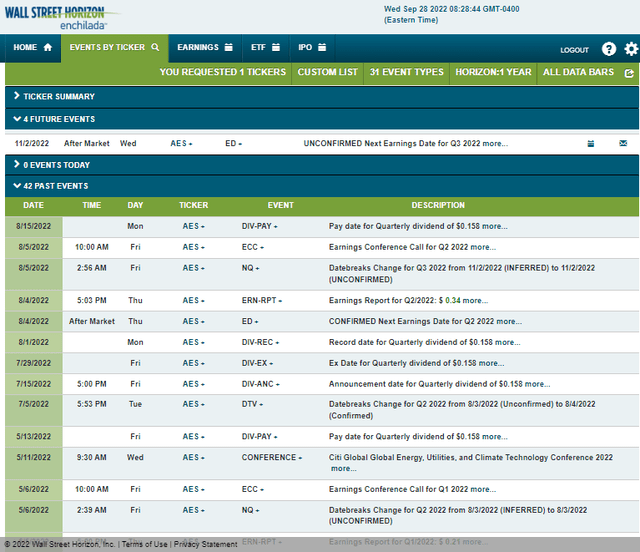

Looking ahead, AES has an unconfirmed Q3 earnings date of Wednesday, November 2 after market close, according to data provided by Wall Street Horizon. The calendar is light until then.

Corporate Event Calendar

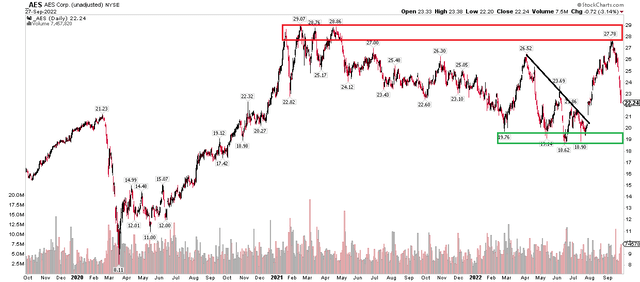

The Technical Take

AES shares could be on the way back down to support in the upper teens. It has been in freefall mode since approaching resistance in the upper $20s earlier this month amid broad market volatility. It’s important for traders and investors to manage risk right now. I think being ready to buy shares on an approach of $20 is a good play.

There was a gap from August that could be filled in due time – that could be a good spot to scoop up shares. A stop under the June low of $18.62 makes sense. Short-term swing traders might want to sell if the stock climbs back toward $29, but a breakout above $30 would be bullish long-term.

AES Shares Could Retreat Further

The Bottom Line

I like the valuation and growth prospects with AES here. The technical chart suggests buying on a further dip is the prudent play. But longer-term, watch out for a bullish breakout above $30. The upper-teens range must hold though.

Be the first to comment