Markets are moving higher as sentiment improves and interest rates, oil prices fall Ago87/iStock via Getty Images

Brian Dress, CFA — Director of Research, Investment Advisor

No matter how you look at it, it’s been a difficult 2022 for investors, as we have experienced the first bear market in more than a decade. What’s worse is that both stocks and bonds have fallen, which rarely happens.

However, since mid-June, we have observed a significant change in sentiment among market participants. After a disastrous 1st quarter earnings season, where stock price drops of 20%, 30%, and 40% were seemingly commonplace, things have been palpably different in the 2nd quarter earnings season. What we have been seeing has been more muted reactions to bad news, positive reactions to mediocre news, and overall better investor sentiment.

In this week’s letter, we will focus closely on the earnings reports that came in this week and our observations of the stock price reactions, in the context that I mentioned above. We were particularly impressed by earnings out of Starbucks (SBUX), EPAM Systems (EPAM), along with Advanced Micro Devices (AMD). The caution we have felt for most of 2022 is beginning to fall away slightly, as we hear directly from certain companies that have shown a remarkable ability to perform in what is clearly a challenging business environment.

Despite the fact that we see green shoots developing in technology and a few other sectors like healthcare, we think investors have to continue to be discerning stock pickers, given that we still see headwinds in the economy. One major takeaway from us this earnings season has been a confirmation of our thesis that retail consumer discretionary businesses remain challenged. We heard from two retailers this week (Crocs (CROX) and Revolve Group (RVLV)) that suggest that our suspicions of the entire retail sector are well-founded.

We are all aware of many of the issues that plague the economy that are forcing consumers to change their behavior: a general malaise about the state of things, higher prices, especially for energy and food, and finally, rising interest rates. The same pressures have created a difficult operating environment for businesses across the spectrum and have contributed to the negative sentiment in markets. Part of the reason we are seeing more positive energy in the markets is that these pressures are receding: oil prices have now fallen from $120 to $90/barrel, while 10-year U.S. Treasury rates peaked near 3.50% and now have pulled back to roughly 2.70%. Maybe most importantly, 30-year mortgage rates have fallen from over 6% just a couple months ago to a shade above 5% now.

Couple these changes with the latest employment report (which showed more than 500,000 new jobs created in the US in just the last month), we are becoming more convinced that things are improving both in markets and in the economy. Fortunately, over the last few difficult months, our CEO Noland Langford and I have found plenty of opportunities where we can invest as things continue to calm down.

Armed with the earnings reports we’ve read over the last few weeks, we are starting to put cash to work in what we consider superior businesses that have the chance to perform in the next 2-5 years.

With that all being said, let’s get into it!

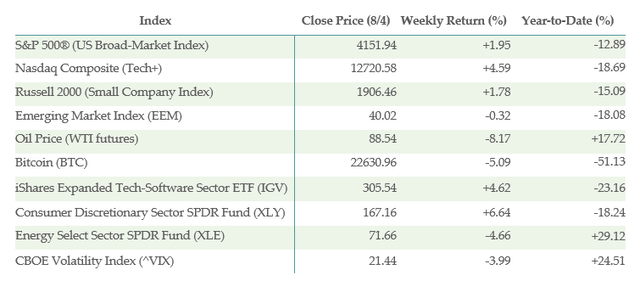

Below is the performance data of key indices, exchange-traded funds (“ETFs”) for the five trading days between 7/28/22 and 8/4/22:

What is/is not Working?

Markets were up sharply over the last week of trading, but mixed underneath the surface. We saw positive moves in the more risk-oriented sectors of the S&P 500 (SPY), including consumer discretionary (up 7.3%), information technology (3.8%), communications services (up 2.6%), and industrials (2.4%). On the downside, we predictably saw a 4.6% drawdown in the energy sector, as prices in the underlying commodity fell by more than 8%. We remain long-term constructive on energy and we take comfort in the fact that the stocks are not falling in a 1-for-1 with the oil price itself. We would remind you that our research indicates that integrated oil companies like Exxon Mobil (XOM) will still be profitable at oil prices between $60-80 per barrel.

Although crypto assets themselves, like Bitcoin and Ethereum had modestly a strong week, the two strongest ETFs in our list were First Trust SkyBridge Crypto Industry and Digital Economy ETF (CRPT) and Bitwise Crypto Industry Innovators ETF (BITQ).

With the NASDAQ up by nearly 5% this week, you won’t be surprised to read that our “risk on” sector indicators were popping off the screen. Among the strongest ETFs on the list this week were ProShares Big Data Refiners ETF (DAT), Renaissance IPO ETF (IPO), ARK Innovation ETF (ARKK), Consumer Discretionary Select Sector SPDR Fund (XLY), and First Trust Cloud Computing ETF (SKYY), all of which advanced this week by more than 6%. As markets begin to turn, it certainly appears that investors are willing to begin dipping their toes back in the water in the riskier sectors. Robust companies that investors loved back in 2021 at extreme valuations all of a sudden look more attractive now with much lower earnings multiples!

As we have alluded to above, energy was the big loser this week. We saw 10 of the 20 worst performing ETFs from our list this week came from the energy sector. This includes the United States Brent Oil Fund, LP (BNO), Invesco S&P SmallCap Energy ETF (PSCE), ClearBridge MLP and Midstream Fund Inc (CEM), and SPDR S&P Oil & Gas Exploration & Production ETF (XOP). Again, for investors that still aren’t invested in energy, this may be a great chance to buy these stocks at a discount to where they’ve traded all year. We like the long-term supply/demand situation for oil companies and we will hold that view, just as long as oil executives retain capital spending discipline.

For the most part, the rest of our “What’s Not Working?” list is populated by inverse and hedging ETFs.

Earnings Highlights: Comeback candidates

In this section, we are going to cover two companies that reported earnings this week, both of which we consider “bounce back” candidate stocks. These are companies that have predictable profitability and moderate growth, which happen to have strong competitive positioning. Those of you who have followed Left Brain over the years will know that these are the basic characteristics of stocks we favor. However, due to various circumstances and the general market weakness we have seen over the past year, these stocks are trading at significant discounts to their previous all-time highs.

The first of these stocks we want to cover this week is Starbucks (SBUX), a household name if ever there was one. This company has been one of the all-time best performing stocks, but has fallen on hard times in the post-Covid years. China has been their most important growth market and business there has come to a screeching halt, with the sporadic and unpredictable lockdowns mandated by the government there. Not only that, but also the company is working its way through a management change, with former CEO Kevin Johnson retiring in early 2022 and former CEO/founder Howard Schultz returning to the role in an interim capacity.

In this week’s earnings report, Starbucks reported global comparable same store sales of 3% in the most recent quarter, driven by a 9% figure in North America. This slightly obscured the problems in the Chinese market, where comp sales dropped by 44%! Business has come to a near standstill in China, but the company was still able to deliver reasonable company-wide results.

From our point of view, this is great news for Starbucks. Despite the extremely restrictive Covid-19 protocols in China, we do think eventually things will return to some level of normality in China and we think growth for the company in that country will resume at some stage. Our perspective now is that investors in Starbucks are purchasing the business ex-China, with a call option on the China portion of the company. In other words, any profits/growth coming from China will be bonus. As a result, we think this is a good way for investors to play a potential China recovery without taking on the risk associated with China-based corporations.

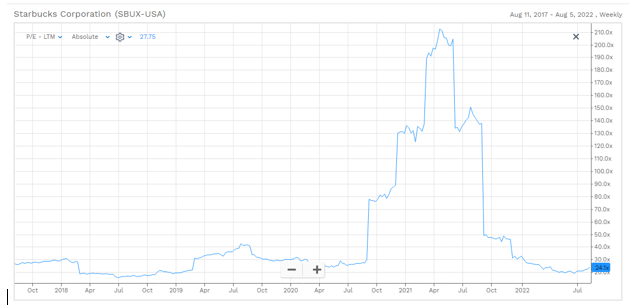

Another part of the story interests us here with Starbucks and that is the valuation. As you can see in the chart below, Starbucks current price/earnings ratio of 24x is relatively low in the historical range for SBUX. We like stocks like these, where we see a potential earnings growth catalyst, along with the opportunity for multiple expansion.

FactSet

The second company we will cover here today briefly is EPAM Systems (EPAM). EPAM is a digital platform engineering and software development services company, which competes with leaders in the consulting world like Accenture (ACN). EPAM has an important competitive advantage: the company employs software engineers across the globe in areas, with strong engineering talent bases at relatively low average wages. Examples of this include Eastern Europe, Latin America, and Central Asia.

This stock fell roughly 75% in late February, corresponding exactly to the beginning of the war in Ukraine. At the time, EPAM employed a significant portion of its workforce in the countries of Ukraine, Russia, and Belarus. Business operations in Ukraine were predictably impacted and the ensuing global sanctions against Russia and Belarus created a massive challenge for CEO Arkadiy Dobkin to solve.

And solve the problem they have. This week we received the earnings report from EPAM, in which the company delivered second quarter revenue of $1.20 billion, up 36% over last year, despite all the difficulties associated with the war in Ukraine. According to Dobkin, EPAM management snapped immediately into action as the war began, shifting much of the company’s engineering capacity to other geographies like Latin America and Central Asia, effectively mitigating the disruption in Eastern Europe.

The stock has rallied by roughly 15% since the earnings report, but still sits more than 40% below its all-time high from 2022. We think this is a stock that has a great chance for outperformance in the coming 2-3 years and is a highlight on our “bounce back” list.

Retail: Still Challenged

We told you earlier in the letter this week that consumer discretionary was the strongest sector ETF on the board this week. We think under the surface, this masks an unfortunate reality: retail still faces many challenges. Note first that Amazon (AMZN) and Tesla (TSLA) make up a disproportionate segment of the retail index and their moves higher this week skewed the performance of the sector.

As we have read the earnings reports of some very important retailers, like Target (TGT) and Wal-Mart (WMT), retailers are still fighting supply chain problems, mismatches in inventory, and shifting customer behavior in the face of rising prices. With retail behemoths like TGT and WMT struggling in this environment with all their competitive advantages, it is no surprise that smaller retailers are suffering similar fates.

We heard from two such retailers this week, both of whose stocks fell by 10%+ after they released their reports: Crocs (CROX) and Revolve Group (RVLV). These are two companies that we have followed in the past, but are the types of businesses we are avoiding in the current market conditions.

Let’s dig in a bit deeper on CROX. Crocs is the maker of the ubiquitous rubber clogs that were a fad nearly two decades ago, but have come back with a vengeance in the last handful of years. Last quarter, the company did deliver results that beat expectations (revenues were higher by nearly 51% versus last year), but unfortunately the cost of goods sold increased by 90%, so the company’s profitability is under threat.

The biggest problem was that the company cut its forecast for future quarters’ results. Previously, the company had set expectations of investors for sales growth in excess of 20% on a go-forward basis. Unfortunately, management disclosed that sales growth in North America is slowing and guided for 14-17% sales growth in the near-term. The market punished the stock brutally in the session after. We still think this is an interesting company with a good strategy, but retail stocks like this just happen to be wrong for the current market, in our view.

Takeaways from this Week

It is good that we see markets firming for a number of weeks in a row. We have made it through most of earnings season and sentiment continues to improve among investors. We continue to gain more confidence in the market, particularly in stocks we liked before the bear market. We like the opportunity to purchase quality merchandise like SBUX, EPAM, and AMD at relatively low historical valuations.

At the same time, we continue to see weakness in retail stocks, based on shifting consumer behavior, prolonged supply chain problems, and contracting margins. In terms of “bounce back” stocks, we think investors should continue to steer clear of retailers, especially small ones with high debt levels like CROX.

Be the first to comment