ablokhin/iStock Editorial via Getty Images

United Natural Foods, Inc. (UNFI) is the largest publicly traded grocery, organic foods, and merchandise distributor. In our opinion, its market power and operations in the essential food industry make this a potentially long-term profitable investment for retail value investors.

The Company

United Natural Foods sells more than 250,000 natural and organic brand name and private label groceries (e.g., Woodstock, Blue Marble Brands, Field Day), produce and perishables, frozen foods, vitamins and herbal supplements, personal care items, pharmacy products, beauty care, and general merchandise. They distribute across North America. They sell nuts, dried fruits, seeds, granola, organic snack foods, and sweets.

The company imports and wholesales food in bulk. They offer store planning, marketing, and equipment sourcing services. United Natural Foods is a full-support provider for the retail food industry offering electronic payment processing services, networking and data hosting solutions, various food services, e-commerce, and helping acquire the military business.

On the macroeconomic food trend front, Businesswire.com predicts the food and beverage market is growing. It closed 2021 at $5,818.25B in sales and is expected to hit $8,010.98B in 2026; that is a rate of increase of about 6.6%. Sales of organic foods and beverages are expected to grow by 12.6% CAGR between 2022 and 2030. Few competitors are in a better position than United Natural Foods to capitalize on the trends.

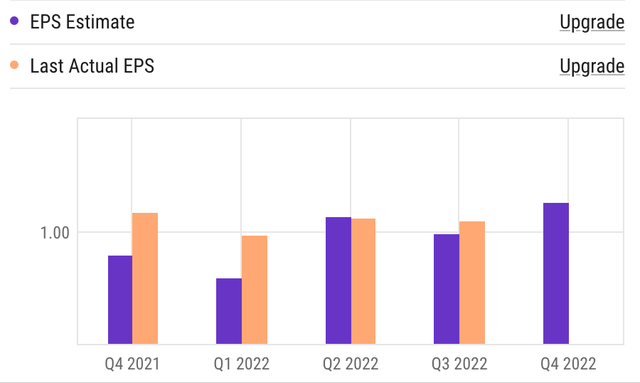

EPS History & Estimates (YCharts.com)

They sell through +30 thousand independent locations by some of America’s largest national grocery chains, including Whole Foods (AMZN). General Mills (GIS) and Unilever PLC (UL) among others use United Natural to distribute some of their products. Splash Beverage (SBEV) is the latest to sign a distribution agreement with United Natural for their TapouT Performance drinks through 515 Winn Dixie stores.

Market Power

Market power is especially important in the food business. The grocery business is heavily guarded by gatekeepers keeping start-ups out, keeping inventory flowing, and protecting valuable shelf space. Swoon prospered after signing with United Natural. An Omnicom Commerce Group proclaims, that United Natural “has been the main gateway for brands to distribute through Whole Foods.” Picked up by United Natural “is a certification that you’ve made it, from a naturals food standpoint.”

The work-from-home phenom has fewer people out shopping even for groceries and cooking. The company this month began distributing reasonably priced frozen meal kits from suppliers that appeal to young singles and working moms. Trend awareness, flexibility, and service are how United Natural sparks and supports its growth. Management talks about upping annual net sales by about 4% and earnings of 12% to 18% ending the fiscal year 2024.

Corporate Shakes

United Natural Foods is shaking things up internally. The CEO announced at the time of the third quarter earnings call that a disciplined approach is called for “that will drive economic profit instead of growth simply for growth sake. We believe this will contribute most to shareholder value creation.” He expects management to concentrate more heavily on organics where margins are healthier.

Over the past 5 years, organic foods, or its “supernatural” foods channel, is about the fastest growing product category in its inventory. Supernaturals account for over $5B in sales and are closing in on 20% of gross sales.

This commitment to building profits comes with new leadership. The company has a new supply chain chief officer and next month there will be a new Chief Operating Officer. Some duties are being shuffled among other managers. The leadership restructuring plan is laid out here.

Better By The Numbers

United Natural Foods beat quarterly earnings per share expectations in seven of the last nine quarters. During the pandemic years of challenge, United Foods reported outstanding financial results in 2021. It sparked favorable bullish financial news reports and increased awareness among investors. Net sales at the end of Jan. 29, 2022, were reported at $7.42B, which is +7.5% from $6.9B in the same period a year earlier. Earnings grew annually by about 7% each of the last 5 years.

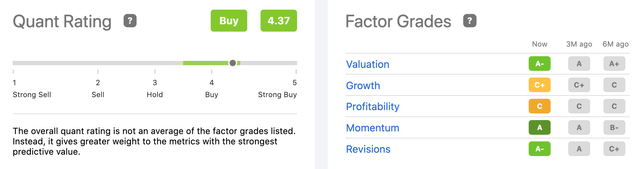

Quant & Factor Grades (seekingalpha.com)

The share price is up about 2.5xs since we began following United Natural in July 2020. The momentum has carried forth. The average target price over the next 12 months among analysts ranges from the mid-$60s to $112. Shares are +18.3% for the year to date. In my opinion, investors can expect the average price target to be $60 over the next three reporting quarters.

Coming off this momentum, United Foods’ third quarter results keep propelling the company to new heights. Net sales reported in June for the third quarter rose 9.2% over the same quarter year over year. Net income increased by almost 40%. Earnings per diluted share of $1.10 was an increase of 37.5%. Management negotiated a refinancing and upsizing of its credit facility by $500M maturing in June 2027.

Shares rose over 18% over the last 12 months. Since the end of 2020, through the first week of September ’22, the share price climbed 64%. We forecast United Natural Foods will potentially beat expectations again and report an EPS of $1.25 or higher.

Downsides And Risks

There is no dividend to cushion long-term investors. Second, the stock has not always been an easy climb. The shares are down in price +27% over the past 10 years. United Natural’s shares are up 21.4% over the last 5 years, but that does not compare satisfactorily to the upside of Invesco Dynamic Food & Beverage ETF (PBJ). It is +50.7%.

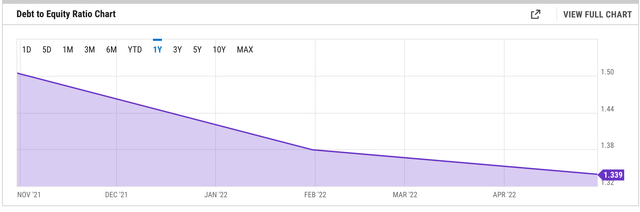

Debt-to-Equity Ratio (YCharts.com)

Third, the company accumulated a lot of debt ($3.67B), much of it linked to the company’s purchase of SuperValu in 2018 for some $3B. Cash on hand as of June was just $48M. Yet, the company recently cut $34M from the debt. 10.3% of the debt is covered by cash flow. We are not worried about the debt, but pressures on profit and margins might make deeper cuts less possible.

There are other risks for investors to consider. Some investors are hedging on the stock.

- Short interest is up near to a bearish 5%.

- The price-to-earnings ratio is almost 8.98%.

- Margins in the food industry are low compared to other industries.

- The gross profit at United Natural is only about 15%; the net profit margin is razor-thin, less than 1%, and has barely risen over the years.

- Inflation is not going to hurt United Natural as much as a recession, higher transportation, and labor costs. These nibble at the margins.

- One risk lurking in the shadows is that United Natural depends heavily on Whole Foods to undergird its sales. However, the two have a distribution agreement into 2027 and that seems to leave investors comfortable for now.

Takeaway

The company is scheduled to release its fourth-quarter earnings report on September 27th. The stock is down from its 52-week high but 279% higher than it was three years ago. That fuels United Natural’s advocates. The stock is popular again among hedge funds. United Natural is focusing on building profits and cutting its debt without having to sell Shopper’s and Cubs Foods, as we previously assumed they might.

A lot hangs on the next quarterly report but, in our opinion, there is room for a 20% to 25% upside in share price this year. In our opinion, United Natural Foods is a solid long-term investment opportunity with little dramatic risk.

Be the first to comment