Marcos Calvo/iStock via Getty Images

Co-produced with Treading Softly

When I was young, I used to haul a wagon behind me twice a week and trudge through snow, wind, rain, or the blazing sun to deliver my local newspaper.

I can distinctly remember coming home from school as a boy and stuffing flyers and ads into the newspaper and stacking them neatly in boxes and bins, which would be transported in my wagon to deliver over 300 newspapers to their customers.

I’d get a check in the mail regularly for my work from the newspaper. My parents would deposit it into my account at our local bank, and the teller would stamp my new balance into my book. I felt so big watching that number grow over time.

Once a year, my parents would withdrawal almost all of the balance of that account from my paychecks and let me spend it freely.

I learned a lot without knowing it during those moments. I learned the value of hard work and saving. I also learned that when I held the cash in my hands, I could buy a few expensive items or many cheap ones. If something was on sale, my dollars went further. I also could decide to save it for another year and roll it over into the next “shopping spree” opportunity.

You cannot control when a sale occurs, but you can control whether you take advantage of it. Right now, the market turmoil is causing others to panic and sell their holdings at rock-bottom prices. I am taking my excess cash flow generated from my dividends and buying the panic. I’m buying amazingly high yields from others who decided they’re too afraid.

Let’s dive in!

Pick #1: BRSP – Yield 12.7%

The last time BrightSpire Capital (BRSP) was this cheap, it wasn’t paying a dividend at all. Today, it is paying out a 12%+ yield and is likely to continue seeing dividend growth. BRSP is a commercial mortgage REIT that invests in floating-rate mortgages.

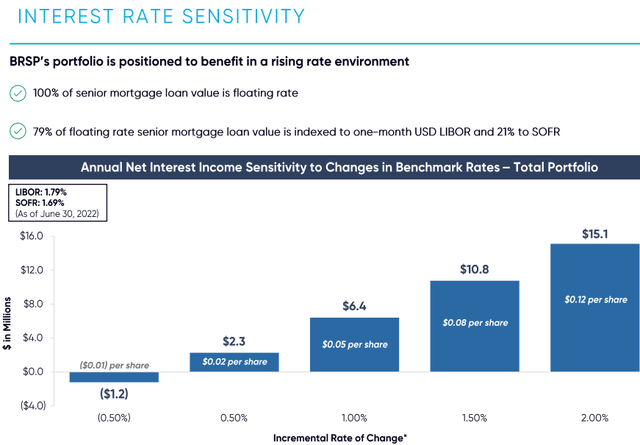

When interest rates are rising, floating-rate investments are a great place to be. Here is a look at BRSP’s interest rate sensitivity (Source: Q2 2022 Supplement):

This is as of June 30th. Since then, LIBOR is moving up, and it is more likely than not that we will see it move up more than 2% by year-end. That’s an extra $0.12/share in net interest income!

Yet despite income that should be climbing, BRSP is trading at nearly a 50% discount to book value. In normal times, this could be a warning sign that the market believes the assets are at high risk. Yet when we look at BRSP’s portfolio, we can see that its assets are not high risk at all.

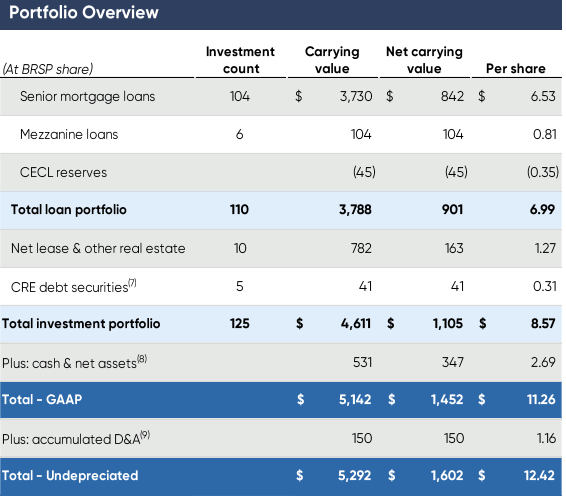

Q2 2022 Supplement

The bulk of its equity is invested in senior mortgage loans, these are first-lien loans secured by real estate. A few years ago, BRSP’s predecessor CLNC invested heavily in mezzanine loans. While mezzanine-level loans receive a higher yield, they are also much riskier because, in a default situation, the senior mortgage gets paid first. More importantly, the senior lender has a lot more control over determining what happens with the property. Whether to pursue foreclosure, force a sale, auction the property or work out a deal with the existing borrower are all options on the table for a senior lender. The mezzanine lender just goes along for the ride.

When Mazzei took over as CEO, cleaning up the portfolio and derisking it by moving out of mezzanine loans and into first-lien mortgages was a major priority. Today, mezzanine loans only account for $0.81 of book value. Another volatile area is CRE debt securities (aka CMBS), to which BRSP has also materially decreased its exposure and now only accounts for $0.31 of book value. So we agree with the market, BRSP probably deserves some discount to book for those remnants, call it $1.

When you add up cash of $2.69, net lease real estate of $1.27, and accumulated depreciation (from the real estate) of $1.16, you get to $5.12. We can feel really solid about all those numbers reflecting current value, or in the case of the real estate, probably below current value.

How much is the loan portfolio worth? BRSP is carrying it at $6.53/share. The market is giving it to us for under $2. Sometimes the market gives you a valuation of a company that is simply incomprehensible. BRSP is falling into that category.

However pessimistic you might be about the future of the economy, BRSP is trading at an incredibly attractive price. It has plenty of cash on hand that it intends on deploying at lower prices, it has a real estate portfolio that is 97% occupied and performed well through COVID, and you’re getting the senior mortgage portfolio for a song even though that is the portion of the portfolio driving earnings higher. When the market gets irrational, I love to buy discounts, and BRSP is the best deal among commercial mREITs right now.

Pick #2: OXLC – Yield 18%

COVID is over, and kids across America rejoiced over the summer, returning to their favorite roller coasters at their favorite theme parks. Kids love roller coasters. Retirees on the market roller coaster? They often are not big fans. But they should be! Swings in prices are what create the opportunity for reinvesting at higher yields. If you are a buyer, lower prices are positive. When you are a seller, you want those prices to be high. The most important part of investing is knowing whether you are a buyer or a seller in the current environment.

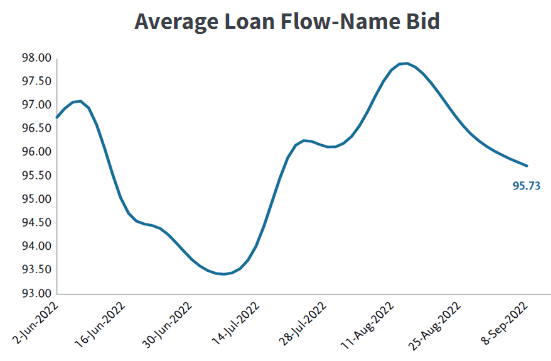

The equity markets frequently resemble a roller coaster. What is rarer is for the debt markets to look like one. This year, the debt markets have been in disarray. Prices have been up, then down, then up, and are now down again.

TCW

Over the past 4 months, bids on leveraged loans have ranged from an average of $98 down to $92. For a market that historically has seen changes of 1-3% per year, those are considered large swings.

These are the loans that are held in collateralized loan obligations or CLOs. A CLO buys up loans, and then sells them in “tranches” providing various levels of seniority. The senior A tranches get paid first, making them very low-risk. These tranches sell at a premium and have a much lower yield than the average loan held in the CLO. The junior and subordinated tranches get paid only after the senior tranches are paid in full. The bottom tranche is called the “equity” tranche. It typically is supported by about 10% of the debt. In other words, out of $100, the “debt” tranches will receive $90, and the equity tranche receives the last $10 when the loan is repaid. If loans default, it is the equity tranche that realizes the loss. If the average default rate is say 3%, then the equity tranche would expect to receive $7 out of that last $10.

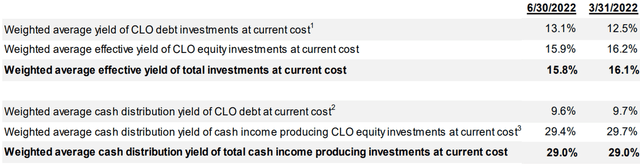

Oxford Lane Capital (OXLC) is a company that buys these “equity” tranches. Since these tranches are the first to realize losses, they are usually purchased at a discount to the underlying par value. As a result, OXLC is able to achieve yields substantially higher than the borrowers are paying.

OXLC is receiving a cash yield of 29.4% on its equity CLO investments at OXLC’s cost basis, which is about 5-6x the yield that the borrowers are paying.

Of course, defaults will happen. It is unreasonable to expect that they won’t. And since these equity positions are the first ones to realize a loss, the realized yield can be significantly lower than the current cash yield. OXLC provides the “effective yield” as an estimate of the yield that it will receive. This incorporates the assumption that defaults are at average levels. While we believe that defaults are likely to remain below average for the foreseeable future, we need to recognize that, eventually, they will get back to normal.

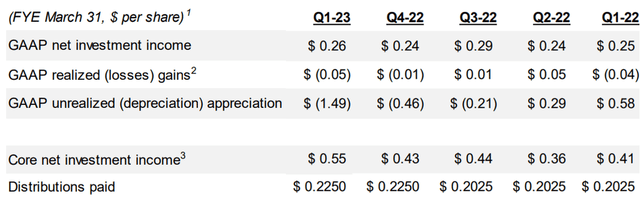

So when we judge dividend safety for OXLC, we have two metrics: GAAP net investment income and core net investment income.

GAAP net investment income utilizes the “effective yield” above, so it incorporates the assumption that eventually, defaults will happen, and actual realized gains will be lower than the current cash flow suggests.

Core net investment income tells us how much cash OXLC is realizing from its current holdings. It’s real money that is showing up in OXLC’s hands every quarter, and it can reinvest, distribute, or otherwise spend. However, history suggests that it is not sustainable.

Note the two numbers have become very different, with core more than double GAAP earnings. This is because defaults have been at historic lows. We can be confident in OXLC’s current dividend because it has been covering it with the more conservative GAAP number by 110%+ and by 200% with core net investment income. For a company with a dividend yield of 17%, that is phenomenal dividend coverage.

The share price of OXLC has had a lot of headwinds. The market is full of fear. The debt market is afraid of the Fed, impacting the price of all debt investments, including leveraged loans. Many investors fear a recession, which is weighing down the price of investments exposed to credit risk. OXLC is both and has seen its price weighed down by this fear.

Given the strength of corporate credit, as companies spent the COVID years cleaning up their balance sheets and generally are not overextended, we believe that defaults will remain relatively low. We can be the beneficiaries of the market’s fear and receive a high yield as our reward.

Dreamstime

Conclusion

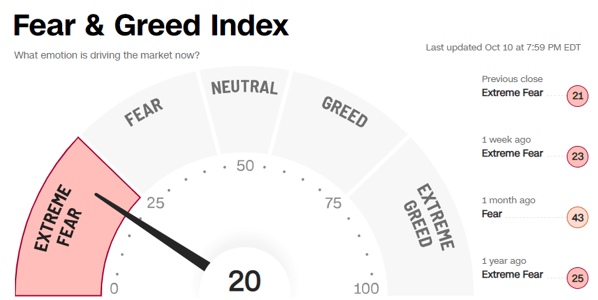

The market is filled with fear:

CNN

Fear is the primary feeling in all the historical metrics as well.

Yet, like that school-aged boy walking into the store with a year’s worth of paper route earnings. I am ready to buy and maximize the effectiveness of my dollars.

With income investing, you are looking to lock in excellent income for decades to come. I don’t need to share in fear or panic. I have a different perspective and outlook, which isn’t reliant on someone else buying my shares from me!

Imagine a retirement where you can go on a cruise to Alaska, visit Fuji, and see the Alps, all without ever having to look at the market. Your bank account balance continues to grow from deposits. OXLC and BRSP provide two of the 42 various companies paying you for simply holding their shares. You don’t stress about price changes or the latest “what if” disaster scenarios the media has dreamt up today.

You just have to decide what you want to eat and where in the world you want to eat it.

That’s the difference income investing can make. Trade the fear for a steak dinner and see how much less stressful it is!

Be the first to comment