PashaIgnatov

Thesis

We follow up on our previous article on leading platinum group metals (PGM) and gold miner Sibanye Stillwater Limited (NYSE:SBSW) stock, as our Speculative Buy thesis has not played out accordingly.

We had anticipated its May lows to hold robustly. However, SBSW has maintained its downward bias, breaking toward lower lows through September. We postulate a significant level of downside risks has been factored into its valuation. However, its unconstructive price action and worsening macroeconomic headwinds could further pressure its valuation.

Our assessment suggests that the consensus estimates could be overly-optimistic in their projections of Sibanye maintaining its profitability through the coming economic recession. The price action in the underlying market has also been pretty mixed. While palladium futures have been recovering from their June lows, gold futures continued to be pressured by the dollar’s unyielding strength.

We postulate that SBSW’s valuation likely reflects a mild to moderate recession. However, a worse-than-expected economic downturn could lead to further estimates cuts, forcing downward value compression from the current levels.

As such, we deduce it’s appropriate for investors to be more cautious now and watch for a potential re-test of its near-term support before considering adding exposure.

Sibanye Stillwater Stock Could Re-Test Its Near-term Support

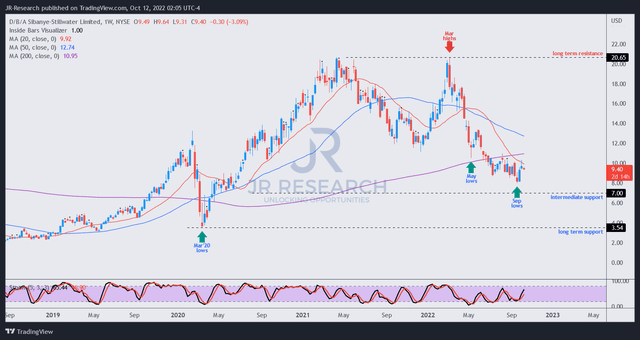

SBSW price chart (weekly) (TradingView)

As seen above, SBSW could not sustain its May lows, which is critical to overcoming the loss of its medium-term bullish bias. Accordingly, the decisive breakdown of that level led to further lows being taken out, as the market forced the selling toward its September bottom.

Also, it’s critical for investors to consider that SBSW has lost its 200-week moving average (purple line), corroborating the strength of the downward bias. Hence, we believe investors need to be cautious adding at the current levels, as we postulate the next significant support (intermediate support) to be more than 25% down from here.

Hence, we urge investors to wait patiently for the potential re-test of that level before considering adding exposure.

The Street Seems Too Optimistic On Sibanye’s Estimates

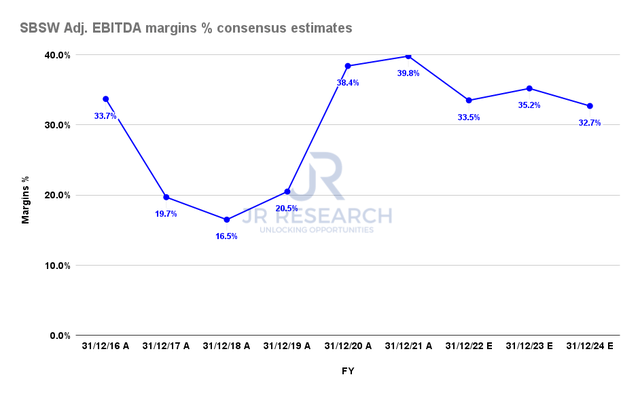

Sibanye Adjusted EBITDA margins % consensus estimates (S&P Cap IQ)

As seen above, the consensus estimates (bullish) suggest that Sibanye should be able to maintain its robust profitability through the worsening macroeconomic headwinds. As a result, the Street expects Sibanye to post an adjusted EBITDA margin of 35.2% in FY23, above FY22’s 33.5%. Hence, the moderation from 2021’s highs is not expected to persist, despite the potential of a global recession that could further impact commodity suppliers and their customers.

However, we urge investors to be careful about making such an assumption. UBS recently issued a somber assessment that legacy car makers could face significant profitability headwinds in 2023 as the world enters a looming global economic recession. It articulated:

Profits for US and European car companies are set to drop by half next year as weakening demand leads to an oversupply of vehicles. [We think] 2023 estimates for the sector need to move materially lower. Demand destruction is no longer a vague risk, but has started to become a reality. A three-year run of unprecedented pricing and margins is about to end abruptly, with a glut of cars beginning to emerge as soon as three months from now.

As a reminder, Sibanye is a crucial supplier for automotive companies in their production supply chain. Sibanye also highlighted these risks in its disclosures, which investors are urged to consider carefully. The company accentuated:

Changes in demand drivers for PGMs may cause the prices of PGMs to fall over the short or long term. For example, PGM prices are linked to demand for catalytic converters in automobiles, among other things. Any economic downturn or other event that reduces the sale of automobiles will likely impact the price of PGMs. (Sibanye 20-F)

Is SBSW Stock A Buy, Sell, Or Hold?

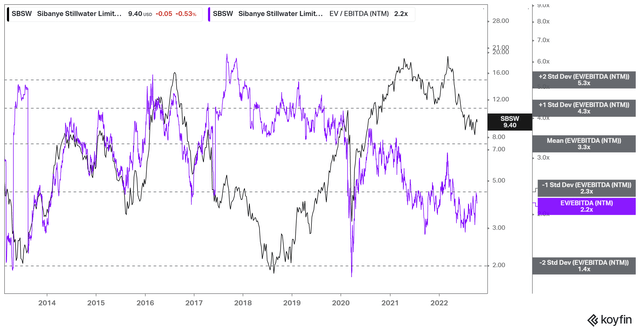

SBSW NTM EBITDA multiples valuation trend (koyfin)

With SBSW down nearly 55% from its March 2022 highs, bullish investors could argue that much of its damage has been priced in.

We concur that its near-term risks seem to have been reflected, as SBSW last traded at an NTM EBITDA of 2.2x, in line with the one standard deviation zone under its 10Y mean.

However, our assessment of potential estimates cuts moving ahead to appropriately reflect the risks of a global recession should lead to further value compression to de-risk the revisions.

Hence, we urge investors to demand a more considerable margin of safety, given the significant uncertainties in the automotive industry and SBSW’s unconstructive price action.

As such, we revise our rating from Buy to Hold for now.

Be the first to comment