zimmytws/iStock via Getty Images

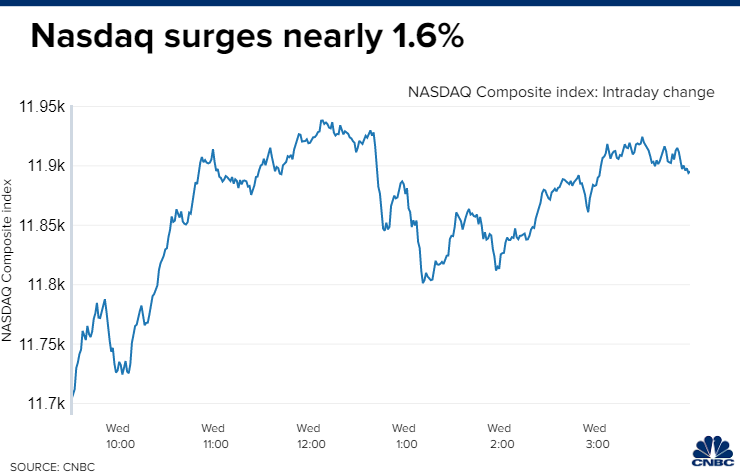

Animal spirits returned to the tech-heavy Nasdaq Composite yesterday, which rose 1.6% to its highest level since the beginning of June. Netflix results were better than expected, which gave a lift to all of the streaming stocks, while legislation advanced in the Senate beneficial to the semiconductor industry. The technology sector was the tip of the spear in the broad market decline that started last November, so it is encouraging to see this sector lead in the rebound.

Finviz

Unlike what the consensus was expecting, the second-quarter earnings season has not been a disaster. In fact, far from it, as companies in aggregate are beating expectations. More importantly, many are lowering the bar for the second half of the year, which is not producing a negative response from stock prices. It was the uncertainty of what to expect that drove stocks lower, but now investors know where the bar is being set. I think it is being set at a level most mangement teams feel they can beat, which should give us a tailwind, especially if the rate of inflation falls, as I am expecting.

CNBC

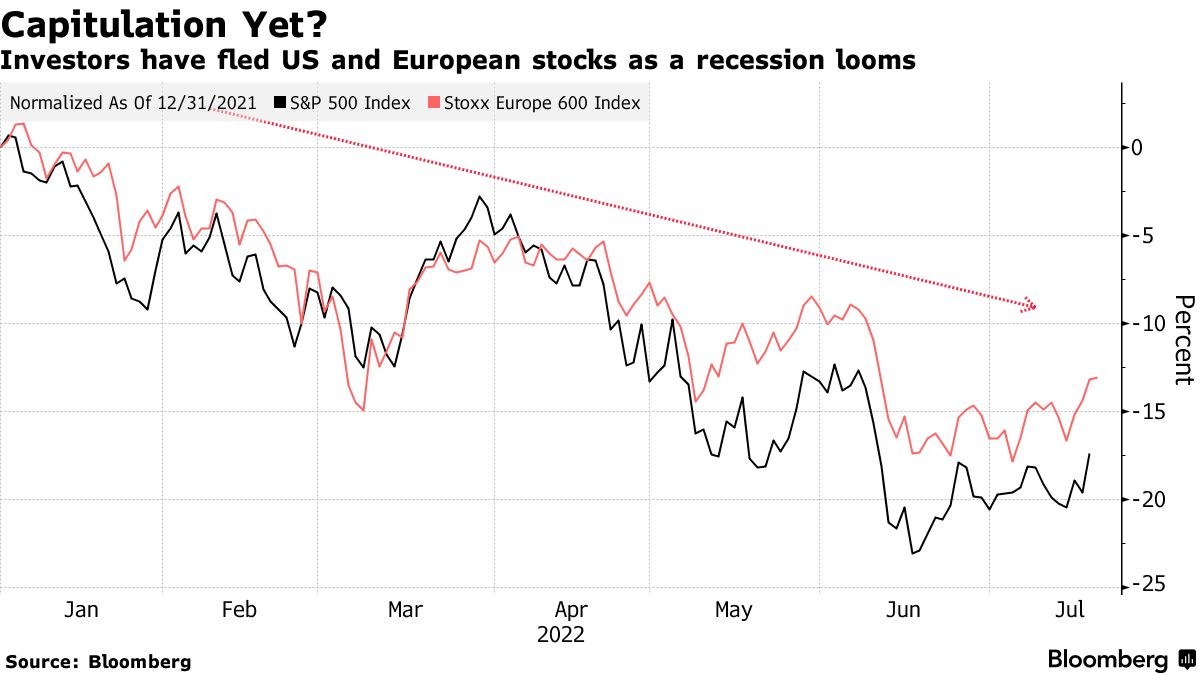

Shortly after I called for capitulation yesterday, Sanford C. Bernstein asserted that “we have not yet seen capitulation in outflows from equity funds.” In fact, the outflows “have only just begun.” I can’t argue with that or other factors that question whether a bottom is behind us. For example, the volatility index (VIX) and put-call ratios have yet to reach extremes that coincided with prior bear-market bottoms. Instead of outflows, stock funds have seen approximately $180 billion of inflows this year, but nearly all of that occurred during the first quarter. That said, every bull and bear market is unique, and none follow a specific playbook.

Bloomberg

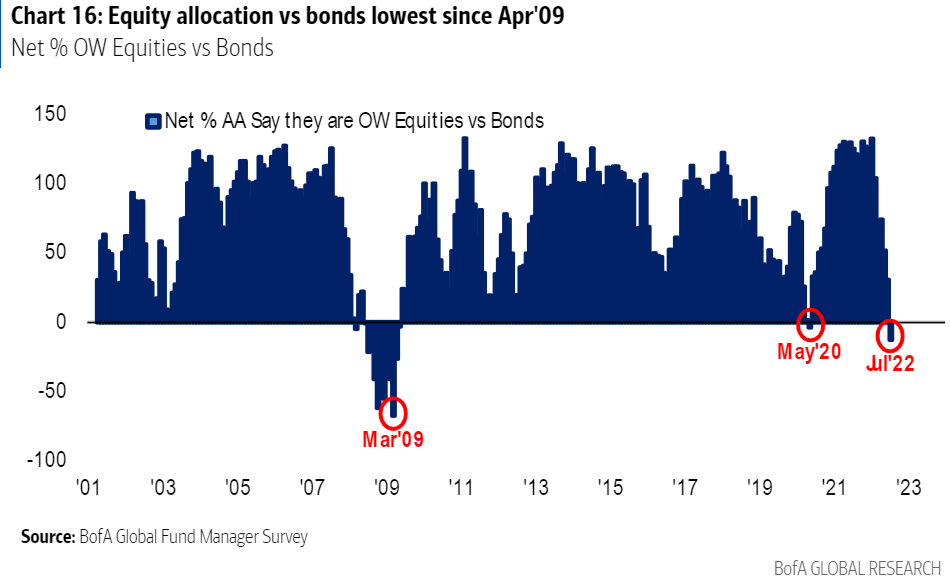

I think the equity allocations of global fund managers is a better indication of capitulation than retail investors, who may be a little savvier than they were 10 or 20 years ago. Drawing from Bank of America’s monthly survey, fund managers are more underweight stocks relative to the safety of bonds than at any time other than March 2009, which was THE bear market low during the Great Financial Crisis. Again, I call that capitulation, but this debate won’t be settled until the end of the year.

Bloomberg

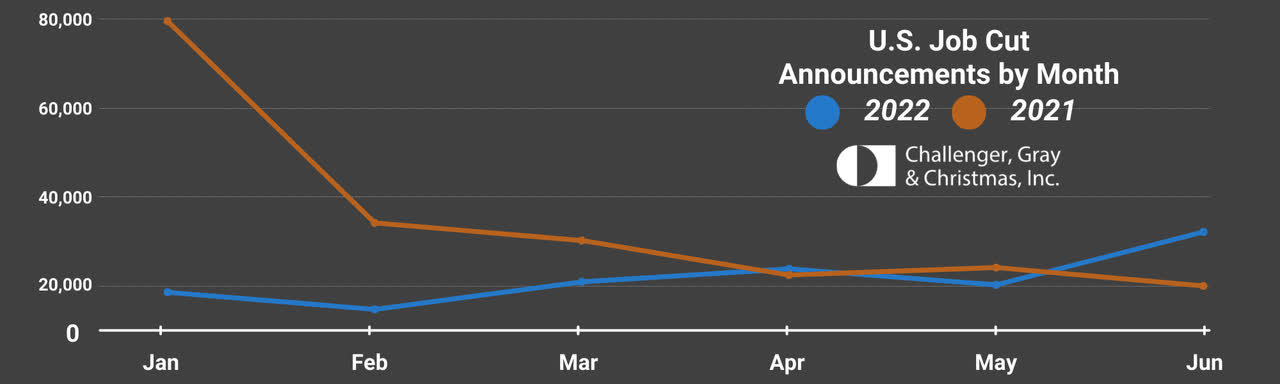

Yesterday, I was talking with a peer of mine who is in the recession camp. He was trying to alert me that the recent increase in layoff announcements is a precursor to the recession he sees coming down the road. Granted, employers announced more than 32,000 job cuts in June, which is 58% higher than the cuts announced a year ago, but that can largely be explained by specific industry headwinds. The auto sector has reduced headcount because they don’t have semiconductors available to build the cars consumer want to buy. The rise in interest rates has led to job losses for companies in the mortgage business. Some technology companies that were beneficiaries of the stay-at-home trend during the pandemic are reducing headcount.

Challenger

Yet when I looked at the data provided by Challenger, Grey, and Christmas, Inc. it revealed that year-to-date layoff announcements totaled 133,211, which is 37% lower than the number of layoffs announced during the first half of last year and the lowest January-to-June total since this data started to be collected in 1993. This is no sign of recession.

If we avoid a recession this year, this phase of the economy looks to be a mid-cycle slowdown, which suggests that the second half of this year will provide investors with attractive returns. That is how I am positioned.

Be the first to comment