Images By Tang Ming Tung/DigitalVision via Getty Images

Over the last 40 years, Markel Corporation (NYSE:MKL) has consistently beaten all major American indices and has a track record of generating outstanding returns for shareholders. Markel has evolved from a classic insurance company to a diversified holding company reminiscent of Berkshire Hathaway (BRK.A, BRK.B). Markel is a company with a lot of potential, with high-growth divisions (Markel Ventures), without debt, and trading in the low valuation range of recent years. The potential that Markel offers is enormous, since if it manages to make its line of insurance more profitable, it will be able to invest all that floating capital in growing at rates higher than those of the rest of the companies listed on the market. I personally believe that Markel’s current valuation and low debt make it a very interesting choice to add to a long-term oriented portfolio.

Company Description

Markel Corporation is an insurance & holding company which operates in niche markets such as specialty insurance and, at the same time, acquires business and invests in equity and debt markets using the float provided by the insurance engine. Over the last years, Markel has grown its revenues at a rate of 12% per annum, and its book value has increased in the same proportion over the last years. Markel structures its business on three segments, which they call ‘engines’. The three engines that move Markel forward are: Insurance, Markel Ventures and Investments.

Insurance Engine

Markel’s insurance business is divided into the following categories: underwriting, insurance-linked securities, and program services. Even though insurance is a competitive industry, Markel is a more niche-focused company which allows them to have higher profit margins than other companies in the industry such as Allstate (ALL) or Progressive (PGR). Competition in insurance niche markets is more focused on other value-added traits such as expertise and services provided.

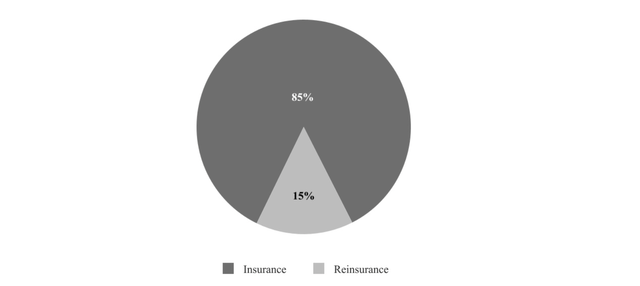

Markel divides its Insurance business into two categories: Insurance and Reinsurance. If you are interested in understanding what reinsurance means, you can check it on this website. The following chart shows the percentage of premiums collected by Markel by segment.

Insurance and Reinsurance Premiums (sec.gov)

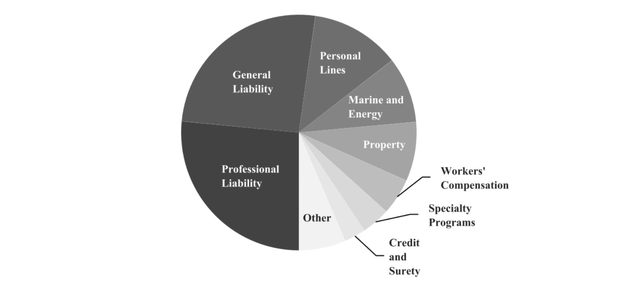

The Insurance segment consists of a highly diversified and low risk portfolio. Last year it generated earned premiums of $5 billion and an underwriting profit of $696 million. The policyholders belong to a different range of categories such as: Professional Liabilities (includes highly specialized professionals such as accountants, lawyers, engineers or brokers), General Liabilities (retail stores, heavy industrials…), Personal Lines (classic cars, yachts, vintage boats…), Marine and Energy (includes a portfolio of insurance policies for cargo, energy or terrorist risks) and more business lines that can be considered secure investments. Indeed, the company has a very diversified insurance portfolio (although highly dependent on professional services and general services). This makes Markel far from traditional insurance such as: life insurance, home insurance or car insurance, which have a higher probability of being claimed than other niche products such as luxury vehicles or terrorist attacks.

Insurance Lines offered by Markel (sec.gov)

The Reinsurance Segment is made up of casualty, property and specialty and currently generates $1 billion in earned premiums and an underwriting loss of $55 million in 2021. In general, this type of reinsurance is riskier and is made up of a less niche range of products, which explains its negative performance in 2021. However, it represents a small part of the premiums earned by Markel.

Reinsurance Segment Lines (sec.gov)

The financials of Markel’s Insurance business have been really positive over the last years. Gross premiums earned have grown at a pace of 10% per annum, and the combined ratio, which is a measure of the profitability of their operations, is lower than those of their peers, due to the niche markets in which they operate.

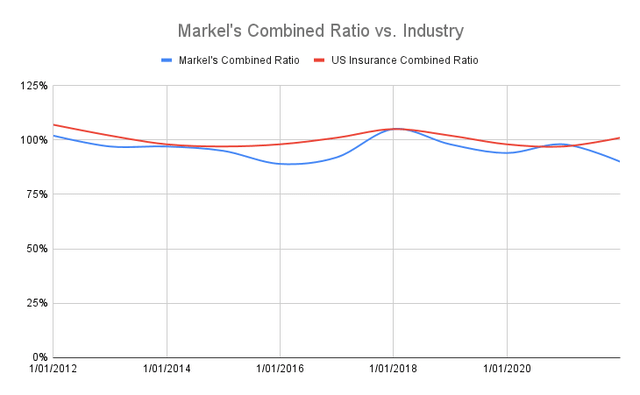

The evolution of Markel’s profitability in the Insurance segment is measured by: the amount of premiums the business is going to earn less the claimed premiums from policyholders and other losses or expenses. The best metric that analyzes the performance of an insurance company in the long term is the combined ratio, which is defined as the quotient between expenses + incurred losses and the premiums earned by the company. Naturally, the company will be profitable if and only if the combined ratio stays below 100%. The following chart shows the evolution of Markel’s combined ratio over the last decade (2011-2021).

Markel’s Combined Ratio vs. Industry (sec.gov and Own Models)

Over the last decade, Markel’s average combined ratio has been of 96%, whilst the industry’s average over the last decade has been of 101%. Indeed, Markel has remained profitable whilst other companies have not done so in the last decade. Some years have been particularly bad for the industry (2017), when a series of hurricanes produced lots of damages in properties all over the American geography. It must be stressed out that the future success of Markel’s Insurance Division depends heavily on:

- Increasing the number of premiums written: to achieve this goal, Markel will increase the number of acquisitions they will make and at the same time they will broaden the reach of the global operations they make. The objective they have is to produce $10 billion within the coming 5 years.

- Maintaining a lower combined ratio than the rest of companies: Markel’s management team is also aware of the importance of producing underwriting profits in order to produce float that can be invested in acquiring new businesses and expanding the base of investable assets they have. The goal is to achieve 90% average combined ratio in the coming 5 years that, combined with the $10 billion annual premiums goal will yield $1 billion of underwriting profits. They are willing to achieve this by exposing themselves less to natural catastrophes, which has increased the combined ratio of the firm more than they had expected.

Markel’s insurance business is key to becoming a successful company in the coming years. If Markel is able to increase the float they generate, the company will be able to invest more capital into Investments and Markel Ventures. This will increase the operating income of the company and its book value, leading to value generation for shareholders.

Markel Ventures Engine

Without doubt, this is Markel’s crown jewel. The philosophy behind Markel Ventures (MVs) is similar to that of Berkshire. Investing in good business with the float generated by the Insurance Engine. At the beginning, MVs was more focused on acquiring smaller insurance companies but now that years have come to pass, Markel is open to investing in many other businesses that may fit into their investment universe: good businesses with the ability to reinvest capital and that are leaders in their respective markets.

If one word has to describe the spirit of MVs it would be decentralization. The idea of giving autonomy to the management teams of the business fully acquired by Markel has also played well at other companies such as Berkshire Hathaway and Constellation Software (OTCPK:CNSWF). In the words of Mark Leonard, CEO and founder of Constellation:

We continue to believe that autonomy and responsibility attract and motivate the best managers and employees.

The management teams that operate the businesses wholly owned work autonomously from Markel’s headquarters, and they are the ones responsible for capital allocation decisions and investment strategies.

Markel seeks to acquire businesses that are profitable and Free Cash Flow generative and with management teams that can be relied upon. In addition, capital reinvestment is also sought, as well as reasonable valuations to acquire the business. Even though Thomas Gayner (co-CEO of Markel) is a follower of ‘quality investing’, price is a determinant factor to be considered when acquiring a business.

MVs is now present in many economic sectors outside the niche market they operate in the insurance segment. The company wishes to seek diversification and expansion into other economic sectors that may avoid the cyclicality of the financial industry, which is really sensitive to macroeconomic conditions.

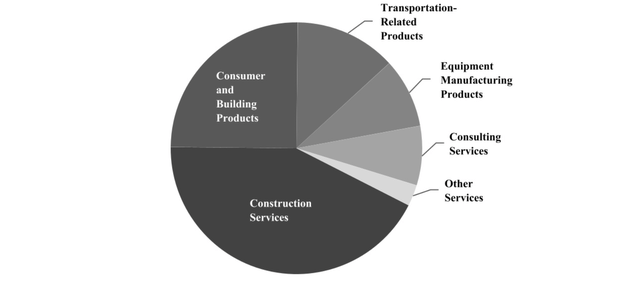

The following image shows the different sources of operating revenue of MVs based on the different economic sectors they operate in.

Markel Ventures Revenue Lines (sec.gov)

Even though these business may be high-quality businesses that are able to resist all sort of bad economic conditions, Markel has too much exposure to the housing segment, which represents more than 50% of the revenue generated by MVs. In their own words:

These businesses may experience revenue fluctuations over time due to the cyclical nature of supply and demand in the construction industry, which they support.

Nevertheless, Markel’s management has also been intelligent and has expanded the MVs segment into new markets to avoid the cyclicality produced by their exposure to the housing market. New acquisitions have been made in sectors such as food processing equipment, consulting services, healthcare companies and other diversified investment services.

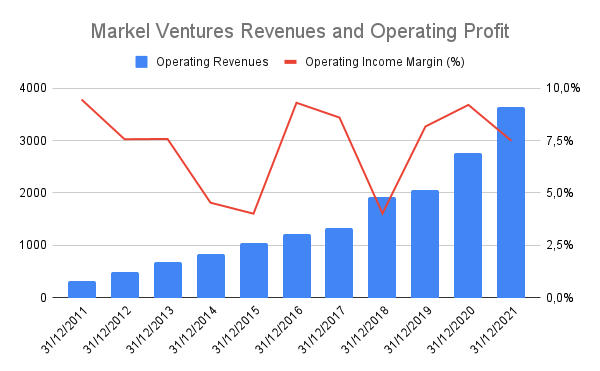

Over the last years, the financial performance of MVs has been outstandingly good, as one can see in the financial numbers they have been reporting year after year. Revenues have grown at a pace of 25% due to the many acquisitions made during this decade. In addition, this is not some venture capital experiment, as MVs produces operating profits with margins that oscillate between 5-9%. The following graph gives testimony of that.

Operating Revenues of Markel Ventures (sec.gov, Own Models)

Regarding the evolution of this division, I have two concerns that may affect the performance of this segment in the medium term. Being so dependent on the housing market, I believe the operating income could come down in the coming years. Monthly mortgage payments have skyrocketed in the United States, and prices may go down as mortgage rates have escalated over 5%. These two factors, alongside with the high probability of entering into a recession, may impact negatively on MVs. Although this may look bad in the short term, MVs will move forward due to: high possibilities of acquiring companies at low valuations, higher diversification and a long-term recovery of the US housing market.

Investment Engine

This other segment is somewhat similar to what Berkshire does when it invests in publicly traded companies such as Apple (AAPL), Coca-Cola (KO) or American Express (AXP), among others. In addition to their equity investments, Markel’s co-CEOs are aware of the risky nature of Wall Street, and prefer to have a diversified portfolio that comprises debt securities and other fixed income investments. The majority of the investable assets that Markel currently has come mainly from premiums paid by policyholders.

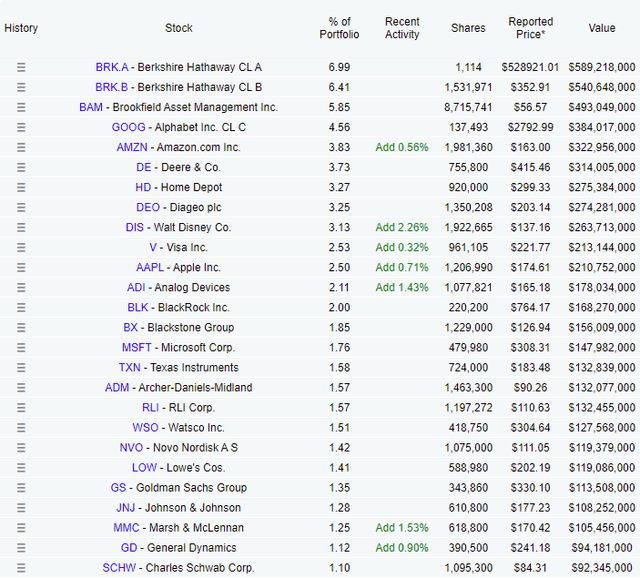

Markel’s main focus when investing in publicly traded companies is looking for profitable companies, with honest and disciplined managements that exhibit capital discipline at reasonable prices. The ideal holding period is forever. Markel’s current portfolio of publicly traded companies can be found here.

Markel’s Portfolio (Dataroma)

In addition, Markel’s portfolio is heavily diversified (the biggest holding is Berkshire Hathaway) and invested in companies that will produce outstanding returns in the years to come.

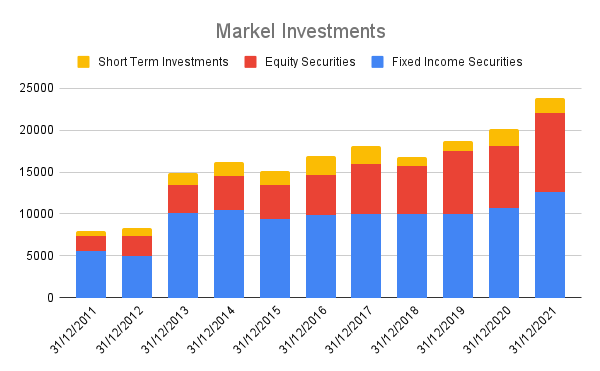

Another component of Markel’s Investment portfolio is fixed income securities and short term investments, which they believe to be crucial in case they have to pay back the claims made by policyholders. The vast majority of premiums paid by policyholders are invested in high-quality government, municipal and corporate bonds that have the same duration of their loss reserves (money needed to pay back to policy holders in case claims are made). This almost ‘risk-free’ investments allows Markel to collect premiums (interest payments of the bonds they hold) that are used to increase their loss reserves or to fund equity investments. Another important part that makes up Markel’s investment segment is cash and short term investments, that may be needed in situations of financial stress such as the 2008 financial crisis or the 2020 COVID crisis.

Evolution of Markel’s Investments (sec.gov and Own Models)

This graph clearly shows that Markel’s investment portfolio has increased all over the years, with a clear preference for equities over the last years. At the beginning of the decade, equities weighted around 23% of Markel’s portfolio, whilst now they have a weight around 40%.

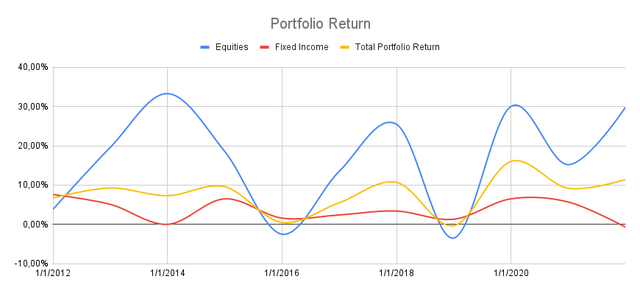

Portfolio Returns (sec.gov and Own Models)

On average, Markel’s Equities have yielded on average a total return per annum of almost 17% over the last decade, whilst the equity portfolio has yielded a return around 3.5% in the same period. This two returns combined yield a total return per annum of 7.8% over the last decade. I believe that returns will diminish over the coming years, due to the collapse experienced in the bond market and the current correction that we are living in the American Markets. Nevertheless, the portfolio will keep growing at rates of around 6-7% in the coming years.

Management Team

Markel is a fantastic and outstanding business that performs well in the different segments in which it operates. But this extraordinary performance is due to the quality of the management that leads the company.

Thomas Gayner has been co-CEO of the company since 1998. He has an investment philosophy similar to Buffett and Munger’s, focusing on companies that can deploy capital to compound value over long periods of time. Even though he is wary of high valuations, Gayner puts more emphasis on incentives and the abilities of management teams to reinvest profits and thus increase the value of the shareholders. His unique approach has made Markel look like a baby Berkshire Hathaway, even though the business are a bit different. If Gayner continues leading the company, I believe returns will be higher in the years to come.

Markel – Valuation

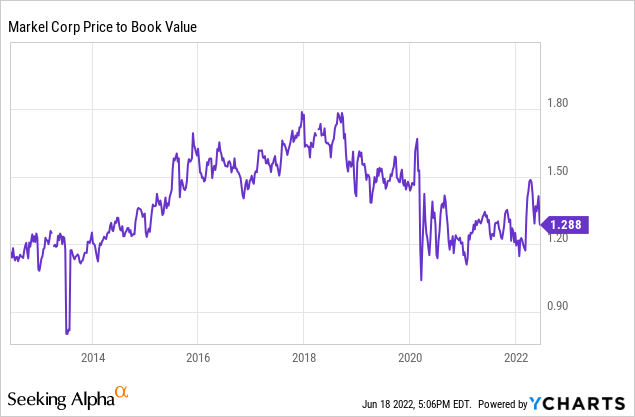

Markel is not an easy company to value due to its complicated holding structure and the different parts that make up the business. It is true that Markel is a diversified financial holding company with a significant weight in the insurance sector along with investments in fixed income and variable income. However, the part of Markel Ventures has more and more weight in the holding company and is difficult to assess valuation using a Price/Book Value metric. That is why, although the Price/Book Value can be used as a first approximation, I think it is convenient to sum up the parts to correctly value the company.

Book Value

If we look at the Price/Book Value (P/BV) criterion, it can be verified that the P/BV ratio is in the lower part of the valuation of the last 10 years, and is currently trading at levels similar to listed holding companies such as Berkshire Hathaway. Using a reasonable valuation level that corresponds to the average of the last 10 years (1.5x), Markel’s value could be around $1,500 per share, far from the $1,200 at which it is currently trading.

Sum Of The Parts

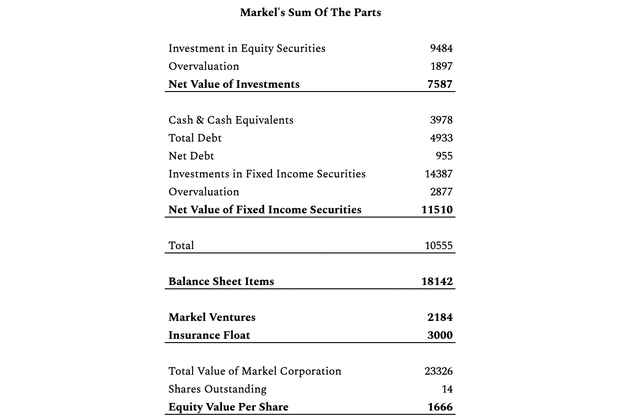

To correctly assess the issue of Markel’s valuation, I believe that the Sum Of The Parts method (SOTP) must be performed to get a number that may tell us what Markel is worth. The following table shows my own estimates of Markel’s Fair Value using the SOTP method.

Markel’s SOTP valuation (Own Model)

The sum-of-the-parts method consists of independently valuing each of the businesses in which Markel operates: insurance, Markel Ventures and Investments.

The value of the investments (taking into account the overvaluation of the market) is around $7.5 billion, while the investments in fixed income (which have also lost value throughout this year) add up to an approximate value of $11.5 billion. Due to the current situation of market overvaluation (there is a very deep correction in many indices, NASDAQ (COMP.IND) -30%, S&P 500 (SP500) -20%…), I have thought it appropriate to normalize the value of Markel’s investments by applying a correction of the 20% to the value of their investments in fixed income and listed equities. The overvaluation section in the SOTP Table corresponds to the accounting excess valuation of investments on Markel’s balance sheet. Discounting the overvaluation from the value of the assets invested, a more reasonable value is obtained for the investments that the company currently has.

Currently the value of the investments is $19 billion, to which must be discounted the existing net debt, which is around $1 billion. Thus, Markel’s net investments are around $17 billion. Valuing Markel Ventures at a multiple of about 8x operating profit along with the value of the float (which I estimate to be around $2-$3 billion), the total value of the company is around $23 billion. Divided by the number of shares outstanding, this arrives at a Markel target value of $1,666 per share, giving a safety margin from current prices of 30%.

Risks

Obviously, Markel is by no means a ‘risk-free’ asset. Investing in Markel carries a series of associated risks that I list below:

- Existence of catastrophic events: Although Markel has reduced the risk of its portfolio to avoid problems related to catastrophic events, it is true that they can continue to occur. Hence the importance of Markel moving towards more niche and specialty insurance markets.

- Remarkable increase in the combined ratio: it is extremely important that all long-term investors in Markel monitor this metric, since it will be the one that guarantees the profitability of the business and the one that ensures the existence of free float to be reinvested in Markel Ventures and in listed equities.

- Excessive presence of Markel Ventures in the real estate sector: I personally believe that Markel should focus more on diversifying the business portfolio due to its excessive dependence on the real estate sector. This may expose the company to too much cyclicality and its profits could be reduced in the event of a severe real estate crisis in the US.

Conclusion

I believe that Markel is an extraordinary business that can continue to offer returns above the market average due to the quality of its assets and the highly diversified portfolio that it has. Markel is a company that still has the capacity to continue growing its book value at rates greater than 10%, hence its long-term performance on the stock market will be higher than these numbers. In addition, the management is outstanding and will continue to produce positive returns for shareholder in the years to come. I believe that if Markel stays for a long period of time in our portfolios, it will surely become a very profitable investment.

Be the first to comment