lamyai

With rates rising but inflation also still persisting for now, the holy grail are investments that do well in both environments of wealth destruction, because we are still not sure of the conviction of current monetary policy regimes due to the nature of inflation being cost-push. Food stocks, and not necessarily consumer staple brands that don’t avail of the same level of vertical integration, can perform well where they are capable of pricing products in an inflationary environment to maintain at least unit margins, and where products are essential enough where end-markets will be resilient. We have three picks that benefit from either sufficiently overwhelming growth, ability to outprice inflation or essential enough end-markets in a consumption crimp where given the price, the value provided by their security in an uncertain environment seems under-appreciated.

Aker BioMarine

The first idea is the most obscure and the most interesting, which is the Norwegian company Aker BioMarine which trades exclusively on European exchanges, principally the OSE.

Aker BioMarine is very well positioned for the current environment due to both idiosyncratic and industry factors. The company owns specialized trawlers which together fish more than 50% of the world’s krill, a small and delicate crustacean whose oils are used for omega-3 supplements and whose flesh are used in fishmeal for shrimp and salmon farming. The contracts with aquaculture in particular do not yet reflect the inflationary environment, so we are assured to have pricing growth as contracts have already rolled over for the next quarter, and the aquaculture exposure now accounts for 50% of the company’s profits. With fishmeal competing with grain meal, the Ukraine wheat crisis benefits Aker BioMarine. The supplement exposure is more discretionary and more exposed, but because of a weak couple of years due to a market collapse in South Korea due to bad actors lying about krill oil content in products, comps are very weak and the gradual recovery there to even a recession level would constitute incremental improvement.

The other major draw of Aker BioMarine is that they have hedged their oil exposure, about 20% of OPEX, entirely until 2024 through hedges created in 2020, the worst year for oil in a while.

Finally, taking a moat approach, Aker BioMarine’s closes competitors will take at least four years to build the specialized trawlers used to suck krill out of the ocean. Moreover, the krill catch is around half the annual quota, meaning overfishing isn’t a risk, and Chinese players won’t be able to scale operations for years. With around 38% in scaled and normalized EBITDA, the company has high margin, tangible asset economics with several idiosyncratic factors that are going unnoticed given the 10x normalized EV/EBITDA ratio. With growth secular, evidenced by the surplus krill in the oceans even after fishing, this emerging product deserves a much more growth oriented multiple.

The only downside, besides risk to the consumer discretionary market, is liquidity, where orders are hard to fully fill when above $10k, so we give some more food ideas for investors to consider.

Adecoagro (AGRO)

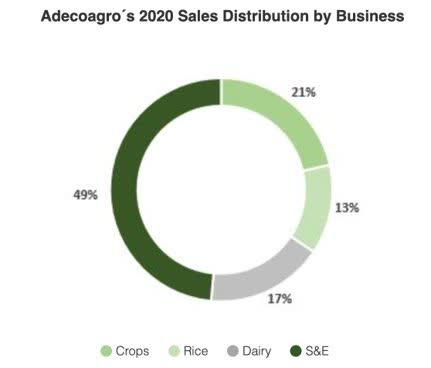

The next interesting food idea is Adecoagro. The company acknowledges results in 4 segments.

Segments (Adecoagro Website)

Crops include peanuts, sunflowers and grains. Dairy is simply the milk and cheese segment. Rice is accounted for separately. S&E is the production of ethanol from the agricultural waste.

The company is a clear beneficiary due to the crop exposures to the Ukraine invasion, where effective fertile land for supplying food has fallen meaningfully for the Western bloc. Sunflower oil stands out to me personally, with its prices in my supermarket having 5xed since the beginning of the year. But because of Ukraine and Russia both accounting for major grain production, whether wheat or any wheat substitute, prices will have risen for these durable reasons not associated to the regular cycles of the market.

Rice is a typical discount product, possible to consider inferior, which should be resilient in the current consumer crimp. Dairy should also be rather resilient. Finally, ethanol being required to increase fuel octane in Brazil, a market that has fully embraced this alternative fuel almost as a primary fuel, this segment constitutes a reopening play, where resumed mobility supports the direction of the segment, as well as general lacking capacity for refining and the supply vice in oil markets. Trading at a 7% FCFY, the company is pretty interesting, although some variable rate leverage and commodity related cash flow volatility is something that investors should consider as meaningful risks when sizing the position.

Industrias Bachoco (IBA)

Another idea that offers investors value is IBA. They are a Mexican company that produces primarily chicken and sells it in supermarkets under its own brand name. In an inflationary environment, they have easily outpaced inflation of meal prices with price increases, growing absolute margins. Moreover, their markets should be pretty resilient, with chicken being a staple protein in Western diets.

However, the peculiarity with IBA that makes it interesting is that the controlling family is wanting to make a tender offer for all shares it doesn’t own, effectively looking to take the company private. As of the writing of this article, the offer price should be about 10% above current prices, and with the process having started with authorities presumably many months ago, we may be very close to the finalizing that offer and the 10 day period in which the board will need to turnaround a fairness opinion. A 10% return in short amounts of time is enviable in the current market where capital appreciation is difficult.

Whether the board recommends that shareholders accept the offer or not is not known yet, but in either case new investors could stand to benefit. Longstanding investors would complain about the offer price which is below book value. With the business being rather attractive, and with more long-term value creation possible, it is reasonable to be against it. Therefore, a recommendation to reject, if it stops the tender offer from succeeding, could also be a good thing for new investors as well as old.

There is also the risk that the tender offer approval is taking this long because the controlling family has done something recently and might submit a lower offer than previously expected. If this got recommended by the board, and the tender offer went through, it would be more unfortunate, but ultimately the downside risk is very limited with a highly discounted offer being very unlikely to go through. With favored fundamentals, the company appears interesting.

Bottom Line

Food stocks have been able to outplace inflation with price increases, and a consumer crimp should not be a big problem for essentials like food which are likely to gain wallet share, albeit in a shrunken consumer wallet. With the ideas above benefiting both from a category overweight and specific sources of margin of safety, it proves there are still some select places for investors to hide in the difficult current markets. While even these come with their own risks, unless you want to miss the handful of major up-days in the market by staying on the sidelines, unsure when it’s really safe to re-enter, these food stocks look like they’re among the few right places to park cash.

Be the first to comment