ArtistGNDphotography/E+ via Getty Images

BellRing Brands, Inc. (NYSE:BRBR) acquired several nutrition brands, which later became popular in the United States. I believe that further internationalization and more ecommerce could bring more revenue growth and free cash flow than expected. Besides, in my view, with expertise in the M&A markets, BRBR could enhance revenue growth, and the valuation may grow. I see some risks from lack of diversification and too little product categories. However, the stock appears undervalued.

BellRing Brands

BellRing Brands presents itself as a leader in the nutrition category. The company’s food products include brands like Premier Protein and Dymatize, which consist of ready-to-drink protein shakes, RTD beverages, and powders.

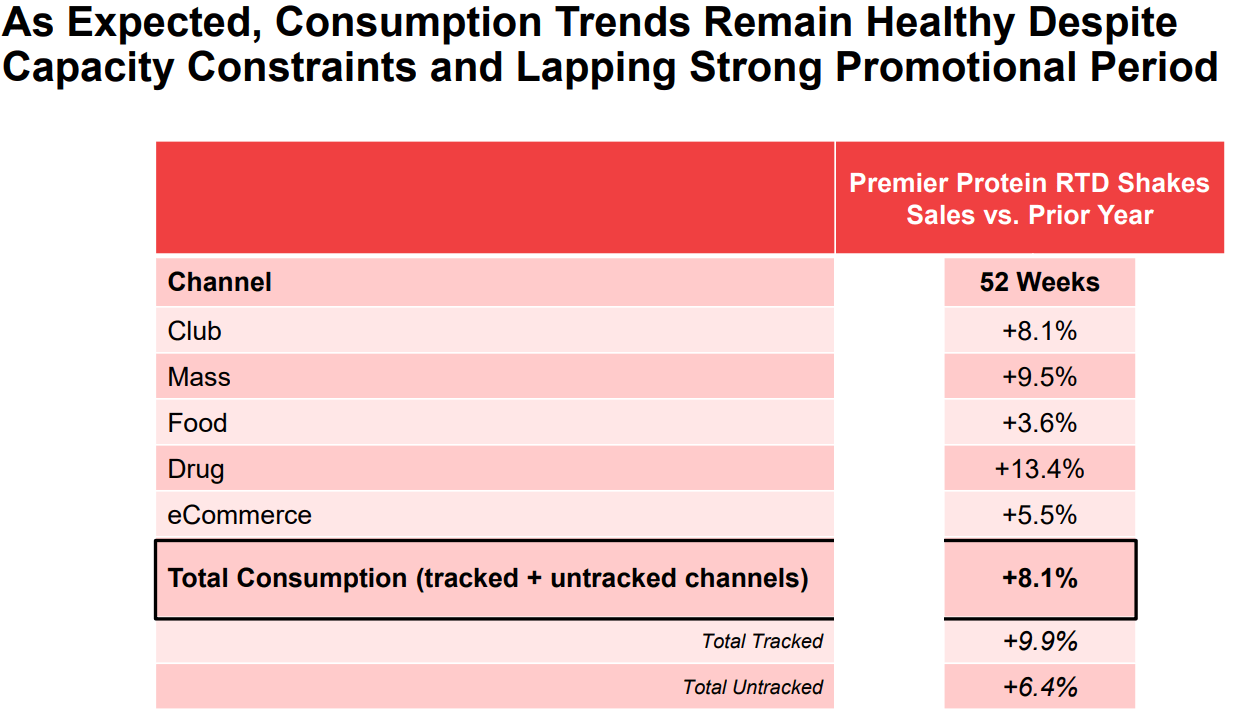

In my view, the first feature to remark about BellRing is the increase in consumption of products. According to a recent quarterly presentation, total consumption increased close to 8.1% in the last 52 weeks. I believe that this figure is significant for a company operating in the food industry. Thus, in my opinion, the company is offering something that has significant demand.

Source: Quarterly Earnings Presentation

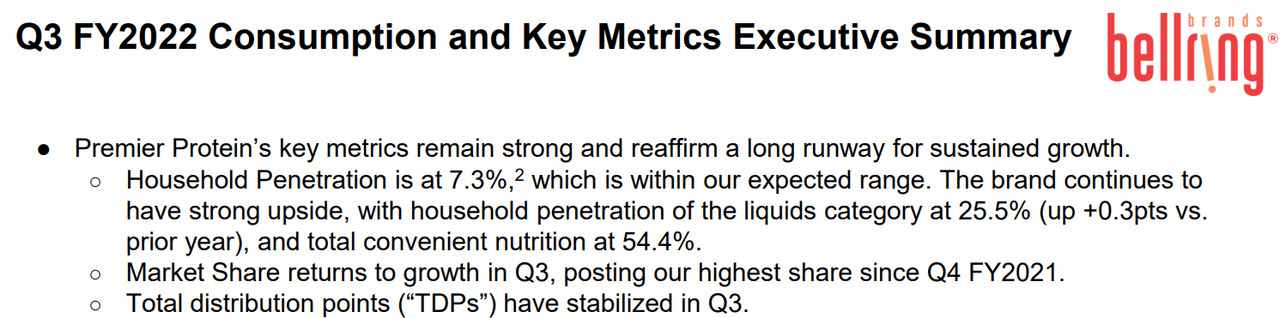

Besides, the household penetration of the company’s most relevant brand, Premier Protein, continues to remain strong as expected. If market share continues to trend north too, I believe that future free cash flow will likely trend north in the near future.

Source: Quarterly Earnings Presentation

In my view, BellRing has acquired a few brands with significant internationalization potential. Note that in Q3 2022, only 11% of the total amount of revenue was international.

Besides, I believe that with more efforts in the ecommerce sales channel, revenue could grow significantly. In the third quarter of 2022, ecommerce only represented 12% of the total amount of revenue.

Source: Quarterly Earnings Presentation

I searched a bit for the results of some of the company’s websites. Premier Protein’s website does not receive an overwhelming number of visitors per day. In my view, if the company uses its cash on hand to launch online marketing campaigns, and pays more influencers, both revenue growth and visitors will likely trend north. The management noted that it is already doing campaigns. I just want to say that more campaigns may be necessary:

Premierprotein possibly receives an estimated 2,397 unique visitors every day. Source: Premier Protein

The brand utilizes an influencer marketing program called “Premier Shakers” that leverages micro-influencers, content creators and top-tier influencers to generate further awareness of Premier Protein. Source: 10-k

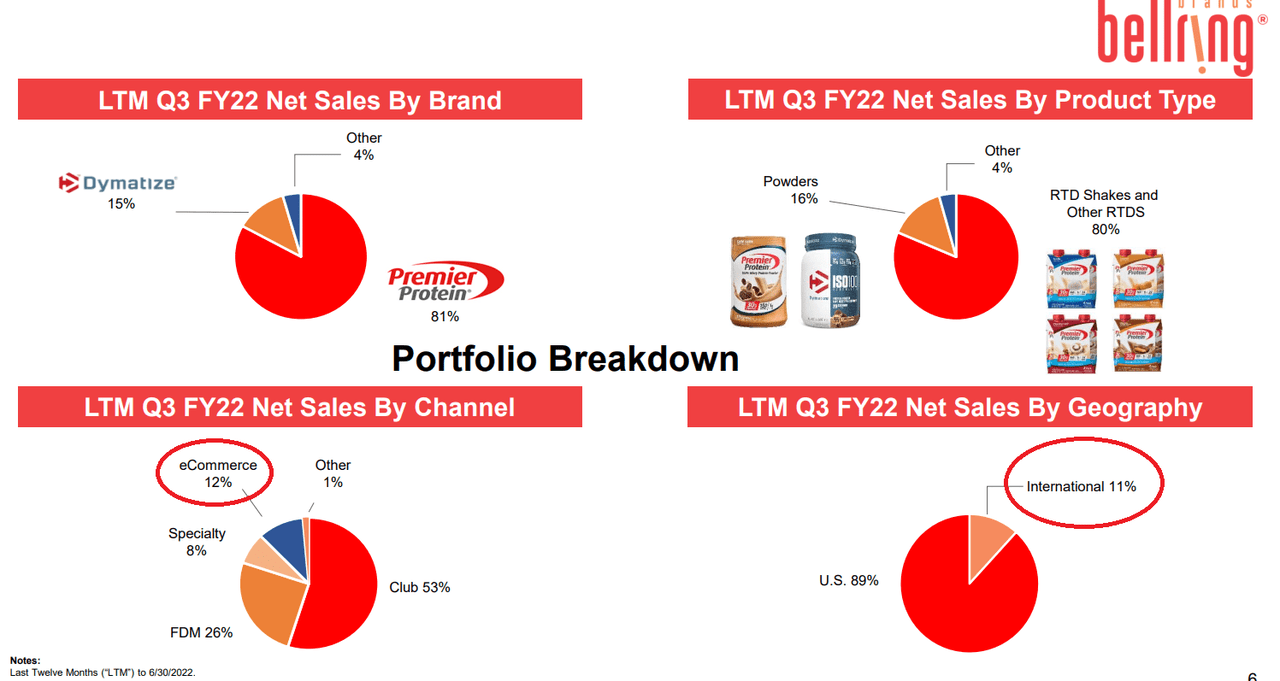

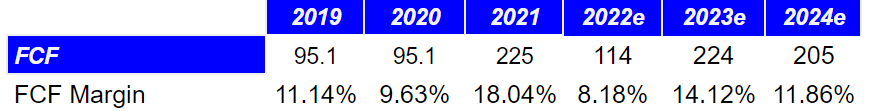

Expectations From Financial Analysts Include Declining Sales Growth, But Growing Net Income And FCF

For 2024, investment analysts expect a net sales of $1.72 million, with a net sales growth of 8.95%. 2024 EBITDA would also stand at $337 million, with an EBITDA margin of 19.50%. The operating profit would stand at close to $306 million, with an operating margin of 17.70%. Finally, 2024 net income would stand at $219 million.

Note that the company’s EV/EBITDA ratio stands right now at 13.9x, but the company traded, in the past, at close to 7x. I wanted to review all these numbers before heading to offer my figures, so that readers grasp what other analysts are forecasting.

Marketscreener.com

For 2024, analysts are also expecting a free cash flow of $205 million, with a free cash flow margin of 11.86%. Note that free cash flow is expected to double from 2020 to 2024.

Marketscreener.com

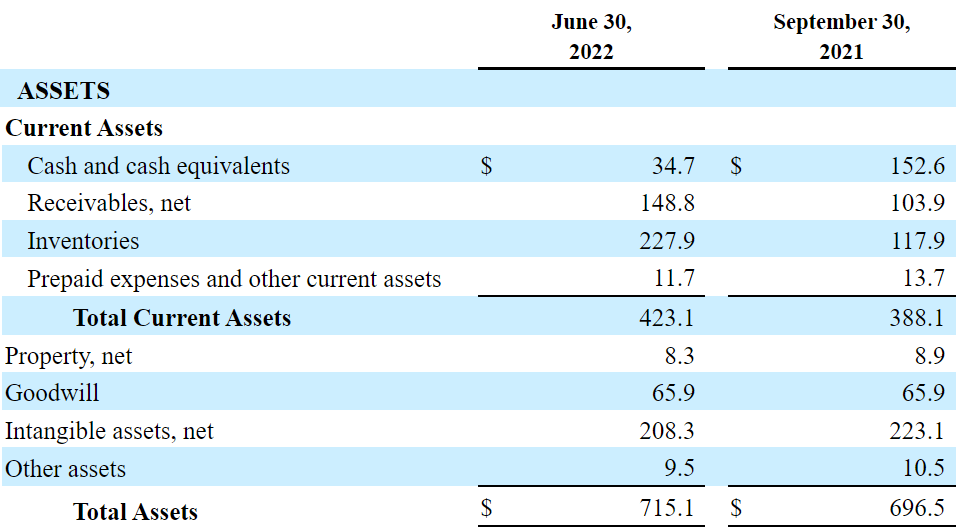

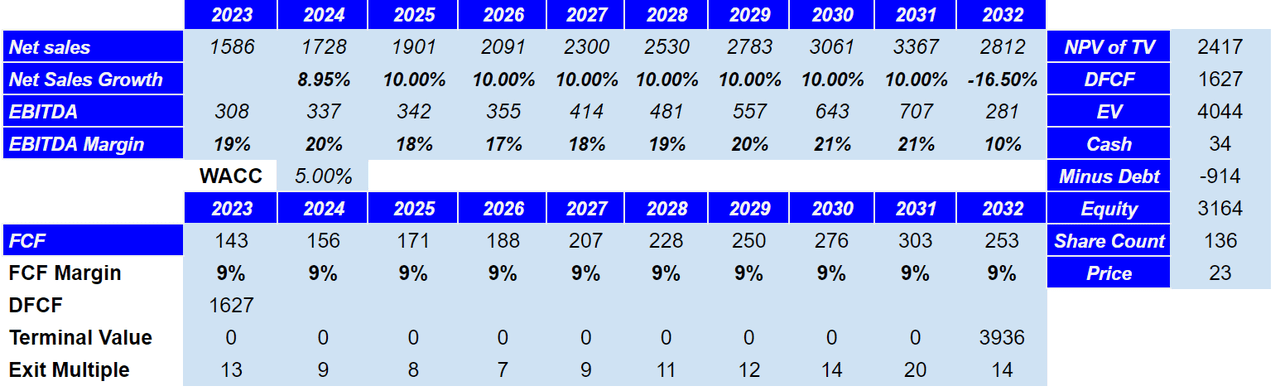

Balance Sheet

As of June 30, 2022, the company reported cash of $34.7 million, in addition to accounts receivables worth $148.8 million and inventories of $227.9 million. I believe that the company’s liquidity is in good shape. Total current assets are $423.1 million, and total current liabilities are $177.0 million. The company does report some expertise in the M&A markets. The goodwill stands at $65.9 million, with intangible assets worth $208.3 million. Finally, the total assets are $715.1 million.

10-Q

The total liabilities are worth $1.1 billion, which means that the asset/liability ratio stands at less than 1x, which is not ideal. With that, in my view, if future free cash flow grows as expected, most investors would not worry about the state of the balance sheet. Total current liabilities are $177.0 million. In addition, the long term debt stands at $914.2 million, which would be close to 2x-3x 2024 free cash flow.

10-Q

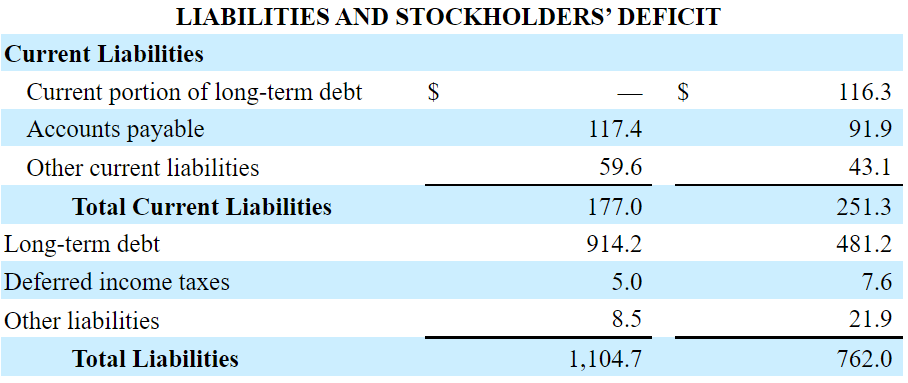

With Sufficient M&A Efforts And More Investments In Ecommerce, The Fair Price Would Be $23 Per Share

Under my base case scenario, I believe that management will likely try to acquire other brands in the near future. As a result, I would expect sales growth and free cash flow growth in the coming years. Let’s keep in mind that the company has a lot of expertise in the acquisition of brands. Also, Premier Nutrition and Dymatize were acquired from third parties.

In its year ended September 30, 2013, Post acquired Premier Nutrition. In 2011, Joint Juice, Inc. acquired the Premier Protein brand and related assets from Premier Nutrition, Inc. via a corporate restructuring.

In its year ended September 30, 2014, Post acquired Dymatize, which, at the time, was a manufacturer and marketer of high-quality protein powders and nutritional supplements under the Dymatize brand and nutrition bars under the Supreme Protein brand. Dymatize was founded in 1994 and purchased the Supreme Protein brand in 2012. Source: 10-k

Under this scenario, I assumed that the investments in the ecommerce channels will increase substantially. As a result, both sales growth and free cash will likely increase. Note that selling online is significantly cheaper most of the time than through direct sales channels.

In the U.S., we utilize a direct sales force in multiple channels, including club, FDM, convenience, specialty and eCommerce. Source: 10-k

In this scenario, by 2032, I would expect net sales close to $2.8 million, 2032 EBITDA of $281 million, and an EBITDA margin of 10%. I also assumed the FCF margin close to 9% from now to 2032 and an optimistic WACC of 5%, which would imply a net present value of the terminal value of almost $2.5 billion and enterprise value of $4 billion. Finally, adjusting the current debt and cash on hand, the equity would be almost $3.165 billion, and the fair price would be close to $23 per share.

Chatool Investments

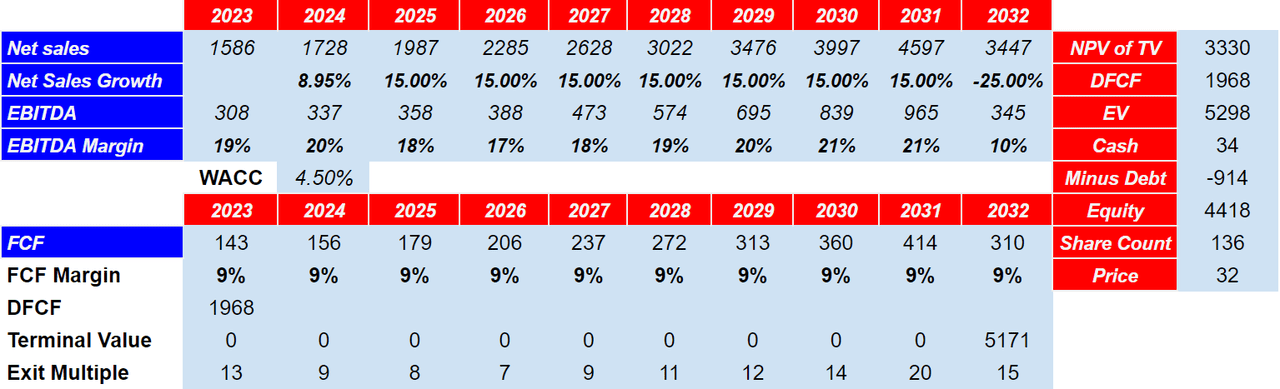

With New Distribution Partners, And New Design Of Flavors, The Fair Price Would Be $32 Per Share

BellRing Brands has a team dedicated to research and development of new products, design of flavors, and new technologies. Under this case, I assumed that the company will create a new product in-house and a new brand that will generate significant revenue growth. As a result, I am assuming that sales growth will reach double digit, which I believe could happen. Let’s note that the company has been increasing its R&D expenses significantly since 2019.

We continue to improve and expand our product offerings with new flavors, ingredients, packaging and process development technologies. We leverage our dedicated market research, consumer insights and innovation teams, supplemented by leading design firms, product development companies, third party flavor houses and consultants. Source: 10-k

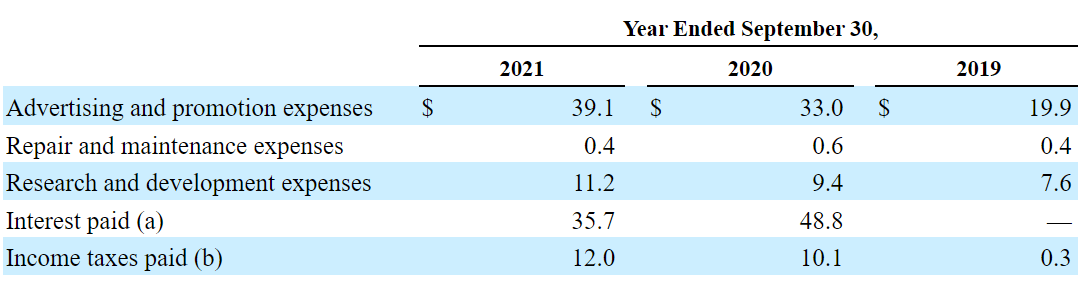

Source: 10-k

Under this case, I also assumed that BellRing Brands would start working with new distribution partners, perhaps in Europe and Asia. Right now, the company works with partners that represent a significant part of the total sales. It is not ideal, so I would expect certain diversification in the coming years.

Our largest customers, Costco (COST) and Walmart (WMT), accounted for approximately 65.3% of our net sales in our year ended September 30, 2021. Source: 10-k

For 2032, under this case scenario, I forecast net sales of $3.4 billion and an EBITDA of $345 million. With the FCF margin close to 9%, 2032 free cash flow would be $310 million.

If we use an exit multiple of 15x, the terminal value would stand at close to $5 billion, which would imply a net present value of $3.3 billion and DFCF of almost $2 million. The enterprise value would be close to $5 billion with equity of $4.4 billion and a fair price of $32 per share. I don’t think that my numbers are that optimistic. In my view, this scenario is not far from reality.

Chatool Investments

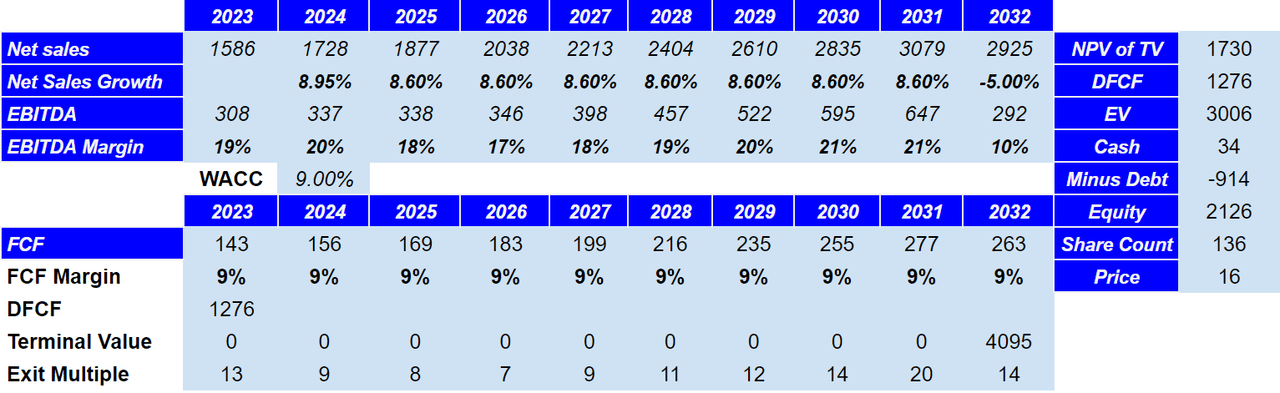

Lack Of Diversification Or Failed New Product Launches Could Bring The Stock Price Down To $16.1 Per Share

I believe that the number of product categories offered by BellRing Brands is not significant. In my view, in the future, management may suffer from its lack of diversification. Let’s note that 80% of the total amount of sales come from RTD protein shakes. Changes in consumer taste or any campaign against these types of products could bring the company’s revenue growth down.

A substantial amount of our net sales is derived from our RTD protein shakes. Sales of our RTD protein shakes represented approximately 80.2% of our net sales in our year ended September 30, 2021. We believe that sales of our RTD protein shakes will continue to constitute a substantial amount of our net sales for the foreseeable future. Source: 10-k

I also believe that the largest risk for BellRing would come from failed new product launches. If marketing becomes too expensive, customers dislike the new flavors, or management invests too much, revenue growth may not grow as expected:

We may not be successful in developing, introducing on a timely basis or marketing any new or enhanced products, and specifically, the initial sales volumes for new or enhanced products may not reach anticipated levels, we may be required to engage in extensive marketing efforts to promote such products, the costs of developing and promoting such products may exceed our expectations and such products may not perform as expected. Source: 10-k

I expect, for 2032, net sales of $2.9 million and net sales growth of -5%. I also included an EBITDA of $292 million, with an EBITDA margin of 10%. I expect the FCF to be $263 million, with a FCF margin of 9%. The DFCF would be $1.2 billion with a NPV of the terminal value of $1.7 billion and an enterprise value of $3 billion. Finally, the fair price would be $16 per share.

Chatool Investments

Conclusion

BellRing Brands successfully acquired different brands, and it is currently reporting an impressive increase in revenue growth, net income, and free cash flow. In my view, the company’s business model would improve significantly thanks to further internationalization and ecommerce efforts. By including new acquisitions and new products, my discounted cash flow model reported an implied valuation of close to $32 per share. I don’t think that my numbers are that unlikely. Even considering risks from lack of diversification and changing customer taste, I believe that the company is undervalued.

Be the first to comment