grinvalds

Adobe’s (NASDAQ:ADBE) stock has fallen more than 50% in the last year. The main reasons are the current bad macroeconomic situation and the very high valuation at which Adobe was trading at an all-time high.

But thanks to that significant drop, the company’s shares have reached the levels at which they traded more than three years ago in June 2019. Therefore, Adobe currently has a PE ratio of 29, the lowest PE for which ADBE has been trading since 2013.

Recently, management announced that it would be buying a company called Figma for $20 billion. The market has reacted very negatively to this acquisition because they think management overpaid for Figma and it has made ADBE’s shares fall even further. But I believe this acquisition was a smart move by management and that Adobe is still a high-quality business that still has a wide moat and can deliver really very attractive returns, for long-term investors.

About Adobe

Adobe is a software company focused on computer graphics, digital marketing, and publishing.

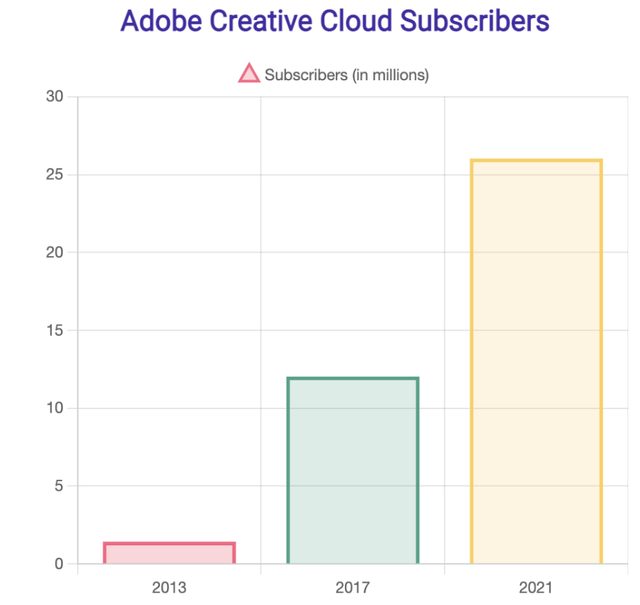

ADBE has over 20 software applications, including Adobe Photoshop, Premiere Pro, Acrobat, and more. Adobe offers several plans that include different applications of the company. Perhaps the most famous plan is “Creative Cloud All Apps” which, as you can already tell from the name, contains all the apps and which costs $54.99 per month. The company recently raised prices on all plans. This indicates that ADBE has pricing power. Overall, Adobe subscribers were over 26 million, at the end of 2021, and that number has grown really fast in recent years. Adobe has, as you’ve probably understood by now, recurring revenue, which I personally really like because it’s easier to predict the company’s future sales.

Overall, ADBE has 3 major business segments: 1. Digital Experience (this includes e.g. Adobe Advertising Cloud, Adobe Marketing Cloud, and Adobe Analytics), 2. Publishing and Advertising (It is a cross-channel platform that offers customers the ability to plan, buy, manage, measure, analyze, and more) 3. Digital Media (Creative Cloud, these are apps such as Adobe Photoshop, Premiere Pro, Acrobat, and others), which is where over 60% of the company’s sales come from.

Adobe’s CEO is Shantanu Narayen, who has been with the company since 1998 and became CEO in 2007, and remains so today. He’s the one who made Adobe the company we know today. Because of this, I think Adobe could be considered a founder-led business even if it is not literally so. Narayen didn’t set up ADBE, but he built a business that is still worth more than $130 billion after a 50% decline over the last year. Personally, I think ADBE has a great CEO, which is the key thing to the success of any company.

The Acquisition Of Figma

Now let’s focus on the Figma acquisition. First, I would like to briefly tell you what Figma actually is. Figma is a cloud-based collaborative design tool. One of Figma’s biggest advantages is that it’s real-time. This allows a coder, copywriter, UX designer, or project manager to work on a single project, all at the same time. It’s all in the real-time cloud. This is really a revolutionary thing, as 100 people can work on one project at a time, which will make the whole launch of the project faster. Figma has several other advantages and is very intuitive indeed. The fact that Figma is really great also shows the fact that it is already used by tens of thousands of Microsoft employees. And for many of them, Figma is “the heart of their daily work.” Figma is used in more and more large companies, where it has grown mostly organically, including Google (GOOG) (GOOGL), Airbnb (ABNB), Twitter (TWTR), Stripe, Dropbox (DBX), and others.

Thanks to Figma having such a great product, Adobe decided to buy the company. On September 15, Adobe announced it would buy Figma for $20 billion. The market reacted negatively to the news, thinking that ADBE had overpaid for Figma. Maybe in the short term, but not in the long run, in my opinion. The acquisition is coming in the form of a deal that is half cash and half stock.

ADBE can afford this acquisition with its strong balance sheet and high free cash flow. Figma is expected to add $200 million in net new ARR this year, which would be over $400 million overall in ARR in 2022. The company is growing triple digits YoY with best-in-class net dollar retention of greater than 150 percent. This shows us what a great product Figma has, as users spend more and more each year on the product. The gross margins of Figma are 90 percent and the company has positive operating cash flows.

There’s still some chance that regulators will reject the acquisition, but the chances are in my opinion, really slim. While the Figma acquisition is definitely not cheap, ADBE is buying a high-growth company with a great product that Adobe itself could not replace. The product is praised by the employees of the biggest companies in the world, and the pace at which Figma is growing is really fast. That is why the management of ADBE decided to buy Figma and in my opinion, it was the right move in the long run.

The Growth Of Adobe

Now let’s focus on the strategies that ADBE is likely to use for further growth. The first one is more subscribers. The company had over 26 million subscribers at the end of 2021, and that number grew really fast over the last few years. Adobe’s rapid growth has also been helped by a pandemic, and the big advantage is that most ADBE subscribers are likely to use the products for the next few years. Management wants to focus further on increasing the number of subscribers. They will use different strategies to do it, but the main one to attract new subscribers is ads.

Another opportunity for the growth of Adobe is Figma. This is a company that has grown impossibly fast over the past few years and this rapid growth is not expected to slow in the next few years. Figma has a great product that users highly praise and the growth is mostly organic, which is also an advantage. Figma fits in nicely with the Adobe business and in my opinion, it was a smart acquisition by ADBE management that will bring interesting growth in the long run.

As a further opportunity for growth, there is the release of new products and the continuous improvement of existing ones. This is something that the management of the company has done very well in the past few years and that makes Adobe such a quality business. If management keeps releasing new products, more and more users can start using ADBE, and that will mean more sales and profits for Adobe. Personally, I will continue to monitor the fact that the company is constantly releasing new products and thereby attracting more users and maintaining the dominant position in the market that it currently has.

Adobe Creative Cloud Subscribers (Stock Photo Secrets)

Financials

Now let’s look at the financials of the company.

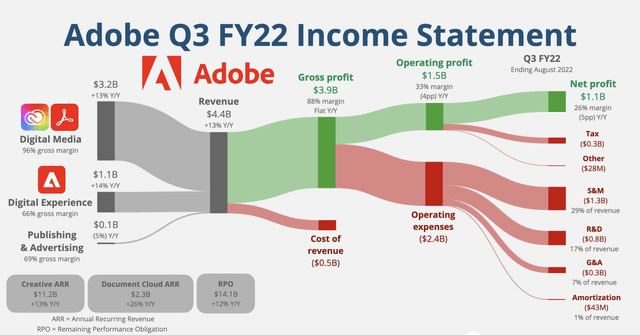

In Q3 2022, ADBE had the highest revenue it ever had in a single quarter of $4.433 billion, an increase of 12.7% YoY. This result was in line with analysts’ expectations. ADBE still has really high gross margins, which it had 87.7% in the latest quarter. Adobe had Free Cash Flow in Q3 2022 of $1.579 billion and Free Cash Flow Margins of 35.6%, while FCF Margins are a little lower than they were in the last quarter, they’re still high.

As for the balance sheet, Adobe still has it strong, with $5.764 billion in cash and only $3.627 billion in long-term debt so far. Overall, the company has $26.744 billion in total assets and only $12.371 in total liabilities. That’s a very strong balance sheet.

By buying Figma, ADBE will take on $10 billion in debt. That means they will have $13.627 in long-term debt overall. This worries many investors, but you have to remember that ADBE had an FCF of $6.893 billion in 2021 and this figure is expected to rise further in the coming years. This means that if the company’s management wanted to, it could be completely debt-free within 2 years. I don’t find that personally so worrying.

Adobe Q3 FY 22 Income Statement (App Economy Insights)

Moat Of Adobe

Adobe has a wide moat, in my opinion. That’s what I’d like to focus on right now. One of ADBE’s competitive advantages is brand awareness. Pretty much everyone knows Adobe these days, and if you want to edit photos, edit videos, etc. more professionally, you usually choose Adobe and there is a good reason why. Adobe products are simply the best on the market with a few exceptions. Figma was one of the few exceptions so Adobe decided to buy Figma. That was, in my opinion, a very smart move on the part of the management of the company. Figma was the only big competitor ADBE had right now. Adobe just doesn’t have a big competitor right now. That’s one of the other competitive advantages the company has right now.

The company has over 230 million monthly visits to its main site, it just shows how big and well-known Adobe is. Then there are high switching costs. Once you’ve used Adobe regularly, it’s not often you suddenly stop using Adobe. This is another competitive advantage of the company. Learning to work with ADBE products isn’t exactly easy, because Adobe products tend to do more advanced things. Once a user learns to work with Adobe products, they usually just don’t want to switch to others anymore. Users would then feel that they would lose the time they spent learning to work with Adobe products and instead have to learn how to use products from another company again from the beginning. These are the main reasons why I think Adobe has such a wide moat.

Valuation

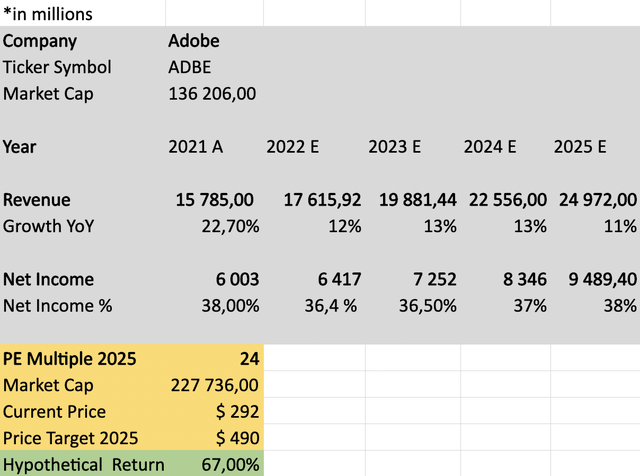

Now let’s take a look at the valuation of Adobe. As you can see, I have created a very simple valuation model here. For revenue and net income growth, I used analysts’ expectations. Personally, I think that might be pretty accurate since Adobe hasn’t exceeded analysts’ expectations just once in the last 36 quarters. That’s a pretty good balance, in my opinion. After that, all I had to do was guess at what PE ratio ADBE would be trading at in 2025. I finally came up with a PE ratio of 24 in 2025. It’s a fairly non-aggressive estimate considering what PE ADBE has traded for in the past, most of it was over 50.

I also came to a PE ratio of 24 because, after 2025, Adobe is still expected to grow sales through double digits. That’s why I came up with a hypothetical return of 67% over the next 3 years. That’s a pretty attractive potential return, in my opinion.

Risks

Now let’s look at the risks involved with investing in Adobe.

The first is the acquisition of Figma. If Figma under Adobe started growing more slowly and ADBE made any significant changes to Figma that would damage Figma’s core product in some way, that could pose major problems for ADBE. What needs to be monitored is that Figma continues to grow rapidly. But according to the information we have now, Figma under Adobe should hardly change at all. Figma will still have the same CEO, and ADBE will keep Figma as it is now, because Figma works and grows just fine.

As an added risk, there is competition. Even though ADBE doesn’t have a strong competitor right now, and even though ADBE’s acquisition of Figma got rid of its previous main competitor, it’s important to see that Adobe continues to improve existing products and keep releasing new ones. That, in my opinion, is the key to Adobe’s long-term success.

Conclusion

Even though the near future for Adobe is unclear, it is still a high-quality business in my opinion. The company still has a very wide moat. The acquisition of Figma was, in my opinion, a smart move by management in the long run.

Adobe has a very prudent CEO who has been with the company for over 20 years and built it into the enormous company we know today. ADBE still has very high gross margins, and right now it’s trading at one of the lowest valuations it’s ever traded at.

ADBE’s balance sheet remains strong and the company is expected to grow double-digit, over many years to come. Even though there are several risks, Adobe can in my opinion, deliver very attractive returns to long-term investors.

Be the first to comment