LPETTET

Author’s note: This article was released to CEF/ETF Income Laboratory members on October 20th.

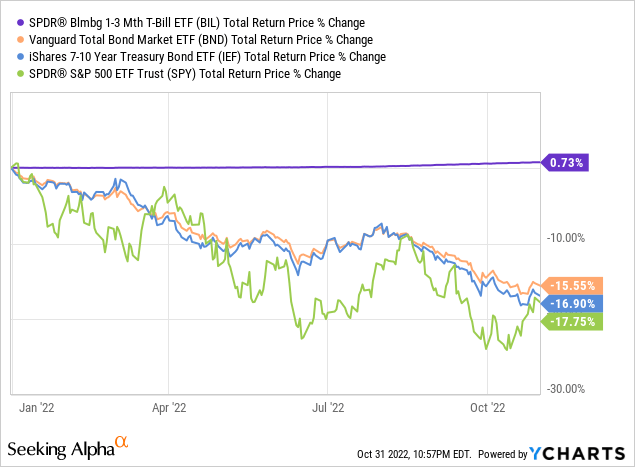

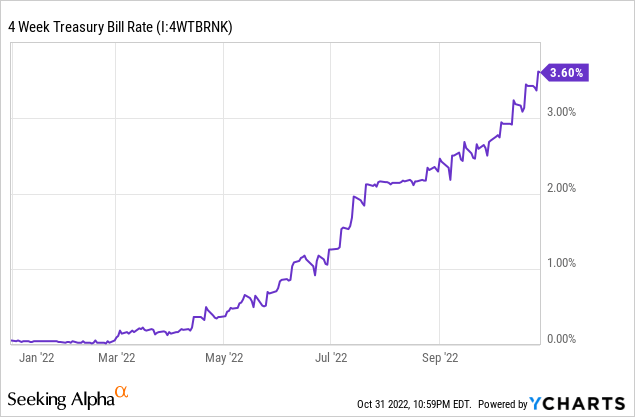

Rising interest rates have led to increased yields for most asset classes. Some short-term fixed-income securities are currently offering compelling yields with very little credit and interest rate risk, a solid combination. Treasury Bills, or T-bills are one such asset class, offering investors 3.60% – 4.20% yields, at very low risk and volatility.

The SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (NYSEARCA:BIL) is a simple T-bill ETF, offering cheap exposure to said securities. BIL has a TTM yield of only 0.5%, but yields should increase to around 3.6% in the next three months, as per prevailing T-bill rates.

In my opinion, BIL is a buy, and particularly appropriate for more conservative, short-term investors. More aggressive, yield-seeking investors could consider higher yielding alternatives to BIL.

BIL – Overview

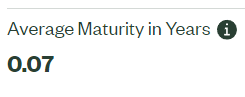

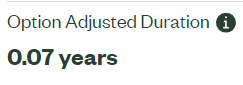

BIL is a simple T-Bill ETF, investing in all publicly issued U.S. Treasury Bills with a remaining maturity of between 1 and 3 months. As with most indexes, applicable securities must also meet a set of inclusion criteria centered on size, liquidity, and certain security characteristics, but these are quite basic. BIL currently invests in 14 different T-Bills, with an average maturity of 5 weeks.

BIL’s holdings are incredibly safe, low risk, low volatility securities. Credit risk is incredibly low, as these securities are issued by the U.S. Treasury, and backed by the full faith and credit of the U.S. Federal Government. Credit risk is effectively nil, and defaults incredibly unlikely, barring an unprecedented U.S. government default.

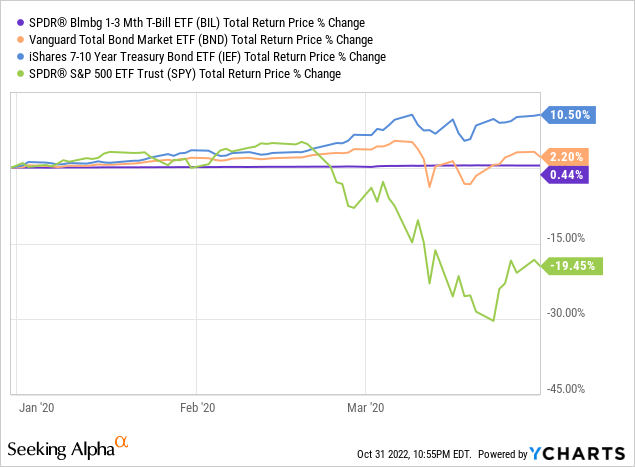

Low credit risk reduces risk, volatility, and potential losses during downturns. BIL should perform relatively during recessions and downturns, as was the case during 1Q2020, the onset of the coronavirus pandemic. On the other hand, the fund rarely sees significant gains during these scenarios, unlike longer term treasuries and similar high-quality assets.

BIL focuses on securities with short maturities and low duration, with an average of 5 weeks for both metrics. Both are relatively low figures, and lower than average for a bond or treasury fund.

BIL BIL

Focusing on short-term securities significantly reduces interest rate risk, so the fund should perform relatively well when interest rates increase. This has been the case YTD, as expected.

Focusing on short-term securities also allows the fund to quickly capitalize on rising interest rates. The fund’s holdings mature quickly, and so are quickly replaced with newer, higher-yielding securities when rates rise. Funds focusing on longer-term securities also do the same, but the process takes them much longer, due to longer maturities.

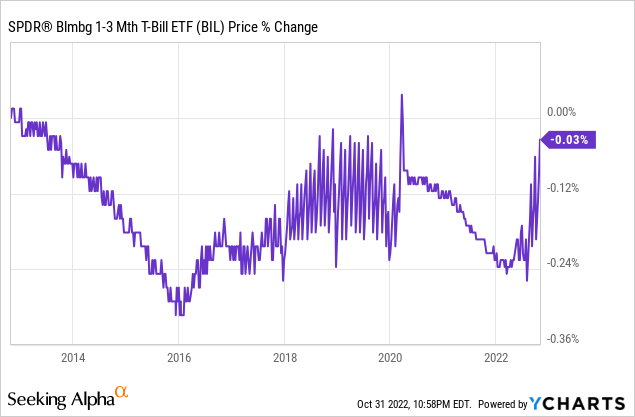

BIL is an incredibly undiversified fund, with investments in a comparatively low number of securities from a very specific bond sub-asset class. In most cases, such highly concentrated funds are excessively risky investments. BIL’s low credit and interest rate risk more than outweigh these issues, making the fund a relatively safe, low volatility investment. In my opinion, and as evidenced by the fund’s incredibly stable share price since inception.

As can be seen above, BIL’s share price is remarkably stable, and rarely moves by more than 0.15% a year. Share price stability is due to the fund focusing on T-Bills, so share prices should remain reasonably stable moving forward, barring an unprecedented U.S. government default.

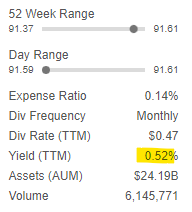

BIL’s underlying holdings generate quite a bit of income, but the situation is a bit complicated, and in flux. The fund currently sports a trailing twelve-month yield of 0.52%, an incredibly low figure.

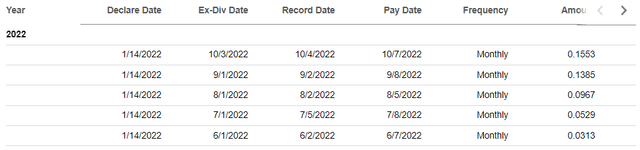

SeekingAlpha

BIL’s forward dividend yield is, however, much stronger than the above. Annualizing the fund’s latest monthly dividend payment nets you a 2.0% dividend yield, four times greater than the above.

BIL also sports a 2.7% SEC yield, a standardized measure of short-term generation of income. ETFs almost always distribute any and all income to investors as dividends and nothing else, so BIL’s yield should increase to around 2.7% in a relatively short amount of time.

Once the fund’s T-bills mature, the fund should use the proceeds to invest in newer, higher-yielding T-bills, leading to greater income and dividends. The fund’s holdings are, as a whole, closer to 4 week T-Bills than to issues of other maturities. These securities currently yield 3.6%. The fund’s yield should increase to around that, assuming no further interest rate movements.

Importantly, T-bills are currently yielding 3.6%, which means investors should expect around 3.6% in dividends and returns from investing in BIL right now. The fund’s dividend yield and SEC yield metrics are accurate, but backwards-looking, and so not necessarily reflective of future dividends and expected performance. Looking at actual T-bill rates is much more informative, and should prove a more accurate indicator of future dividends and performance for BIL.

The Federal Reserve is aggressively hiking rates right now, so longer-term dividends and returns would almost certainly be higher. Federal Reserve officials have indicated that they see interest rising to around 4.6% next year, so T-Bills should see yields of 4.0% – 5.0% next year as well. Still, dividend growth and future yields are ultimately dependent on future interest rate movements, which are uncertain.

As a final point, BIL’s dividends have increased by around 0.40% per month since June 2022. Growth should average around 0.40% moving forward as well, in my opinion at least.

Let’s summarize the above.

BIL currently yields 2.0%, annualizing its latest monthly dividend payment. Yields should increase to around 2.7% in the coming months, as per the fund’s SEC yield. Yields should then increase to around 3.6%, as per prevailing T-bill rates. Yields should increase to 4.0% – 5.0% next year, as per Federal Reserve guidance, but the situation is strongly dependent on future interest rate movements. BIL’s dividends have grown by around 0.40% percentage points each month since June, so further growth will likely be around said number.

Quick Peer Comparison

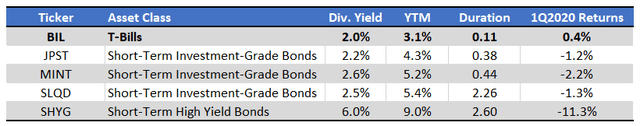

Finally, a quick table comparing BIL to a few other cash-alternative and short-term bond ETFs. Dividend yields are latest monthly dividend payment annualized. YTD is a measure of long-term expected returns / dividend yield, particularly important when rates are rising. Duration is a measure of interest rate risk. 1Q2020 returns are indicative of the credit risk of the different funds, and of the performance that investors can expect during future downturns and recessions.

Fund Filings – Chart by Author

As can be seen above, BIL has the lowest credit and interest rate risk of its peers, but the lowest yield as well. The combination might be most appropriate for more conservative investors and retirees, while those seeking higher yields could consider other funds.

Conclusion

BIL’s safe, low risk holdings, and strong expected dividend growth make the fund a buy. As the fund’s yield is comparatively low, more aggressive, long-term investors should consider other funds.

Be the first to comment