Andrew Burton

Description

I believe LiveWire (NYSE:LVWR) is worth $35.93, representing ~372% upside from the date of writing. Speed. Elegance. Class. Prototype after prototype, LVWR is revolutionizing the motorcycle world. Every investor desires a business from which his investment can yield a windfall. This is such a company, and it’s taking the world by storm.

Company overview

With its cutting-edge technological advancements, LiveWire has breezed ahead of many other motorcycle companies. In 2019, Harley-Davidson unveiled the prototypes of its electric motorcycles to the world, setting off a wave that birthed more two-wheeled electric motorcycles. These prototypes have now reached market viability, as the Harley-Davidson (HOG) LiveWire became the apex premium motorcycle in the US and Europe in both 2020 and 2021. HOG launched LiveWire as its own brand in 2021, with the LiveWire ONE making its debut in July of the same year.

Huge market opportunity

The high-value Internal Combustion Engine [ICE] and electric vehicle market for LiveWire is estimated at $40 billion in sales (according to LVWR prospectus) across North America, Europe, and China. The trademark of LiveWire lies in its light, medium and heavy motorcycle segments. 2020 saw the sales of light motorcycles soaring to $9 billion dollars while medium and heavyweight motorcycles totaled $17 billion. The sales for the medium and heavyweight models were amassed in Asia and Europe, where customers preferred heavier motorcycles.

With agressive momentum, electric vehicles are expanding everywhere with these four spears that are sure to become the core of the industry for LVWR:

- Technology Enhancements: This has made sure that passionate users get super-performing electric vehicles at lower costs. The charging infrastructure and most of the technologies used in automobiles are retained in electric vehicles. Concentrating resources in this direction will benefit the electric motorcycle market all the more.

- Consumer Adoption: Since they gained greater awareness of electric power trains and their sustainability, consumers have shifted their focus to electric vehicles. This decision is made easier through the lower price points involved, as over 50% of consumers have cast their weight behind electric or hybrid vehicles.

- Government Support: Governments around the world are supporting the mission to revolutionize the electric vehicle market, particularly in urban environments. These measures include stricter regional emission regulations. I believe electric vehicle purchases are set to shoot up as the US government decides to invest in the charging infrastructure.

- Product Availability & Desirability: LiveWire’s electric vehicle is every user’s dream. It reduces noise and introduces more mind-blowing features like automatic gear shifting. For consumers who take up riding as a sport, this is an irresistible commodity.

Users who have migrated to LiveWire have enjoyed the superior riding experience and immense performance advantages of using this electric powertrain. Without using a clutch or gears, you can get instant power delivery and linear acceleration. Many other ICE riders are expected to adopt LiveWire motorcycles in unending streams. I expect new riders will fall in love with motorcycles once they realize how easy they are to ride, how exciting it is, and how long it lasts.

Strong strategic partnership with HOG

For the past 119 years, HOG has been one of the most recognizable motorcycle brands in the world. Its capabilities in designing, developing, manufacturing, marketing, and distribution of vehicles are globally unquestioned. Aside from the transitional service agreements that go along with the split, LiveWire uses HOG’s skills in two very important areas: technical services and contract manufacturing.

These are the key services provided by HOG, which I believe help LVWR a lot:

- Product Development and Testing: This ranges from the process of designing and developing LiveWire’s product components, physical testing at the HOG’s workshop. The LiveWire Electric Vehicles will be tested for durability, performance, vehicle dynamics, failure evaluation, and regulatory compliance. This is done alongside a virtual test that simulates the performance of the electric vehicle.

- Regulatory Support: different regions in different countries support certificate submissions.

- Warehousing Support: This involves drafting and revising required service communication materials like service manuals, parts catalogs, and instruction sheets for LiveWire.

- Marketing Vehicle and Fleet Center: Helps LiveWire to receive, set up, store, and provide LiveWire fleet vehicles that smash through the standards for road worthiness.

LVWR ARROW architecture provides scalability

Investors in LiveWire should get acquainted with a new, scalable architecture on which future LiveWire vehicles could be built. The ARROW blueprint would be launched into the production process by 2023. ARROW possesses a proprietary battery, motor, charging, and control system. It is designed to be the central component of the motorcycle chassis.

This amazing invention, created by the LiveWire team, takes advantage of the benefits of scalable, modular architectures in vehicle systems and software. This approach is designed to limit recurring investment and cut delivery time for new models, while at the same time keeping customer satisfaction in mind.

Using the ARROW system, the production team is able to supercharge each attribute of the electric motorcycle for a delightful riding experience. With ARROW, LiveWire is in full control of the nascent electric vehicle, making it easier to improve on both hardware and software. The job is done faster and better because the manufacturing blueprints are easy to change and adapt to newer models.

Opportunity to capture revenue stream from providing adjacent services

LiveWire is well-positioned to explore growth opportunities beyond the electric motorcycle market. For example, when a customer purchases a LiveWire electric vehicle, LiveWire could upsell the customer access to a streamlined suite of financing and protection offerings tailored to the specifics of their purchase.

In addition to making high-quality electric motorcycles, LVWR could strengthen its relationship with its customers by selling service parts, safety gear, and branded clothing. Other services include maintenance and repair, which will be in the charge of the LiveWire maintenance and repair personnel.

Valuation

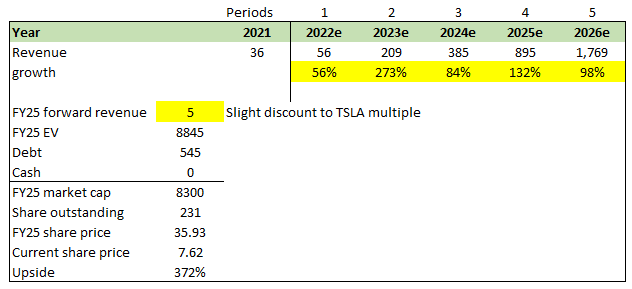

I believe LVWR is worth USD35.93 in FY25 representing 372% upside from the date of writing.

This value is derived from my model based on the following assumptions:

- Revenue growth will follow management’s mid-term estimates until FY26. The growth will be supported by more unit sales as LVWR captures a larger market share.

- Valuation wise, I believe LVWR should trade around 5x revenue, a slight discount from where Tesla (TSLA) is trading today given that it is a weaker brand with no profits.

Given that we are already 5 years into the future, each of these presumptions is highly debatable and may not come true. In any case, we need to estimate how much LVWR could be worth if it meets guidance, and my model indicates a significant upside if it does.

GS Investing estimates

KEY RISKS

No meaningful revenue or cash flow in the near term

LiveWire, in spite of its groundbreaking innovations, is still walking in uncharted territory. It has incurred its fair share of losses and expenses. For now, there is no stable and predictable cash flow. As a new product, there are no timelines to make references to concerning demand for electric vehicles. LiveWire is blazing the trail for newer companies at its own expense.

A lot of competitors

LiveWire is walking into a competitive industry. It will be competing with leading ICE-focused and other electric vehicle companies. Now that LiveWire has joined the electric vehicle market, other companies are following suit.

Summary

At the time of writing, LVWR is undervalued at its current share price. I believe that LVWR’s large TAM and existing partnership with a strong incumbent provide a strong growth opportunity. More importantly, it possesses a suite of proprietary technologies that ensures high-quality products.

Be the first to comment