dima_zel/iStock via Getty Images

Perficient (NASDAQ:PRFT) is a smaller and thus lesser-known competitor to the larger IT service companies such as Accenture (ACN), Cognizant (CTSH), Capgemini (OTCPK:CAPMF) (OTCPK:CGEMY), Infosys (INFY), etc. However, we think the company’s focus on digital transformation and revenue concentration in the US is likely to hold it in good stead against the current macro headwinds.

Business

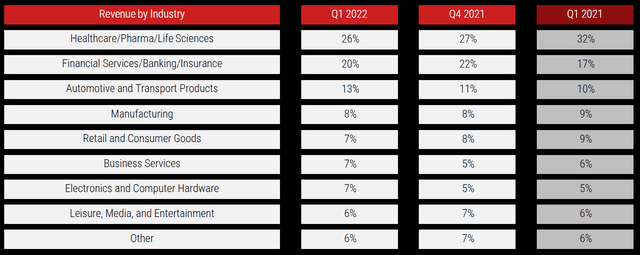

Perficient is an IT services company focusing on digital consulting and transformation space. The company operates across energy and utilities, healthcare, BFSI, manufacturing, auto, consumer, and telecom markets, with most of its revenue coming from the US. Given the relatively inexpensive valuation, we expect the stock to provide stellar returns, reaching triple digits.

Perficient’s service offerings are spread across:

- Strategy and Consulting – support for business decisions and help adapt business processes

- Data and Intelligence – to enhance the cost of customer acquisition metrics and supply chain characteristics

- Platforms and Technology – to improve upon the performance of legacy technology systems

- Customer Experience and Digital Marketing – to help brands acquire and retain customers

The past couple of years has led to an acceleration in demand for digital transformation to meet better customers where they are (mostly online). Perficient has been a beneficiary of this trend.

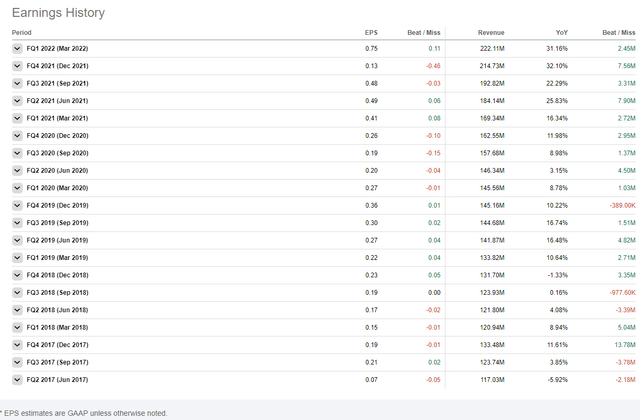

Over the last three years, the company has only missed revenue estimates once. However, to match the demand for service offerings, the company has hired at a rapid clip, which can partly explain the higher EPS misses.

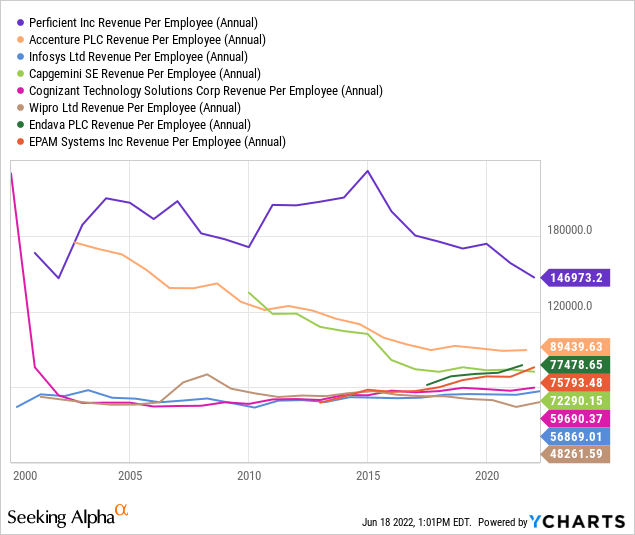

Despite the hiring, the company has one of the highest revenue per employee metrics in the IT services industry.

We think with the Fed rate hikes and an imminent recession, Perficient has a fascinating situation at hand:

- The macro tightening is likely to lead to a reduction in discretionary spending; however, digital transformation is not seen as a frivolous expense anymore and thus should not hurt the likes of Perficient.

- After a challenging few quarters, the hiring environment has mellowed down with a spate of layoffs. This should again augur well for Perficient – while the revenue per employee has been the highest in the sector, there has been a downward trend in the metric. With the change in the hiring environment, we will not be surprised if this metric starts to see a slight uptick in the coming quarters.

Financials

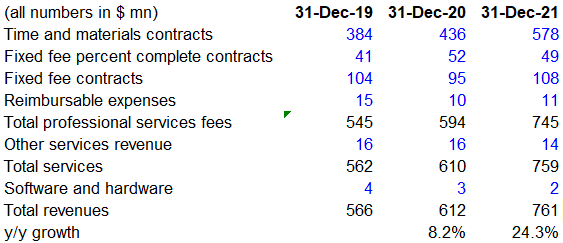

Perficient does not break out revenue by segments but by the nature of billing.

Company filings, Author’s analysis

Per the company’s 10K, the definitions of revenue are as follows:

- For time and material contracts, revenues are generally recognized and invoiced by multiplying the number of hours expended in the performance of the contract by the hourly rates.

- For fixed fee contracts, revenues are generally recognized and invoiced by multiplying the fixed rate per time period established in the contract by the number of time periods elapsed.

- For fixed fee percent complete contracts, revenues are generally recognized using an input method based on the ratio of hours expended to total estimated hours, and the client is invoiced according to the agreed-upon schedule detailing the amount and timing of payments in the contract.

Source: Perficient 10K

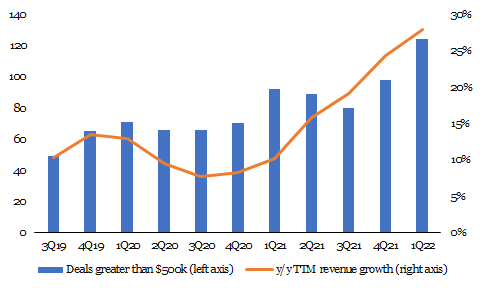

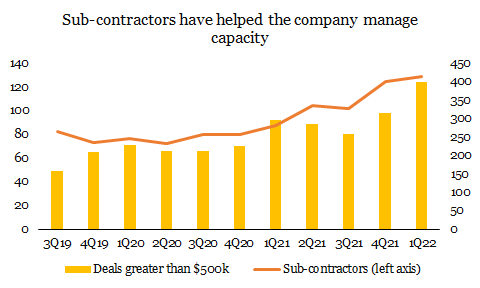

Given the management does not provide much directional commentary around segment-level revenue expectations, we think good leading of the company’s revenue health is the activity on the deals greater than $500k and contractor hiring.

Over the last three years, the TTM revenue growth has had a near-perfect correlation with the number of deals greater than $500k.

Seeking Alpha, Author’s analysis

Perficient’s business has limited deferred revenue, leading to most of the billed revenue being recognized within 12 to 18 months. Looking at the trends, we think the momentum in the business is intact.

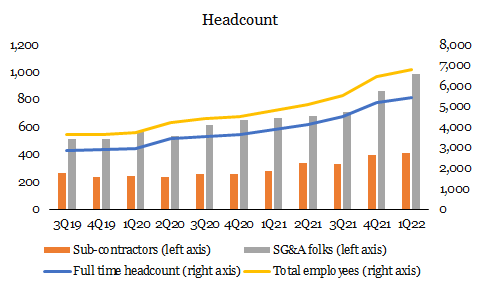

Another notable aspect of the business has been the sustained growth in headcount.

Seeking Alpha, Author’s analysis

Despite the pandemic, the headline headcount number hasn’t dipped over the last three years. Notably, Perficient has also not missed revenue growth targets other than the one time. So how is that possible for a company dependent on employee headcount for delivery? The answer lies in the split of employee count.

Seeking Alpha, Author’s analysis

Perficient has used the sub-contractor capacity to manage the ebbs and flows in the workflow. Considering the momentum in wins and the company’s guidance raise to a 20%+ revenue growth for fiscal 2022, we think the subsiding headcount costs should give a significant fillip to margins.

Financials

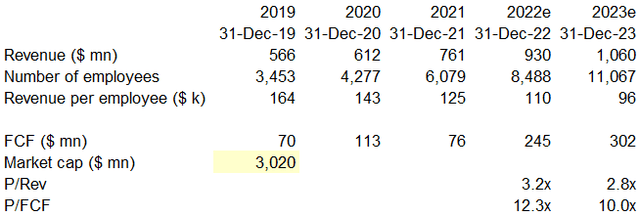

We think Perficient’s revenue growth would be closer to the higher end of the management guidance (with the upside risk of possibly exceeding it).

Company filings, Seeking Alpha, Author’s analysis

We think the strong FCF growth makes the company relatively cheap – 12x 2023e FCF implies an 8% FCF yield (1 divided by Price / FCF), which is more than double the current 10yr yields. 2024e numbers paint an even more rosy picture.

From a one-year standpoint, we expect the stock to potentially double, which will make the 2023x FCF yields closer to the 10yr yields.

Risks

We see three risks, one upside and two on the downside.

Upside: Employee growth rate

- If our assumption of employee growth rate turns out to be too aggressive with revenues remaining at the same level, margins and thus FCF could see a material upside.

- If the employee count remains the same and the company can reduce the fall in its revenue per employee, we see a significant upside to both revenues and FCF.

Downside

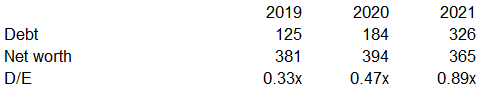

Balance sheet risk

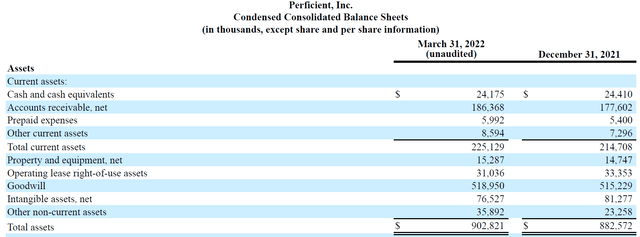

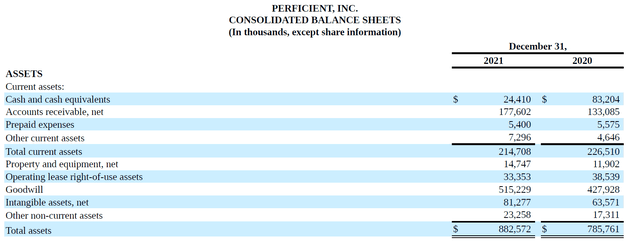

In 2021, Perficient raised new debt to part refinance existing debt and balance for working capital issues.

Company filings Company filings

The accounts receivables for the company have gone up almost 50% in 15 months. While we like the Perficient’s revenue profile, the rising debt along with the AR is a matter of concern.

Company filings, Author’s analysis

IT services companies have working capital needs that should ideally be met by operating cash flows. While debt is not uncommon for M&A, we are wary of a growing debt balance in a world of rising interest rates to finance working capital.

We also acknowledge that the company might be planning to use the dry powder for potential acquisitions, which would be available at a much sweeter price than a few quarters back.

Macro concerns

Considering that Perficient derives over 90% of its revenue from the US, we see a limited direct impact from the Russia – Ukraine conflict. However, the spillover effect on the broader global economy and the Fed’s tightening must be kept in mind.

Conclusion

Overall, we find Perficient to be a solid play to weather the impact of inflation while betting on the growth of the US economy and digital transformation trends.

Be the first to comment