SamuelBrownNG/iStock via Getty Images

VanEck Vietnam ETF (BATS:BATS:VNM) is an exchange-traded fund with a focus on Vietnam; the fund seeks to track the performance of its benchmark, the MVIS Vietnam Index. Vietnam is a less sophisticated economy; the OEC, for instance, ranks Vietnam down at position 61 in terms of economic complexity (just underneath countries such as South Africa, Kuwait, Uruguay, and many others).

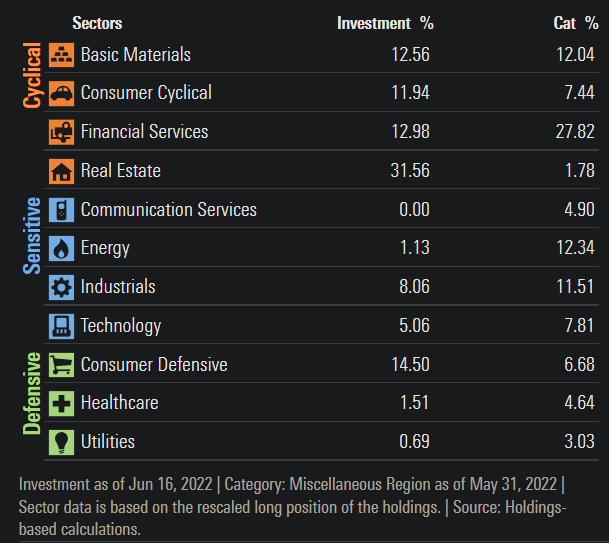

The domestic equity market is similarly less developed than major markets, and hence VNM’s portfolio is limited. VNM had 59 holdings as of May 31, 2022, with most of the portfolio invested in lower-return sectors such as Real Estate and Staples (“Consumer Defensive”, in the table below).

Morningstar.com

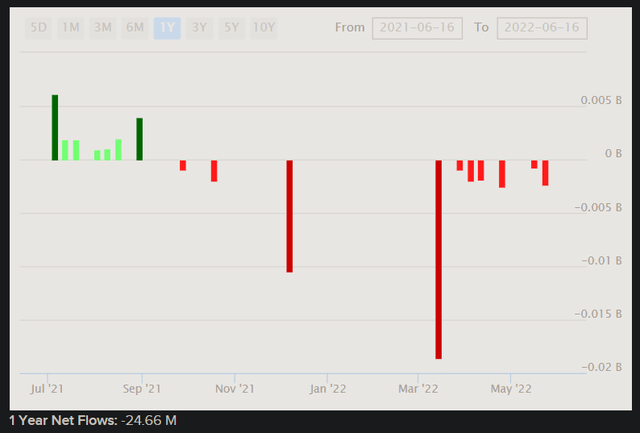

The expense ratio of the fund is high, at 0.59%, though assets under management were $419.20 million as of May month-end. That is a small AUM, but still it shows a reasonable amount of interest for a niche macro fund, especially one with an expensive carrying cost. That AUM follows negative net fund flows over the past year of about $25 million (see below), although in nominal terms there has not been much movement.

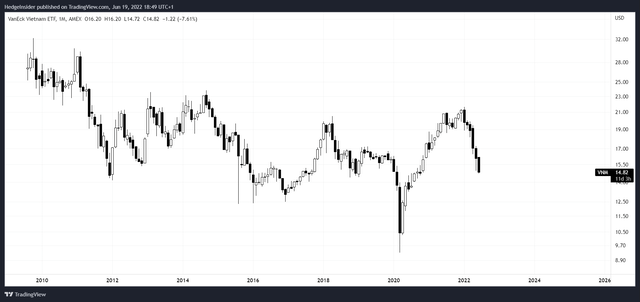

VNM has performed poorly since inception in August 2009. The VNM share price is well below the inception price.

While that does include the value of dividends to date, total returns have been poor too. As reported by Lazy Portfolio ETF, in the last 10 years, VNM produced a 0.53% compound annual return, with a 21.94% standard deviation (at the time of writing). That is a volatile instrument with a low return. Perhaps VNM can be traded opportunistically, but holding for the long term seems to be a bad idea, at least looking to history.

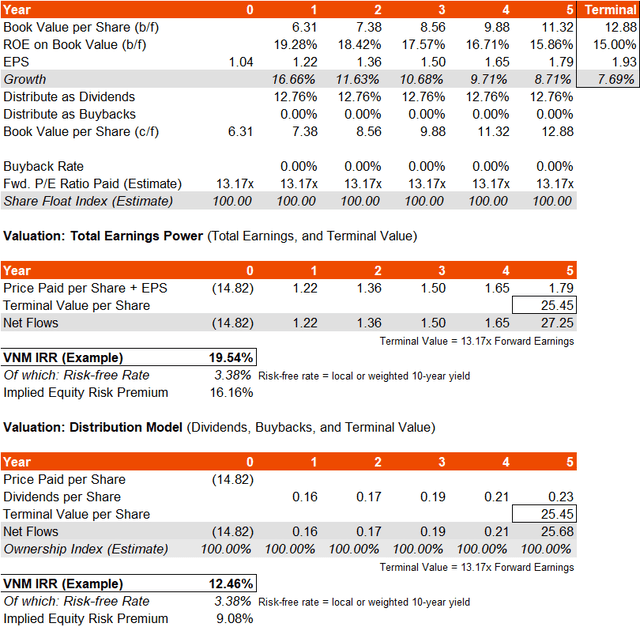

Still, underlying corporate productivity is decent. Morningstar offers a forward price/earnings ratio of 12.23x (or, as of May 31, 2022, about 13.17x), and a price/book ratio of 2.04x. Dividing the latter into the former gives us an implied forward return on equity of 16.68%, which is quite good. Furthermore, we can look to MVIS for a recent factsheet for VNM’s benchmark; this reveals that as of May 31, 2022, the trailing price/earnings ratio for the index (a proxy for VNM’s portfolio) was 15.37x, with a price/book ratio of 2.67x, and an indicative dividend yield of 1.18% (implying a roughly 12.8% earnings distribution rate, into dividends). The benchmark index data also notably suggest a stronger underlying forward ROE of 19.28%.

Morningstar pegs three- to five-year earnings growth at 12.45%, which is probably workable, given VNM’s benchmark index data implying a one-year bump in earnings of about 17%. One reasonable estimation is a trailing off of earnings growth to 2% by our terminal year six, which would also suggest a declining return on equity from around 19% to around 15%. My three-year and five-year average earnings growth rates are 12.21% and 8.91%, respectively; at least both below Morningstar’s number. Vietnam’s core inflation rate was only 1.61% annually in May 2022 though, while average inflation since around 2015/2016 has been 1-2%. So, we should note that this level of earnings growth is not particularly conservative.

Nevertheless, if we proceed on these assumptions, the potential IRR for VNM is something like 12-20%, which is very strong, with the local 10-year government bond yielding only 3.4%.

Professor Damodaran as of January 2022 suggests that the country risk premium for Vietnam is 3.56%. If we were to apply a base mature market risk premium of 5% to 3.56%, we get a sum of 8.56%. Add in the local 10-year yield of 3.38% recently, and you get a net cost of equity of 11.94%. That is still less than my lower bound estimate for the forward IRR, at least based on my own forward earnings stream guesstimate.

Another way of thinking VNM is by looking at the forward price/earnings ratio. If we assume at least 2% earnings growth into perpetuity from hereon in, we should award VNM a forward price/earnings ratio of 1 divided by the net of 11.94% less 2%, or in other words a forward multiple of 10.06x. That is lower than the current 13.17x. If we take into account next year’s earnings bump, we could suggest 11.18x instead (today), but that is still lower than the current forward multiple. So, while the underlying IRR might seem strong, we have to bear in mind that we are assuming the forward multiple will hold up, and it might not.

More optimistically, we could see the Vietnamese country risk premium unwind over time, should the economy become perceivably safer to invest in from an international investor’s perspective. In that case, you might see a contraction in the overall risk premium to something like 5%, which (on a 10-year yield of 3.38%) would lend to a forward multiple of perhaps 15.67x. I did not assume any of this in my model above, but I suppose there are ways for VNM to perform well that are as much to do with risk sentiment and local economic development as earnings power. But as the sector breakdown presented earlier shows, VNM does not boast a sophisticated or technological portfolio, and so long-term equity returns are not likely to be impressive.

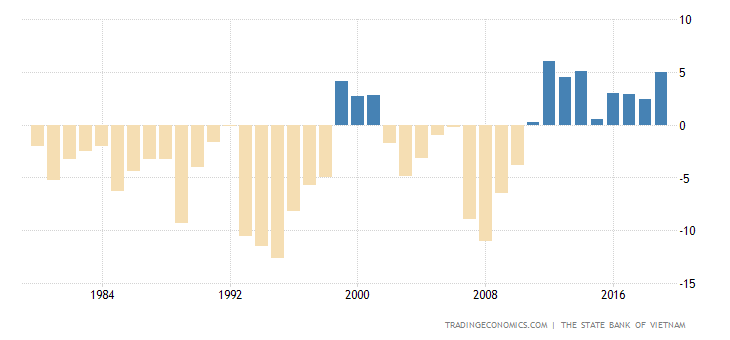

FX is another point. Vietnam’s currency is the “đồng”. Given that Vietnamese rates are similar to U.S. rates, I do not perceive any significant carry trade potential here, however, a country’s current account is another indicator for currency fair values. Vietnam’s current account relative to GDP has strengthened since 2011, and remained within a fairly good bound of 0-5% positive.

TradingEconomics.com

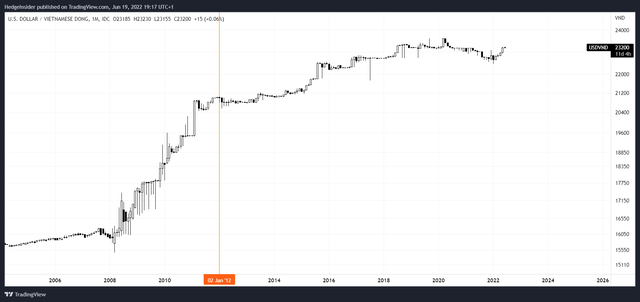

The currency has a “crawling peg” to the USD, although USD/VND has risen since the start of 2012.

What that means is that the Vietnamese local currency is managed by the central bank and essentially “kept cheap”; USD/VND should probably be trading lower, i.e., VND should probably be stronger, but it isn’t due to intervention and a lack of free tradability. That means that Vietnamese corporates have a small FX tailwind in general provided the USD/VND rate remains roughly stable, which should help to continue to support the economy’s current account, while from an investor’s perspective in funds like VNM, potential exchange rate losses are probably going to be quite limited.

In spite of poor historical performance, recent equity market declines may make VNM somewhat attractive at present prices, with a decent IRR potential. I would, therefore, take a bullish stance on valuation alone, especially with a fairly robust FX position. However, given poor historical performance and cyclicality, I would avoid making VNM a large position in any equity portfolio.

Be the first to comment