Andrew Burton/Getty Images News

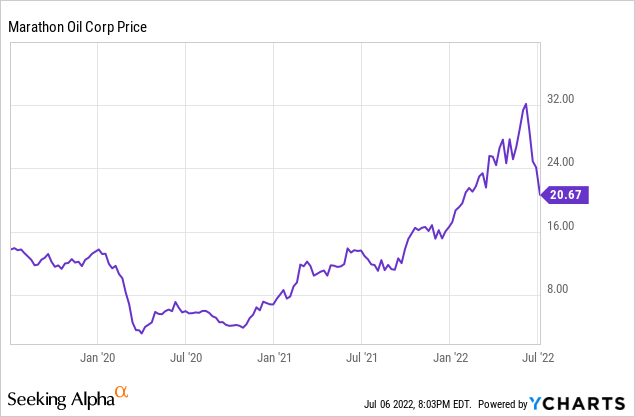

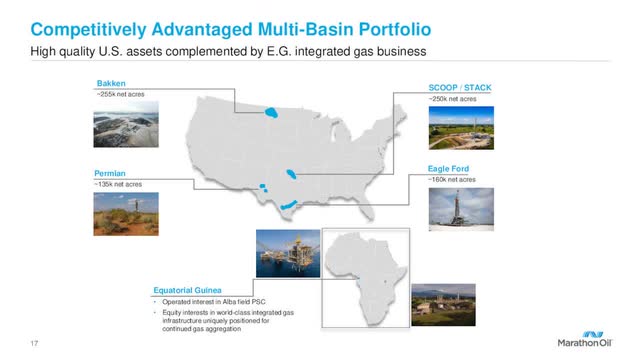

Marathon Oil Corporation (NYSE:MRO) produces oil, natural gas liquids and natural gas in the US and the African country of Equatorial Guinea. The company’s stock price has advanced 56% in the last year, due partly to its investor-friendly share repurchase program, as well as improved oil and gas prices, earnings, and future prospects. In the US, Marathon Oil is primarily active in the Bakken (North Dakota) and Eagle Ford (south Texas), with smaller operations in the New Mexico side of the Permian and Oklahoma’s SCOOP/STACK provinces.

Investors should be aware of the low value of the company’s Equatorial Guinea reserves and production. Additionally, the company’s US activities are mainly outside of the largest oil and gas basins, the Permian and the Appalachian. Marathon Oil is not recommended to dividend-hunters due to a slender (1.5%) dividend.

However, given the recent oil and gas price dips, the company’s debt paydown, precisely its diversified activities outside the Permian, the share repurchase program, and its commitment (and history) to return at least 40% of operating cash flow to investors at WTI prices of $60/bbl or more, I recommend Marathon Oil to energy investors seeking capital appreciation who have a stable-to-constructive outlook for future oil and gas prices.

Investors may recall that despite similar names, Marathon Oil is an upstream oil and gas company distinct from Marathon Petroleum Corporation (MPC), a downstream refiner.

MRO’s First Quarter 2022 Results and Guidance

In the first quarter of 2022, Marathon Oil reported net income of $1.3 billion ($1.78/diluted share). Adjusted net income was $749 million, or $1.02/diluted share. Net operating cash flow was $1.07 billion compared to $622 million for 1Q21.

These results included a loss of -$143 million on derivatives and a non-cash charge of $423 million for depletion, depreciation, and amortization.

The company returned 50% of cash flow from operations to equity investors through nearly $600 million of share repurchases and $52 million in base dividends.

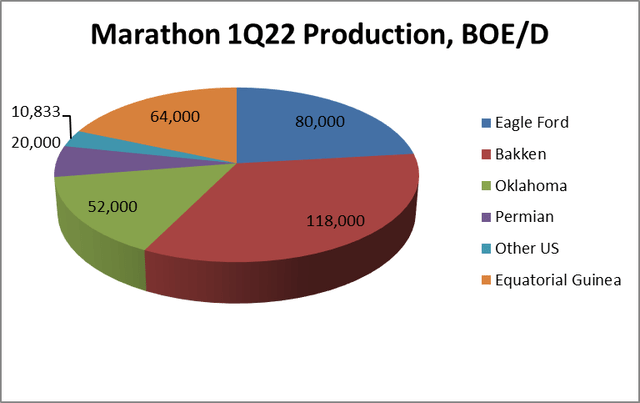

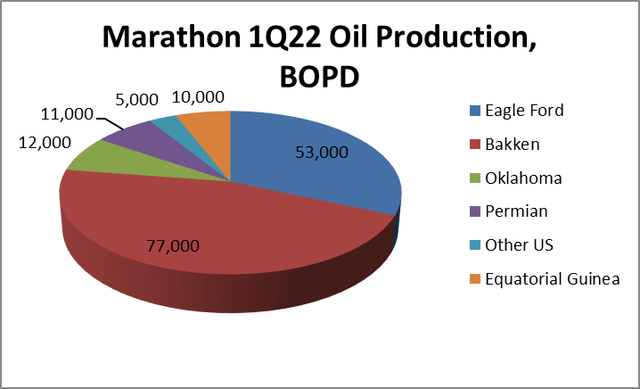

Marathon produced 345,000 net barrels of oil equivalent per day (BOE/D); of that, oil was 168,000 net barrels per day (BPD), or 49%. The graphs below show operational regions.

Starks Energy Economics, LLC & marathonoil.com

Most 1Q22 EG production was low-priced ($0.24/MCF) natural gas.

Starks Energy Economics, LLC & marathonoil.com

In 2021, Marathon Oil’s largest customers were Marathon Petroleum at 17% and Valero Marketing and Supply (VLO) at 10% of sales.

With higher prices in recent months, 2Q22 results can be expected to be even stronger.

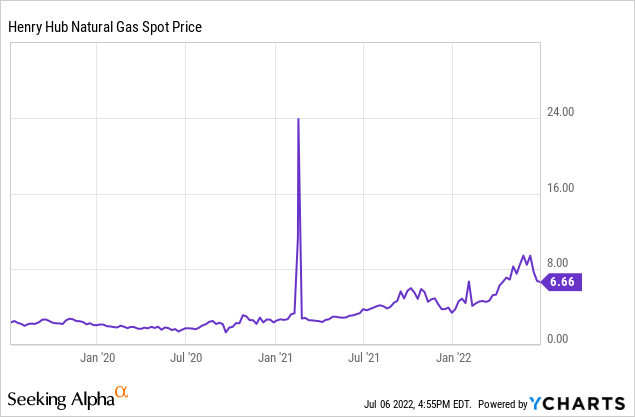

At $80/bbl WTI and $4/MMBTU for Henry Hub natural gas, the company estimates $3.0 billion of 2022 adjusted free cash flow.

(Although the company cited $4.5 billion of adjusted free cash flow in its 2Q22 presentation, that is calculated at $100/bbl WTI oil and $6/MCF Henry Hub natural gas.)

Marathon’s board increased the share repurchase authorization to $2.5 billion effective May 4, 2022. It anticipates continuing to exceed its minimum commitment to return at least 40% of cash flow from operations to investors.

Hedges

At only a third of oil volumes and less than a third of natural gas volumes, Marathon Oil’s 2Q22 hedges do not significantly limit its upside.

US Oil and Gas Prices, Differentials, and Oil Production

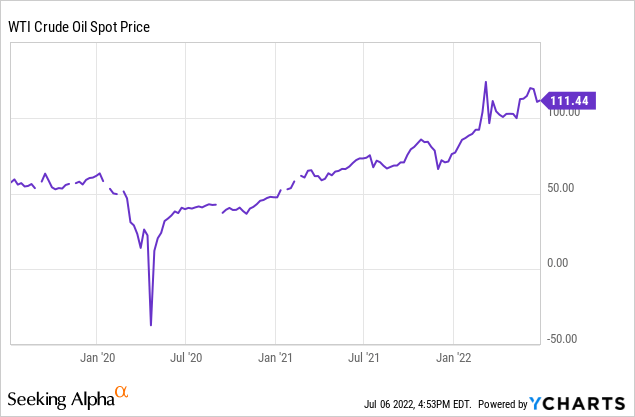

The July 6, 2022, oil futures price was $98.54/barrel for West Texas Intermediate (WTI) crude oil delivered in August 2022.

On July 5, 2022, when WTI was $96.05/barrel, the price for Louisiana Light Sweet oil was $97.23/barrel and the price for Bakken crude oil (North Dakota Light Sweet) was $96.35 per barrel, so all within a narrower band than sometimes occurs.

The July 6, 2022, natural gas futures price for August 2022 delivery was $5.54/MMBTU.

For the week ending June 24, 2022, US oil production was 12.1 million barrels per day (BPD), below the all-time high of 13.1 million BPD in March 2020 but edging up and higher than the February 2021 low of 9.7 million BPD.

Reserves

At December 31, 2021, Marathon Oil’s total proved reserves were 1.1 billion BOE. This divided as 89% US and 11% Equatorial Guinea. Of the total, about 52% is crude oil and condensate.

Proved developed is 68%; proved undeveloped is 32%.

The SEC PV-10 value of the reserves was $12.4 billion, far above the $4.0 billion at year-end 2020. The difference is primarily due to higher prices used for the 2021 calculation compared to the abnormally low prices used in the 2020 calculation.

Only 3.5% of this reserve value ($429 million) is attributable to the company’s Equatorial Guinea holdings.

Competitors

Marathon Oil Corporation is headquartered in Houston, Texas.

In the Williston/Bakken region, Marathon Oil’s competitors include Chord Energy (CHRD) – the new combination of Oasis Petroleum and Whiting Petroleum – going-private Continental Resources (CLR), ConocoPhillips (COP), Devon (DVN), EOG Resources (EOG), Hess (HES), Exxon Mobil (XOM), and smaller companies. The Bakken formation continues into Canada, and Canadian producers also compete for US markets and pipeline space.

In the Eagle Ford, Marathon Oil’s competitors include large companies like BP (BP), Chesapeake (CHK), ConocoPhillips, EOG, and Exxon Mobil as well as several smaller companies, such as SilverBow Resources (SBOW).

The company also has competitors in Oklahoma’s SCOOP/STACK formations and innumerable competitors in the Permian.

The company’s largest competitor in Equatorial Guinea is ExxonMobil.

Governance

At July 1, 2022 Institutional Shareholder Services ranked Marathon Oil’s overall governance as a 3, with sub-scores of audit (5), board (6), shareholder rights (5), and compensation (2). In this ranking a 1 indicates lower governance risk and a 10 indicates higher governance risk.

Short shares were 2.9% of floated shares on June 15, 2022. Insiders own a tiny 0.19% of outstanding stock.

Marathon Oil’s beta of 2.57 represents considerably more volatility than the overall market but is in line with market gyrations for both oil and natural gas prices.

On March 30, 2022, much of Marathon Oil’s stock was held by institutions, some of which represents index fund investments that match the overall market. The four largest institutional holders of Marathon’s stock were Vanguard (12.0%), Blackrock (7.6%), State Street (6.8%) and Hotchkiss & Wiley (5.4%).

Vanguard, BlackRock, and State Street are signatories to the Glasgow Financial Alliance for Net Zero, a group that, as of May 31, 2022, manages $61.3 trillion in assets worldwide and which (despite less energy supply due to reduced Russian exports to Europe) limits hydrocarbon investment via its commitment to achieve net zero alignment by 2050 or sooner.

Financial and Stock Highlights

The company’s 52-week price range is $10.41-$33.24 per share, so its July 6, 2022, closing price of $20.68 is 62% of its 52-week high and 61% of its one-year target of $33.96. Market capitalization is $14.6 billion.

Marathon Oil’s trailing twelve months’ earnings per share (EPS) is $2.86 for a price/earnings ratio of 7.2. The average of analysts’ 2022 and 2023 EPS estimates is $4.88 and $4.17, respectively, for a forward price-earnings ratio range of 4.2-5.0.

Twelve-month return on assets is 6.1% and return on equity is 19.5%.

Trailing twelve-months operating cash flow is a hefty $3.7 billion and levered free cash flow is $1.9 billion.

Marathon Oil increased its dividend to $0.32/share for a dividend yield of 1.5%. As noted, it also is continuing a substantial share repurchase program.

At March 31, 2022, the company had $6.6 billion in liabilities, including $3.9 billion of long-term debt and another $100 million of long-term debt due within a year (long term debt is now more than a billion dollars reduced from a year ago.)

Marathon Oil had $18.0 billion in assets giving it a liability-to-asset ratio of 37%. The company’s ratio of debt to market capitalization is 0.27. The debt-to-EBITDA ratio is a comfortable 1.05.

The company’s mean analyst rating is a 2.5, between “buy” and “hold” from twenty-seven analysts.

Notes on Valuation

With an enterprise value (EV) of $19.3 billion, the EV/EBITDA ratio is 5.0, well below the maximum preferred ratio of 10 or less, suggesting the stock is a bargain.

The company’s book value per share of $15.85 is below the current market price, indicating positive investor sentiment.

Market capitalization per flowing BOE is $42,400 while the market cap per flowing barrel of oil is $87,113. This more-than-doubling reflects the inclusion of lower-valued natural gas and natural gas liquids in the BOE calculation, particularly Marathon’s receipt of only $0.24/MCF for its EG gas.

Summarizing, the company has assets of $18.0 billion, liabilities of $6.6 billion, market capitalization of $14.6 billion, enterprise value of $19.3 billion, and 2021 SEC PV-10 reserve value of $12.4 billion.

Positive and Negative Risks

Potential investors should consider their oil and natural gas price expectations as the factors most likely to affect Marathon Oil. The Bakken Tier 1 core is smaller than the Permian. Additionally, while the Eagle Ford is prolific and sizable, its reserves are also smaller (and more gas-prone) than the Permian.

Two newer, more prominent risk factors are — despite the desperate need for hydrocarbons and consequent high prices — first, the drumbeat of eliminating hydrocarbon use (by countries) and refusing to finance its development (banks, investment funds, and international lenders). Second is the extreme political risk in the US, the locus of most of Marathon Oil’s operations as the Biden administration does all in its regulatory power to halt US oil and gas development (supply) while — bizarrely — also wishing to bring down prices.

Although the Supreme Court’s decision in favor of West Virginia and against the EPA may lessen regulatory overreach, the real factor in the US to bringing down prices for customers (and revenues for oil/gas producers) is dampening of demand due to high prices. This is already occurring.

However, because of relative fuel and regulatory inflexibility, price reaction alone will not address the severe shortages in Europe as that continent seeks to/is forced to reduce imports of Russian oil, gas, and coal after the Russian invasion of Ukraine. They are doing so with fuel substitution (coal, oil for natural gas), conservation, and building increased liquefied natural gas import infrastructure.

International operations bring their own set of different political risks; however, since Equatorial Guinea depends on oil and gas production for its GDP and fiscal revenues, both it and Marathon Oil are incentivized to keep volumes flowing.

Recommendations for Marathon Oil

With higher revenues, Marathon Oil has paid down debt and so increased its balance sheet flexibility. It has instituted a big share repurchase program. Its dividend is small, but it has instituted a big share repurchase program. MRO’s stock is a bargain based on EV/EBITDA and price-earnings ratios.

As with any hydrocarbon company in the US, Marathon unfortunately has significant political risk from both the current administration and banks and hedge funds that expect rapid hydrocarbon production phaseouts.

While Marathon Oil is not recommended to dividend-hunters, I recommend it as a now-lower-priced opportunity for energy investors with a stable oil and gas price outlook interested in diversifying across US basins.

The company has already lived up to its commitment to return at least 40% of operating cash flow to investors at WTI prices of $60/bbl or more and is in excellent position to continue to do so.

marathonoil.com

Be the first to comment