In times of uncertainty, it’s important to go back to basics and to do the simple things well. kozmoat98/E+ via Getty Images

Energy prices right now are controlling headlines globally as a main driver of inflation and, therefore, interest rates, sending the world headlong into a recession. Throw in an already weakened global economy from COVID-19 and every investor is right to feel nervous about the impacts to their portfolio.

In order to navigate uncertainty in the markets, it’s important to keep your focus on the principles of successful investing, and that includes filtering out noise, seeing the bigger picture, investing in high-quality businesses, and always having a plan (and sticking to it).

One of those plans should include shoring up your portfolio with stocks in industries resistant to inflation, high interest rates, recessions, and geopolitical turmoil. One of those industries shaping up to be a great contender is the oil & gas industry. Relatively protected from inflation and interest rates, and with geopolitical turmoil driving higher energy prices, this leads me to search for opportunities here worth considering.

Today’s piece looks at a crude oil and gas exploration and production company, Marathon Oil Corporation (NYSE:MRO). To begin, we’ll break down the firm’s basic financial health to search for areas of concern, consider a broad view of whether the firm’s valuation is attractive, and then search for a more specific pricing mechanism based on peer comparison. So, let’s dig in…

(Data & prices correct as of pre-market 6th September, 2022)

(The Top Oil and Gas Exploration and Production Stocks referred to can be found on this Seeking Alpha screener)

Want to skip the analysis & go straight to finding out who had the best (or worst) valuations in Oil & Gas? Download my research for free here

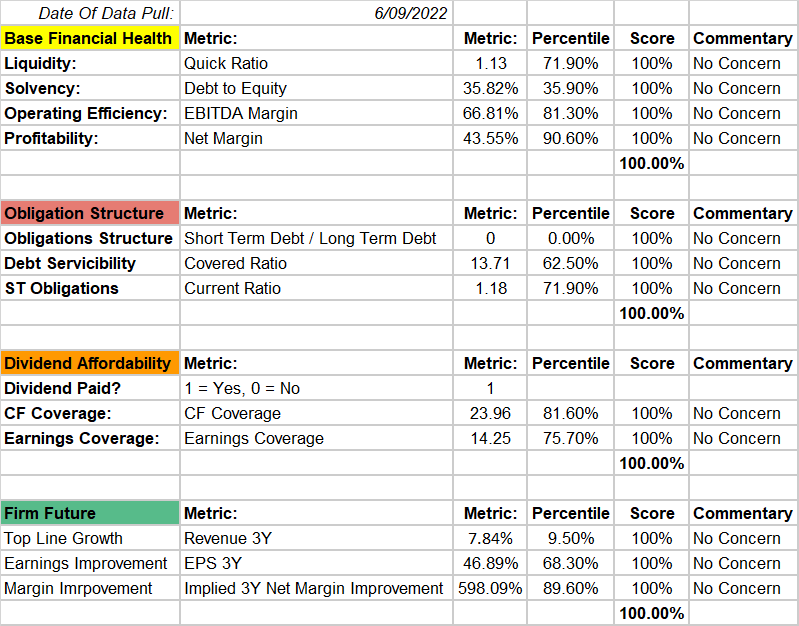

Marathon Oil Corporation’s Base Financial Health

In my time analyzing companies, firms with a perfect score for their base financial health are a rarity, and as such, there is a strong initial case for a premium valuation.

MRO certainly looks to be worthy of such an opinion, with market-leading margins, low debt, good coverage of obligations, well-covered dividends and very solid future outlooks.

A balance sheet in this condition affords a firm’s management almost limitless options to take on risk and chase opportunities.

Author, Seeking Alpha

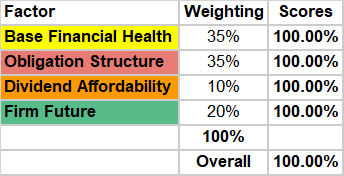

Perfect scores all round, perfect overall score. Nothing more to see here.

Author, Seeking Alpha

Assessing Marathon Oil Corporation’s Pricing Attractiveness

With the picture of perfect financial health in the back of our minds, we now turn to valuation attractiveness, which begins to consider how the market is pricing MRO and its performance compared to its peers.

What grabs my attention immediately is the P/E, P/B and P/FCF ratios. These scores are calculated as the inverse of the metric’s percentile ranking in the peer group. In short, the bigger the score, the cheaper the valuation compared to its peers.

Author, Seeking Alpha

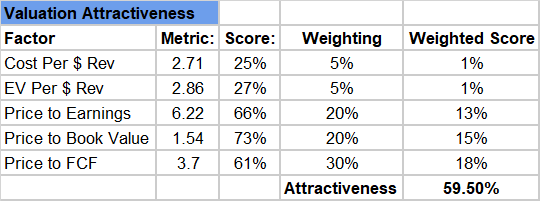

Finding An Appropriate Valuation Method For Marathon Oil Corporation

Now is the exciting part of our analysis, and that is attempting to find the ideal pricing mechanism for the firm.

Firstly, we eyeball the long list of pricing mechanisms for normal and abnormal pricing metrics and then look at which metrics correlate strongest with how the market prices firms.

Luckily for us, we’ve already gone through the process of finding which metrics we should lean on, so we can rely on past homework.

Author, Seeking Alpha

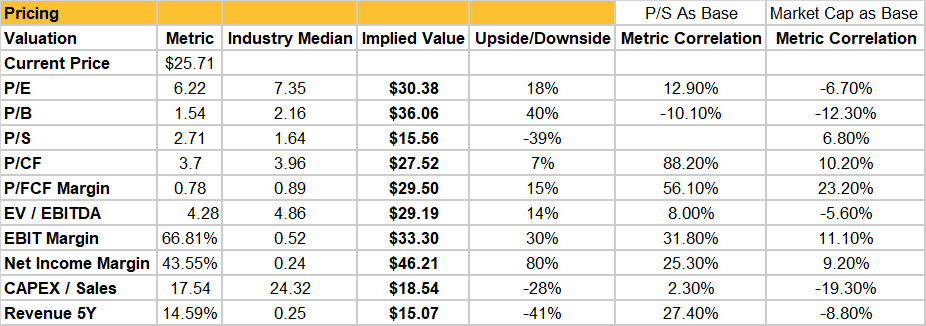

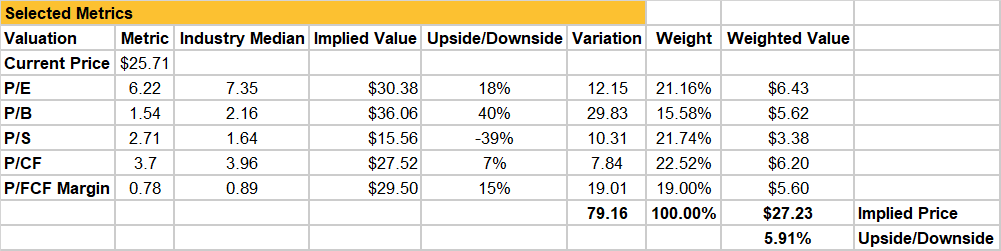

Using a mix of the oil and gas industry’s most reliable metrics brings us a pretty meager 5.9% upside risk. However, recall a perfect financial health score means we can choose to use this as a base scenario, and look more favorably at metrics offering us a more premium valuation for the firm.

Author, Seeking Alpha

Closing Remarks

While the oil and gas industry peer comparison pricing metrics suggest only a 5.9% upside scenario, I believe we can afford to have hope, thanks to the firm’s perfect financial health. I’m going to suggest investors see MRO as a good buy opportunity, with price targets closer to the +15%/+18% range in-line with P/E and P/FCF metrics, with a super-upside target of +40% thanks to the P/B ratio.

With my own views around the likelihood of an impending Fed-driven recession, paired with the energy market’s historical outperformance in high-inflationary environments and geopolitical instability driving higher energy prices, I see a period of opportunity ahead for energy firms.

Author’s Note: The commentary in this article is general in nature and does not consider your personal circumstance. The opinions expressed in this article are opinions only, and data referenced is sourced from third-party sources including Seeking Alpha and other publicly available sources.

I make no warranties or guarantees around any of the views expressed in this article and suggest all investors consider my writing to be for interest purposes only and not considered exhaustive investment research or advice.

Be the first to comment