AUD/JPY, Covid-19 Vaccines, Wall Street, RBA – Talking Points

- S&P 500 climbs to record close as Wall Street cheers improving unemployment claims

- RBA Governor Philip Lowe stays course with dovish outlook in address to lawmakers

- AUD/JPY prices find resistance at Descending Triangle’s upper bound

Recommended by Thomas Westwater

Get Your Free Top Trading Opportunities Forecast

The S&P 500 closed at a record high Thursday after US jobless claims data injected a fresh dose of optimism into economic recovery prospects. Initial jobless claims for the week ending January 30 crossed the wires at 779k, beating the 830k estimate, according to the DailyFX Economic Calendar. The small-cap Russell 2000 index and Nasdaq Composite also registered record-high closing prices, gaining 1.98% and 1.23%, respectively.

A series of tailwinds ranging from increased fiscal stimulus chances to vaccine distribution efforts have helped push US equity prices higher. The United States is seeing a 7-day average of 1.3 million vaccine doses administered per day as of February 3, according to the Centers for Disease Control and Prevention (CDC). That figure is up from the 255k doses per day average seen at the start of the year.

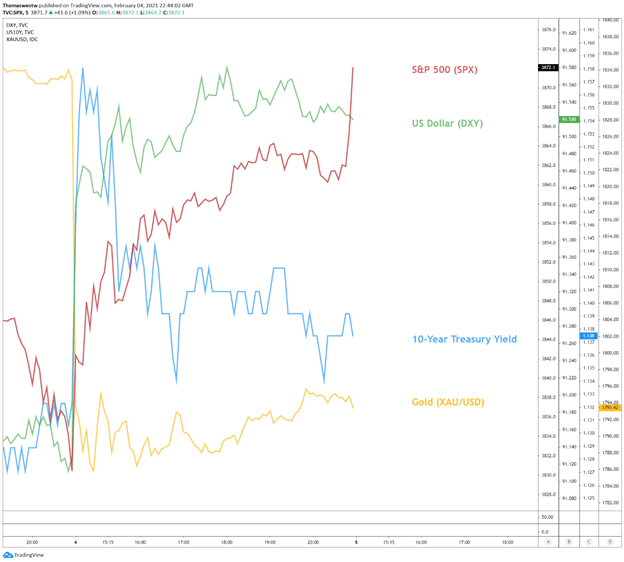

Elsewhere, Treasury yields and the US Dollar continued to climb as markets focus on positive developments on President Joe Biden’s $1.9 trillion stimulus package. The House cleared a hurdle on Wednesday that clears a path for Democrats to pass the aid package without GOP support. Mr. Biden is still hoping to gain bipartisan support but it appears they are readying to press ahead with only blue votes.

S&P 500, US Dollar, 10-Y Treasury Yield, Gold – 5 Minute Chart

Chart created with TradingView

Friday’s Asia-Pacific Outlook

Wall Street’s optimism may spill over into the Asia-Pacific trading session to close out the week. APAC equities moved lower on Thursday. Australia’s ASX 200 index retreated 0.87% despite strong export figures for December. The Australian Dollar fared better from the trade data, moving higher against the Japanese Yen and New Zealand Dollar.

China’s Shanghai Composite recorded a 0.44% loss. The People’s Bank of China has unexpectedly been removing liquidity from its money markets this year. The PBOC may be attempting to curtail potential asset bubbles to help insulate China’s economic recovery from possible market shocks. However, the pace of tightening has eased this week.

Speaking Friday morning to lawmakers, Reserve Bank of Australia (RBA) Governor Philip Lowe reiterated that the path for interest rates will stay suppressed for some time. The RBA chief praised the strong recovery seen thus far in the Australian economy but cited low inflation and wage growth as a headwind to the bank’s policy outlook. The comments follow last week’s rate decision where an additional A$100 billion round of bond buying was announced.

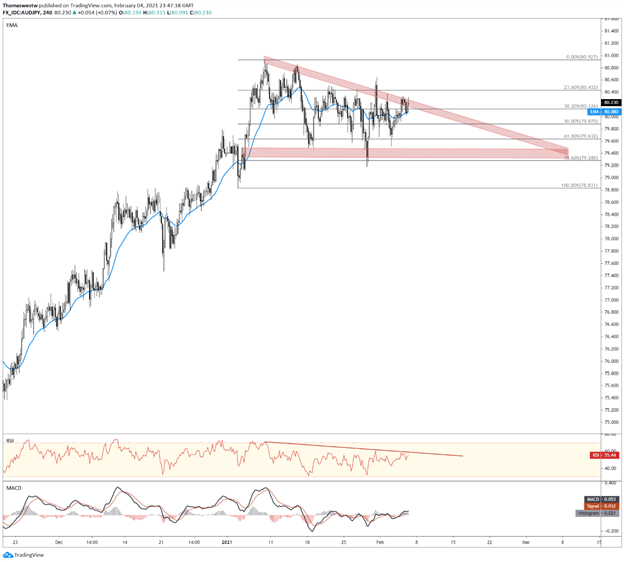

AUD/JPY Technical Outlook

The Australian Dollar’s rise against the Japanese Yen has pushed prices up against the upper bound of a Descending Triangle. If AUD/JPY can manage to break above resistance, it may resume its preceding trend higher. Currently, the MACD oscillator appears bullishly positioned and the Relative Strength Index is climbing within neutral territory. A move lower would look for the triangle’s horizontal resistance to provide support.

AUD/JPY4-Hour Chart

Chart created with TradingView

Recommended by Thomas Westwater

Improve your trading with IG Client Sentiment Data

AUD/JPY TRADING RESOURCES

— Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwateron Twitter

Be the first to comment