KEY POINTS:

- USD/JPY Bounces as Markets Seek Dollar Safety on Increased Geopolitical Tensions.

- Japanese Data Continues to Disappoint Capping Yen Gains.

- 100-Day MA Remains a Stumbling Block for Further Upside.

Recommended by Zain Vawda

Get Your Free JPY Forecast

Most Read: USD/JPY Eyeing Deeper Retracement as Dollar Index Rises

USD/JPY FUNDAMENTAL BACKDROP

USD/JPY dropped lower Tuesday during the US session as a softer US PPI print for October saw the dollar face renewed selling pressure. The pair bounced from lows around 137.60 before rallying in Asian trade to a high of 140.300. The bounce and dollar reprieve came about as a consequence of rising geopolitical tension as rumors of a missile attack on NATO member Poland filtered through.

NATO members are scheduled to meet later today which could keep markets on edge. Early comments from Poland and US President Joe Biden hint at an effort to de-escalate the situation, with President Biden stating that the trajectory of the missiles make it unlikely that it originated from Russia. This should provide markets with a sense of calm ahead of the NATO meeting. Should we see risk-off sentiment return following the meeting dollar bulls could make a comeback.

Recommended by Zain Vawda

How to Trade USD/JPY

The Yen has failed to capitalize on dollar weakness in the early part of the week due to a host of lackluster data releases. GDP growth missed estimates coming in at -1.2% compared to estimates of 1.1% while earlier today machinery orders came in at a paltry 2.9%. The contraction in GDP and poor machine orders are likely to keep the yen from significant gains against the greenback.

Customize and filter live economic data via our DailyFX economic calendar

Later in the day US retail sales data will be released while Federal Reserve policymakers John Williams and Mary Daly are scheduled to speak. A positive retail sales figure could result in some dollar strength as markets look ahead to the Feds December meeting.

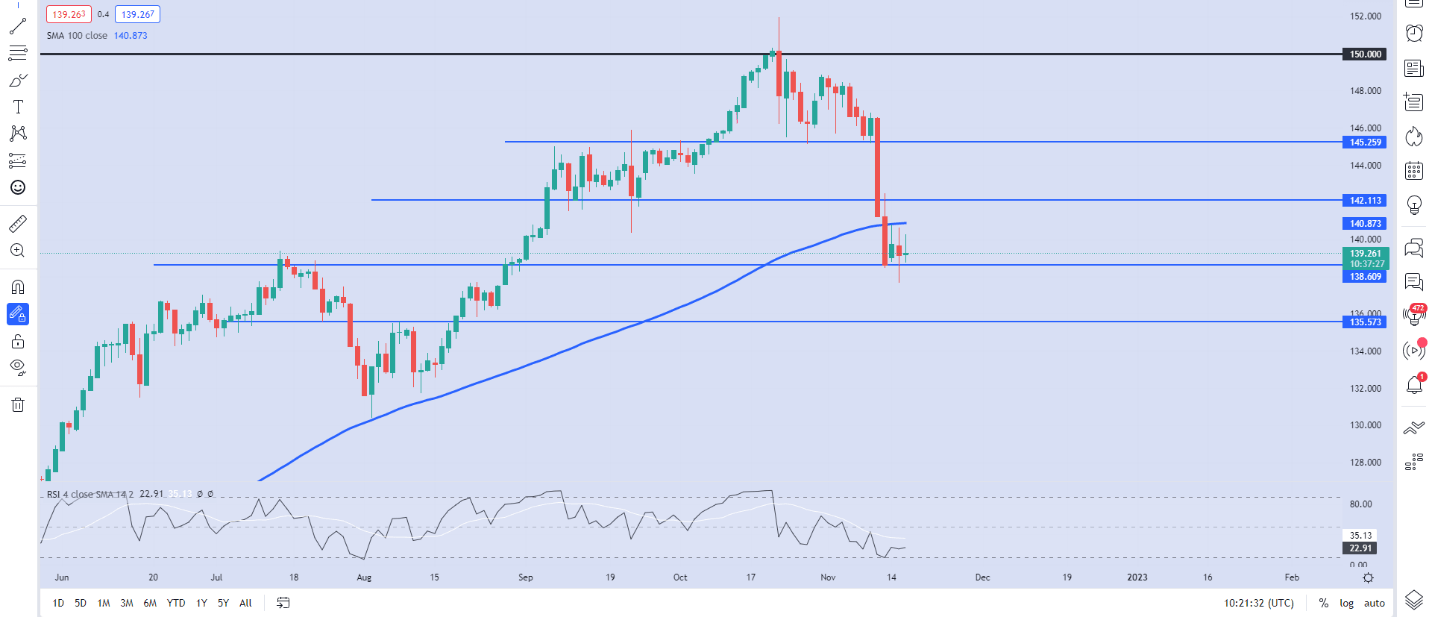

USD/JPY Daily Chart – November 16, 2022

Source: TradingView

From a technical perspective, the pair saw a decline of 800 pips last week with the weekly candle engulfing five weeks of bullish price action. Following the test of the 100-day MA on Monday the pair has struggled to break any higher.

Yesterday’s daily drop failed to result in a candle close below the support area resting around the 138.60 with a daily candle close below opening up the potential for further downside. This highlights the continued indecisive nature of the pair at present with the RSI remaining in oversold territory. Should the pair eye a deeper retracement the 100-day MA will need to be cleared first with the 142.00 the next key area of resistance.

Introduction to Technical Analysis

Relative Strength Index (RSI)

Recommended by Zain Vawda

Key intraday levels that are worth watching:

Support Areas

•138.600

•137.500

Resistance Areas

•140.900

•142.000

Resources For Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicators for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Be the first to comment