tongpatong/iStock via Getty Images

A Quick Take On Zevia PBC

Zevia PBC (NYSE:ZVIA) went public in July 2022, raising approximately $150 million in gross proceeds from an IPO that was priced at $14.00 per share.

The firm sells a range of canned beverages with no sugar or calories and sweetened by the stevia plant extract.

While ZVIA isn’t in the clear yet due to ongoing inflationary pressures, the stock is definitely worth putting on a watch list.

Zevia Overview

Encino, California-based Zevia was founded to design and market consumer beverages that have no sugar and are naturally sweetened by the stevia plant.

Management is headed by Chief Executive Officer Amy Taylor, who has been with the firm since March 2021 and was previously president and Chief Marketing Officer at Red Bull.

The company’s primary offerings include:

-

Sodas

-

Energy drinks

-

Teas

-

Mixers

-

Kidz

The company distributes its products via distributors across the United States and Canada.

Zevia’s Market & Competition

According to a 2021 market research report by Market Research Future, the global non-alcoholic beverages market is forecast to reach $1.07 trillion by the end of 2024.

This represents a forecast CAGR of 4.61% from 2021 to 2024.

The main drivers for this expected growth are a growing popularity of energy/sports drinks and increasing consumer demand for product choice.

Also, the market is segmented by packaging type, product type, distribution channel and region.

Major competitive or other industry participants include:

-

The Coca-Cola Company

-

Keurig Dr. Pepper

-

PepsiCo

-

National Beverage

-

Monster

-

Red Bull

-

Emerging brands

Zevia’s Recent Financial Performance

-

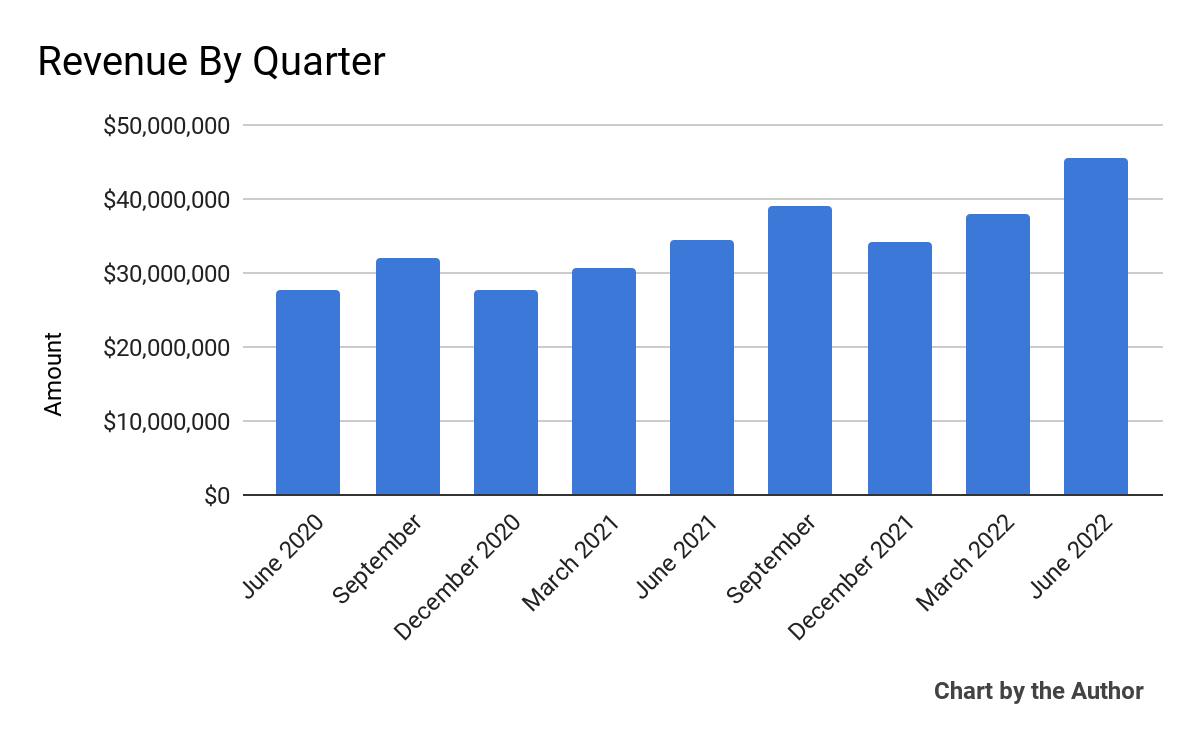

Total revenue by quarter has grown as the chart shows below:

9 Quarter Total Revenue (Seeking Alpha)

-

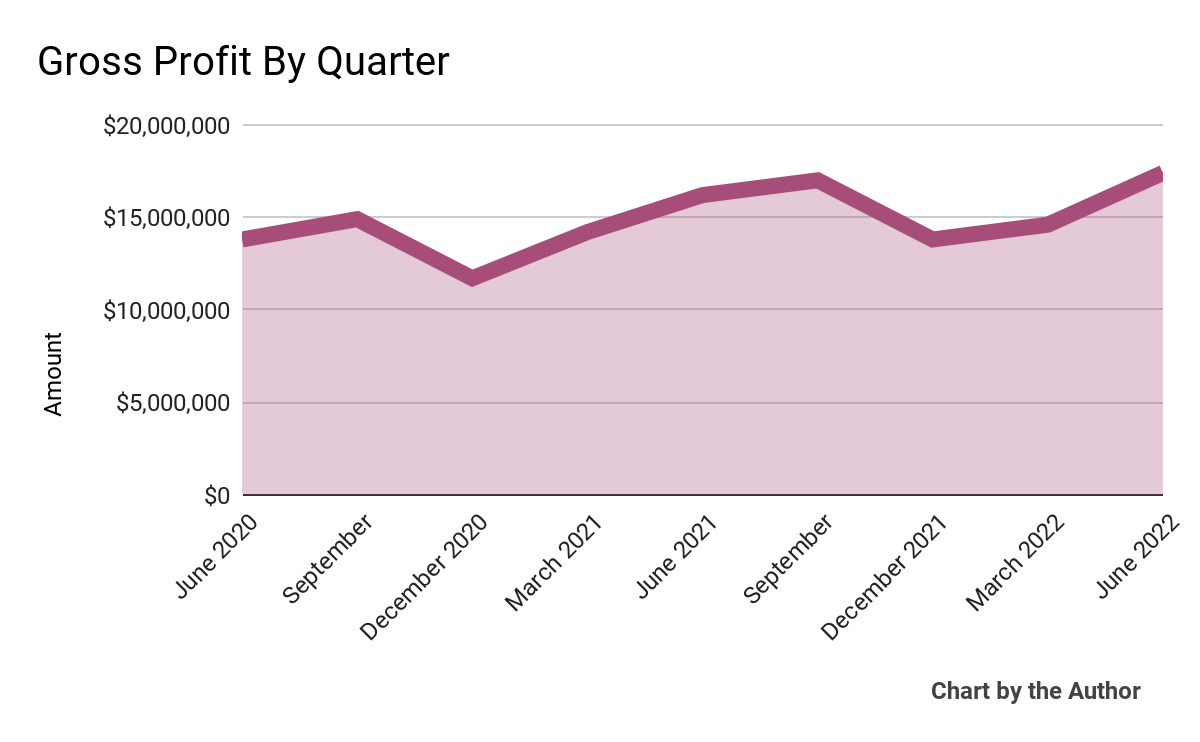

Gross profit by quarter has also trended upward:

9 Quarter Gross Profit (Seeking Alpha)

-

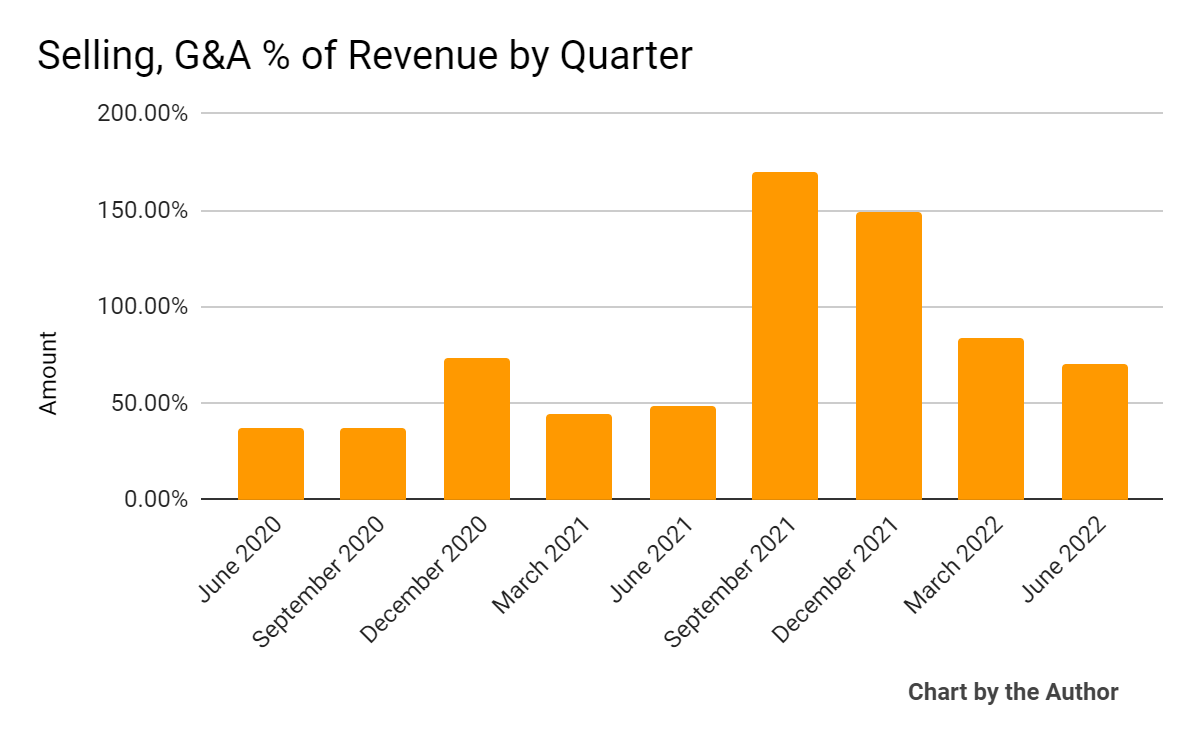

Selling, G&A expenses as a percentage of total revenue by quarter have trended higher as revenue has increased:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

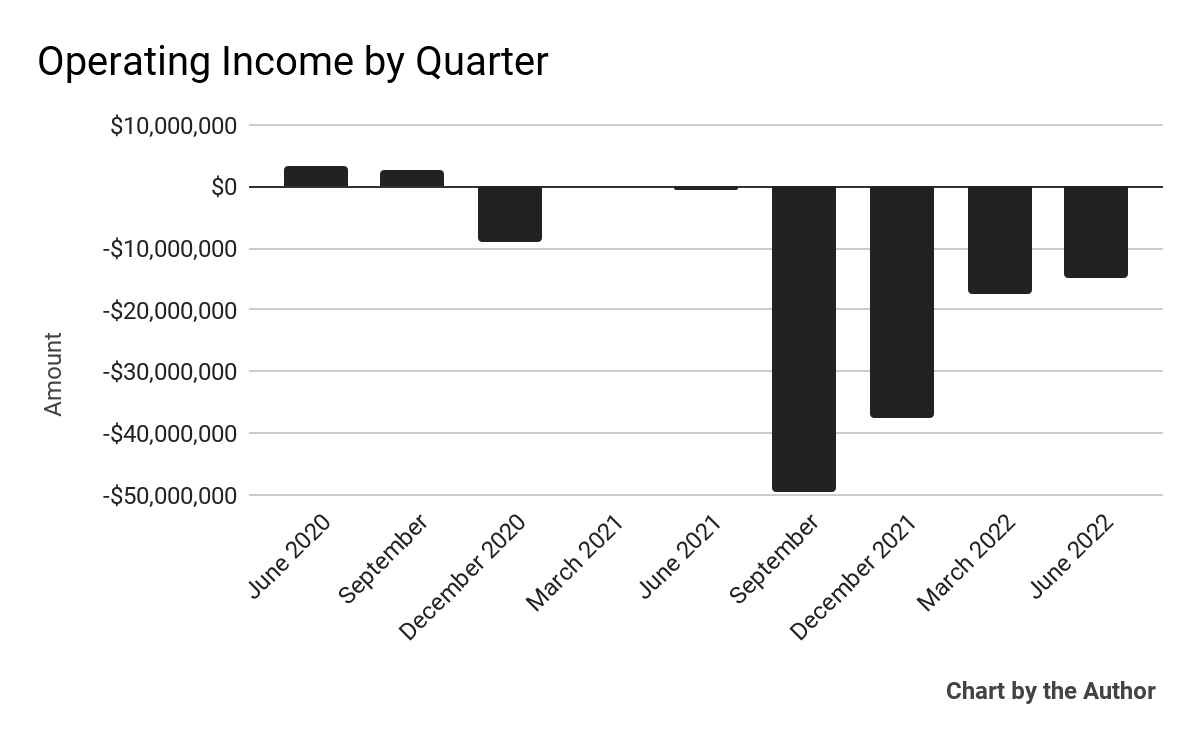

Operating income by quarter has remained substantially negative, as the chart shows here:

9 Quarter Operating Income (Seeking Alpha)

-

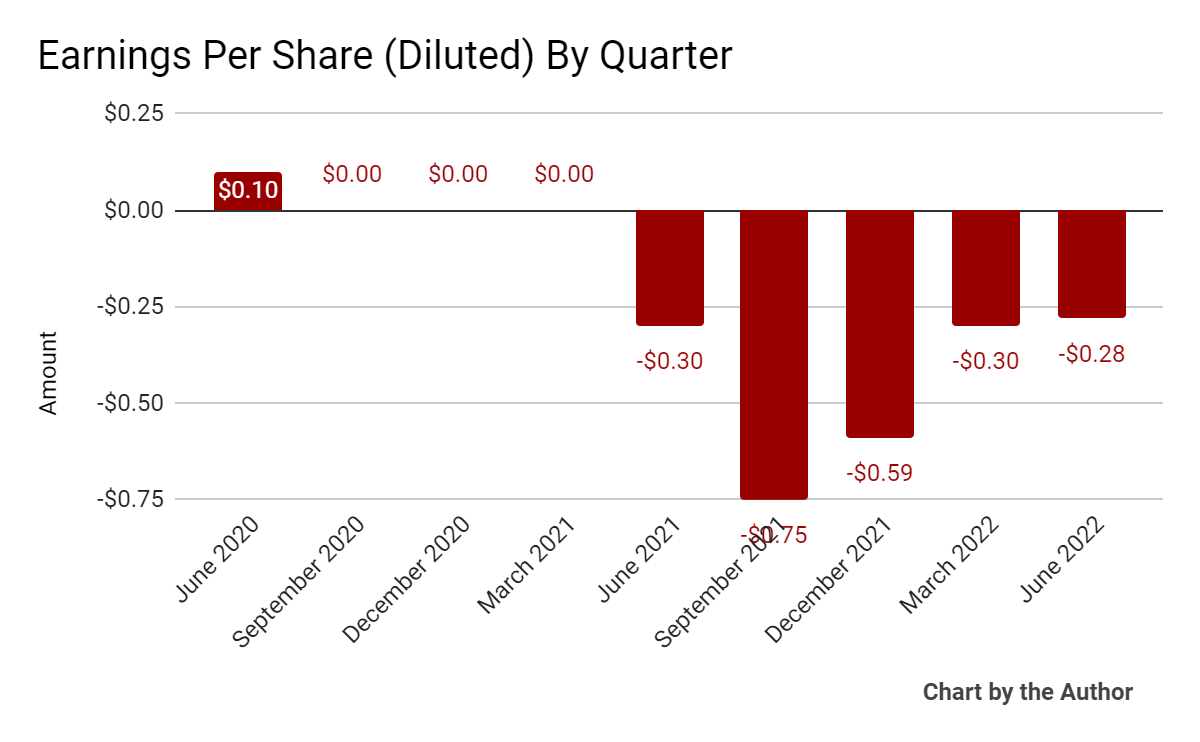

Earnings per share (Diluted) have also remained negative:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

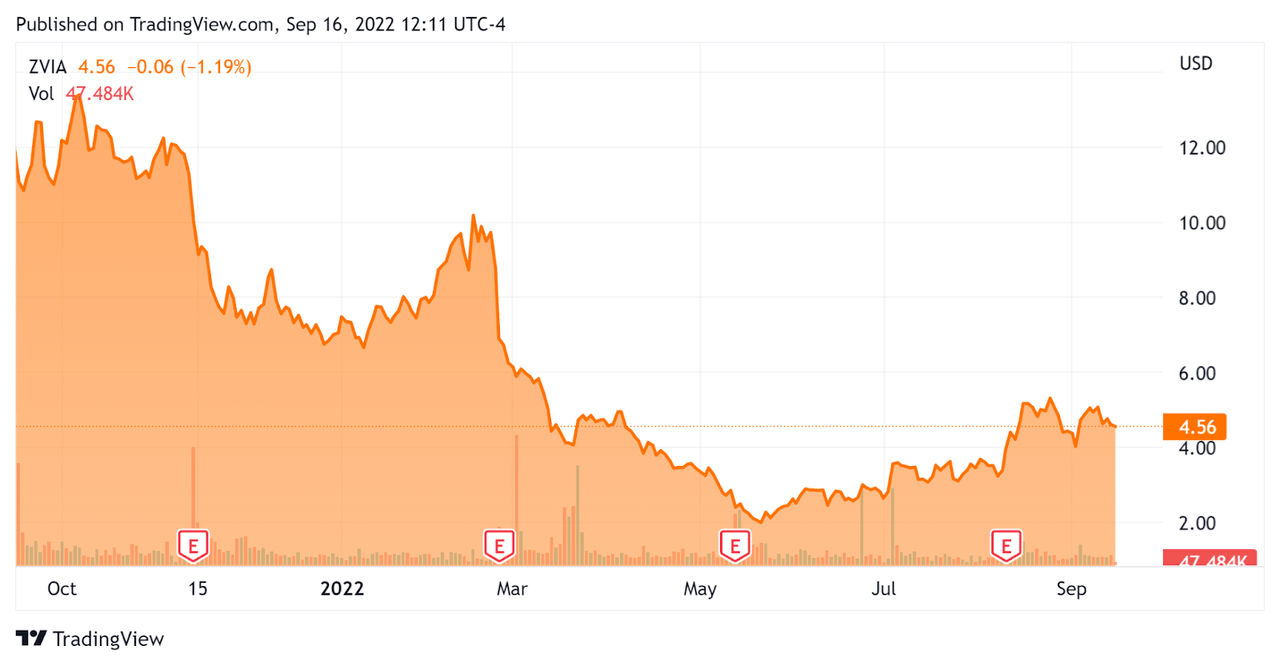

Since its IPO, ZVIA’s stock price has fallen 67.3% vs. the U.S. S&P 500 index’ drop of around 14.4%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Zevia

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

0.81 |

|

Revenue Growth Rate |

25.5% |

|

Net Income Margin |

-44.3% |

|

GAAP EBITDA % |

-75.3% |

|

Market Capitalization |

$316,400,000 |

|

Enterprise Value |

$126,440,000 |

|

Operating Cash Flow |

-$37,320,000 |

|

Earnings Per Share (Fully Diluted) |

-$1.92 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be National Beverage (FIZZ); shown below is a comparison of their primary valuation metrics:

|

Metric |

National Beverage |

Zevia |

Variance |

|

Enterprise Value / Sales |

3.40 |

0.81 |

-76.2% |

|

Revenue Growth Rate |

4.9% |

25.5% |

415.4% |

|

Net Income Margin |

12.3% |

-44.3% |

–% |

|

Operating Cash Flow |

$117,090,000 |

-$37,320,000 |

-131.9% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

Commentary On Zevia

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted a positive shift in mix and strong early indicators of consumer acceptance of recent and forthcoming retail price increases.

Also, the company doesn’t appear to have supply chain problems, at least through the remainder of 2022.

Zevia expanded its kids’ line of products, added to its club channel which brought in a high percentage of new customers.

As to its financial results, net sales rose 32.5% year-over-year which management said was double that of the ‘broader non-alcoholic beverage category.’

The company recently instituted a 6% price increase on its 6-pack soda packages followed by a 10% increase across its entire soda category on August 1.

However, selling & marketing expenses rose 30% in part due to inflation and G&A expenses grew by 4.2%, year-over-year due to higher headcount. Stock-based compensation was $8 million in Q2.

For the balance sheet, the company finished the quarter with $49.6 million in cash and equivalents and no debt.

Over the trailing twelve months, free cash used amounted to $40.0 million, of which $11.4 million was used to increase inventory.

Looking ahead, management reiterated its full year 2022 guidance, with expected revenue growth of 30% at the midpoint of the range.

Regarding valuation, compared to a January 2022 basket of publicly held Beverage company stocks compiled by noted valuation expert Dr. Aswath Damodaran, the market is currently valuing Zevia at a substantial discount on an EV/Sales basis, with ZVIA now at 0.81x versus the basket of 4.97x.

In my view, the market has likely overreacted to the firm’s operating losses, which have now turned toward breakeven and have more room to improve as the company has passed through multiple price increases, which appear to be acceptable to consumers.

As a result, revenue and gross profit are poised to grow further, while operating breakeven may be in sight by year end.

While ZVIA isn’t in the clear yet, the stock is definitely worth putting on a watch list.

Be the first to comment