JHVEPhoto

Dear readers/followers,

First things first – I’m very long Manulife (NYSE:MFC) at this point, having invested 2.8% of my portfolio into the company as things have dropped and dropped more successively. Despite what can be viewed as extremely stable trends across the board for the company, with strong performance across all business segments, the market isn’t yet convinced by the company.

That’s fine by me – it means I can buy more cheaply, and that’s exactly what I’m doing.

Revisiting Manulife

It’s no secret that I’m a heavy investor in global finance, and I invest heavily in banking, insurance, and asset management across the world. Not just US or Canada, but Sweden, Norway, Germany, France, and other nations. Some of you might expect Unum (UNM), and I did own it – but I now own key holdings in things like Allianz (OTCPK:ALIZY), Munich RE (Murgy) Scotiabank (BNS) and many others.

Manulife though, is a worthy addition to this storied list of great financial companies.

Why?

Because the company has the qualities I look for in a great financial business.

- Its credit rating is A.

- Its payout ratio, despite a 6% yield, is very conservative

- Its upside is nearly 50% on a conservative 10-11X forward P/E.

- It has managed the post-financial crisis years very well.

- The forecast calls for annual earnings growth of 9-11% on average, going beyond 2022.

Manulife is the largest insurance company in all of Canada. It’s also one of the largest fund managers in the world based solely on AUM, and their Manulife Bank of Canada is a wholly-owned subsidiary of Manulife. It’s a market leader in terms of the past 5 years in overall TSR while also managing increasing dividends, and its normalized payout ratio is well below 50% at the time in terms of EPS.

I’ve mentioned before that part of what attracts me to Manulife is its superb fundamentals and positioning.

- The growing emerging market middle class, where Manulife is well-positioned to grow as the need/desire for insurance increases.

- An aging, global population, necessitates the need for more healthcare/insurance along with a heightened perception of the importance of insurance.

- The company operates in 13 overseas, Asian markets, with 115,000 company agents with access to 30 million customers. The company has scale along its three global businesses, and it has good adoption for digital thus far.

While Asia (and China specifically) isn’t an easy geography, and likely not to get any easier, I view the company’s foundations as safe enough to offer a substantial, great upside here despite these. The biggest risk and part of the reason why the company is being punished as it currently is its reliance on Asia as a market for new ventures and growth – but not just China, thankfully. It’s also Vietnam, Japan, Cambodia, Indonesia, and other markets.

The official 2022-2025 targets include a heavier focus on digital and tech, investing in Asia, accelerating growth through its agency force, and exclusive bancassurance (basically a sort of agreement between a bank and an insurer, which allows the insurer exclusive rights to sell to the bank customer base), and optimization of legacy.

Focus metrics are expense efficiency goals, employee engagement, and better portfolio contribution from higher-margin segments, all of which are expected to drive growth.

On a high level, MFC is exactly the sort of major insurance company you want to invest in. With a solid legacy core and a promising growth market and rock-solid fundamentals. The legacy continues to be solid in the latest reporting period of 2Q22, and even Asia showed significant growth.

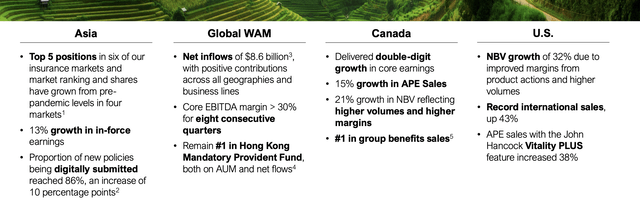

MFC IR (MFC IR)

The company is also taking advantage of the significant valuation weakness by repurchasing shares. So far, a reduction of 2% of SO has been achieved by buybacks, and more seems to be coming. The solid results despite macro and lockdowns are worth highlighting especially here.

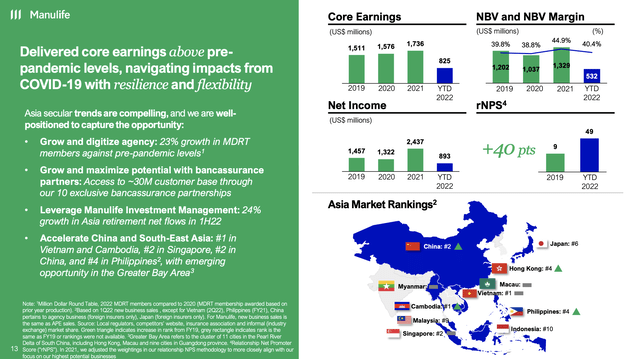

MFC IR (MFC IR)

Note that the graphs show YTD comparisons, not YoY, which is why they are as low as they are. For the full year, I expect results more or less in trend with 1H22, based on current acceleration. The company is, as you can see, expanding its push into Asia, and I’m pleased that China is not the #1 market.

Over $1.5B worth of core earnings despite the current environment is superb, even if this represents a single-digit drop YoY and impacts from unfavorable market trends, lower gains in NBV, and a reinsurance transaction. This is also part of what is pushing the valuation to quite “bottom” levels here.

Legacy, meanwhile, continues to show strength with good core earnings growth in Canada and USA. Much of the decline in the company’s sales in Asia were offset by growth in North America.

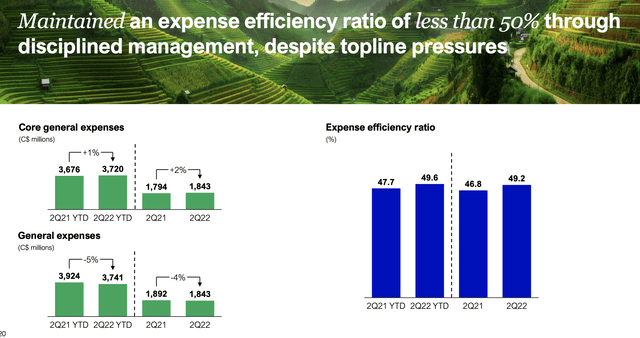

The asset management business continues to generate good results as well, with only slight drops in the margin, AUMA, and Net fee income yield; which, considering the environment, is very good. I believe the focus should be on things that the company can control to a greater degree, such as expense management – which is now at excellent levels, showcasing just how the company is managing its expenses here.

MFC IR (MFC IR)

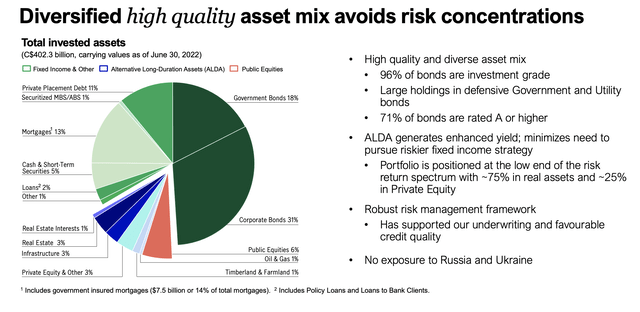

Also, aside from this, I believe the focus should be on fundamentals – such as the company’s superb asset mix and using a forward-looking perspective.

MFC IR (MFC IR)

It’s entirely possible that MFC will continue to see pressure in its valuation and share price. I hope this is the case because I am not yet done purchasing shares in the company. When the market wishes to be irrational, we need to stay alert to make sure that we allocate our capital in accordance with “best upside practices”. And MFC certainly has a good upside – not the best perhaps, but the quality is what really sells things here, aside from the dirt-cheap valuation we have going for us.

Manulife Valuation

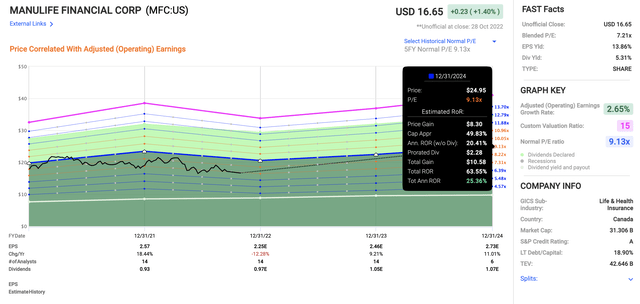

And when I say dirt-cheap, that’s what I mean. MFC is still A-rated and trades at a current NYSE-normalized P/E of 7.21x. While not as low as Unum during its doldrums, we’re still at a very low multiple seen only a few times the past 5 years.

The company’s normalized 5-year P/E is 9.1x. This isn’t high when you consider the low yield, the extremely attractive fundamentals, and the stable operations.

The upside to that conservative upside here is around 25% per year, or 63.5% year in less than 3 years.

MFC IR (MFC IR)

This, to me, is an excellent investment potential overall. What you do is buy insurance businesses and financials below 10X P/E. The market is severely discounting this business’s cash flows. Even if we only consider a 7-8X P/E on a forward basis, it still marks an almost 14% annualized RoR until 2024. If we consider a normalized 10-11X P/E, more accurate for the 10-year forward period, we see returns of 30%+ annualized here.

Still, I don’t want to give the picture that there are zero risks here. It’s just that the risks that do exist are impairable and manageable as a whole.

The current significant risk is the COVID-19 impact – especially with the company’s Asia exposure. There are also continued challenges endemic to certain of the company’s markets, such as the Philippines. In essence, Asian markets aren’t exactly the easiest to navigate, and investors should provision for, or discount for larger amounts of volatility inherent in companies with earnings from such markets.

The company’s analyst-guided upside is significant here. MFC is followed by a number of analysts both for the NYSE and TSX tickers. The current upside to average PT’s is between 20-30%, similar to my own, and the analysts following the company are usually fairly split between “BUY” and “HOLD”, which makes sense when you consider what some expectations for the remainder of 2022 are.

It shouldn’t be a surprise to you if you follow my work, that I am positive or investing in insurance or financial businesses. Over 18% of my portfolio is currently split among attractive banks, insurance businesses, reinsurance businesses, asset managers, and ancillary operators in the segment. I view the change in interest rates as incredibly positive for these businesses, and preliminary results for the current fiscal all but scream the confirmation to this thesis, with forecasts for dividend increases and the like. This is especially true for large banks and insurance businesses as well as reinsurance – while payment processors are suffering a bit more.

All in all, I believe it extremely advantageous to continue to position oneself in accordance with a bullish stance towards financials and insurance overall – and Manulife is one of the premier L&H insurance players in the Canadian region.

My stance is “BUY” – and my PT/Thesis is as follows.

Thesis

- MFC is one of the more undervalued and high-yielding L&H insurance operations on the market today, coupled with superb fundamentals, class-leading credit rating, and an excellent 3-5-year prospect going forward.

- I expect no less than a 60-100% total RoR over a 5-year period – which is within my target realm of what I am looking for when I invest in things.

- Based on this, I view MFC as a “BUY” at a multiple of 7.2x with a PT of closer to $25/share for the NYSE ticker.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment