Maskot

Introduction

We finally had it: ManpowerGroup (NYSE:MAN) reported earnings. While this may seem not particularly interesting, I have come to keep an eye on two main industries to understand better how the economy is performing. On one hand, I try to look at the freight industry (I am covering North-American Railways evaluating them with Warren Buffett’s criteria); on the other, I take the human resources and employment services industry to feel the pulse of the labor market well beyond the monthly unemployment rate.

Summary of previous coverage

In my first article about ManpowerGroup, I highlighted how this industry is very responsive to changes in the level of economic activity. Secondly, the industry is highly fragmented and very competitive with limited barriers to prevent (mostly) local players from coming up. In fact, the real ground where companies compete is speed in finding the workers needed and pricing. Price competition is fierce and this is why we are seeing low net margins and a shift of the main competitors towards higher margin segments. However, the industry requires very low capex and most of its companies usually have low debt.

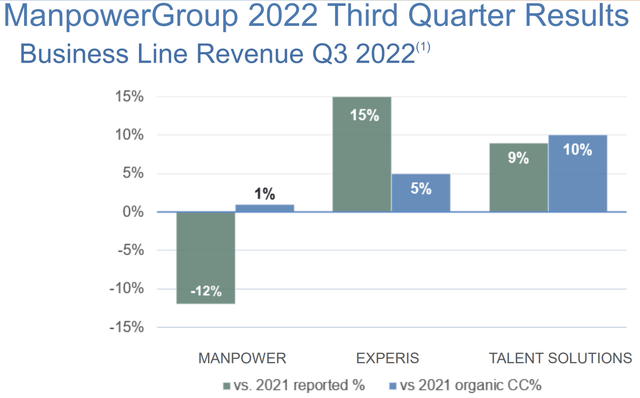

ManpowerGroup has three main brands. Manpower focuses on staffing and permanent recruitment. Experis offers professional resourcing and project-based solutions, in particular in IT, engineering and finance. It is the fastest growing division of the company and it is more profitable than Manpower. Finally, we have the Talent Solutions division that aims at addressing client demand for expert offerings, integrated and data driven workforce solutions.

I then pointed out how, in the past decade, ManpowerGroup remained pretty much flat at a revenue of $20 billion, allowing Randstad (RANJF, OTCPK:RANJY) to catch up and overcome it as the world leader. Yet, Randstad still has only 5% of the global market share.

Q3 Earnings Report

Before we look at the numbers, we need to hear an important caveat that ManpowerGroup’s management gave during the last earnings call:

Due to the significant strengthening of the dollar, particularly against the euro, year-over-year foreign currency movements continued to have a significant impact on our results. It is important to note that our businesses operate in local currencies. And as a result, foreign currency translation does not impact cash flow activity within our businesses, and the result is largely an accounting item based on reporting translation into U.S. dollars.

We need to consider this since it will have a big impact on ManpowerGroup’s report, which is in USD and we will see quite a difference between reported results and constant currency results. I think, on the other hand, that since ManpowerGroup’s main competitor Randstad posts its results in EUR it will benefit from currency tailwinds.

The company reported revenues of $4.8 billion (-7% as reported, +5% constant currency). The gross profit margin was 18.3%, up 170 bps YoY thanks to an improved mix of permanent recruitment fees. As we see below, Experis is leading the company’s growth.

ManpowerGroup Q3 Results Presentation

ManpowerGroup also reported margin expansion YoY with improved EBITA margin of 3.6% (+60bps YoY) and operating margins of 3.4% (+50bps YoY).

As we move to the bottom line, we see net earnings of $111.3 million versus $ 97.7 million in 2021, which is equal to 13.9% increase, which at constant currency would be a 31.2%. This translates into net earnings of $2.13 per diluted share for the quarter compared to $1.77 per diluted share in the prior year period.

The company also improved its balance sheet because it repaid remaining $50 million of debt related to the U.S. Experis acquisition. As a result, the balance sheet ended the quarter with cash of $527 million and total debt of $896 million. Net debt equaled $369 million at quarter end. Its total adjusted debt to total capitalization is now at very good 27%.

Revenues by geography

ManpowerGroup is quite present in the Americas and in Southern Europe. In the Americas, ManpowerGroup grossed 26% of its consolidated revenue. Revenue in the quarter was $1.2 billion, an increase of 27% in constant currency or 8% on an organic constant currency basis. The U.S. alone account for 76% of this revenue.

Southern Europe is usually a good market for staffing companies. This proved true once again as ManpowerGroup saw 42% of its consolidated revenue coming from this region. Revenue in Southern Europe came in at $2 billion, representing a 1% decrease in organic constant currency. France comprised 57% of this revenue and Italy for another 20%. The outlook for both of these economies is actually favorable, as France is adopting a new policy to reduce the business tax, known as CVAE, by 50% in 2023, which will benefit companies and employment. Italy is seeing a massive inflow of funds (around €200 billion) linked to the Recovery and Resilience Plan funded after the pandemic. This is supporting new investments and a strong labor market that is actually making the country one of the most profitable for staffing companies.

Weaker results were achieved in Northern Europe that comprised 20% of consolidated revenue in the quarter. The revenue in this region came in at $954 million 1% decline in organic constant currency. Here the company stated that Germany remains one of its most difficult markets due to the regulations impacting management of the bench workforce, the outsized impact of the automotive sector and the continued supply chain disruptions brought on from the Russia-Ukraine war. Now, alt

The Asia Pacific Middle East segment is still small compared to the other three mentioned, as it comprises 12% of total company revenue. However, it is growing fast and in the recent quarter, revenue grew 12% in constant currency to $587 million, with the largest market in the APME segment being, Japan which represented 44% of segment revenues in the quarter.

Overall, I expect Manpower to keep on growing in the U.S and Southern Europe, though in the latter the growth rate may indeed slow down a bit and come in at low single digits. On the other hand, I don’t see Northern Europe as the area that may boost ManpowerGroup’s growth in the upcoming quarter.

My take on these results

We have to acknowledge that, although the company reported a decreasing revenue, on a constant currency basis it has achieved some growth, which is something that in my previous coverage I outlined that was lacking. This shows that the company has been able to engage profitably with a strong labor market across many regions of the world. We will need to wait for Randstad’s and Adecco’s results that will be published in the upcoming days to judge if ManpowerGroup gained market share or not.

In any case, I think it is very interesting that ManpowerGroup is executing its thought-out plan to shift toward higher value solutions and services. The growth of Experis is quite important because it shows that demand for skilled talents is very strong and it seems not to be hindered as much even by the economic uncertainties that loom on the horizon. The growth of higher margin services such as Experis and Talent Solutions has led ManpowerGroup to declare that in the past quarter 44% of its gross profit comes from these two, with Experis alone accounting for 27%. Investors should monitor closely this segment because it is the real driver of EBITA growth. However, it faces one risk that may actually seem a paradox: talent scarcity. While the need for skilled workers is usually good for companies such as ManpowerGroup, if the sought for workers are very hard to find, staffing companies face a very hard time meeting demand and lose some of the higher margin opportunities. This is why, if a mild recession may take place, we could actually see more favorable conditions for ManpowerGroup to have enough skilled workers available for a somewhat softened demand, that, however, will not go to zero.

Now, ManpowerGroup reported that the U.S. labor market remains very tight. Very interestingly, the company sees that in case the economy slows down, the labor market is forecasted to move from very tight to tight, with an unemployment rate at 4.5% to 5%. This is because there is still a shortfall in supply that is still not solved. I think that if we reach this unemployment rate, companies such as ManpowerGroup will fare just fine, because there will actually be a little more workers available while demand will still be quite significant. Things, however, may change, if the economic outlook will worsen, leading to a far higher unemployment rate. So, I think that for investors who expect a mild recession, investing in ManpowerGroup may be a reasonable play; on the contrary, those who are expecting a big economic downturn, should stay away from the industry as a whole.

However, more than once during the earnings call, ManpowerGroup’s managers said that while employers are still looking for talent and they keep on hiring, uncertainty about the upcoming year still casts a shadow that doesn’t allow ManpowerGroup to state with confidence that it will see further growth.

Conclusion

Overall, I still stick to the discounted cash flow model I published in my first article which gave a target price of $76. The stock has basically traded flat and it is now exactly at this price. Even though ManpowerGroup is well managed as it keeps on focusing on margins and on shifting it services toward higher value tiers, I would either need a major drop in the stock price or a clear sign the company is at pace to resume growing its top line, too. The company runs well its business, but it still seems a bit stagnant. Thus, I confirm my hold rating.

Be the first to comment