Editor’s note: Seeking Alpha is proud to welcome Alerian – Thematic Research as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

imaginima/E+ via Getty Images

Since Russia invaded Ukraine on February 24, commodity prices have risen sharply as markets digest potential supply impacts from sanctions on Russia – one of the world’s largest exporters of commodities. The situation threatens to exacerbate record inflation already gripping global economies. Today’s note highlights recent events across commodity markets that are magnifying inflationary pressures and how natural resources could be an attractive investment in the current environment.

Commodities soar following Russia’s invasion of Ukraine

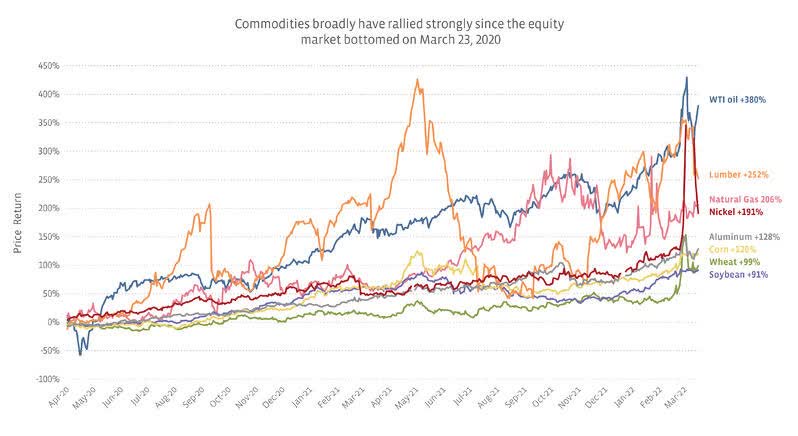

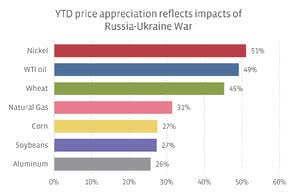

While stronger demand has fueled a sustained commodity price rally since the doldrums of the pandemic in 2020, the news of Russia’s invasion of Ukraine sent commodity prices soaring to new highs. The most pronounced impacts have been seen across energy, metals, and agricultural commodity markets, where Russia and/or Ukraine are significant global exporters. Russia is one of the world’s top crude oil exporters and the largest exporter of natural gas. Russia is also the largest wheat exporter while Ukraine is the fifth largest, and combined, they account for nearly 30% of the global wheat export market. Furthermore, Russia is also among the largest producers of aluminum, nickel, palladium, cobalt and other metals and raw materials critical for manufacturing.

On March 1, WTI crude oil closed above $100 per barrel (bbl) for the first time since 2014, surging as high as $130/bbl intraday on March 7. The same day, US natural gas prices at Henry Hub rose above $5 per million British thermal unit, while Dutch gas prices at the TTF hub, the leading European benchmark, closed at the highest level ever recorded. Wheat futures traded limit up (i.e., at the maximum increase allowed on a single trading day) five consecutive days during the first week of March and surged to $14.25 per bushel on March 7, their highest level since 2008. On March 8, nickel prices jumped and briefly surpassed $100,000 per metric ton on the London Metal Exchange (LME), forcing the LME to suspend nickel trading. While commodities that spiked sharply, including oil, wheat, and nickel, have come down from record highs, commodities broadly remain near multi-year highs.

Broad Commodities Performance (Author) Commodities YTD Price Appreciation (Author)

Making the case for natural resources amid inflationary pressures

Supply shocks stemming from the Russia-Ukraine conflict come during a time when inflation across energy and food is already running rampant. As reported by the US Bureau of Labor Statistics, inflation rose to 7.9% in February on an annual basis, with food and energy price increases contributing to the highest CPI reading in 40 years. Moreover, the Food and Agriculture Organization of the United Nations reported global food prices also rose to an all-time high in February. The surge across agricultural commodities could further aggravate global food inflation as the effects from the disruptions spill over to food supply chains. Meanwhile energy prices may continue to see upward pressure, as the Russia-Ukraine conflict has triggered what could be the largest energy supply crisis in decades, according to the International Energy Agency. Historically, commodities have served as a viable hedge against inflation. This commodity outperformance has also corresponded with periods of positive economic growth coinciding with the reopening of the global economy.

Investors that are looking to gain exposure to rising commodity prices, either as a hedge against inflation or for capital appreciation, may find it cumbersome to invest in commodity futures. Trading contracts could be complex for many investors, and owning individual commodity futures makes it difficult to diversify exposure. An index-based approach could provide exposure to multiple commodities via a more familiar product structure like an exchange-traded fund. Equity-based natural resource ETFs offers exposure to commodities through companies directly involved in natural resources and raw materials. Relative to an equity-based approach, an ETF based on commodity futures may have more volatility and can be negatively impacted by the need to roll into new contracts as front-month contracts near expiration.

Finding a resourceful way to invest in natural resources

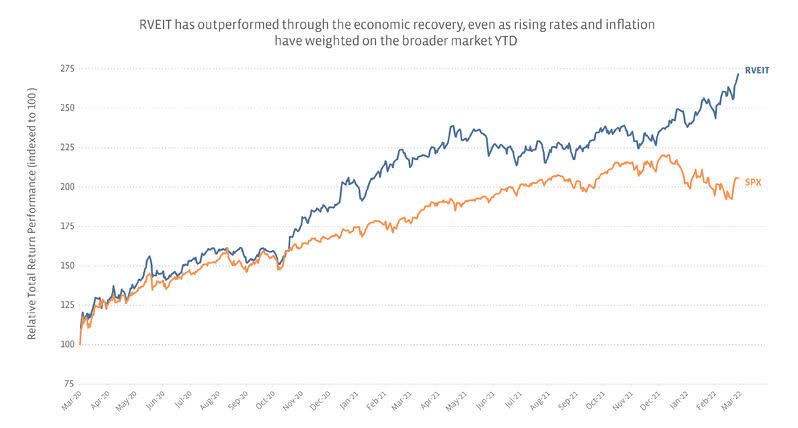

The VanEck Natural Resources Index (RVEIT), which is calculated by S-Network Global Indexes, includes companies involved in the production and distribution of commodities and commodity-related products and services in the following sectors: Agriculture, Alternatives (Water & Alternative Energy), Base and Industrial Metals, Energy, Forest Products, and Precious Metals. Strong demand for commodities and natural resources has contributed to RVEIT’s outperformance relative to the broader market since March 2020, during a time when inflation has also continued to edge higher. While record inflationary pressure and rising interest rates have pressured broad equity indexes in recent months, RVEIT has continued its upward trend.

RVEIT Outperformed Through The Economic Recovery (Author)

Incorporating natural resources in an equity allocation

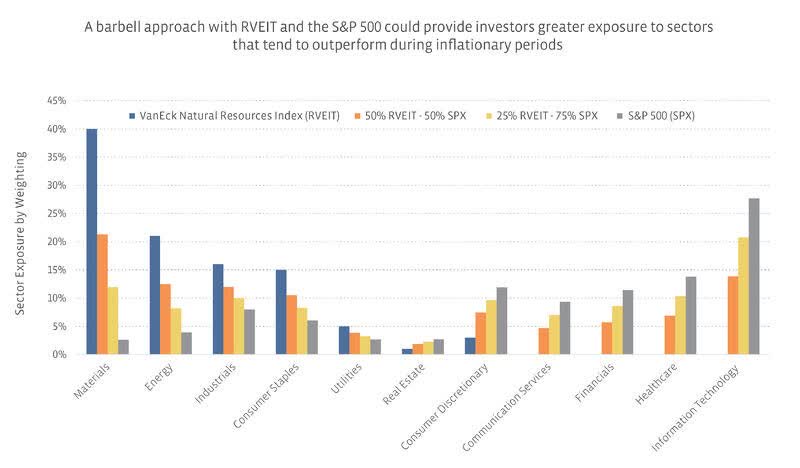

With continued uncertainty ahead and no clear signs of inflationary pressures easing soon, a barbell approach could be used to incorporate a natural resource allocation into a broad equity portfolio. The chart below provides representative examples of combining natural resources, represented by RVEIT, with a broad equity allocation, represented by the S&P 500, and how sector exposures would be modified. For example, a 25% allocation to RVEIT could moderate exposure to heavily weighted sectors like tech that could see continued pressure from rising interest rates, while increasing exposure to commodity-related companies within the industrial, consumer staples, materials, and energy sectors. These sectors typically have more inelastic demand, do better during rising rate environments, and could benefit from inflation given the pass-through nature of their businesses.

Barbell Approach With RVEIT And S&P 500 (Author)

Bottom Line

Given the ongoing global demand recovery for commodities, supply shocks stemming from the impacts of the Russia-Ukraine conflict are likely to exacerbate inflationary pressures. RVEIT offers investors access to global growth and may serve as a potential hedge against inflation.

The VanEck Natural Resources Index (RVEIT), which is calculated by S-Network Global Indexes, is the underlying index for the VanEck Natural Resources ETF (HAP).

Disclosure: © Alerian 2022. All rights reserved. This material is reproduced with the prior consent of Alerian. It is provided as general information only and should not be taken as investment advice. Employees of Alerian are prohibited from owning individual MLPs. For more information on Alerian and to see our full disclaimer, visit Disclaimers | Alerian

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment