Tatiana Volgutova

MamaMancini’s (NASDAQ:MMMB) is a manufacturer and distributor of prepared, frozen and refrigerated food. The company was concentrated on packaged and deli meatballs but made acquisitions that orient it towards other forms of deli as well.

Last January I wrote an initiation coverage on MMMB, where I commented on the company’s interesting operating history but warned about significant acquisitions in a turbulent year.

Indeed, the acquisitions proved complicated in the current economic context, particularly in terms of gross margin loss. Also, the acquisitions seemed expensive. I covered that in an article in May.

In this article, I review the company’s latest two quarters. I also include a written interview of two questions with the company’s new CEO, Michael Adams.

In my opinion, MMMB is still not a buy, given that it has not solved operational issues relating to gross margins, and that now has substantially increased its liquidity and dilution risks.

Disclaimer: I have not solicited, been offered, received or will receive any form of compensation from MMMB in return for any service of any kind. The opinions in these articles express my own understanding of the situation, paying loyalty and diligence duty to the readers of Seeking Alpha. MMMB’s IR agency approached me with the proposal to have a written interview with the company’s CEO, again without any form of compensation attached.

Note: Unless otherwise stated, all information has been obtained from MMMB’s filings with the SEC.

Previous situation

For a more detailed review, please refer to my initiation coverage on MMMB and my follow-up article from May.

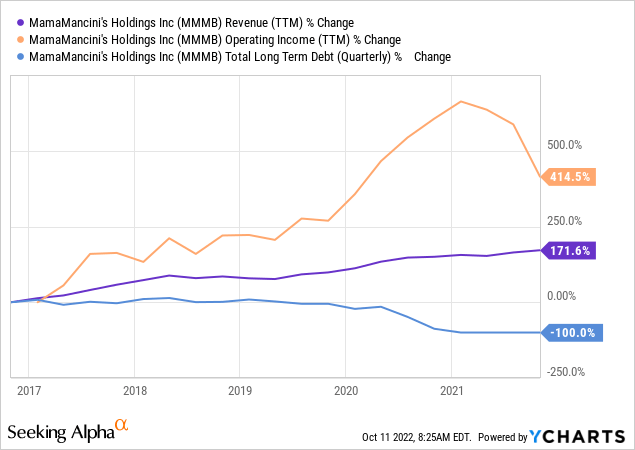

As a summary, when I first reviewed MMMB, I found a company with an interesting operating history. Fast growing revenue, faster growing profits, and no debt called my attention.

With these characteristics, the company traded at a substantial premium at the time, with a P/E ratio of 23x on expected earnings. But this was not the most important problem, given the previous growth path. Rather than price, I was worried about prospects.

The problem was that MMMB had announced two significant acquisitions, for almost $14 million, of businesses that manufactured salads for deli and hot bars in grocery stores and restaurants. With little financial information on the acquired companies, I believed the acquisitions could significantly change the business’ operations. The company was also using all of its cash reserves, and then taking debt, to acquire these companies, weakening its financial position. Finally, the economic outlook in January already seemed foggy, compounding the previous uncertainties. In that context, that P/E ratio of 23x seemed expensive and uncertain.

Indeed, by May, most of those fears were confirmed. First, financial information was provided on the acquired companies. One of them had debts and had been losing money for FY21. The other one was making only $250 thousand in net income. The two acquired companies generated about $27 million in revenue in 2021. Margins were lower than those of MMMB pre-acquisition. The final price paid (including debts assumed) was $16 million, not accretive in my opinion (low price to sales ratio but also low margins on sales operations).

Second, MMMB was showing margin problems. The company was not able to pass raw materials, labor and logistics price increases to customers. Still, no data on the combined operations of the three companies was available. Again I warned for caution.

Latest developments

Now moving to present conditions, MMMB’s updates from the first and second quarter of 2022 are not great.

The most salient problem is the destruction of profitability, shown in a collapse of margins. Profitability was attacked by two forces: first the new businesses have lower margins, this is what MMMB should try to improve; second, input inflation is not being translated to customers quick enough.

The situation is not only bad but getting worse quarter by quarter.

The company’s showed a significant decrease in profitability but was at least profitable in 1Q22. MMMB presented a net loss of $100 thousand in 1Q22 compared to a net profit of $600 thousand in 1Q21. Before changes in working capital, CFO was positive by $700 thousand in 1Q22.

1Q22 is the first quarter where MMMB consolidates the operations of the acquired companies. The effect on margins is terrible. Gross margins fell from 32% in 1Q21 to 17% in 1Q22. Operating margins from 8% to 1% during the same period.

This was something to be expected, and the company commented on its quarterly earnings call that it would quickly reduce duplicated costs and raise prices to recover margins.

But by the second quarter of 2022 net losses had widened to $750 thousand. Gross margins fell another 600 basis points on a QoQ basis, to 11%, even although the business combination was included in both quarters.

Cash flow before changes in working capital drained to $0 by 2Q22. This means the company is not generating cash to grow its working capital needs without resorting to financing.

This finally leads to the finance and debt aspect. As of 2Q22, MMMB had approximately $2 million in cash, and a total of $8.5 million in debts. It has $2 million available in a credit facility.

The biggest problem at the financing level is liquidity. The credit facility, from which $2.5 million have been drawn, and $2 million remain available, matures in June 2023, not so far in the future. MMMB also has to come up with almost $1.7 million a year to pay for interest and amortization maturities on a term loan of $7 million (amortizing monthly in 60 installments and paying SOFR + 3%).

How is the company going to come up with at least $4.2 million in the following months if its operations are unprofitable and are losing cash? Share issuance. MMMB announced that it plans to issue up to $5 million in preferred 8% cumulative dividend shares (under the title ‘Series B Preferred’ in the company’s 10-Q for 2Q22). The first $1.2 million are offered at a conversion price of $1.66 per common share, which is accretive to shareholders compared to current prices. This will add an accrual liability for shareholders (cumulative dividends can be accumulated and therefore imply no liquidity risk and can be later converted to shares) but at the expense of future dilution.

Interview with Michael Adams, MMMB’s CEO

The following is a two question written interview with Michael Adams, who took the job of CEO at MMMB last June. Mr. Adams comes from the food industry, with a particularly long tenure at Mondelez. He replaced Carl Wolf, Chairman and CEO since 2009.

The interview is reproduced without any edition, as that was part of the agreement with MMMB’s IR team.

First Question: In hindsight, how would you qualify the acquisition strategy started at the end of 2021? Would you have done something differently if you knew the macro-economic pressures that emerged this year?

I LOVE our recent acquisitions! First, as mentioned above, these perfectly build on our vision to become a one stop shop deli solutions provider. Completely accretive to our business and the macro-trends reaffirm that there are only tailwinds to consumer and retailer trends.

Second, it’s synergistic! From an operations perspective, it nearly doubles our manufacturing footprint. We are seeing that there are overlaps with our raw materials & packaging that can drive cost synergies. There are best practices being shared across R&D and Quality and Marketing to improve efficiency. There are additional cost synergies we have already identified around administrative functions like HR & Finance that we will be implementing. My personal favorites are the sales synergies. Let me give you an example.

There are a few customers that we have already identified, pitched, sold in and shipped T&L Creative Salads products to existing MamaMancini’s customers who Creative Salads never sold before. MamaMancini’s has literally dozens of existing relationships with retailers that we can now sell in Creative Salads and Olive Branch products. The best part is, it’s not theory, we are already doing it!

And, by the way, we are already shipping to those customers, so we are capturing significant freight synergies by putting more products on the trucks to the same locations! And I can same the same thing about T&L Creative Salads and Olive Branch customers where we can sell in our meatballs, prepared meals and pastas. It’s highly synergistic.

In hindsight, I may have planned a bit more before the acquisitions closed. As mentioned, in my last role at Mondelez, I was responsible for our North American M&A and Ventures activities. So, not just the initial market scouting, not just the due diligence, but also the planning and integration of these new businesses. Over my three years in the role, we acquired five businesses and in each case, the planning and integration was a critical part of the ultimate decision to acquire the business. We had to share with our Global CEO the sales, marketing & operations plans and expected synergies of the acquisition. If the synergies were not realistic, we didn’t make the offer. While smaller companies naturally don’t have the resources that a multi-national like Mondelez has, I think we could have planned better at MamaMancini’s so we knew what the day after the acquisition would look like.

Second Question: How concerned are you with a recessionary environment and its effects on MMMB on two fronts: sales and credit conditions?

Great question, Tomás. A day does not go by that we don’t read up on macroeconomic conditions and discuss as a leadership team, in particular on commodity pricing and inflation. So it is absolutely top of mind every day.

That being said, I feel good with the position we are in today amongst a recessionary environment and even better with our new CFO, Anthony Gruber, in place who brings tremendous foundational finance experience in the public and private markets that we did not have previously.

- First, from a consumer perspective, a recessionary environment is going to create tailwinds for our sales. At the start of a recession, consumers cut down on their out of home eating and start eating at home more, driving prepared food sales at the grocery. That’s a tailwind for us.

- Second, from a retailer perspective, labor challenges and the need to pull back on in store costs will make our prepared meals more attractive for grocery store operators. We are doing the work of food preparation for them, so they just have to place the prepared meals in the refrigerator or put the bulk items onto the hot bar. We are a labor and kitchen space solution for our retailers, which is another tailwind.

To conclude on how we expect to face changing credit conditions, we are fortunate enough to have a great relationship with our bankers. Coincidentally, just last month, our bank gave us another $1 million line of credit increase. It was not asked for and we really don’t need it, but it’s good to know we have it.

We are also finishing up on a secondary raise of preferred stock we announced via an SEC filing several weeks ago, which provides additional non-debt optionality in the event an acquisition opportunity or CapEx needs are required. Lastly, and most importantly, with the new product pricing we are rolling out and the operational improvements that we are realizing, I expect to see significant near-term improvements to cash flow and profitability – further alleviating our credit position. So taken as a whole, we I believe we are well positioned to thrive in the uncertain economy we face today.

My take on the interview

Three things stand out from the interview, in my opinion.

First, the company justifies the acquisitions in terms of synergies and of a strategy to become a more varied deli provider. Synergies means margin improvement to me. Ideally, the after acquisition company should sell the same or more than the combined companies, at a lower total cost. This has not been materialized yet.

Second, Adams explains that he would ‘have planned a bit more before the acquisitions closed’, he mentions particularly the integration aspect. In my opinion this has to mean cost control and the operational materialization of the previously mentioned synergies. I hope it is a matter of planning, meaning something that can be solved in future quarters. However, I suspect the companies might simply not have been that profitable to begin with, and that MMMB’s management did not realize the future could be different from the past in terms of demand and margins.

Finally, Adams considers that economically troubled times, like a recession, could actually improve MMMB’s sales, as people eat less outside of their homes and move towards cheaper alternatives. My take on this last comment is that it may well be that MMMB is helped by a recessionary context, or at least not negatively impacted significantly. Frozen foods do show inferior good dynamics, for example.

Conclusions

It is not clear that MMMB’s strategy will be successful. It could work, but it was extremely aggressive, as I have commented on previous articles. The company could have passed this recession with a cash vault, no debts and higher margins. In contrast, it is entering the recession with risky debt, no profitability and very low cash.

With two quarters since the acquisitions were completed, MMMB has still not shown that it can bring about the synergies and improvements for which it paid such a lofty price.

Until these uncertainties are resolved, MMMB seems too risky.

Be the first to comment