Kevin Frayer

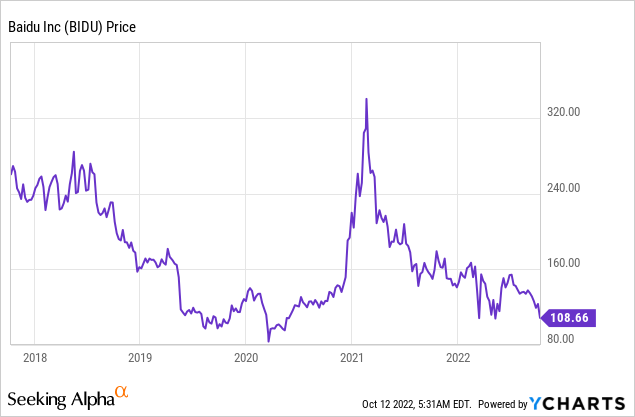

Baidu (NASDAQ:BIDU) (HK:9888) is a diversified technology company that truly is the “Google of China” in my opinion. The business owns the country’s most popular search engine, has a thriving advertising business and a rapidly growing cloud segment. Baidu is also making strong progress with its “Robo Taxi” division which is already operational across many Chinese cities. The market fears around China-US tensions and government intervention have caused a strong sell-off in Chinese stocks. Baidu’s stock price has slid down by 50% since March 2021, despite the company beating revenue and earnings growth estimates in the second quarter of 2022. In this post I’m going to break down the company’s financials and valuation, let’s dive in.

Solid Financials

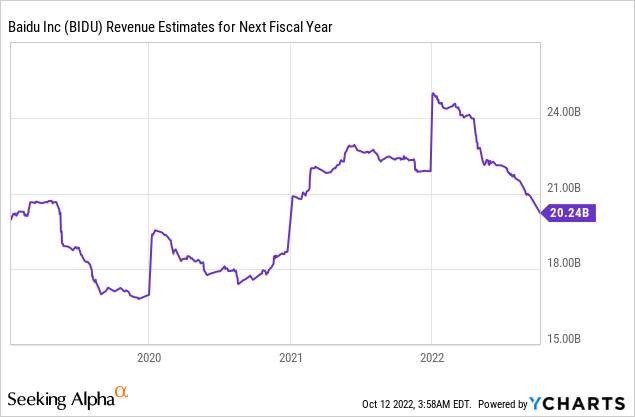

Baidu generated solid financial results for the second quarter of 2022. Revenue was $4.43 billion, which beat analyst estimates by ~$42 million, despite being down 5% year over year. Baidu Core makes up the majority (78% of this revenue) and declined by 4% year over year. This was driven mainly by declining advertising revenue due to macroeconomic concerns and hard Covid restrictions in China. In my post on Google (GOOG) (GOOGL), I also highlighted a similar issue as the advertising market is cyclical. In addition, advertisers tend to follow each other like sheep, when one pulls spending they all do. A positive tailwind was the 618 Shopping Festival which helped to offset some of the lower advertising spending by customers.

Thriving Cloud Business

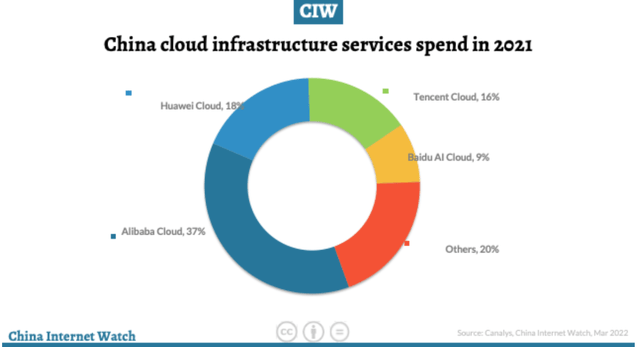

Similar to Google Cloud, Baidu has a Cloud Services business called “AI Cloud”. This has been the fastest-growing part of the business with revenue of $2.1 billion (RMB 15.1 billion) in the second quarter. Baidu reports its Cloud business under “non-marketing” related revenue inside its “Baidu Core” segment. Digital Transformation is still in the early stages of development in China as more businesses move their IT workloads to the cloud. A study by McKinsey believes China’s public cloud market will triple in value by 2025, jumping from $32 billion in 2021 to $90 billion by the end of the period. Analysts forecast this to be driven by the vast number of manufacturing companies in China. Management predicts profitability as the business scales and I believe them given that western Cloud service providers such as AWS, Google Cloud and Azure are the most profitable parts of the big three tech giants. Alibaba (BABA) Cloud has the largest market share in China capturing ~37% of cloud spend. Baidu AI cloud is in fourth place with a 9% market share, but this is still solid given the size of the market which is growing. In addition, Baidu’s focus on Artificial Intelligence workloads could be a key differentiator.

China Cloud Providers (China Internet Watch)

Robotaxi King

Baidu is a leader in self-driving vehicles in China with its Apollo Go Robo Taxi which is much further along than Google’s Waymo in the west. Apollo Go is already live in over ten cities across China and charges fees to customers for its ride-hailing service. Each “Robotaxi” vehicle completes approximately 20 rides per day and its new RT6 model now sells at a similar price range to a mass-market electric vehicle. A key point nobody seems to be talking about is that Robotaxis could actually be a preferred necessity for people in China. The country is still facing ongoing lockdowns and thus people tend to prefer not to interact with others. Therefore, there is no better way to do this than with a Robotaxi which doesn’t have a driver who would be interacting with lots of customers. In addition, the platform is already operating in Wuhan, thus I believe this could further accelerate adoption, depending on how the business markets the product.

The autonomous vehicle industry is forecasted to grow at a rapid 40.1% compounded annual growth rate (CAGR) and be worth over $2.1 trillion by 2030.

The Netflix (NFLX) of China

Baidu also owns the largest video streaming platform in China, which is called iQIYI (IQ) and is often referred to as the “Netflix of China”. The business brought in revenue of $994 million (RMB 6.7 billion) in the second quarter of 2022, which declined by 13% year over year, driven by a cyclical rotation in habits by consumers. The good news is its cost of revenues was $2.27 billion (RMB 15.2 billion) which declined by 5% year over year, as the company increased the efficiency of its content spend. Despite the top-line head wins this improved efficiency has resulted in positive operating profit being reported for the second quarter in a row.

Improving Profitability

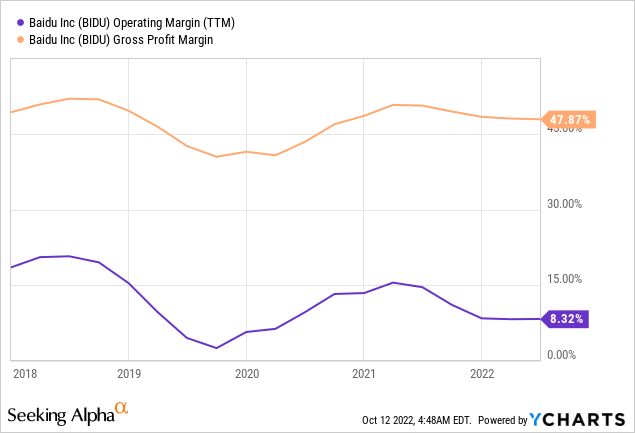

Baidu generated an overall operating income of $508 million (RMB 3.4 billion), which increased by a rapid 24% year over year. Earnings per share was $1.44 which beat analyst estimates by $0.53. The business has a solid gross margin of ~48% and an operating profit margin of between 8% and 17% which has been fairly consistent despite some cyclicality. The business also generated solid free cash flow of $823 million (RMB 5.5 billion).

Baidu has a robust balance sheet with $28.28 billion in cash, cash equivalents and short-term investments. The company does have fairly high debt of $14.2 billion but “just” $2.8 billion of this is short-term debt (due within the next two years).

Advanced Valuation

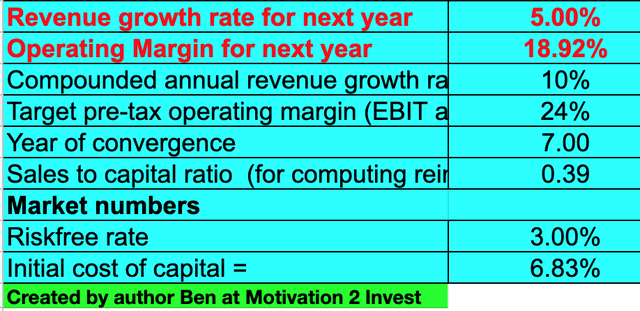

In order to value Baidu, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted a conservative 5% revenue growth rate for next year and 10% revenue growth over the next 2 to 5 years. I forecast this to be driven by the continued growth of the cloud segment and the cyclical rebound of the advertising market.

Baidu stock valuation 1 (created by author Ben at Motivation 2 Invest)

I have capitalized the company’s R&D expenses which have adjusted the operating margin up from ~13% to nearly 19%. I forecast this adjusted margin to increase to 24% over the next seven years as the business’s cloud segment grows, iQIYI continues to bring in greater profit and self-driving increases in popularity.

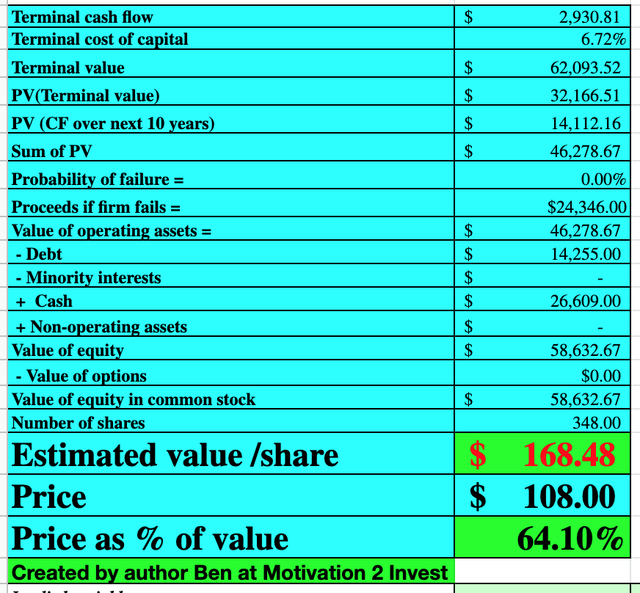

Baidu stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $168 per share, the stock is trading at $108 per share at the time of writing and thus is ~36% undervalued.

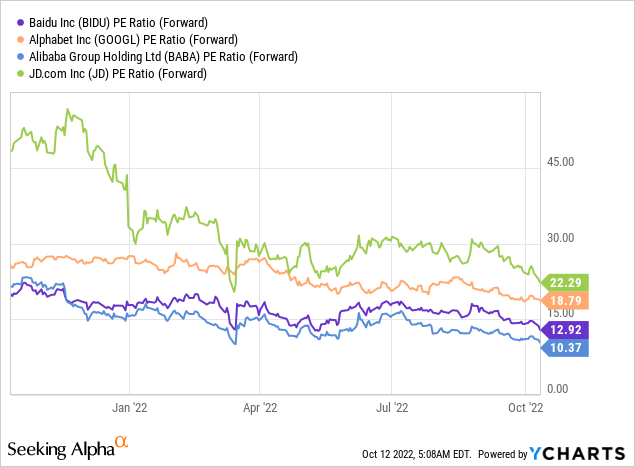

As an extra datapoint, Baidu trades at a Price to Earnings ratio = 12.99 which is 52% cheaper than its 5-year average. Baidu trades at a substantially cheaper PE ratio when compared to Alphabet which trades at a PE = 19. However, the business is not as cheap as Alibaba, which trades at a PE = 10, but that business does have many more negative headwinds.

Risks

China-US Tensions

There are increasing tensions between the US and China, with regards to data privacy, accounting, and much more. Baidu is listed on the Hong Kong stock exchange under the ticker HK:9888, and I don’t believe the business is listed on the New York Exchange which means delisting is not an issue. Baidu also trades on the OTC exchange under the ticker BAIDF, but this exchange does offer less liquidity which could impact institutional investors. The Chinese government also plays a key role in decisions governing tech giants in their region. Alibaba was slapped with a $2.8 billion fine and Tencent has also been fined in the past. Baidu has flown under the radar for the most part but this doesn’t mean they are not still prone to the same risks. Therefore it makes sense to make a “China risk” allowance for any stocks in the region.

Recession

Many analysts are forecasting a recession in the west due to the high inflation and rising interest rate environment. China has managed to keep its inflation rate low at just 2.5% for September which is relatively similar to historic levels after a brief spike to 6% in 2020. However, as China makes the majority of its GDP from exports, a recession in the west will impact them also. In addition, China has a leveraged housing market which some analysts believe is close to an economic collapse. Beijing’s “Zero Covid” lockdown policy is also impacting economic activity.

Final Thoughts

I think Baidu is the “Google of China” and is a strong technology backbone in the region. The company is poised to benefit from a rebound in advertising spend, growth in the cloud and even self-driving cars in the years ahead. The business is undervalued intrinsically and relative to historic multiples at the time of writing and thus could be a great buy over the long term.

Be the first to comment