mbbirdy/E+ via Getty Images

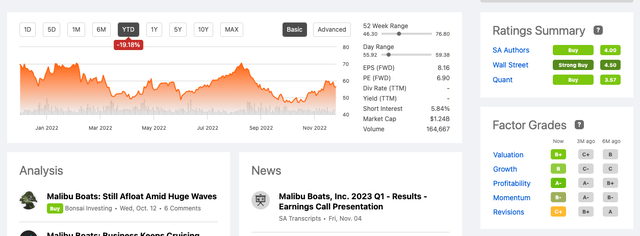

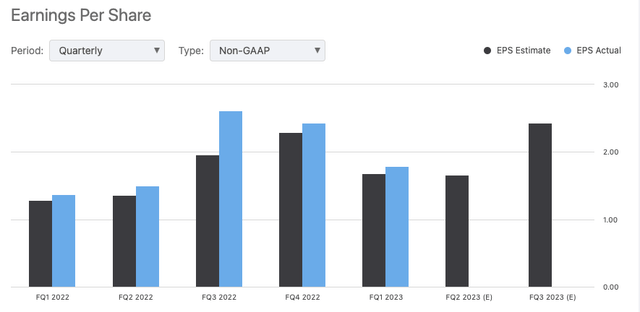

Malibu Boats, Inc. (NASDAQ:MBUU) is a small-cap stock at $1.146 billion in the recreational power boating industry that has been motoring through this year, beating earning expectations for the fifth consecutive quarter by $0.11 to reach $1.79 per share. However, the stock has yet to perform well on the market, fluctuating between highs of $70.49 and lows of $46.96. Moreover, supply chain disruptions, seasonality and changing demand cycles will continue to impact performance.

Stock at a glance (SeekingAlpha.com)

You should not consider MBUU if you are looking for short-term gains. However, the company has heavily invested in innovation and vertical integration and is expanding its production capacity. It allows the company to benefit from the surge in boat demand, better control its margins and benefit from its long-standing brand that it continues to develop and grow through strategic acquisitions. On top of that, SeekingAlpha’s Quant Factor Grades indicate improved valuation, growth and profitability over the last six months. Therefore, investors may want to take a bullish stance on this company while the price is currently well under analyst one-year target estimates of $68.57.

Overview and Drivers

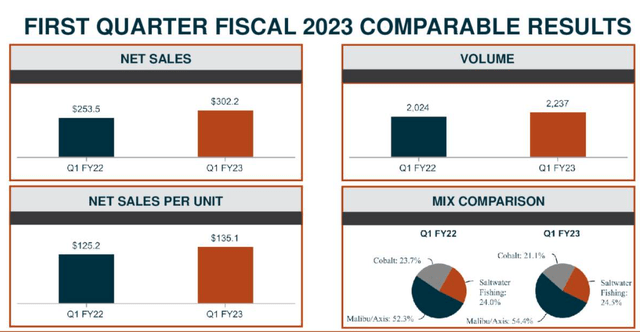

My previous article gave an overview of MBUU and the performance boat industry. MBUU has broadened its market scope over the last few years through acquisitions to enter the saltwater and sterndrive segments. In the pie chart below we can see the mix of its products.

Q1 2023 Quarter Overview (Investor Presentation 2022)

The company caters to the affluent outdoor and leisure-seeking market. The sector saw a spike in demand due to the impact COVID-19 had on the US population seeking out outdoor and socially distanced activities. The need for boats surpassed the supply, which still impacts companies today.

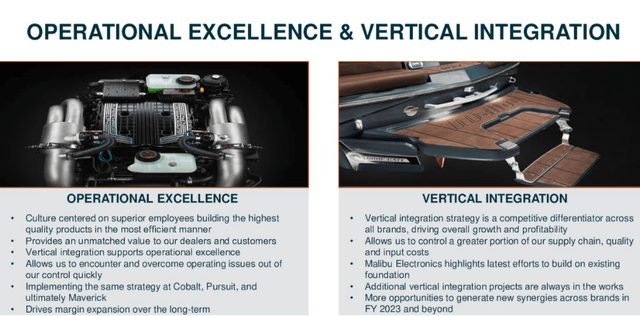

MBUU’s strength has been its ability to meet customer demands and grow its customer base while streamlining and controlling more of its production line through continuous innovation and strategic vertical acquisitions. MBUU is a front-runner in the market with a longstanding, reputable brand that it has been able to use to enter profitable adjacent and compatible categories. Furthermore, it has quickly met changing customer requirements by bringing new products, features and models to the market in a timely fashion.

Investing in innovation and production (SeekingAlpha.com)

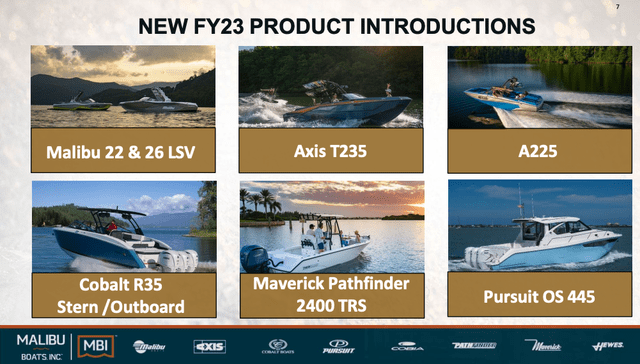

To give an idea of the variety of offerings in which MBUU releases new models to the market, here are some of the soon-to-be-released offerings.

2023 Offerings (Investor Presentation 2022)

Financials and Valuation

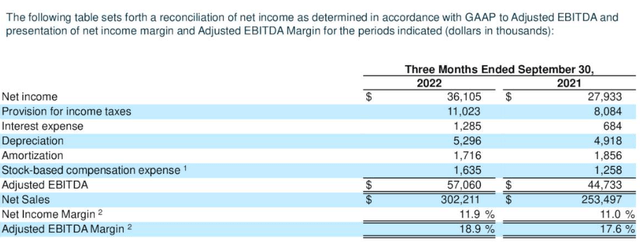

MBUU has produced record numbers quarter after quarter, and this Q1 2023 is no different. Notably, not only did the financials increase, but the number of units sold increased year-on-year by 10.5% to 2,237 units, a record high for the company. Net sales this past quarter increased by 19.2% year on year to total $302 million. Net income increased by 29.3% to $36.1 million, and EBITDA grew by 28% to $57.1 million. The company is showing the benefits of its vertical integration strategy by a solid increase of 24.9% in its gross margins to $74.6 million. While in a period when industry-wide companies are battling with supply chain pressures.

Q1 2023 Financial Quarter (Q1 2023 Financial Report )

MBUU has been impressive in beating EPS expectations for the last consecutive quarters, as seen in the graph below.

EPS versus expectations (SeekingAlpha.com)

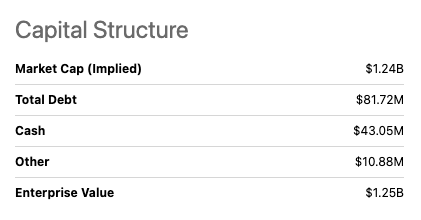

Below we can see the capital structure of MBUU. It has a total debt of $81.72 million, which is lower than the previous quarter, which was $131.8 million. It has $43.05 million available in cash. The company has a generally healthy free cash flow to pay debts when due. Keeping track of the liabilities and when they are unsettled is vital. MBUU has $147.5m in liabilities unpaid within the following year.

Capital Structure (SeekingAlpha.com)

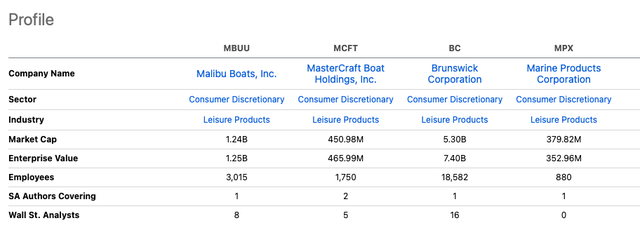

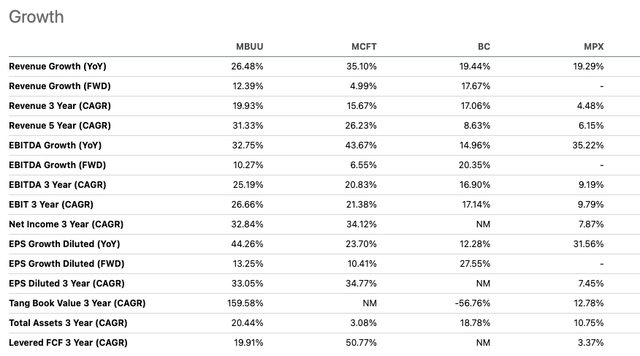

The boating industry is very competitive. If we compare MBUU to three of its peers, Marine Products (MPX), Brunswick (BC) and MasterCraft (MCFT), as seen in the table below, MBUU is attractive on a few of the relative evaluations.

Industry Peer Comparison (SeekingAlpha.com)

The company has impressive asset growth compared to its peers and its five-year revenue growth of 31.33%.

Growth Comparison amongst Peers (SeekingAlpha.com)

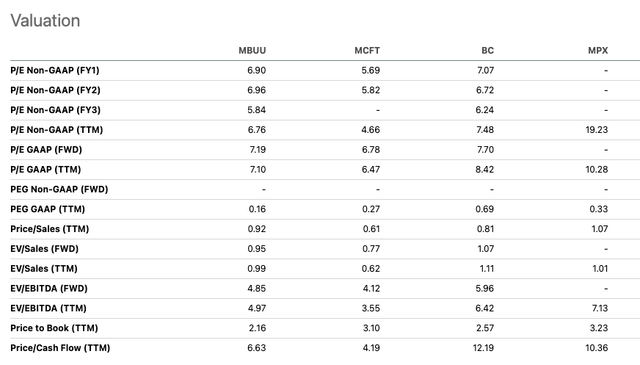

Furthermore, if we look at the valuation across the board, MBUU looks undervalued and is priced lower than some of its larger peers in the industry. It has a lower price-to-book ratio than its peers at 2.16, indicating that it is trading for less than the value of its assets. MCFT is the most undervalued among the four companies. However, it has shown significantly less growth than MBUU.

Relative Peer Valuation (SeekingAlpha.com)

Risks

While COVID-19 brought a surge in first-time boat buyers, many of these first-time buyers have become less enthusiastic about keeping and maintaining boats two years later. This has created a surplus in the availability of new second-hand boats for sale, which may be something to be wary of, and boat industry stocks are being downgraded as the demand starts to decline from the COVID-19 period. Another factor is the seasonality of demand. Furthermore, natural events can severely impact the business. Most recently, we have seen this with Hurricane Ian, which is said to have affected revenue and margins to influence the coming quarter. Lastly, supply chain disruptions have and will continue to impact production. Although MBUU has a competitive advantage over its peers through the growing level of vertical integration, it is not entirely immune, and issues and costs will continue into 2023.

Final Thoughts

Although the recreational boat industry is not experiencing the surge it experienced during the COVID-19 outdoor activity craze, MBUU has still been delivering record numbers and upward trending top and bottom line financial performance. The company is not sitting still, either. It continues to streamline its business, grow manufacturing capacity and enhance its brand. MBUU is capitalizing on its brand and steadily building up a broader product range of offerings while controlling more of the backend through strategic vertical mergers to drive down costs and streamline processes across the different sectors. MBUU is interesting in the long run with a wide selection of new product releases and more production capacity to meet the growth in demand. Investors may want to take a bullish stance on this company while the price is lower than its predicted potential.

Be the first to comment