Zephyr18/iStock via Getty Images

Transcript

Alex Brazier, Deputy Head, BlackRock Investment Institute

We see a new regime of greater macro and market volatility playing out.

And this backdrop made for a spirited gathering at our 2023 Investment Outlook Forum.

1) A stark growth-inflation trade-off

Central banks are poised to generate recessions. We think serious recession could be needed to get inflation back down to their targets.

And if they pause their rate hikes early, we’ll see persistent inflation.

They face a stark growth-inflation trade-off driven by constraints on what economies can produce.

2) New regime is here to stay

The new regime is here to stay, in our view – reinforced by three big transitions: demographics, reducing labor supply; geopolitical fragmentation reshaping supply chains; and the net-zero transition rewiring economies.

Wei Li, BlackRock Global Chief Investment Strategist

3) A new investment playbook

The old playbook does not apply anymore.

Specifically, we will push against this idea of applying a mean-revert strategy when it comes to asset return expectations. We would also push against blindly buying the dip, as well as this idea that one just automatically hides in long-duration government bonds during a recession.

At this juncture, we have a risk-off stance. We prefer to hide out in short-duration, quality credit and government bonds, while still staying underweight developed market equities and keeping an eye on turnaround signposts.

______________

We see the new regime of greater macro and market volatility playing out. This backdrop made for a spirited November 1-2 Forum, a semiannual gathering of BlackRock’s top investment leaders to debate the outlook. We think this new regime is not about to change, and debated how to navigate a recession foretold, persistent inflation, geopolitical fragmentation, a strong U.S. dollar and the energy crunch. Watch for our updated views in our 2023 Outlook on November 30.

Wishful thinking on inflation

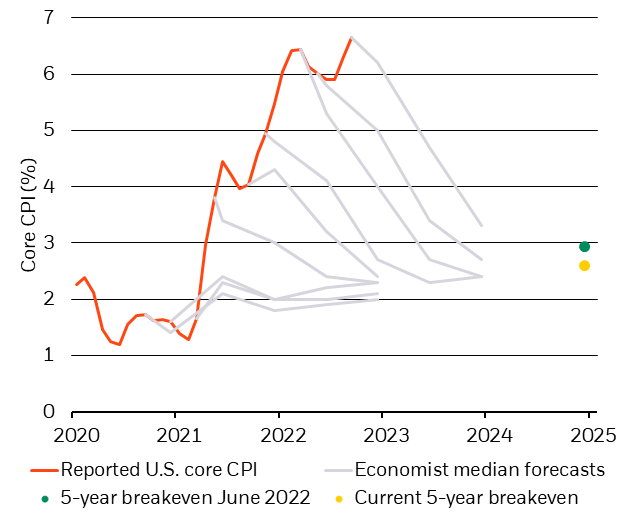

Core CPI Inflation, Forecasts And Breakeven Rates, 2020-2025 (BlackRock Investment Institute, with data from Bloomberg and Refinitiv Datastream, November 2022)

Note: The gray lines show consensus economist projections of CPI inflation reported by Reuters. The yellow dot shows market-implied five-year-ahead inflation expectations as of November 1. The green dot shows the same expectation as of June 14.

The constant upside surprises in inflation relative to median forecasts (gray lines) are at the heart of market volatility – and underscore that we are in a new regime of greater macro and market volatility. Market pricing (green and yellow dots in chart) shows markets continue to expect a normalization of inflation. We think core inflation will be sticky primarily due to ongoing production constraints, especially in the labor market. Those constraints mean economies are overheating, even though activity hasn’t reached its pre-Covid trend. Central banks are set to overtighten, pushing economies into moderate recessions. But a deep recession is coming if central banks insist on bringing inflation fully back down to target as quickly as they typically aimed to do in the past.

We see the new regime playing out. Central banks face sharper trade-offs between activity and inflation. For now, we see them on a path to overtighten and cause recessions while attempting to bring inflation back to target. A resilient economy only makes further overtightening more likely, in our view, and would be even worse for the economy – and bad news for risk assets. The risk of financial cracks is also real. We think central banks will eventually pause their hikes once confronted with the economic damage they’ve caused. That would mean living with some higher inflation if production capacity doesn’t come back quickly.

Drivers of the new regime

The new regime is not about to change, in our view – reinforced by three big transitions that mean repeated drags on production capacity and thus persistent inflation. First, aging populations are limiting the number of working-age people and will place pressure on public finances. Second, we think the era of great geopolitical moderation has ended, leading to a persistent geopolitical risk premium, exemplified by rewiring global supply chains and strategic competition between the U.S. and China. This is the most fraught environment we have seen in the world in the post-World War II era. Third, we see the transition to net-zero carbon emissions reshaping energy demand and supply over time.

So, how should investors adjust to all this? The new regime needs a new investing approach. We think ongoing sizing of what’s in the price of a given asset is crucial. It will matter more than trying to time a sustained bull market, in our view. Investors learned it paid to “buy the dip” during the bull markets of the “Great Moderation,” a multi-decade period of stable growth and inflation that is over now. The urge is still there, much like all characters in The Lord of the Rings are drawn to the power of the One Ring – but what promised gains before now promises pain, we think. We must avoid the ring’s temptation – the old playbook – to buy dips or time rallies. Doing so risks ruining one’s life, like Gollum, or one’s portfolio in the new regime. This is true for stocks as well as bonds. Central banks are hiking rates and causing recessions, not responding to them by cutting rates. So we think long-term government bonds won’t offset risk asset selloffs like they did in past recessions.

Our bottom line

The new regime is here to stay. We need to make more frequent portfolio changes and plan for more granular allocations to pounce on opportunities – and avoid the temptations of the One Ring. In the near term, attractive yields on short-term credit make it an appealing place to wait out the coming recession, we think. We don’t think equities have fully priced recession risks – and earnings forecasts still look too optimistic. Stay tuned for our 2023 Outlook on November 30.

Market backdrop

Stocks slumped and short-term U.S. Treasury yields hit 15-year highs after the Federal Reserve delivered another mega rate hike, as expected, but also signaled it would have to take rates higher than it originally planned, even if at a slower pace. Markets were disappointed again as the dovish signal they were hoping for failed to materialize, snuffing out an equity bounce. We see the Fed on a path to overtighten policy and don’t expect it to pause until the damage caused is clearer.

Markets will keenly watch the U.S. CPI for any signs of easing inflation. Persistently high inflation could embolden the Fed to hike rates even more than the market expects. Consumer sentiment may give a sense of the economic damage inflicted by the Fed’s tightening, and the report will also show the latest snapshot of household inflation expectations.

Be the first to comment